A Guide to Corporate Finance Fundamentals

Part 1 | Finance Basics: Return & Risk

This post is the first of four installments from our Corporate Finance in 30 Minutes whitepaper. In this series of posts, we walk through the three key decisions of capital structure, capital budgeting, and dividend policy to assist family business directors and shareholders without a finance background make relevant and meaningful contributions to the most consequential financial decisions all companies must make.

In our experience, an informed and engaged shareholder base is the most important ingredient for preserving family harmony. The purpose of this short review of basic finance principles is to promote productive engagement by equipping family business shareholders with a conceptual framework and vocabulary for communicating their financial needs and preferences to the board. While family businesses face many important questions, the scope of this guide is limited to the three inter-connected financial decisions of capital budgeting, capital structure, and distribution policy. Our goal is to enable family business directors and shareholders to understand the manner in which these decisions are linked together and how they interact with corporate strategy to generate shareholder returns and value.

In this series, we start with a brief overview of return and risk, the two basic building blocks of corporate finance. Having laid that foundation, we proceed in future posts to address the three big financial questions facing corporate directors. Following a quick overview of the key finance concepts relating to each decision, we will offer a list of related discussion topics for boards and shareholders. We will conclude by reviewing how each of the three questions relates to, and depends upon, each other.

Finance Fundamentals

The first fundamental axiom of corporate finance is the time value of money: a dollar today is worth more than a dollar tomorrow. In other words, the passage of time has a corrosive effect on wealth. The essence of investing is deferral; one elects to defer consumption today in hopes of having more tomorrow. Corporate managers are engaged in a race against the clock, knowing that their stewardship of family resources will be evaluated by the degree to which they offset and overcome the corrosive effect of passing time on the family’s wealth.

Investment returns have two components. Yield measures the current income (interest or distributions) generated by an investment. Capital appreciation measures the increase in value during the period. As shown in Exhibit 1, total return is the sum of yield and capital appreciation. There are no other sources of financial return to investors. There is an inherent tradeoff between these two components – higher current income limits future upside, and faster growth usually comes at the expense of current income.

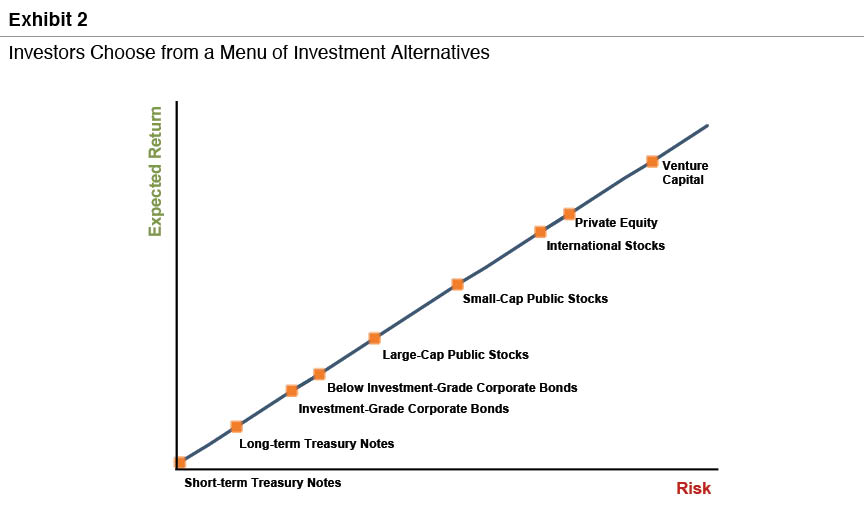

Families must select their investments from a large, but limited, menu of potential alternatives. Investors uniformly desire higher returns. However, in the process of competing with one another, investors bid up the price on less risky investments. For a given financial outcome in the future, a higher price today results in a lower return over the holding period. As a result, the more desirable investments offer lower expected returns. The second fundamental axiom of corporate finance, the risk-return relationship, follows from this. As shown in Exhibit 2, return follows risk.

The diagonal line illustrates some of the more common risk-return combinations available to investors. In order to achieve a higher expected return, investors must be willing to accept greater risk.

