5 Trends Facing Family Businesses Today

Back in the spring of this year, we discussed five broad economic indicators family businesses needed to keep their eye on. In this week’s post, we wanted to revisit those trends and see where we have come over the last four months, as well as what we are hearing from our clients on the ground.

COVID-19 Cases and Vaccinations

Since March, over 120 million people have received at least one dose of the various COVID-19 vaccines, pushing the COVID vaccination rate for U.S. adults to nearly 70%. Daily cases troughed in mid-June and have begun rising once again. However, daily death counts remain 90% below their mid-January peak, and a confluence of vaccinations and estimated infections has pushed a level of ‘herd immunity’ to over 70%, according to J.P. Morgan’s reading of the data. While there is some trepidation regarding the recent increase in infections, the majority of our family business clients are operating at the most “business as usual” we have seen since the genesis of the pandemic.

Interest Rates

In March, a consensus was beginning to form that interest rates would continue their ascent unabated. However, as rates took a dive my colleague, Jeff Davis, posed whether or not the “reflation trade” could be coming to an end, with fears of economic growth stalling out and (thankfully) inflation fears perhaps overblown (more on that below).

Current rate movements present a double-edged sword for family businesses. If broad rates continue their decline it could portend less-than-stellar economic growth. However, low interest rates still represent an opportunity for financing capital projects and are favorable to gift and estate strategies. Our advice given the backdrop is similar from the gifting side as it was last year: gift now.

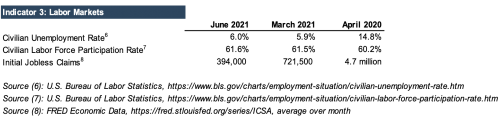

Labor Markets

Broadly speaking, the labor market has improved dramatically since the height of the pandemic, with most major indicators pointing toward a stronger labor market. This trend is exacerbating one of the main issues facing our family business clients: labor shortages. From electrical supply distributors to medical suppliers, general contractors, and HVAC companies, finding and maintaining talent remains a sticking point for many of our clients. Our clients are quick to point out these are not minimum-wage jobs, with industries most affected looking for labor in pay ranging between $20 to $30 an hour.

An article in the Wall Street Journal highlighted Americans are leaving unemployment rolls more quickly in states that were set to end expanded benefits early and reentering the job market. According to NFIB’s monthly jobs report, “46% of small business owners reported job openings they could not fill in the current period, down two points from May but still above the 48-year historical average of 22%.” Expanded benefits are set to expire nationwide in early September, which should create an influx of workers if the states ending benefits early, serve as a guide.

Inflation

“The Gipper” once said, “Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” While perhaps it’s not really quite as bad as those things, readers who lived through the early Reagan years likely recall the economic pain brought about by inflation rates topping 10% annually. Tighter labor markets, supply chain constraints and disruptions, and a red-hot economy boosted inflation fears during the second quarter.

Many of our clients who operate in the energy, hard goods, distribution, and construction fields have seen input costs rise sharply. Inflation rose in June at its fastest rate since the U.S. housing market crash in 2008. The fed continues to monitor inflation levels, but still views the current increase as “transitory”. We will have to wait and see: while lumber prices have fallen precipitously and steel stabilized below recent peaks, absolute levels for many inputs goods (soybeans, copper, resin,) and services (container shipping rates) remain high (or as the Reddit-ors would say “To the Moon”). Family businesses would be wise to keep an eye on the ball and revisit pricing assumptions on forecasts more than a few months out.

Sentiment Indicators

When we last took a look at sentiment indicators, the concerns of CEOs of larger businesses, could not have been more optimistic, whereas small businesses saw numerous challenges ahead. While the difference in outlook still exists, overall confidence has risen across the board. Consumer confidence (related to consumer spending, which represents nearly 70% of annual U.S. GDP) is expected to continue driving a strong economic expansion. This mirrors many of the conversations we are having with our clients, and family businesses are beginning to shift from “cash preservation” mode, back to smart growth and expansion.

Summary

While we don’t pretend to play economists, Mercer Capital maintains a sharp watch on national and global economic trends to better advise you and your family businesses. Give us a call to discuss how economic trends are likely to affect your family business.

Family Business Director

Family Business Director