And Now You Know… The Rest of the Story

Due to the popularity of this post, we feature it again this week. In this post, we discuss return on invested capital, how it’s calculated, and why it’s important for your family business.

The management team at your family business has been hard at work growing revenue and profits by 50% over the past five years, so the value of your shares must have increased, right? Not necessarily.

Revenue growth and profitability are critical measures for the health of any family business, but by themselves, they tell only half of the story. As a family business director, you need the whole story. We’re not aware that Paul Harvey was a financial analyst, but if he were, we suspect his favorite performance metric would have been return on invested capital, because it tells you the rest of the story.

What Is Return on Invested Capital?

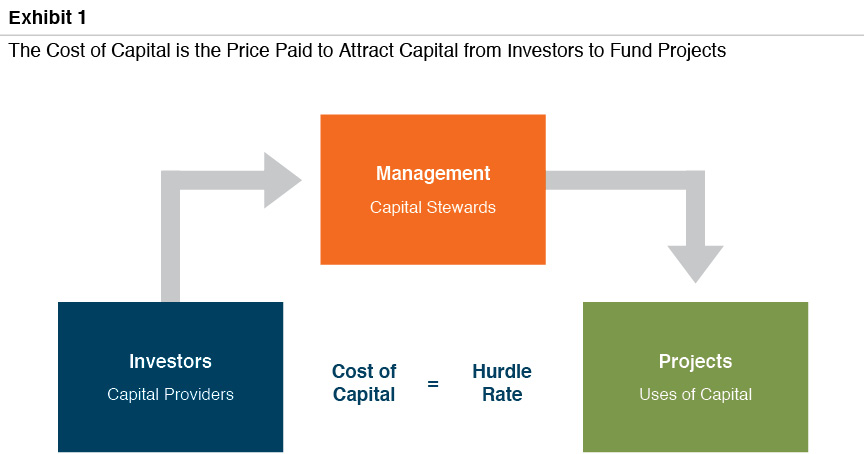

Return on invested capital (ROIC) relates the operating performance of a business to the amount of capital used to support the operations of the business. In other words, it measures the efficiency with which family capital is used in the family business. In last week’s post on capital budgeting, we likened the directors and managers of a business to stewards responsible for selecting the capital projects in which to invest family resources.

Return on invested capital measures how well directors and managers are handling their stewardship of family resources. ROIC allows family shareholders to see how much income is being generated per dollar of investment.

How Is Return on Invested Capital Calculated?

Exhibit 2 illustrates how to calculate ROIC for your family business.

We need to unpack a couple of the terms in Exhibit 2 that may not be familiar.

- Net Operating Profit After Tax (NOPAT) is a measure of earnings that excludes interest expense. Analysts often segregate interest expense from the other expenses of the business for at least two reasons. First, interest does not directly relate to the operations of the business. In other words, interest expense does not fluctuate with revenue and does not compensate employees, pay vendors or suppliers, or otherwise contribute to the operations of the business. Second, interest expense is a function of financing decisions that are often made by someone other than the person bearing operating responsibility. As a result, it is not appropriate to evaluate performance with respect to that expense.

Since interest expense is not deducted, NOPAT is like the more common measure of EBIT, or Earnings Before Interest and Taxes. The difference is that NOPAT is reduced for taxes. NOPAT is therefore equal to EBIT less taxes at the effective tax rate. Sadly, Uncle Sam is the first one in line for returns, and NOPAT takes the tax burden into account. Some analysts like to make additional adjustments to derive NOPAT, such as adding back research & development costs. Such adjustments may have merit in certain circumstances, but they do add complexity to the calculations that aren’t essential to gaining the primary insights offered by ROIC.

- Invested Capital is the sum of all capital provided by shareholders (both common and preferred) and lenders. Since the purpose of ROIC is to measure the efficiency of management’s stewardship of family resources entrusted to the business, invested capital is traditionally measured with respect to book values rather than market values. The average balance for the year in question is the preferred denominator since NOPAT is earned over the course of a year, and a point-in-time snapshot of invested capital may not fully capture the family’s true investment over the course of the year. As with NOPAT, some analysts propose a laundry list of custom adjustments to invested capital. These adjustments may have their place for some companies, but the basic calculation is generally a sufficiently reliable guide.

Why Is ROIC Important?

Now we’re ready for the rest of the story. Management has worked diligently to increase operating income by 50% over the past five years. Yet, the value of your family shares has been stuck in neutral over that same period. What gives?

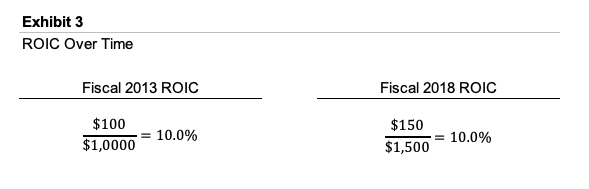

Focusing on profit alone will not reveal the answer. But a quick calculation of ROIC shows us what has gone wrong. Exhibit 3 presents the ROIC calculations for 2013 and 2018.

As revealed in Exhibit 3, the 50% increase in profitability did not boost the share value because the amount of invested capital used in the business also increased by 50%. In other words, the return on invested capital was unchanged. Since the weighted average cost of capital for your family business is also 10.0%, the incremental earnings did not boost per share values. Knowing that profitability has improved is not enough to know whether the value of the shares in your family business has increased. Earnings are critical but are only half of the story when it comes to management performance and shareholder value. As a director, it’s your responsibility to know the rest of the story when it comes to the financial performance of your family business, and ROIC is the perfect tool to do so.

Family Business Director

Family Business Director