August 2024 SAAR

The August 2024 SAAR came in at 15.1 million units, notably 4.5% lower than last month. In fact, this month’s SAAR is even lower than June, which was negatively impacted by the CDK cybersecurity attack. We believe consumers are likely finally feeling the pain of a softer labor market, as indicated by the July 2024 Jobs Report from the Bureau of Labor Statistics. Alongside a lower number of job openings, the unemployment rate ticked up during the month, reaching the highest level since October 2021. These economic indicators suggest that the labor market is moderating, and auto sales might also be feeling the pain, with the Federal Reserve almost certainly cutting rates at their next meeting.

Comparing the August 2024 SAAR to the same month last year, the metric is down 1.1%. However, unadjusted sales outpaced August 2023 due to a unique calendar quirk, with Friday and Saturday of Labor Day weekend falling in August, giving August 2024 a coveted extra selling day. Year-over-year changes in the SAAR have been very modest throughout all of 2024. Despite the modest decrement this month, the general trend has been that 2024 unit sales have outpaced 2023 unit sales. For example, cumulative unadjusted sales over the first eight months of the year are 2.2% higher than the first eight months of 2023.

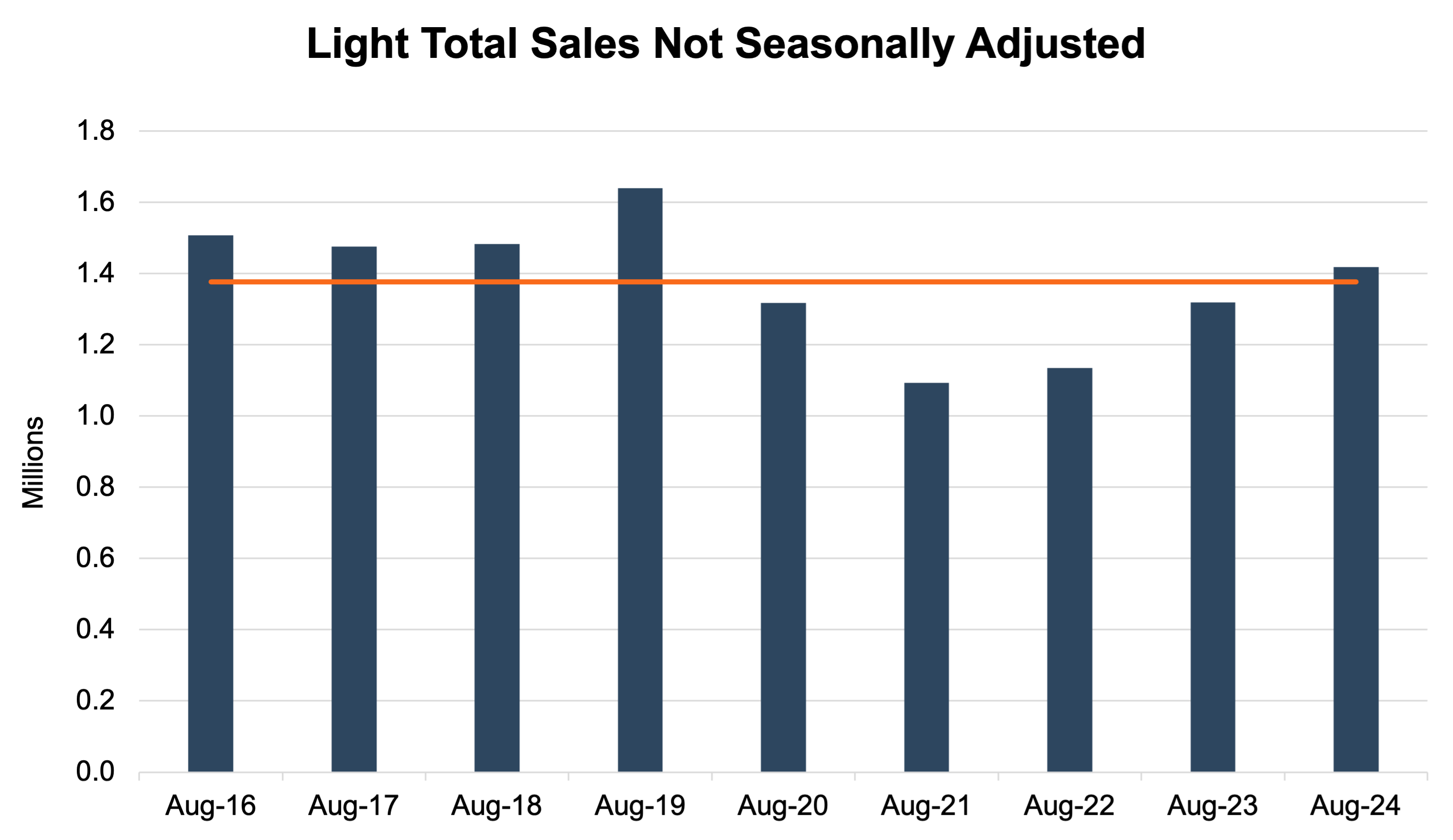

Unadjusted Sales Data

The industry sold 1.42 million total units during August 2024, an 11.2% increase from last month and a 7.6% increase from August 2023. This month’s unadjusted sales beat out the prior month and the nine-year August average (2016 – 2024), which includes four years before the pandemic. Unit sales have certainly picked up over the last month, telling a different story than the seasonally-adjusted metrics like the SAAR. However, data points like the SAAR can help provide a different perspective when a high-sales month like August 2024 comes along.

Furthermore, simply tracking unit sales can ignore an important portion of the story, as profitability has been receding for dealerships across the United States over the past year due to increased inventory and softer pricing. Some OEMs have even over-produced many models, further driving down transaction prices and increasing the amount of units sold wholesale and at auction.

See the chart below for a look at unadjusted sales over the last nine Augusts:

