Basics of Financial Statement Analysis

Part 3: The Statement of Cash Flows

This post is the third of four installments from our Basics of Financial Statement Analysis whitepaper. In this series of posts, our goal is to help readers develop an understanding of the basic contours of the three principal financial statements. The balance sheet, income statement, and statement of cash flows are each indispensable components of the “story” that the financial statements tell about a company.

An accounting professor of mine referred to the statement of cash flows as the “desert island” financial statement because if he were stranded on a desert island and could have only one financial statement with which to analyze a company, he would want it to be the statement of cash flows. While sincerely hoping never to find myself in such a position, I do believe there is merit to the sentiment.

The statement of cash flows reconciles the change in cash balance during the period by reference to reported earnings, non-cash charges, changes in balance sheet accounts, capital expenditures and other investments, and transactions with lenders and shareholders. While often overlooked, the experienced financial statement reader knows that the statement of cash flows reveals the company’s fundamental underlying narrative more clearly than either the balance sheet or income statement do in isolation.

Key Components of the Statement of Cash Flows

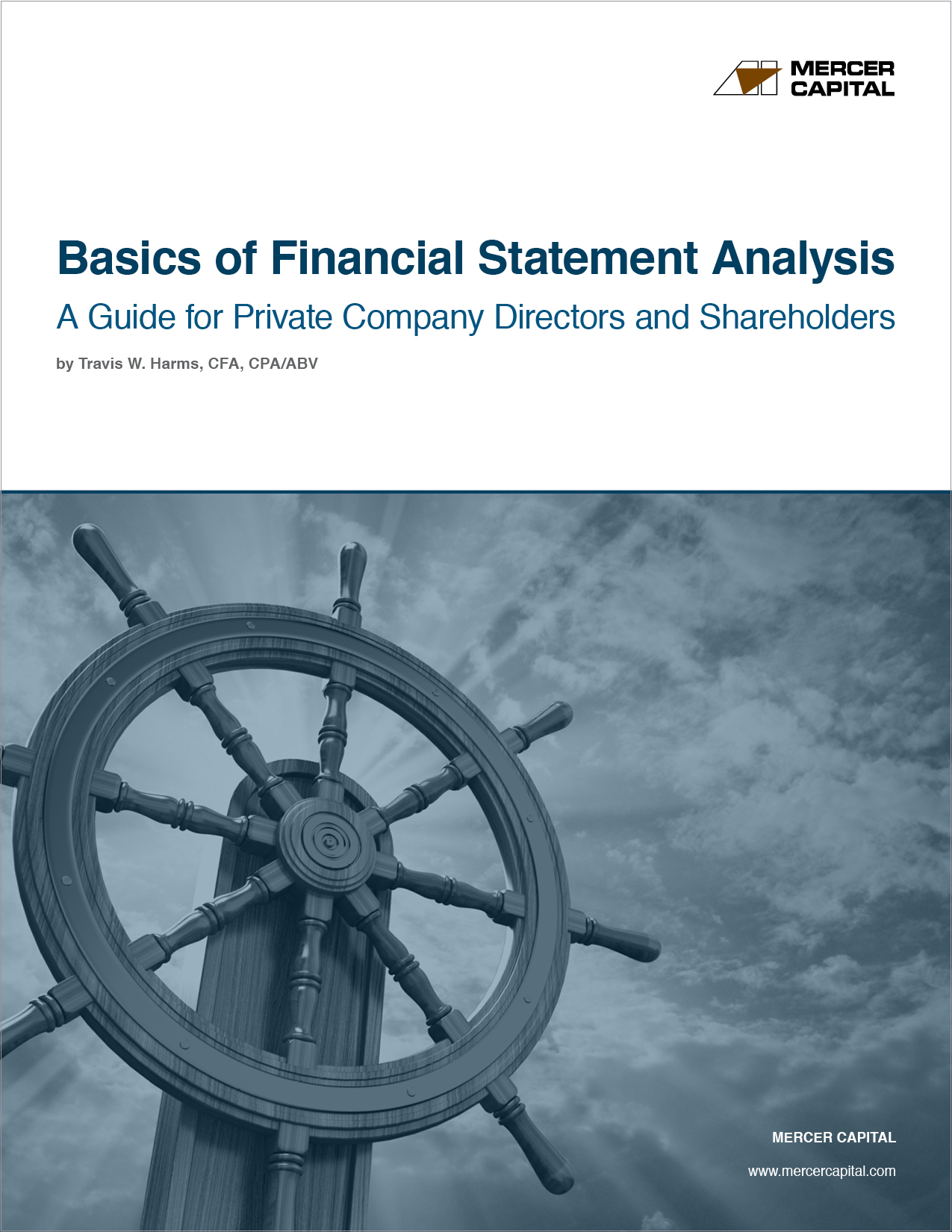

The statement of cash flows is divided into three sections, with all sources of cash flow and uses of cash classified as operating, investing, or financing activities.

Operating Activities

Net income is not synonymous with operating cash flow. The purpose of the operating activities section of the statement of cash flows is to reconcile the two figures. While the operating activities section often includes a dizzying number of reconciling entries, they generally fall into three categories:

- Non-cash charges. Some expenses do not correspond to cash outflows in the current year. Depreciation is an allocation of amounts spent in prior years on long-lived assets. Amortization assigns the cost of acquired identifiable intangible assets to the years following the acquisition. Equity-based compensation expense recognizes promised payments to employees in future periods for services rendered in the current period. Since the purpose of the operating activities section is to reconcile reported net income to cash flow, these non-cash charges are added to reported net income.

- Realized gains and losses. When the company disposes of an asset, the difference between the proceeds received and the net book value of the asset sold is recognized as a component of net income. If the proceeds exceed the net book value, the sale will result in a gain, and if the proceeds are less than net book value, the company will record a loss. While the resulting gain or loss influences reported net income, it does not represent a source of operating cash flow. As a result, gains are deducted from (and losses are added to) reported net income in the reconciliation of operating cash flow.

