Vulcan Materials’ Acquisition of U.S. Concrete

Is the Price Right?

As participants in and observers of mergers and acquisitions, the 2021 acquisition of U.S. Concrete, Inc. (“U.S. Concrete”) by Vulcan Materials Company (“Vulcan Materials”) (NYSE: VMC) is a terrific opportunity to study the valuation nuances of the construction and building materials industry. In this article, we look at the fairness opinions delivered by Evercore and BNP Paribas rendered to the U.S. Concrete board regarding the transaction and provide some observations on the methodologies utilized by these two investment banks.

First, a little background on the two parties to the transaction before we delve into the analysis. At the time of the acquisition, U.S. Concrete was a publicly traded leading supplier of aggregates and concrete for infrastructure, residential, and commercial projects across the country, holding leading positions in high-growth metropolitan markets. Vulcan Materials, a member of the S&P 500 index, is the largest producer of construction aggregates, such as crushed stone, sand, and gravel in the U.S. and a major producer of aggregates-based construction materials such as asphalt and ready-mix concrete.

U.S. Concrete agreed to be acquired by Vulcan Materials at a price of $74.00 per share, or $1.3 billion, on June 7, 2021. The $74.00 per share offer price represented an approximate 30% premium to U.S. Concrete’s closing stock price of $57.14 on June 4, 2021, the last trading day before the deal was announced. The implied enterprise value of the deal was tallied at $2.1 billion. Deal multiples included 27.5x analysts’ consensus EPS for the next 12 months and 10.3x NTM EBITDA.

This deal was no surprise to industry observers. U.S. Concrete had engaged Evercore for strategic advisement during the onslaught of COVID-19, as the company’s stock price had dropped from $41.25 per share on January 2, 2020 to an intraday low of $6.75 on March 18, 2020. Evercore and U.S. Concrete considered numerous strategic actions, including executing a noncore disposition, growing the aggregates segment, and pursuing additional capital, but ultimately, U.S. Concrete decided the best path forward was to merge with Vulcan Materials.

The Evercore and BNP Paribas Fairness Opinions

The proxy statement dated July 13, 2021 enumerated the reasons the U.S. Concrete board approved the merger agreement, including the fairness opinions that opined the consideration to be received by U.S. Concrete shareholders was fair from a financial point of view. (A link to the proxy statement can be found here).

A fairness opinion provides an analysis of the financial aspects of a proposed transaction from the point of view of one or more parties to the transaction, usually expressing an opinion about the consideration though sometimes the transaction itself. Ideally, the opinion is provided by an independent advisor that does not stand to receive a success fee, especially when the transaction is a close call or involves real or perceived conflicts. In the case of the Vulcan Materials-U.S. Concrete transaction, both U.S. Concrete advisors stood to receive much larger contingent fees if the transaction was consummated compared to the fixed fee fairness opinions. Evercore received a fee of $3 million for the fairness opinion and was to be paid a success fee of $19.75 million. BNP Paribas’ opinion and success fees were $2.0 million and $6.4 million, respectively.

Guideline Public Company (“GPC”) Analysis

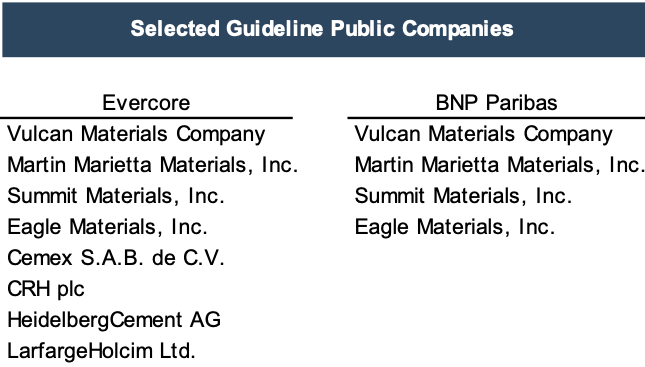

Evercore and BNP Paribas reviewed and compared specific financial and operating data relating to U.S. Concrete with selected GPCs deemed comparable to U.S. Concrete. The GPC’s used by each advisor were as follows. We note that Evercore selected four additional GPCs in addition to the four selected by BNP Paribas. We are not privy to Evercore’s reasoning for selecting the four additional GPCs.