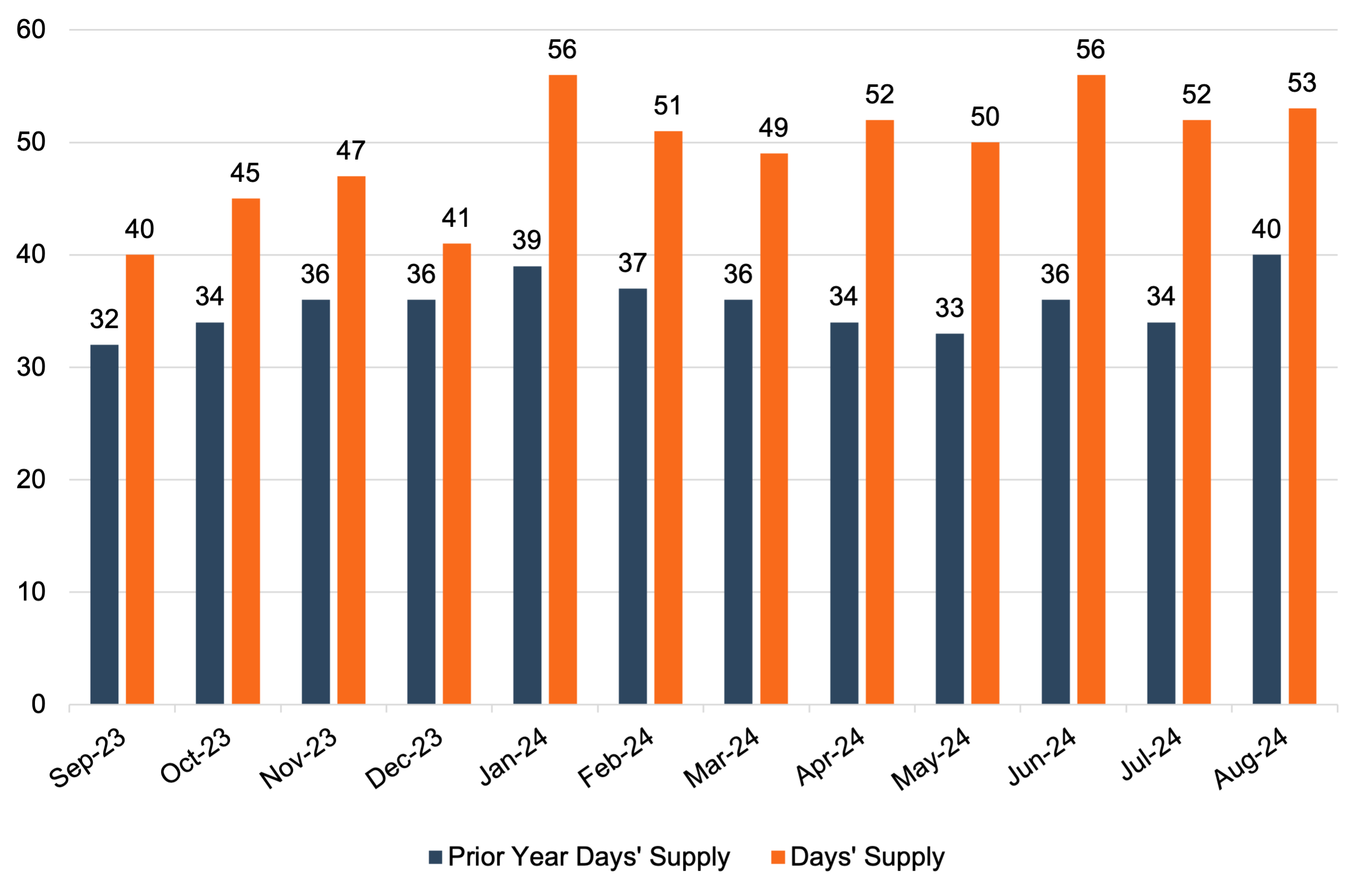

Days’ Supply

Days’ Supply came in at 53 days in August 2024. While this is certainly higher than the same time last year and reflects a recovery in the manufacturing supply chain at a global level, this measure of average inventory availability obscures the large differences in Days’ Supply by brand. For example, Toyota has been reported to have a days’ supply below 20 days, while Stellantis is reported to have a supply of nearly 100 days or more.

The chart below presents Days’ Supply for U.S. Light Vehicles over the past twelve months (per Wards Intelligence).

Transaction Prices

Thomas King, the president of data and analytics at J.D. Power, discussed the factors impacting average transaction prices for new vehicles in August:

“The average new-vehicle retail transaction price is declining from a year ago due to higher manufacturer incentives, larger retailer discounts and rising availability of lower-priced vehicles. Transaction prices are trending towards $44,039—down $1,895 or 4.1%—from August 2023. The combination of higher retail sales and lower transaction prices means that buyers are on track to spend nearly $50.7 billion on new vehicles this month— 6.3% higher than August 2023.”

As inventory levels stabilize and sometimes become inflated, certain OEMs are forced to ramp up incentives for specific nameplates across their lineup. We expect the average transaction price to continue to moderate in the final quarter of 2024, particularly as many consumers’ vehicle purchases are about fitting payments within constrained monthly budgets, and declining trade-in values increase auto loan balances. Again, it is important to note that even though average transaction prices have contracted in recent months, the average transaction price is still well above pre-pandemic levels.

Incentive Spending and Profitability