- Changes in working capital. When the company sells goods or services on credit, it recognizes revenue despite the fact that no cash has been collected yet. The same potential timing differences apply to the relationship between cost of goods sold, operating expenses, and other components of working capital (principally inventory, accounts payable and various accruals). The accumulation of working capital assets reduces operating cash flow, while growing working capital liabilities increase operating cash flow.

Differences between reported net income and cash flow from operating activities are to be expected. However, persistent accumulations of working capital (beyond that reasonably necessary to support sales growth) may be a signal that the quality and/or sustainability of reported earnings is doubtful. For example, excessive accumulation of accounts receivable or inventory may result in future writedowns if accounts are ultimately uncollectible or if inventory becomes stale or obsolete.

Investing Activities

One of the most important tasks of corporate managers and directors is identifying suitable investments that merit allocation of available capital resources. This process, known as capital budgeting, involves comparing the returns expected from potential projects to the firm’s cost of capital and selecting those projects that are financially feasible and consistent with the company’s broader strategy and competitive advantages. The investing activities section of the statement of cash flows summarizes the results of the capital budgeting process. As noted in Exhibit 1, cash flows from investing activities generally fall into one of three buckets.

- Capital expenditures. Capital expenditures represent amounts paid to maintain or expand the productive capacity of the business. Whereas depreciation expense represents a systematic allocation of the cost of long-lived assets to the accounting periods during the useful life of those assets, capital expenditures represent the cash paid for those assets in the period acquired. The level of capital expenditures should be positively correlated with the availability of attractive investments to support growth.

- Acquisitions. Business acquisitions are akin to capital expenditures. Rather than investing in new production capacity, acquisitions allow the company to consolidate production capacity that already exists in the industry. Most business combinations are rooted in a belief that there are economic benefits available to the combined business that are not otherwise available to either company on a standalone basis. Capital expenditures may be wise or unwise, but the price of the acquired assets is generally well-known. The amount paid for a business combination, on the other hand, is a matter of negotiation, and often involves competitive bidding among multiple potential acquirers. As a result, there is a risk of overpaying for what would otherwise be a “good” acquisition. The portion of the purchase price paid through issuance of the acquiring company’s shares will not appear on the statement of cash flows, but the attentive financial statement reader will note the corresponding increase in the number of shares outstanding.

Since both capital expenditures and acquisitions represent uses of corporate cash, they appear on the statement of cash flows as negative figures (i.e., cash outflows).

