A Little Planning—A Lot of Tax Savings

Charitable Giving Prior to a Business Sale

Over the last few weeks, I’ve had both professional and personal conversations with family business owners who utilized a business transaction to maximize their charitable giving and minimize their tax burden. While taxes are not generally the primary driver in making large gifts to charity, a little foresight and planning can create flexibility in your giving, yield more bang for your buck, and result in fewer taxes owed to Uncle Sam. In this week’s post, we discuss the tax strategy that charitable family business owners should keep in mind when selling their business.

Charitable Gifts and Business Transaction

For many family businesses, the original cost basis of their business ownership interest is extremely low, if not zero. If you have received stock via gifting, your stock’s basis is “carried over” from the original donor (or was the stock’s fair market value at the time of the gift). In short, for many family businesses, any sale likely has quite a large built-in capital gains tax, especially if your family business has generated solid returns over generations.

So, where’s the beef? A donation of some portion of your family’s business ownership in its business prior to a sale provides two benefits:

- A charitable tax deduction for the fair market value of the interest at the time the gift is made.

- Minimized capital gains exposure for the portion donated and sold by the charity rather than the family.

Below we provide an example and some thoughts on this strategy.

Utilizing a Donor Advised Fund

A donor-advised fund, or “DAF,” is a flexible and tax-efficient way to give to charities. A DAF operates like a charitable investment account for the sole purpose of supporting charitable organizations. When taxpayers contribute assets, such as cash, stock, or other (read: private business stock) assets to a DAF, they can take an immediate tax deduction, avoid capital gains recognition, and grow the donation tax-free.

A primary benefit of using a DAF to implement this gifting strategy is a practical one. Many charities are not structured to take stock of privately held companies, whereas organizations that support DAFs are able to handle the complexities around private family-owned stock gifts.

Gift Timing

As the saying goes, “Pigs get fat, hogs get slaughtered.” If you already have a legally-binding transaction agreement in place, this strategy is less useful, and the IRS is not likely to allow recognition of the gift. However, a non-binding letter of intent (“LOI”), where each side can leave the table, meets the bill. For the gift, a qualified appraisal would likely give significant weight to the pro rata offer on the table in measuring fair market value. The likelihood of a near-term transaction would also limit the typical discounts for lack of marketability or control. This would maximize the value of the ownership interest for gifting purposes.

This works for donating stock to charity broadly, not just in a business transaction context. However, if a path to liquidity is not on the horizon, discounts for lack of control and marketability are likely to be more significant. This lowers the total fair market value of your gift, reducing tax savings at the time of the gift. On the flip side, if the gift is made to a DAF, as discussed, the ownership interest may be held and grow as the business value grows. At a business exit, your DAF reaps the benefits of the sale and avoids the capital gains tax on that portion of ownership, maximizing future charitable gifts from the DAF.

Qualified Appraisal

If you’re reading this blog, you may have guessed this already; Gifts of private family ownership interests require qualified appraisals per the IRS. We talk about what amounts to a “qualified appraisal” and how to pick a qualified business appraiser here.

Tax Benefits of Planning

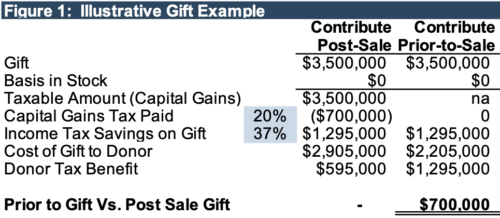

To illustrate the benefits of this strategy, consider two alternative scenarios: (1) the business owner contributes to charity using funds after a sale of the business (“post-sale”), or (2) the business owner contributes stock to charity prior to the deal closing (“prior-to-sale”). We’ll briefly summarize Figure 1 below.

- In both scenarios, the value of the gift is assumed at $3.5 million. This represents the pro rata cash proceeds in the post-sale scenario and the value of the privately held stock based on a qualified appraisal (which referenced the non-binding LOI purchase price in developing the conclusion of fair market value) in the prior-to-sale scenario.

- In the post-sale scenario, the business owner pays a capital gains tax on the appreciation in the stock, or $700,000 (20% of $3.5 million, assuming a $0 basis). In the prior-to-sale scenario, the business owner avoids the capital gains tax because the stock was gifted to a DAF.

- Under both scenarios, the business owner is entitled to a charitable deduction of $1.295 million for income tax purposes.

- The total tax benefit in the post-sale scenario is $595,000 ($1.295 million less the capital gains tax paid of $700,000). The prior-to-sale scenario’s total tax benefit is $1.295 million, or $700,000 higher.

Final Thoughts

As we said in the beginning, tax considerations are generally on the back burner when considering major gifts. While gifts of family business stock can be complex, the benefits of the strategy and the impact it can have are too significant to ignore. We’ve worked with business owners to provide qualified appraisals for gifting purposes in both a charitable and estate planning context. Give us a call if you want to discuss a gifting strategy you are contemplating in confidence.

Note: The example here and tax ramifications are for illustration only. This article does not consider state, AMT, or other complex tax situations. The value of stock in your situation may not equal post-sale pro rata proceeds. Please consult your independent appraiser and tax advisor regarding your situation and potential tax consequences.

Family Business Director

Family Business Director