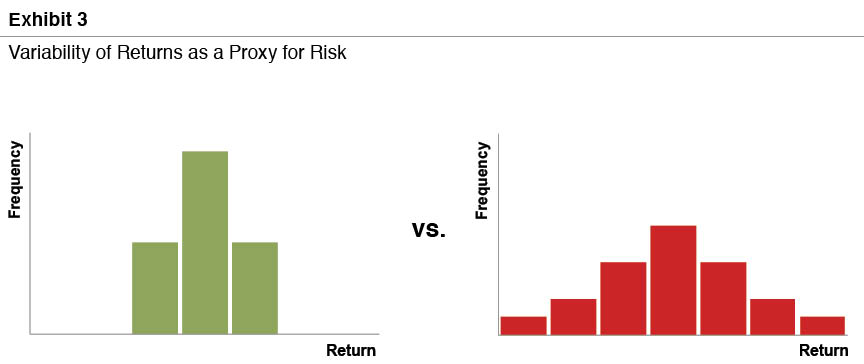

Peter Bernstein defined risk succinctly: “Risk doesn’t mean danger – it just means not knowing what the future holds.” As depicted in Exhibit 3, the most common basis for measuring financial risk is the dispersion, or variability, of potential financial outcomes.

The charts in Exhibit 3 plot an equal number of outcomes for two investments. The one on the left has a tighter range of potential outcomes and is, therefore – on an absolute basis – the less risky of the two.

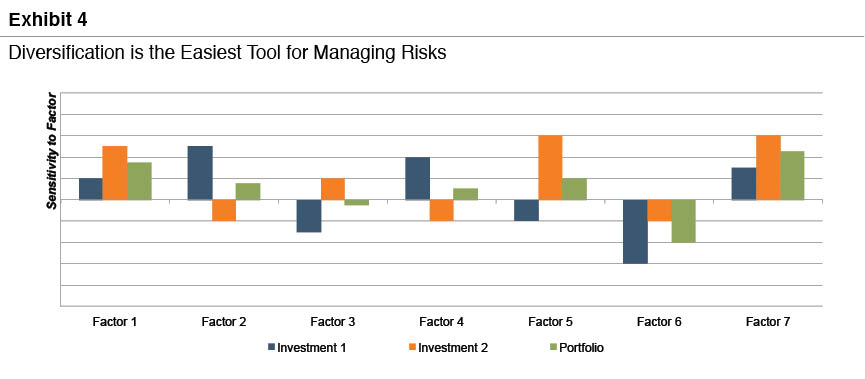

However, the absolute riskiness of an investment is less important than the contribution of that investment to the overall risk of a diversified portfolio. The rational response to risk is to diversify. Diversification is effective to the extent that the components of a diversified portfolio respond differently to common economic factors. Dividing one’s investment portfolio among multiple assets is a waste of time if those assets all behave in the same way. Correlation is a measure of the “co-movement” of returns. The more similar two investments are, the higher the correlation between them; highly correlated investments do not contribute much to diversification. Exhibit 4 illustrates the risk-reduction benefit of less-than-perfect correlation among assets in a portfolio.

The two investments in Exhibit 4 (the blue and orange bars) have equal risk on an absolute basis. However, the returns are not perfectly correlated with one another, making them well-suited diversification partners. As a result, an equal-weighted portfolio of these two assets exhibits is less risky than either investment by itself. Since diversification is relatively easy, most people do it. As a result, the relevant measure of risk that corresponds to return (Exhibit 2) is the asset’s contribution to the overall riskiness of a well-diversified portfolio. This is called systematic risk. So, we can supplement our risk axiom as follows: return follows systematic risk.

Quick Review

Because a dollar today is worth more than a dollar tomorrow, investors evaluate investment performance by calculating returns. Investment returns are the sum of yield (current income) and capital appreciation (future upside). Higher expected returns can be achieved only by accepting higher risk. From a financial perspective, risk is simply the dispersion of the variability of future outcomes. Since diversification reduces risk, the most relevant measure of risk to investors is systematic risk, or an asset’s contribution to the risk of a well-diversified portfolio.

WHITEPAPER

Family Business Director

Family Business Director