Build or Buy?

Is Your Family Business a Builder or a Buyer?

Software developers must regularly decide whether to purchase existing software for desired functionality or to write the software themselves. In fact, software developers make these decisions so often that there is an entire literature devoted to helping them make the best “build vs. buy” decision in any particular situation. Family business directors face a similar decision when it comes to making capital investments. There are essentially two options for capital investment:

- Capital expenditures (i.e., “build”)

- Acquisitions (i.e., “buy”)

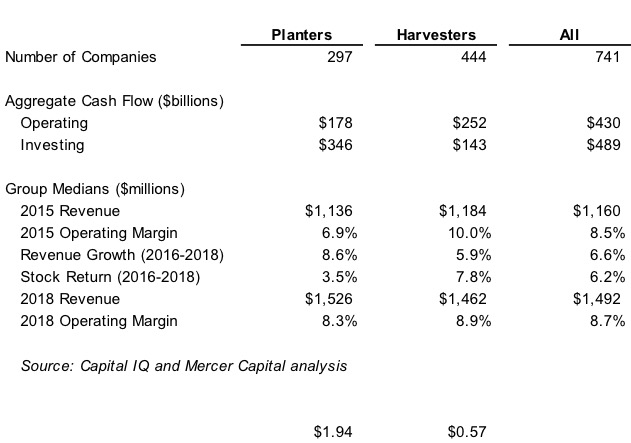

As shown on Exhibit 1, we classified each of the operating companies the S&P 1000 as either “Builders” or “Buyers” based on the relationship between aggregate cash flows for capital expenditures and acquisitions from 2013 through 2015.

As groups, the Builders allocated 89% of total capital investment to capital expenditures, while acquisitions accounted for 81% of total capital investment for the Buyers. With regard to median size (measured by revenue) and operating margin, the two groups are virtually indistinguishable. The Buyers’ relative capital investment was greater, contributing to modestly faster revenue growth over the three years ending in 2018. Buyers are over-represented in the healthcare and IT sectors, while consumer sector (both discretionary and staples) is more hospitable to Builders.

So how should you and your fellow family business directors decide whether to build or buy? What will be the most effective form of capital investment for your family business? Since software developers think more about the build vs. buy decision than most of us do, we thought it would be interesting to apply a software-related decision framework to family business investment decisions. For purposes of this blog post, we follow the six step decision framework advocated by Justin Baker.

Step #1: Identify Functional Requirements

For family businesses, all capital investment should begin with strategy. What strategic objectives require capital investment? What competitive advantage is the company seeking to extend, strengthen, or defend? Strategy should guide family businesses in selecting capital investments; too often, family businesses attempt to formulate a strategy out of available capital investments.

Step #2: Define the Scope of Work and Reconcile Against Constraints

Family businesses face both financial and non-financial constraints when evaluating capital investments. Directors should be carefully attuned to both of these constraints. Since family businesses are often reluctant to raise equity capital from outside the family, the amount of capital available for investment is limited to operating cash flow and available debt financing. Non-financial constraints are most often either cultural (is there any precedent for making acquisitions?) or managerial (does our management team have the requisite capacity or skill set to execute the proposed capital project successfully?). If there is a managerial constraint, are there family members with the needed skills, or will it be necessary to bring in non-family managers? Regardless of the answers to these questions, a clear-eyed assessment of the relevant constraints will help ensure that directors are evaluating a feasible set of build or buy options.

Step #3: Solution Divergence

Solution divergence simply means identifying the potential build and buy options. On the buy side, this might mean keeping a running list of competitors, suppliers, or customers that could provide a compelling strategic combination with the family business. On the build side, operating managers are often the best source of potential capital expenditures. In either case, is your family business’s corporate strategy have enough visibility throughout the organization so that operating managers have a good feel for what acquisition targets or capital projects are going to be worth pursuing? Has the board and senior management communicated a list of “must haves” for any capital investment? It can quickly become demoralizing for operating managers when there are no clear criteria against which proposed investments will be evaluated. Solution divergence is ultimately about nurturing a process for generating a sustainable pipeline of proposals (both “builds” and “buys”) for directors to evaluate.

Step #4: Solution Convergence

Whereas solution divergence describes the process of identifying potential capital investments, solution convergence refers to the process for selecting the capital investments to be made. In addition to strategic considerations, the selection process should also reference financial return metrics like internal rate of return (IRR) and net present value (NPV). Satisfactory financial metrics are a necessary, but not sufficient, condition for selecting a capital project. Capital investments should satisfy both financial and strategic objectives

Should financial hurdles be different for “build” projects than “buy” projects? Some families, concluding that acquisitions are inherently riskier than capital expenditures, assign higher hurdle rates to acquisitions. The risks traditionally ascribed to acquisitions include the tendency to overpay in competitive bidding situations and the difficulty of assuring a healthy cultural fit between buyer and seller. These risks are certainly real, but capital expenditures are not without their own unique risks. Specifically, capital expenditures create incremental industry capacity, and forecasting market demand and the impact of additional supply on pricing can be just as challenging as integrating acquisitions. The use of “premium” hurdle rates for acquisitions is ultimately neither right nor wrong, but simply a form of capital allocation by another name. Regardless of the hurdle rate selected, capital projects must satisfy both financial and strategic criteria to merit investment.

Step #5 – Build or Buy or Both

This is the execution phase. Selecting the capital investments to be made is not the end of the process. Successful family businesses translate forecasts into operating results. Directors cannot just assume that the hand-off from the corporate development and finance teams to the operations team will be done well. In the case of an acquisition, integrating new employees and realizing planned synergies while minimizing negative surprises take top priority. For capital expenditures, avoiding cost overruns and delays that can eat away expected returns on projects is critical.

Step #6 – Develop Guidelines for Reassessment

Capital investments are hard to reverse. Nonetheless, family businesses need feedback processes to ensure that the family doesn’t throw good money after bad, and to help improve forecasting techniques and improve accountability in the interest of making better capital investment decisions in the future.

Conclusion

Is your family business a builder or a buyer? Which factors contribute to your build vs. buy decisions? Do you employ a consistent framework for evaluating these decisions? Do you have a robust process for seeding a pipeline of potential future projects for consideration? Do you understand the cultural factors that make acquisitions or capital expenditures more palatable for your family shareholders? Simple answers elude each of these questions, but directors should assess what processes are in place or need to be developed to ensure that family capital flows toward the most productive uses in the family business, whether in the form of building or buying.

Family Business Director

Family Business Director