With only about 13.0% of new vehicles transacting above MSRP in August 2024, total retailer profit per unit is expected to drop nearly 33% to $2,249 from this time last year. Such a drop in per-unit profitability emphasizes the very different pricing and inventory environment the industry is experiencing in 2024 compared to the last three years. Profitability will likely look very different for dealers in this post-pandemic environment and is approaching pre-COVID levels.

Incentive spending from manufacturers typically displays an inverse relationship with per-unit profitability, as incentive spending is designed to increase volumes at the expense of profitability. Furthermore, certain manufacturers are in a situation where there is an outsized days’ supply of their vehicles in the market. In the face of over-inventoried brands, incentives will likely be the primary tool used by manufacturers to sell these units and normalize inventory levels across the country.

Given this environment, J.D. Power notes that average incentive spending per unit in August 2024 is expected to be $3,035, up 59.5% from August 2023. Incentive spending as a percentage of the average MSRP is expected to reach 6.2% during August 2024, an increase of 2.3 percentage points from this time last year. This dynamic has occurred many times in the auto industry. All it takes is one OEM to overproduce, starting a downward cycle for dealers of incentives and intense battling for market share. While auto dealers had hoped that lessons learned about leaner inventories over the past few years would stick, it is appearing less and less likely to be a new normal for the industry.

September 2024 Outlook

Mercer Capital expects the September 2024 SAAR to be between 15.5 and 16 million. Throughout the remainder of 2024, we expect to see pressure on the average transaction price and per-unit dealer profit as expanding inventory levels drive incentive spending higher.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights