A 2024 M&A Update

In last week’s post, Travis Harms opened the year by offering a few key questions that family business owners and directors should ask themselves in 2024. One of these questions suggests a thorough review of your family business’s M&A strategy.

In this week’s post, we take a closer look at middle-market deal activity in 2023, which sank to its lowest level in a decade, and offer a few thoughts regarding the state of the middle market as we see it in 2024.

Although middle-market transaction activity remained depressed in 2023 compared to 2022 levels, M&A activity and possibly deal multiples could improve in 2024 given the potential for Fed rate cuts, an economy that has remained resilient despite 525bps of rate hikes by the Fed, and ample dry powder held by PE firms to deploy.

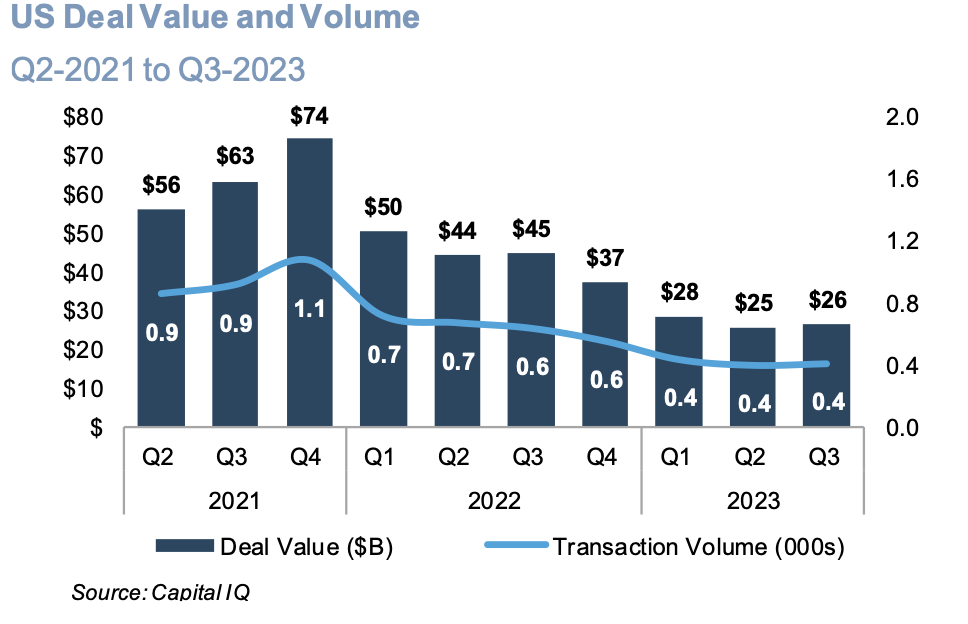

As shown in the following chart, overall U.S. deal activity, as compiled by Capital IQ in the third quarter, was little changed from the depressed levels observed in the first half of 2023. Pitchbook reports that US PE middle-market activity (deals with an enterprise value of more than $1 billion) fell to a six-year low in the third quarter and was down 13% from the second quarter and 55% from the year-ago quarter.

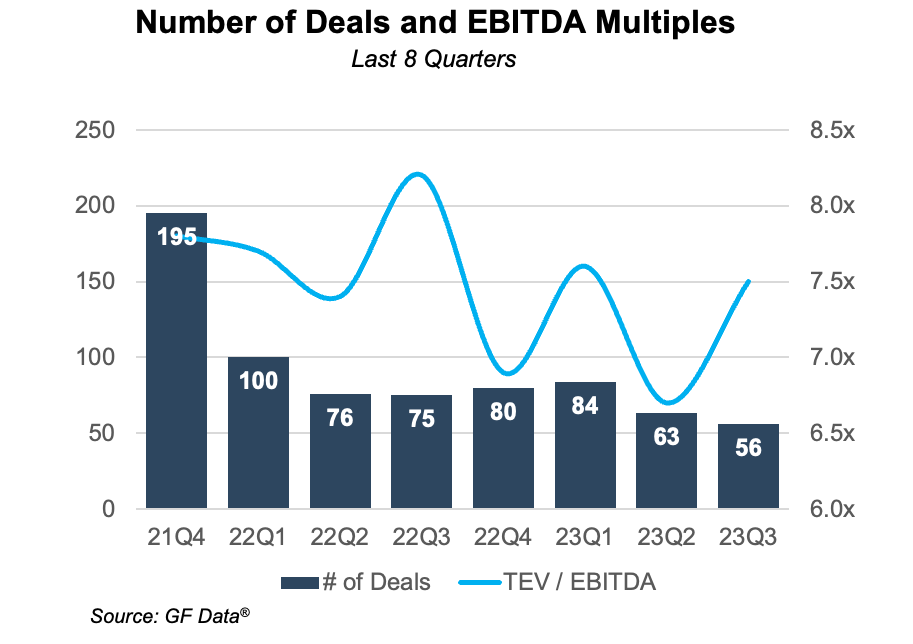

Lower middle-market activity (defined as enterprise values of $10 million to $500 million) as compiled by GF Data® provides several notable observations about PE-backed transactions:

- Similar to the overall U.S. transaction level, lower middle-market activity is depressed relative to 2022 and especially 2021, when financing costs were exceptionally low.

- The average EBITDA multiple for all sub-groups improved to 7.5x in the third quarter compared to 6.7x and 8.2x in the prior and year-ago

- The average EBITDA multiple for the trailing 12 months on a rolling quarterly basis declined to 7.2x compared to 7.4x in and 7.7x in the prior and year-ago

- The average EBITDA multiple for the trailing 12 months by sub-group ranged from 5.9x for deals with an enterprise value of $10-$25 million to 11.2x for deals in the $250-$500 million range.

- Buyer transaction costs excluded from the multiples cited above add about 0.3x to all-in costs.

Deal volume for both strategic and financial deals presents a similar picture. The following chart highlights overall deal value and volume, including strategic deals. The third quarter of 2023 represents a slight uptick in deal value and consistent volume across each quarter in 2023. Deal value is down approximately 41% year-over-year and 59% from third-quarter 2021 metrics.

Even with the general macroeconomic issues of high borrowing costs and prospectively slower economic activity, private equity firms have abundant investment capital to put to work (~$2.5 trillion by some estimates), and strategic buyers are constantly looking for growth opportunities. One takeaway from the increase in quarterly multiples in the third quarter for low middle-market PE deals is that quality firms continue to transact, whereas firms with less attractive characteristics are not transacting as frequently.

There are multiple reasons to be optimistic about middle market M&A activity in the coming year:

- An abundance of committed capital is ready for deployment, prompting investors and acquirers to become more motivated to put their money to work.

- Recent reductions in intermediate and long-term rates, when combined prospectively with a potential reduction in SOFR if the Fed follows through with rate cuts, portends lower borrowing costs.

- Also, the ability of issuers to tap the capital markets for equity and debt financing should improve given the strong rally in small-cap equities and, to a lesser extent, high-yield credit since late October.

- Lastly, technological advancement needs within the market could be driving factors in M&A growth activity in 2024.

It would not surprise us to see a recovery in middle-market transactions in 2024.

If your family business is looking to capitalize on renewed activity levels in M&A markets, preparation will be more important now than ever, as heightened levels of buyer and lender scrutiny will lead to more intensive diligence processes.

Well-crafted offering materials, clean financial statements, and a thorough understanding of value drivers within your family business will help to streamline these processes.

If you are contemplating a transaction on the buy side or the sell side, feel free to reach out to discuss your needs in confidence.

Family Business Director

Family Business Director