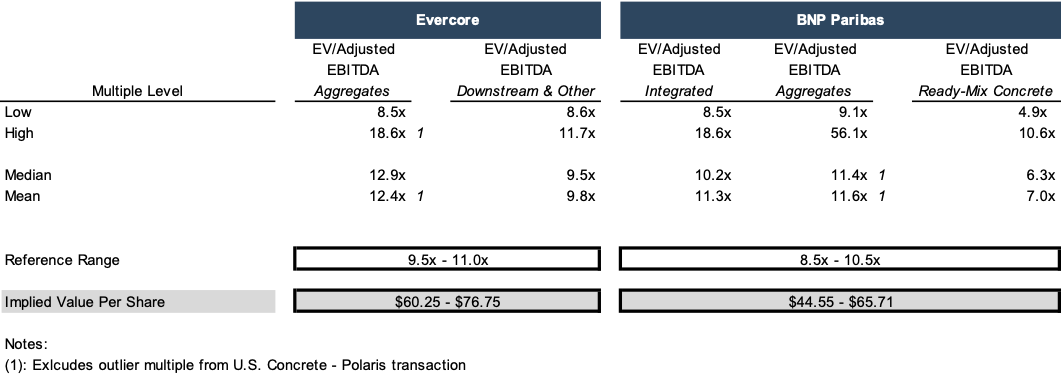

The following table compares the selected GPC’s high, low, and median EV/estimated EBITDA multiples, the reference ranges of multiples selected by Evercore and BNP Paribas, which were based on quantitative and qualitative factors alike, and an implied equity value per share, determined through the relevant ranges of multiples.

Both banks used publicly available market estimates and financial data, including S&P Cap IQ, to estimate EBITDA; however, BNP Paribas also took consensus analyst research estimates into account when determining the figures. When determining the relevant range, both BNP Paribas and Evercore used qualitative factors such as size, market exposure, growth prospects, and profitability levels alongside quantitative factors.

A quick glance at the table above indicates that Evercore’s reference range for both EV/estimated 2021 EBITDA and EV/estimated 2022 EBITDA generally falls above the lowest observed multiple on the low-end and approximates the median observed multiple on the high-end. While BNP Paribas’ respective reference ranges are nearly identical to Evercore’s reference ranges, BNP Paribas’ reference ranges fall below the lowest multiples observed for its selected GPCs. Presumably, Evercore’s selection of four additional GPCs has influenced Evercore’s reference ranges.

Guideline Transaction (M&A) Analysis

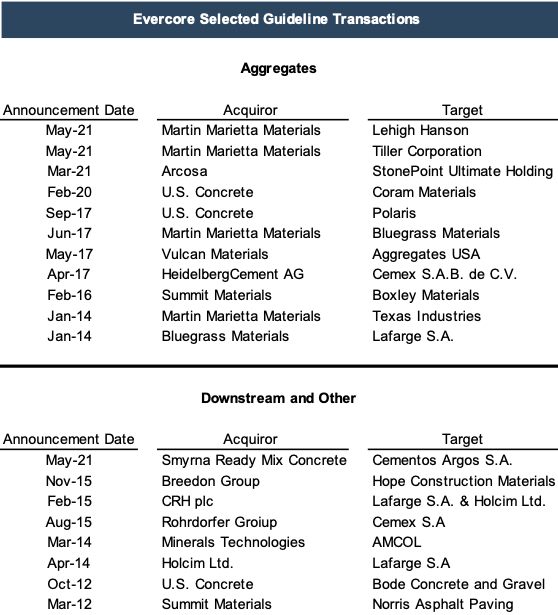

Evercore and BNP Paribas both explored past transactions of controlling interests in companies operating in the same industries as U.S. Concrete and Vulcan Materials to make assumptions about the equity value based on the implied multiples of each transaction. The transactions examined by each company are listed below. Evercore segregated its selected guideline transactions into two groups, Aggregates and Downstream and Other while BNP Paribas segregated its selected guideline transactions into three groups, Integrated, Aggregates, and Ready-Mix Concrete.

