Valuation of a Business for Divorce: Overview of Valuation Approaches, Normalizing Adjustments, and Potential Need for Forensics Services

Valuation of a business can be a complex process requiring certified business valuation and forensic accounting professionals. Valuations of a closely held business in the context of a divorce are typically multifaceted and may require forensic investigative scrutiny for irregularities in the financials that may insinuate dissipation of business/marital property. Business valuations are a vital element of the marital dissolution process as the value of a business, or interests in a business, impact the marital balance sheet and the subsequent allocation/distribution of marital assets.

Valuation Approaches

To begin, the financial expert will request certain information and interview management of the Company. Information requested typically includes:

- Financial statements (usually the last five years)

- Tax returns (usually the last five years)

- Budgets or forecasted financials statements

- Buy-sell agreement

- Information on recent transactions

- Potential non-recurring and/or unusual expenses

- Qualitative information such as business history and overview, product mix, supplier and customer data, and competitive environment

The financial expert must assess the reliability of the documentation and decide if the documents appear thorough and accurate to ultimately rely on them for his/her analysis. The three approaches to value a business are the Asset-Based Approach, the Income Approach, and the Market Approach.

The Asset-Based Approach

The asset-based approach is a general way of determining a value indication of a business, business ownership interest, or security using one or more methods based on the value of the assets net of liabilities. Asset-based valuation methods include those methods that seek to write up (or down) or otherwise adjust the various tangible and intangible assets of an enterprise.

The Income Approach

The income approach is a general way of determining a value indication of a business, business ownership interest, security or intangible asset using one or more methods that convert anticipated economic benefits into a present single amount.

The income approach can be applied in several different ways. Valuation methods under the income approach include those methods that provide for the direct capitalization of earnings estimates, as well as valuation methods calling for the forecasting of future benefits (earnings or cash flows) and then discounting those benefits to the present at an appropriate discount rate. The income approach allows for the consideration of characteristics specific to the subject business, such as its level of risk and its growth prospects relative to the market.

The Market Approach

The market approach is a general way of determining a value indication of a business, business ownership interest, security or intangible asset by using one or more methods that compare the subject to similar businesses, business ownership interests, securities or intangible assets that have been sold.

Market methods include a variety of methods that compare the subject with transactions involving similar investments, including publicly traded guideline companies and sales involving controlling interests in public or private guideline companies. Consideration of prior transactions in interests of a valuation subject is also a method under the market approach.

Synthesis of Valuation Approaches

A proper valuation will factor, to varying degrees, the indications of value developed utilizing the three approaches outlined. A valuation, however, is much more than the calculations that result in the final answer. It is the underlying analysis of a business and its unique characteristics that provide relevance and credibility to these calculations.

The Levels (Premise) of Value

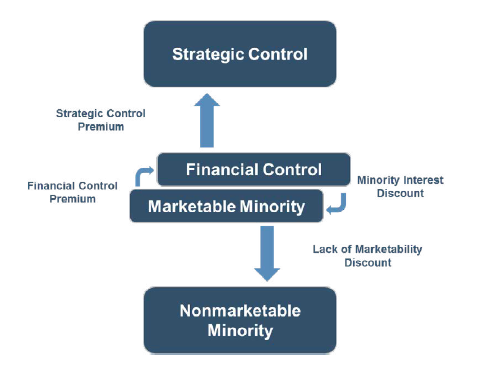

Does it make a difference in value per share if you own 10% or 75% of a business? You bet it does. A 10% interest is a minority interest and does not enjoy the prerogatives of control. How does this affect value per share? The minority owners bear witness to a process over which they may have no control or discretion. In effect, they often play the role of silent partners; therefore, the fair market value per share of a minority owner is likely worth less per share than the shares of a 75% owner.

Likewise, a minority owner of a private business likely does not have a ready market in which to sell their interest. Minority ownership in a publicly traded company enjoys near instantaneous liquidity such as trading stock on organized and regulated exchanges. The unique uncertainties related to the timing and favorability of converting a private, minority ownership interest to cash gives rise to a valuation discount (lack of marketability discount) which further distances the minority owner’s per share value from that of a controlling owner’s value per share.

