A Private Equity Tactic to Consider for Your Family Business

A few weeks ago, we observed private equity investors learning a lesson about liquidity risk, which family shareholders have always known. This week, we turn the tables and explore a PE strategy that might be worth considering for some family businesses.

A couple of weeks ago, the Wall Street Journal noted that — amid a sluggish M&A market — PE-backed companies were increasingly turning to lenders to fund so-called dividend recapitalizations in a bid to provide liquidity to impatient investors.

What Is a Dividend Recapitalization?

In contrast to ordinary dividend payments, which are paid out of profits earned by a business, a dividend recapitalization features a payment to owners out of the value of a business. In other words, a company executing a dividend recapitalization borrows money (increasing debt) to pay a dividend to shareholders (reducing equity). Think of it as a home equity loan on steroids.

Why do PE-backed companies like dividend recapitalizations? They allow PE firms to return money to their limited partners (i.e., investors) without selling the underlying portfolio company. If the PE fund thinks the timing is not right in the M&A market for an optimal sale of the company, a dividend recapitalization allows them to “unlock” at least a portion of the value built inside the company and return that portion to their LPs. Since a dollar today is worth more than a dollar tomorrow, returning cash to investors sooner rather than later boosts investment returns and makes for happier LPs (who will then be more likely to subscribe to the PE manager’s next fund).

What can go wrong? Any time you trade equity for debt, you increase the risk of the business. Following a dividend recapitalization, the company that paid the dividend will have less financial flexibility to withstand business slowdowns or take advantage of unexpected opportunities to make strategic investments.

Why Would a Family Business Consider a Dividend Recapitalization?

One of the primary risks facing enterprising families is an insufficiently diversified family balance sheet. If the family’s wealth is concentrated in the stock of the family business, an adverse event in the family business can have a devastating economic impact on the family’s wealth.

Some family businesses operate with little to no debt, whether because of bad experiences in the past (i.e., narrowly avoiding bankruptcy) or shareholder risk tolerance. On the surface, this appears to be a “conservative” position, but it can actually increase the overall financial risk borne by the family.

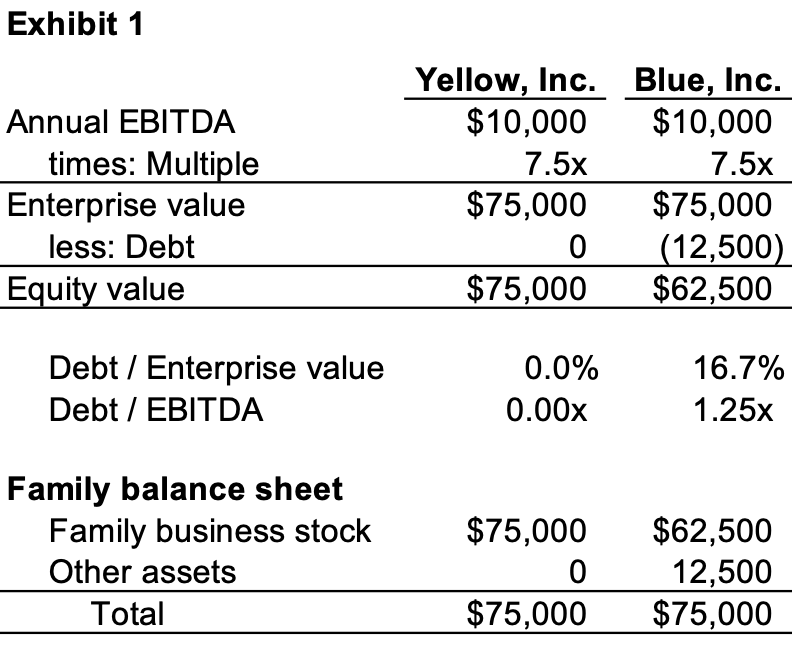

Consider the following simple example. Yellow, Inc. and Blue, Inc. both generate $10 million of EBITDA annually and have an enterprise value of $75 million (7.5x EBITDA). Yellow, Inc. is debt-free, and Blue, Inc. has just completed a $12.5 million dividend recapitalization. Exhibit 1 summarizes the family balance sheets for Yellow, Inc. and Blue, Inc.

By virtue of its debt load, Blue, Inc. stock is now a riskier investment than Yellow, Inc. stock. However, by most standards, the leverage at Blue, Inc. remains quite modest; the company will be able to withstand most unexpected business downturns and still has borrowing capacity to make opportunistic investments when & if they present themselves.

But if we turn our attention to the family balance sheets, there is a good case to be made that the Blue family has reduced its risk by completing its dividend recapitalization. Relative to the Yellow family, the Blue family has a more diversified portfolio and, most significantly, has set aside a meaningful amount of wealth that is no longer tied to the fortunes of the family business. The financial security provided by this diversification likely outweighs the incremental risk to the family business posed by the prudent debt added via dividend recapitalization.

Who Is a Good Candidate for a Dividend Recapitalization?

Dividend recapitalizations are not for everyone. A dividend recapitalization might be right for your family business if:

- The family business is mature. In contrast to high-growth businesses, mature companies have greater earnings predictability and lower incremental working capital requirements.

- The family business has little or no leverage. Companies that have historically retained earnings to avoid debt or have recently paid off debt for prior acquisitions or expansions may be good candidates for a dividend recapitalization.

- The family business has modest capital expenditure needs. To service debt from the recapitalization, free cash flow (i.e., cash flow available after funding capital expenditures) is essential.

- The family’s wealth is concentrated in the family business. For enterprising families that have been focused on building the value of the family business, providing for even a modest degree of portfolio diversification may have taken a back seat to ensuring the business had all the capital resources it needed.

If these characteristics describe your family and business, it may be time to take a page from the PE playbook and explore a dividend recapitalization. Give one of our senior professionals a call to discuss your situation in confidence and plot a path forward.

Family Business Director

Family Business Director