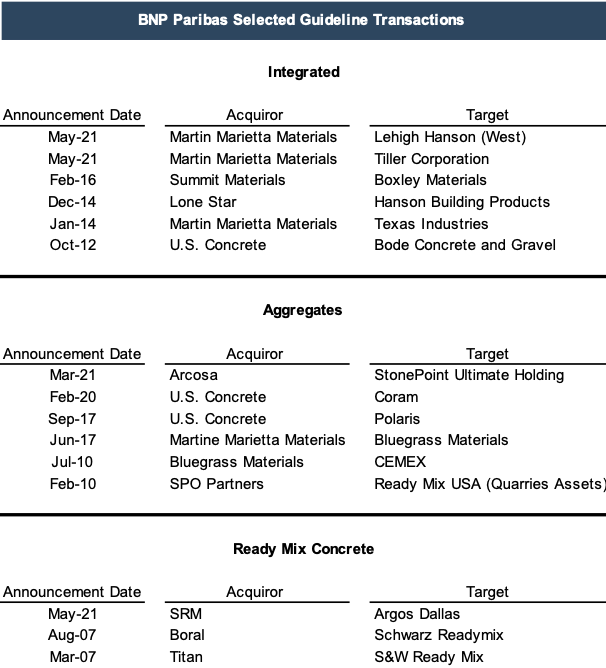

The analyses of both companies’ approaches to transactions are shown below.

Click here to expand the image above

These multiples lead each bank to a very different conclusion in terms of guideline transactions. With a reference range of 9.5x-11.0x, Evercore’s analytics indicate that equity value should range between $60.25 and $76.75 per share. BNP Paribas settled on an 8.5x-10.5x reference range, implying an equity value between $44.55 and $65.71. We note the following observations from the guideline transaction approaches taken by Evercore and BNP Paribas:

- A one turn higher multiple on the low-end (from 8.5x to 9.5x) results in a 35.2% higher value by Evercore

- A half-turn higher multiple on the high-end (from 10.5x to 11.5x) results in a 16.8% higher value by Evercore

- BNP Paribas’ high-end equity value per share of $65.71 is only 9.1% higher than Evercore’s low-end equity value per share of $60.25.

Discounted Cash Flow Analysis

Both Evercore and BNP Paribas performed a discounted cash flow (“DCF”) analysis. The DCF is used universally across business valuation, and especially so in fairness opinions. The gist of the analysis reflects the discounting of unlevered cash flows over a discrete period and the projected debt-free value of the company at the end of the projection period to present values based upon the weighted average cost of capital. Net debt is then subtracted to derive the indicated equity value.

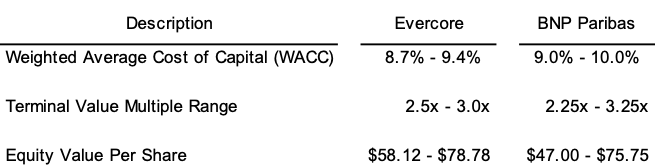

A quick glance at the table below reveals that Evercore’s low-end DCF analysis produced an equity value per share approximately 23.7% higher than BNP Paribas’ low-end DCF analysis, but Evercore’s high-end DCF analysis produced an equity value per share only approximately 4.0% higher than BNP Paribas high-end DCF analysis.

Historical Share Price Analysis

Both banks reviewed the 52-week trading history ending on June 4, 2021 ($20.77-$78.99 per share) for U.S. Concrete and compared this range to both the merger price of $74.00 per share and the closing price on June 4th at $57.14 per share. However, both banks noted that they only used this data for informational purposes and that it was not taken into consideration for the valuation process of U.S. Concrete.

Research Analyst’s Price Targets

Just like the historical share price analysis, the research analyst’s price targets were not considered material for either bank’s valuation. Nevertheless, the range of price targets that both Evercore and BNP Paribas observed spanned from $39.00 to $80.00 with Evercore stating a median target at $65.00.