- Proceeds from sales of assets. The capital budgeting process can also work in reverse, identifying assets that do not promise attractive future returns, no longer align with the company’s strategy, or can be sold for an attractive price. The cash proceeds from the sale or disposition of the asset appear as a positive figure in the investing activities section.

Capital expenditures, acquisitions, and asset dispositions tend to be “lumpy”. In other words, a significant capital expenditure that doubles productive capacity may not need to be repeated for a number of years. As a result, it is often helpful to analyze the statement of cash flows on a cumulative basis (i.e., aggregate cash flows over a multi-year period). This can provide a broader view of the company’s investing strategy and capital budgeting process and reduce undue focus on a single quarter or year.

Financing Activities

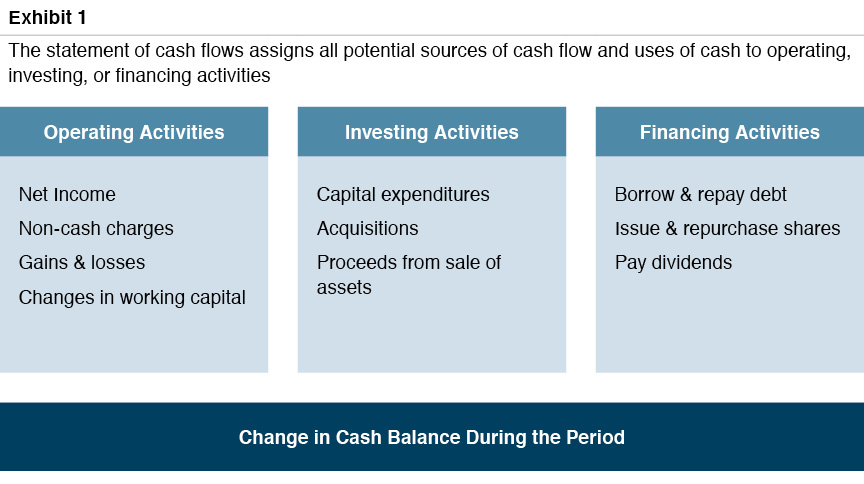

The final category is cash flow from financing activities. As illustrated on Exhibit 2 below, cash flow from financing activities summarizes the company’s transactions with capital providers during the period.

Transactions with lenders include borrowing and repaying debt. If debt on the balance sheet increases during the period, positive cash flows from borrowing will exceed negative cash flows from repaying debt. Borrowing appears as a positive figure on the statement because the proceeds from borrowing money increase the company’s cash balance. One shortcoming of the statement of cash flows is that interest paid to lenders is not classified as a financing cash flow, but rather is a component of cash flow from operations.

A company has two mechanisms for returning cash to shareholders: share repurchases and dividends.

When the company issues new shares to investors, the proceeds from the issuance increase the company’s cash balance and therefore appear as a positive figure on the statement of cash flows. A company has two mechanisms for returning cash to shareholders. The first is to repurchase shares. Share repurchases return cash on a non-pro rata basis to the shareholders electing to sell. If the price paid for the shares differs from the value of the shares, a share repurchase will be either dilutive or accretive to the remaining shareholders. In contrast, dividends provide a pro rata return to all shareholders without the risk of mispricing associated with share repurchases. Among public companies, share repurchases are very common due to advantages under current tax law and the fact that share repurchases do not carry the burden of sustainability that dividends do (failing to repurchase shares is rarely perceived negatively, whereas reducing or suspending dividend payments is a very bearish signal). For private companies, share repurchases are less common, due in large part to the difficulty in identifying a price that is not unduly accretive or dilutive to the remaining shareholders.

Analyzing the Statement of Cash Flows

For an experienced reader of financial statements, the relationships among the primary components of the statement of cash flows reveal the broad contours of the company’s financial strategy, particularly with respect to capital budgeting, capital structure, and distribution policy. As noted previously, investing and financing cash flows are, by their nature, lumpy, so it can be helpful to analyze the statement of cash flows on an aggregate multi-year basis. There are two basic relationships to evaluate.

