Buying Off the Discount Rack?

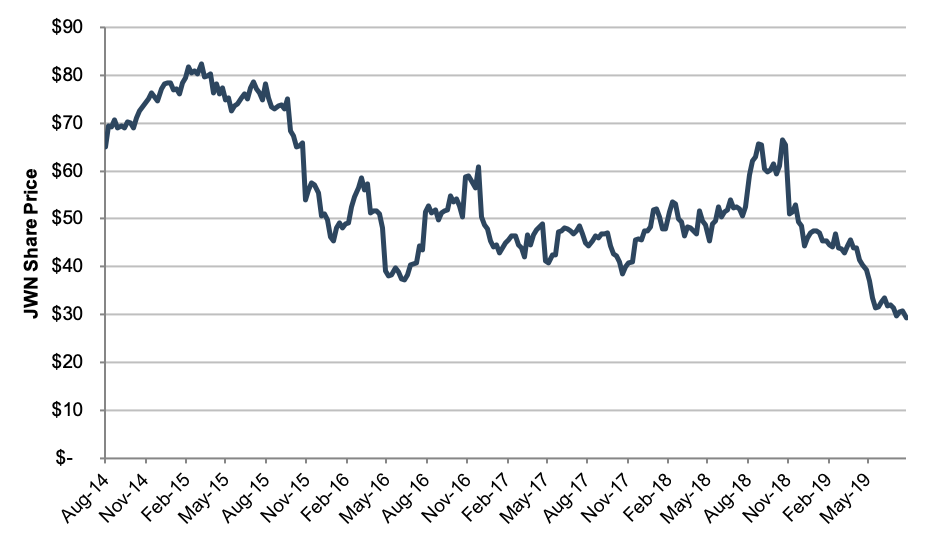

For bargain shoppers, the discounts at Nordstrom have been eye-catching lately. And we don’t mean the clothes. The shares of the fourth-generation family retailer, whose shares have been publicly traded since the early 1970s (ticker: JWN), have lost nearly 40% of their value during 2019.

For bargain shoppers, the discounts at Nordstrom have been eye-catching lately. And we don’t mean the clothes.

According to a Wall Street Journal report, the Nordstrom family is preparing a bid to increase its ownership stake in the company from approximately one-third to over 50%. Although the exact form of the proposed transaction has not yet been specified, it is almost certain that the family would need to offer a premium to the current share price to complete such a transaction.

One interesting twist to this family drama is that at least some observers believe that the shares are depressed because of the inept management of the very family members who are proposing to increase their ownership stake. The company is managed by two fourth generation brothers (three, until the oldest died unexpectedly in January), but a majority of board seats are held by non-family independent directors. Amid stagnating operating performance, some on the board have been seeking to bring in an unrelated outsider to replace the family managers.

These developments come after directors rejected a bid by the family to take the company private in 2017 for $50 per share (the shares closed on Friday at $29.30).

Some stocks are underpriced; others are cheap for a reason. Assuming the family’s proposal to increase its ownership stake goes forward, the independent directors will need to decide which is true of Nordstrom’s shares. Reported earnings for 1Q19 fell 55% from the prior year as total revenue slid by 3.5%. At Friday’s closing price, JWN shares imply a value of approximately 6.2x trailing EBITDA. Department store peer Macy’s (ticker: M), whose shares have also languished during 2019, trades at a comparable 6.5x multiple. As always, whether Nordstrom shares are undervalued or properly assessed by the market remains a matter of difficult judgment.

Some stocks are underpriced; others are cheap for a reason.

Since very few family businesses are publicly traded, their directors do not have to engage in these difficult deliberations under the public microscope. The core issues however, are not uncommon to private family businesses. The alternatives available to the Nordstrom investors likely include some combination of the following:

- Negotiate a transaction price at which the Nordstrom family could increase their ownership stake above 50% while remaining publicly-traded. If the directors accept a Nordstrom family proposal to increase their ownership, it would likely result in the family exerting more direct control over the company in the future. If the current family managers are, in fact, a source of the company’s underperformance, allowing the family to gain control of the board could consign the remaining public shareholders to ongoing underperformance.

- Replace family management with non-family professionals. If the directors believe that recent performance does not reflect the company’s true operating potential, the best course of action may be to remove the current family managers and allow a new group of outside managers to steward the shareholders’ resources. The principal risk with this decision is that Nordstrom’s recent poor performance is a function of inevitable industry trends that will not be eliminated by a new management team. If that is the case, the shareholders (both family and public market investors) may see continued erosion in the value of their investment in future years.

- Solicit a financial partner to help take the company private. The past is the past, and allowing sunk costs to influence future courses of action is probably the most pervasive cognitive bias that afflicts family business decision-making. That said, the fact that the board passed on an offer of $50 per share two years ago undoubtedly rankles for some shareholders while the share price now hovers around $30. The price for a going private transaction today may not be as high as the former $50 per share offer, but is almost certain to exceed the current market price. A financial partner may be allied with the Nordstrom family and allow the current management to remain, or a prospective partner may envision making substantial management and strategic changes following the going-private transaction.

- Sell the company to a strategic buyer. If the directors conclude that the current market price provides a realistic portrait of Nordstrom’s likely future within the new retail landscape, selling the company to a motivated strategic buyer may be the best financial outcome for the shareholders. When motivated strategic buyers exist for a business, the potential synergies and strategic benefits available from the combination may increase the transaction price beyond what the selling shareholders could reasonably expect from any other outcome.

Enterprising families should understand, however, that while selling the family business may eliminate some challenges, it creates new ones. In an insightful article for the New York Times over the weekend, Paul Sullivan describes the new challenges faced by several families after selling the family business.

-

-

- Without the “glue” provided by the business, family ties may weaken.

- Ownership of the family business confers other forms of socioeconomic wealth. Following a sale, these benefits may evaporate.

- Stewarding an active business provides a greater sense of purpose than managing a portfolio of passive investments. Upon selling the business, family members previously active in the business may find they are somewhat adrift personally.

- The publicity around a sale of the family business can change perceptions of the family’s wealth, and create new claims on that wealth.

- Future returns from reinvestment of transaction proceeds may be less attractive than those earned from owning the family business.

-

Most of the family business leaders we know are probably relieved they don’t have to make decisions under the burden of public and market scrutiny like the directors at Nordstrom do. However, the types of decisions that they are called upon to make are often just as challenging. Whether it is assessing the value of your family business, benchmarking the performance of your family business, or evaluating strategic alternatives, our experienced family business advisory professionals are here to help. Call us today to discuss your needs in confidence.

Family Business Director

Family Business Director