A Framework for Ownership Strategy – Part I

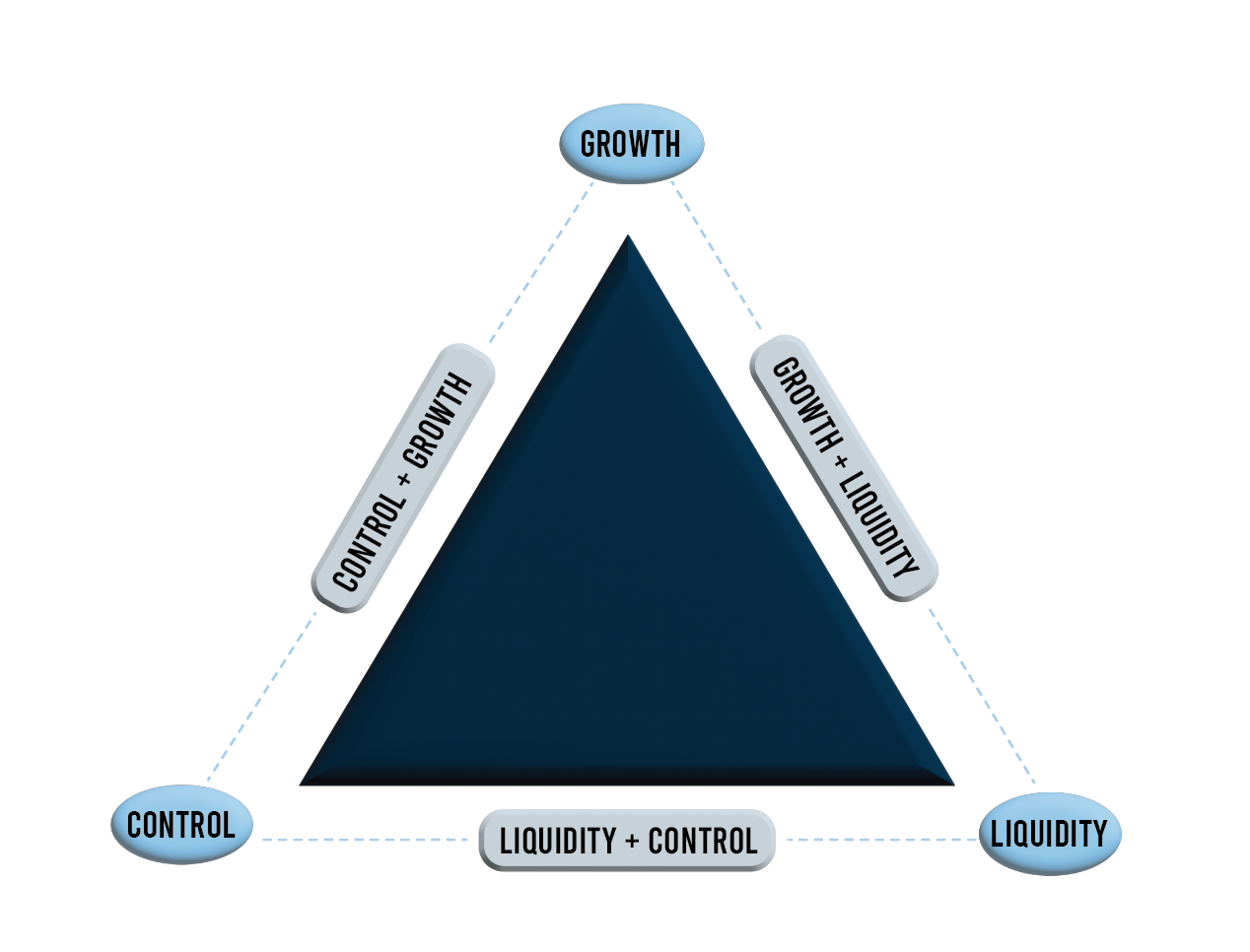

We recently attended a family business symposium where owners, board members, and consultants gathered to share strategies and insights. During one of the presentations, the graphic below piqued our interest. This simple triangle provides a framework for developing and managing an ownership strategy in a privately held family business. While we wish we could claim credit for creating this framework, our research points us to the Harvard Business Review’s Family Business Handbook as the originator of the graphic. Still, we’ll offer some thoughts on developing a strategy through the lens provided by the graphic in this week’s post.

Why Develop an Ownership Strategy?

Any goal or objective in life is doomed without a cogent strategy to achieve it. The absence of an ownership strategy to effect desired outcomes will leave a family business rudderless. Owners have the right to define the goals and objectives of a business, but without an ownership strategy, the odds of achieving whatever the ownership team defines as success will suffer. These goals, objectives, and definitions of “success” or “value” will vary across the spectrum of businesses and ownership groups, but the graphic above and its components, which we discuss below, provide a great starting point for ownership groups looking to develop a strategy to achieve desired outcomes, particularly in periods of growth or transition.

Growth

Growth sits at the top of the triangle. This is appropriate, as growth is often at the forefront of every ownership group’s objectives. Most publicly traded companies focus relentlessly on growth in sales, profits, and, ultimately, value because this growth is how they induce investment from shareholders. In return, shareholders demand this growth in value. Family businesses are not subject to the demands of markets or (typically) large, diverse shareholder groups solely seeking financial returns. Family shareholders have the flexibility to prioritize what is in their best interest in the management and overall direction of the family business. For some families, this might mean prioritizing culture or the well-being of its managers and employees over growth.

Control

In thinking through the triangle framework, the issue of control essentially boils down to this: “Do we want to use other people’s money to grow the family business?” While taking on outside investment, whether through debt or equity, can fund growth opportunities, non-family capital always has strings attached: external capital limits the family’s discretion. Debt capital comes with the financial restrictions and covenants on borrowers often imposed by lenders on borrowers. Non-family equity capital will likely seek some measure of operational influence via board seats and/or key personnel (management) decisions. While outside investment can unlock growth or liquidity options for family businesses, shareholders should evaluate the tradeoffs carefully. For example, perhaps a family business elects to pay its employees above market wages or provides family members with compensation and benefits to fund their lifestyle preferences. Although outside capital can fuel growth in the business, the family’s ability to make decisions like these may be hampered by the influence of lenders or non-family equity investors.

Liquidity

Owners have the right to determine whether residual profits generated by a business are reinvested in the business or distributed to shareholders. There is no correct answer to the question of reinvestment or distribution; owners must carefully weigh the pros and cons of this tradeoff. Reinvestment is not limited to growth opportunities – businesses must be vigilant about making regular capital investments into the business to maintain facilities and shield any competitive advantages. Businesses owe their employees and other stakeholders the opportunity to operate on a level playing field, and a program of regular capital reinvestment can solidify this opportunity. On the other hand, a steady dividend or distribution program can promote the sustainability of a family business because it allows the family to build wealth outside of the business and diversify risk exposures.

The triangle framework provides a simple yet effective starting point for family businesses to develop an ownership strategy. In next week’s post, we’ll look at the pros and cons of each combination and the tradeoffs that come with these strategic combinations.

See Part 2 of this series here.

Family Business Director

Family Business Director