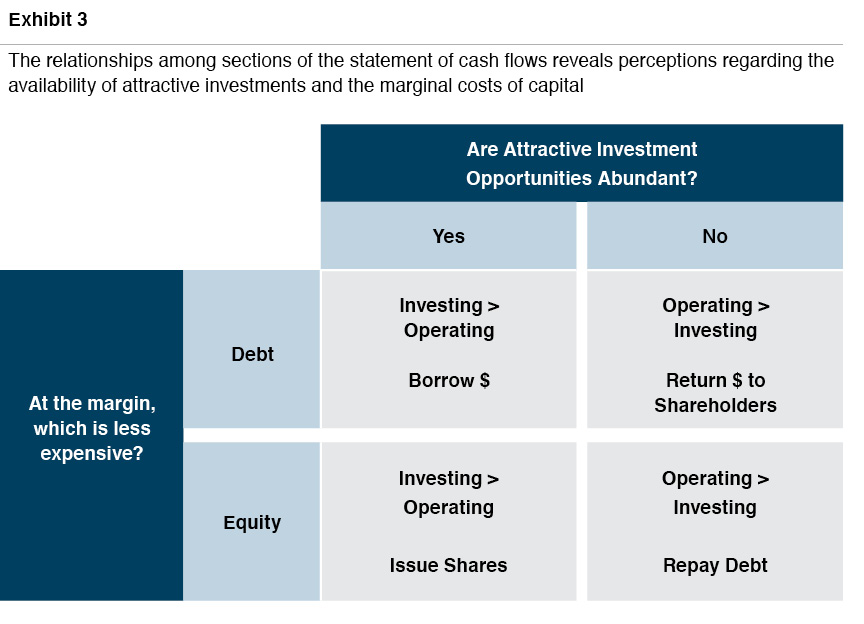

The first is the relationship of operating and investing cash flows. If (the absolute value of) investing cash flow exceeds operating cash flows, management and the directors believe that attractive investment opportunities are readily available. With the allocation of more capital resources to the company’s investment portfolio comes the expectation that future earnings and cash flows will be sufficient to justify the commitment by providing an attractive return on investment.

Investing and financing cash flows are, by their nature, lumpy, so it can be helpful to analyze the statement of cash flows on an aggregate multi-year basis.

If investing cash flows exceed operating cash flows, financing cash flows must be positive (i.e., net cash inflows from either borrowing money or issuing new shares). If, instead, operating cash flows exceed (the absolute value of) investing cash flows, management and the directors believe that attractive investment opportunities are relatively scarce. Limiting the capital resources allocated to the company’s investment portfolio mitigates the pressure for growth in future earnings and cash flows but exposes the company to the potential opportunity cost of foregone investments that would have provided an attractive return. When operating cash flows exceed investing cash flows, financing cash flows will be negative, as the company will have “excess” funds to return to capital providers.

Second is the relationship between transactions with lenders and transactions with shareholders within cash flow from financing activities. This relationship correlates to changes in capital structure at the margin.

- When aggregate financing cash flows are positive, borrowings will predominate over share issuance when management and the board assess the marginal cost of debt to be less than the marginal cost of equity. While beyond the scope of this whitepaper, note that the marginal cost of debt is not the same thing as the interest rate on newly-issued debt. If the marginal cost of debt is perceived to be higher than the marginal cost of equity, companies will issue new shares to fund investment.

- When aggregate financing cash flows are negative, management and the board must balance de-leveraging and returning cash to shareholders. If they perceive the marginal cost of debt is less than the marginal cost of equity, they will forego the opportunity to de-leverage the balance sheet, and opt instead to return cash to shareholders through share repurchases or dividends. If, instead, the marginal cost of debt is greater than the marginal cost of equity, the board should emphasize repayment of debt over returning cash to shareholders.

These relationships are summarized in Exhibit 3 below.

Conclusion

The statement of cash flows should not be ignored. It provides important perspective regarding the company’s strategy and narrative that cannot be easily gleaned from the income statement or balance sheet in isolation. The reconciliation of reported net income to operating cash flow provides additional insight regarding the nature and quality of reported earnings. Cash flow from investing activities reveals the net results of the company’s capital budgeting process. Transactions with lenders and shareholders summarized in the financing activities section reflect the board’s assessment of the marginal costs of capital.

Family Business Director

Family Business Director