A Framework for Ownership Strategy – Part II

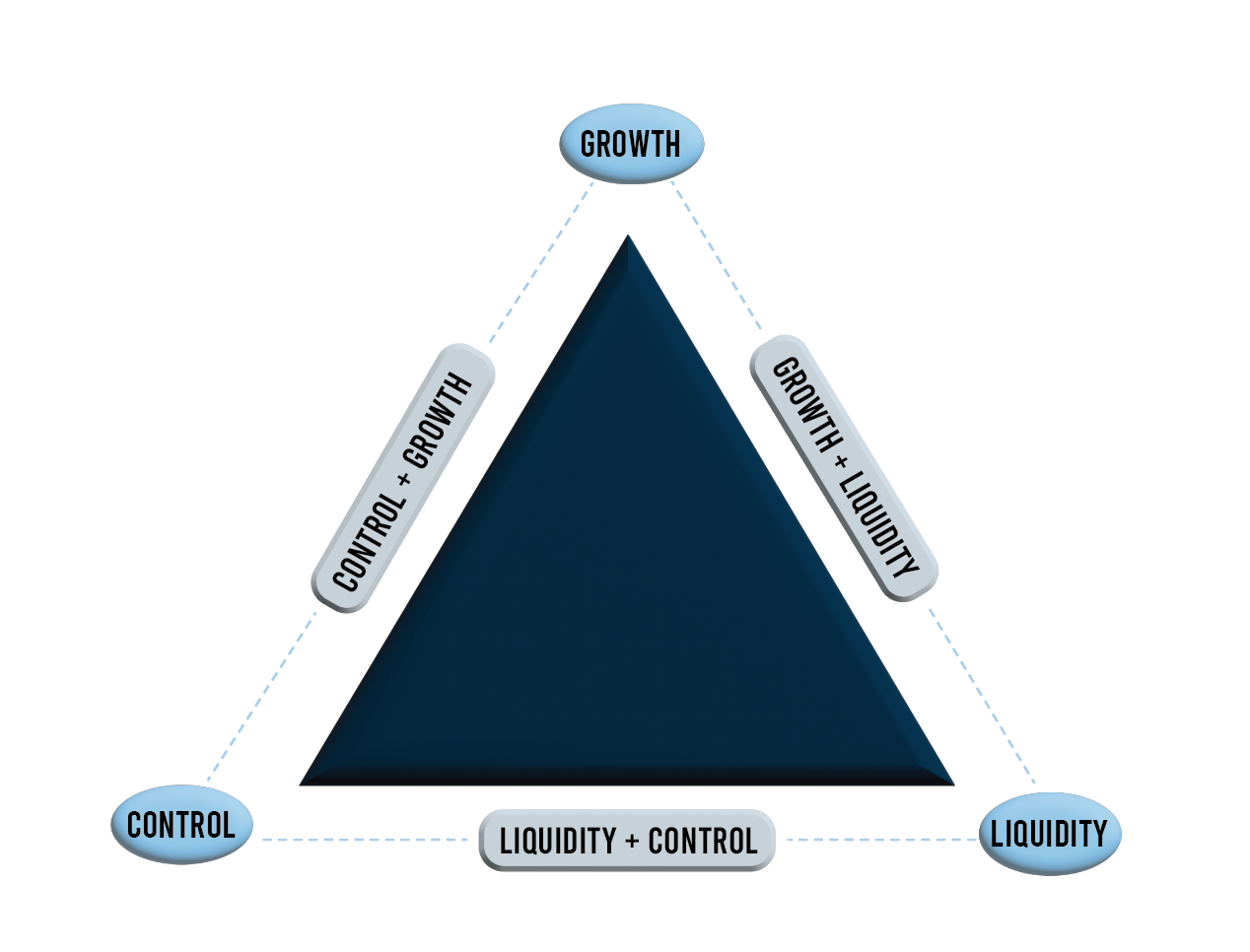

In our last post, we introduced a simple yet effective framework for developing and managing an ownership strategy. We follow up with some further thoughts on the framework as we look at the implications of the various combinations of the three points of the framework below. Thinking about the combinations of growth, liquidity, and control can allow family business owners to further fine-tune an ownership strategy in that it forces ownership groups to consider the benefits and tradeoffs that come with developing a strategy. We examine these tradeoffs and benefits in this week’s post.

Control + Growth

The combination of control and growth implies that a business has not taken on equity or debt capital to the extent that it has given up control over key operations and financial decisions and that ownership has decided to reinvest residual profits back into the business. The reinvestment rate, which measures the percentage of profits being reinvested into the business as opposed to being distributed, can be a useful metric for observing the extent to which ownership is funding the business’ growth with residual profits. This is an easily understandable measure that can direct owner strategy in the tradeoff between growth and liquidity. The decision to reinvest heavily often comes at the expense of shareholder liquidity, and an impatient shareholder base may start clamoring for returns while the company is still actively reinvesting. At any rate, ownership has retained control over the reinvestment vs. distribution decision by not bringing in large amounts of outside capital.

For a further look into the reinvestment rate and its applications, we’d point our readers to this recent article in the Harvard Business Review by Hans Latta, Andy Bahnfleth, and Rob Lachenauer: Is Your Family Business on the Path to Growth?

Liquidity + Control

This situation is the other side of the coin from the control and growth scenario. In this strategic position, ownership controls the business and pays a steady stream of dividends or distributions to its shareholder base. This is a positive in that shareholders will generally be satisfied by this financial return, which can promote long-term sustainability and unity within the business. Owner groups operating with this strategy in mind may also provide liquidity to owner-operators via above-market compensation packages or to owner-board members through board fees. Conversely, giving up growth and reinvestment can be a detriment to the business and its ability to compete with businesses that are actively reinvesting profits into newer facilities, technologies, and processes. Control remains with ownership in this scenario, giving ownership “the ability to act economically irrationally,” as Rob Lachenauer, the co-author of the Harvard Business Review Family Business Handbook, put it last week as we discussed the benefits of control in a family business.

Growth + Liquidity

The final combination is that of growth and liquidity. In this scenario, ownership has given up control of the business, whether that be to lenders who have provided debt capital or equity investors. Outside investment can be used to fund a myriad of growth opportunities — both organic and inorganic. Residual profits under this scenario are also sufficient to distribute money back to shareholders, which is likely to be a demand of private equity investors. While the family’s ownership in the business may have been diluted, financial returns and favorable exit prospects have likely increased due to the growth promoted by an infusion of outside capital.

The triangle framework provides a simple yet effective starting point for family businesses to develop an ownership strategy. We’d encourage family business owners and board members to consider their current position on the triangle and whether or not they are satisfied with it. If you are considering a decision that would strategically realign your business to another side of the triangle, give one of our family business professionals a call.

We’d also like to thank Rob Lachenauer of BanyanGlobal for providing a few minutes of his time to discuss the triangle framework with us. Rob co-authored the Harvard Business Review Family Business Handbook with Josh Baron, which introduces the triangle framework for ownership.

Family Business Director

Family Business Director