The following chart provides perspective of the various levels of value. In most cases a valuation is developed at one level of value and then a discount or premium is applied to convert to another level. These discounts are known as discounts for lack of control and lack of marketability. Knowing when to apply such adjustments and quantifying the size of these adjustments is no simple matter, requiring the need for a credentialed business valuation professional.

Importance of Normalizing Adjustments

Normalizing adjustments adjust the income statement of a private company to show the financial results from normal operations of the business and reveal a “public equivalent” income stream. Keep in mind the levels of value in business valuation, discussed above. In creating a public equivalent for a private company, another name given to the marketable minority level of value is “as if freely traded,” which emphasizes that earnings are being normalized to where they would be as if the company were public, hence supporting the need to carefully consider and apply, when necessary, normalizing adjustments. There are two categories of adjustments.

Non-Recurring, Unusual Items

These adjustments eliminate one-time gains or losses, unusual items, non-recurring business elements, expenses of non-operating assets, and the like. Examples include, but are not limited to:

- One-time legal settlement. The income (or loss) from a non-recurring legal settlement would be eliminated and earnings would be reduced (or increased) by that amount.

- Gain from sale of asset. If an asset that is no longer contributing to the normal operations of a business is sold, that gain would be eliminated and earnings reduced.

- Life insurance proceeds. If life insurance proceeds were paid out, the proceeds would be eliminated as they do not recur, and thus, earnings are reduced.

- Restructuring costs. Sometimes companies must restructure operations or certain departments, the costs are one-time or rare, and once eliminated, earnings would increase by that amount.

Discretionary Items

These adjustments relate to discretionary expenses paid to or on behalf of owners of private businesses. Examples include the normalization of owner/officer compensation to comparable market rates, as well as elimination of certain discretionary expenses, such as expenses for non-business purpose items (lavish automobiles, boats, planes, etc.) that would not exist in a publicly traded company.

For more, refer to our article “Normalizing Adjustments to the Income Statements” and Chris Mercer’s blog.

The Need for Forensic Services

The process of valuing a business is complicated and the financial expert, during the course of his/her analysis, must consider various levels of value, normalization adjustments, as well as methods of valuation to most appropriately conclude on the business.

Valuations of a closely held business in the context of a contentious divorce can be especially multifaceted and may require additional forensic investigative scrutiny for any irregularities in the financials that may insinuate dissipation of business/marital property in anticipation of the divorce and valuation. Examples may include, but are not limited to:

- Owner Compensation. Owners may reduce earnings in anticipation of divorce to appear to have lower earnings capacity. Owners or executives with ownership interest may have made arrangements within the business to receive a post-divorce pay-out. A financial expert, through review of historical financial statements and tax returns, as well as an analysis of the lifestyle of the family, may gather support of the true earnings.

- Rent expense. Owners of a company may also own the land and/or building to which the business’ rent expense is paid, otherwise referred to as a related party. If the rent has increased in anticipation of the divorce, the related party may be taking on pre-paid rent or higher than market rent rates to reduce income. A financial expert may review historical expenses and assess the reasonableness of the rent expense.

- Discretionary expenses. Owners may use business funds to pay for personal, non-business related expenses such as vacations, lavish cars, boats, meals & entertainment, among others. A financial expert can review historical transactions to assess if such items are non-business related and if normalization adjustments are necessary for valuation purposes.

It is important to consider these types of situations if only one spouse is involved with the operations and management of the company, otherwise referred to as the “in-spouse.” That spouse may, or may not, have been altering the financial position of the business in anticipation of divorce and a potential independent business valuation. The services of a financial expert can be vital to you and your client in such matters, as the accuracy of the valuation may impact the equitable distribution of the marital assets.

Conclusion

If suspicions do not necessitate forensic services, perhaps only a business valuation scope is necessary. Furthermore, if the business or an interest was recently bought or sold, if it was recently appraised, or if its value is in a financial statement or a loan application, that information may go a long way in establishing the value of the business (if both parties feel that this value is a fair representation). However, since a business valuation report and expert witness are admissible in court as evidence and since the value of a business or interest impacts the marital balance sheet and the subsequent asset distribution, it may be exceedingly beneficial to hire a professional for evidentiary support.

Originally published in Mercer Capital’s Tennessee Family Law Newsletter, Second Quarter 2018