BNP Paribas’ and Evercore’s Conclusions

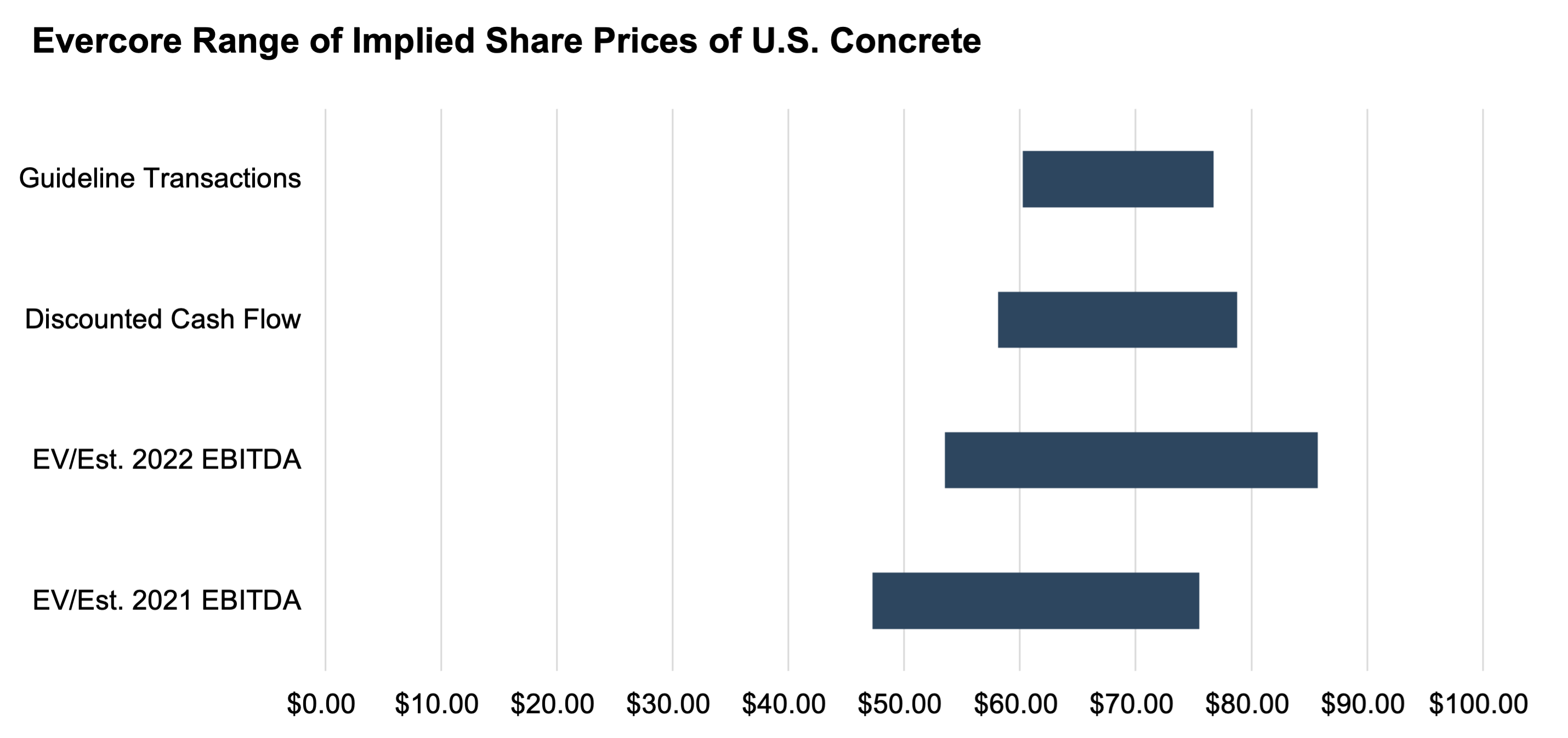

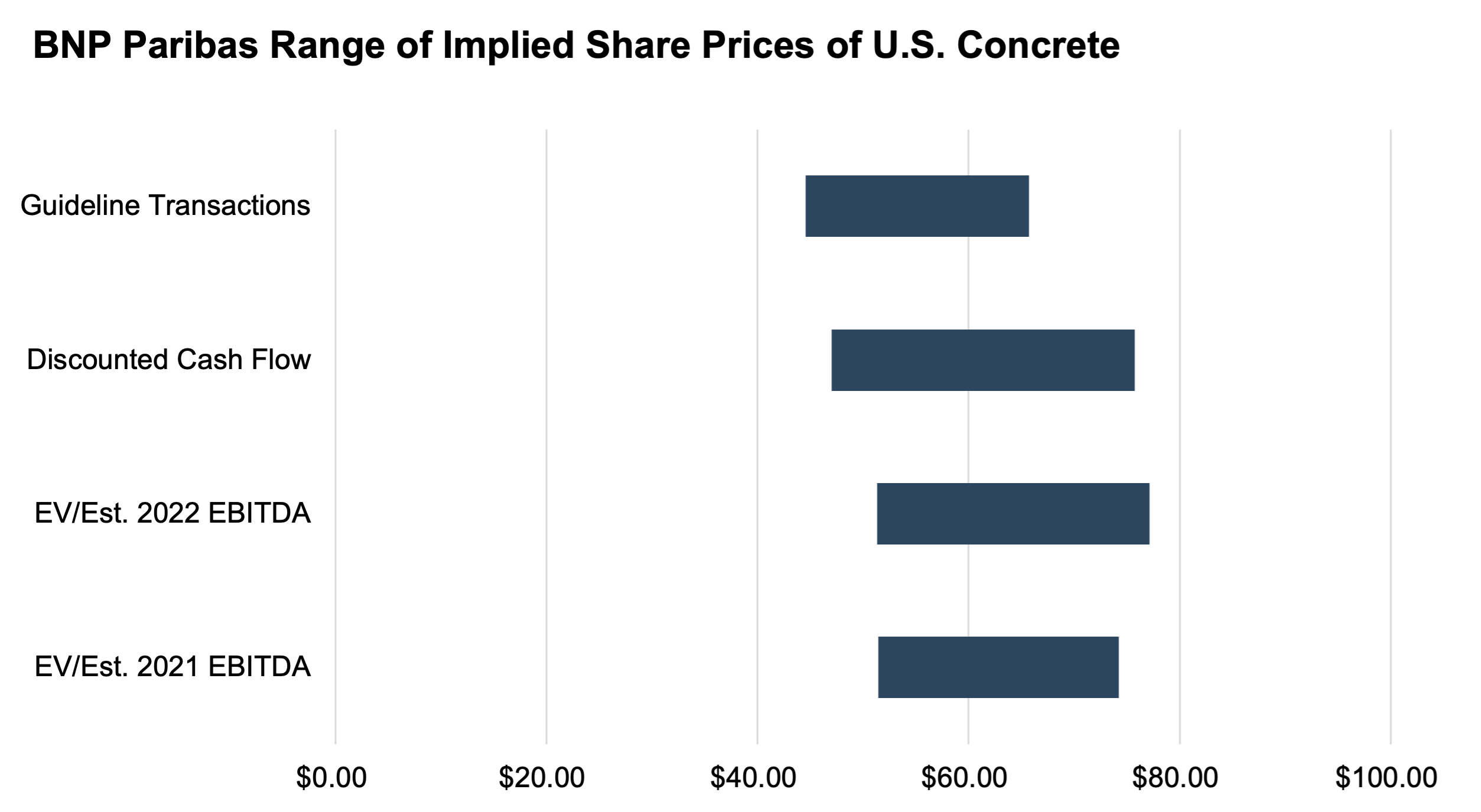

Both banks opined that, from a financial point of view, the consideration to be received by the stockholders of U.S. Concrete in the proposed transaction was fair to such stockholders. As can be seen in the graph below, the $74.00 share price fits into most ranges towards the top end of each range in both banks’ valuations. The deal was officially completed and closed on August 26, 2021.

*All charts and figures in the article are sourced from U.S. Concrete, Inc.’s Schedule 14A Proxy Statement