Value Drivers of a Store Valuation

Auto dealers, like most business owners, are constantly wondering about the value of their business. It’s easy to see how this issue moves to the forefront around certain events such as a transaction, buy-sell agreement, litigation, divorce, wealth-transfer event, etc. As our previous article “Six Different Ways to Look at a Dealership” points out, there are many other instances when a dealer can evaluate the condition, progress, or value of their store. Dealers can actually influence the value of their store prior to these obvious events by understanding the value drivers of a store valuation and addressing them on a consistent basis. So what are some of the value drivers of a store valuation?

Franchise

A store’s particular franchise affiliation has a major impact on value. Each franchise has a different reputation, selling strategy, target consumer demographic, etc. Public and value perception of franchises can be unique and are most easily illustrated through blue sky multiples. As the Haig Report and Kerrigan’s Blue Sky Report indicate, these blue sky multiples can vary over time and from period to period. Often stores and franchises are grouped into broader categories, such as: luxury franchises, mid-line franchises, domestic franchises, import franchises and/or high line franchises.

Real Estate/Quality of Facilities

Typically, most store locations and dealership operations are held in one entity, and the underlying real estate is held by a separate, often related, entity. Several issues with the real estate can affect a store valuation. First, an analysis of the rental rate and terms should be performed to establish a fair market value rental rate. Since the real estate is often owned by a related entity, the rent may be set higher or lower than market for tax or other motivations that would not reflect fair market value. Second, the quality and condition of the facilities are crucial to evaluate. Most manufacturers require facility and signage upgrades on a regular basis, often offering incentives to help mitigate these costs. It’s important to assess whether the store has regularly complied with these enhancements and is current with the condition of their facilities.

Employees/Management

The quality and depth of management can have a positive impact on a store valuation. Stores with greater management depth and less dependence on several key individuals will generally be viewed as less risky by an outside buyer. Also, a store’s CSI (Customer Service Index) and SSI (Service Satisfaction Index) rating can also influence incentives from the franchise and the overall perception of the consumer. A strong CSI and SSI are also a reflection of a strong service department and a commitment to quality customer service.

Recent Economic Performance

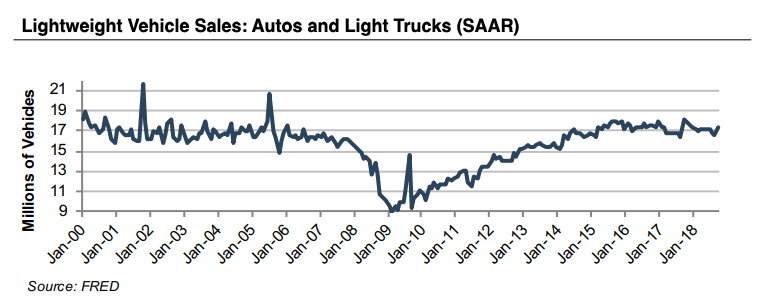

Like most industries, the auto industry is dependent on the national economy. We report later on the current SAAR (Seasonally Adjusted Annual Rate) which is an indicator of economic performance and future sales in the auto industry. Current conditions of rising interest rates and a leveling out of the SAAR compared to October 2017 could be predictors of stabilizing values and less activity in the M&A market in the months to come. In addition to monitoring and understanding the current month’s SAAR, the longer-term history of the SAAR and its trends also provide insight into the auto industry and a store valuation. Below is a long-term graph of the SAAR from 2000 to 2017.

This visual evidence demonstrates the cyclicality of the auto industry. Unlike some industries that may be seasonal or cyclical in a given year, the auto industry tends to be cyclical over a longer period of several years. For instance, it’s common for a store to have stronger volumes and profitability for a period of 4-5 years, before experiencing a sluggish year or two. Store valuations should consider the cyclicality of the industry and not overvalue a store during a strong year, or undervalue it during a sluggish year.

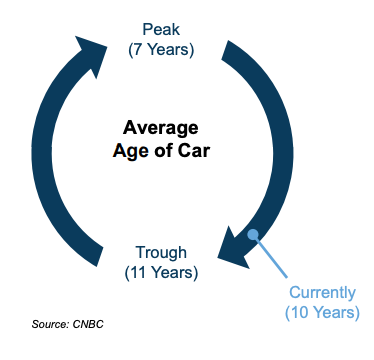

Another indicator of economic performance is an analysis of the auto cycle and where we are in that cycle based upon the average age of cars owned. The figure below illustrates the peak and trough of the auto cycle and where we sit today.

A store’s value and performance can be greatly influenced by the local economy as well as the national economy–sometimes more so. Certain markets are dominated by local economies of a certain trade or industry. Examples can be store locations near oil & gas refining areas, mining areas, or military bases. Each is probably more dependent on local economy conditions than national economy conditions.

Buyer Demand

Buyer demand in the transaction market can illustrate the value climate for store valuations. Typically, buyer demand is measured by the deal activity in the M&A market. The Haig Report indicated that the second quarter of 2018 transaction activity increased by 87% compared to second quarter of 2017. Further, the activity for the first six months of 2018 increased by 23% over the same six months of 2017. Similarly, Kerrigan’s figures reflect an increase in M&A activity of 13% in the first six months of 2018 compared to their data for the first six months of 2017.

Location/Market

The value of a store location can be more complex than urban vs. rural or major metropolitan city vs. minor metropolitan city. Each store location is assigned a certain area or group of zip codes referred to as an “area of responsibility” or “AoR”. Particularly, how does a location’s demographic characteristics line up with a certain franchise? For example, a high line store would perform better and seemingly be more valuable in a major metropolitan area with a high median income level, such as Beverly Hills or South Beach in Miami than in a mid western city. Conversely, mid-line stores would probably fare better in areas with more moderate median income levels.

Single-Point vs. Over-Franchised Market

The amount of competition in a store’s AoR, as well as the nearest location of a similar franchised store can also have an impact. It’s important to make the distinction that we are talking about a market and not a single-point store. A single-point market refers to a market where there is only one store of a particular franchise. An over-franchised market would be a larger market that may contain several stores of a particular franchise within a certain radius. Often, a store in a single-point market would be viewed as more valuable than one in an over-franchised market that would be competing with its own franchise for the same consumers. Additionally, the stores of the same franchise in the same market could be drastically different in size. One may be part of a larger auto group of stores, while the other may be a single-point dealership location, meaning its owner only owns that one location.

Conclusions/Observations

As we’ve discussed, the value of a store can be influenced by a variety of factors. Some of the factors are internal and can be affected by the owner, and some are external and are out of the control of the owner. To find out the value of your store, contact one of the automotive industry professionals at Mercer Capital.

Originally published in the Value Focus: Auto Dealer Industry Newsletter, Mid-Year 2018.