Charlie Munger, Elon Musk, Kenny Rogers and Your Family Business

“He thinks he’s even more able than he is and that’s helped him. Never underestimate the man who overestimates himself. Some of the extreme successes are going to come from people who try very extreme things because they’re overconfident. And when they succeed, well, there you get Elon Musk.” – Charlie Munger

“If the objective was to achieve the best risk-adjusted return, starting a rocket company is insane. But that was not my objective.” – Elon Musk

“You got to know when to hold ’em, know when to fold ’em, know when to walk away, and know when to run.” – Kenny Rogers

Long-time Warren Buffett confidant and business partner Charlie Munger was in the news this week for giving frank interview responses on a wide range of topics. Among his comments was the quote about Elon Musk’s productive overconfidence cited at the top of this post. Return follows risk, and the only way to earn outsized returns is to take outsized risks. As Musk himself acknowledges, hewing to textbook notions of prudent risk management would have derailed SpaceX before it ever got off the ground (literally or figuratively).

Attitudes toward risk are hard to quantify and are unlikely to be uniform across a family. It is reasonable to assume that investors in public companies have similar views of risk. After all, they all chose to be there. Family shareholders, on the other hand, likely have not designed their investment portfolios from scratch, and the family business often represents a far larger portion of the overall portfolio than modern investment management theory would deem prudent.

Most mature family businesses that we know do not have an appetite for taking on the sort of outsized risks for which Mr. Musk is famous. Instead, they adopt a more cautious posture of calculated risk-taking like that espoused by the late, great Kenny Rogers in his immortal song, “The Gambler.”

Confidence and Capital Budgeting

As 2021 draws to a close, family business directors are busy evaluating capital spending plans for the coming year. Capital budgets are influenced by the availability of capital to invest in the future, the availability of projects in which to invest, and the willingness of shareholders to forego current returns in the hopes of greater future rewards.

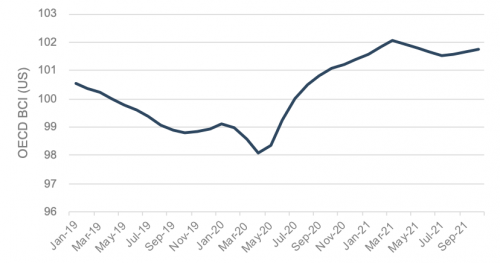

So, just how confident should family business directors feel when forecasting business results in 2022? The Organization for Economic Cooperation and Development, or OECD, publishes a Business Confidence Index (“BCI”), which is based upon survey responses related to developments in production, orders and stocks of finished goods in the industrial sector. Readings above 100 indicate increased confidence, while measurements below 100 correspond to a pessimistic outlook. After dipping into bearish territory in 2H19 and bottoming out in the early months of the pandemic, the measure has given an expansionary reading since July 2020.

Chart 1: OECD Business Confidence Index (2019 – 3Q21)

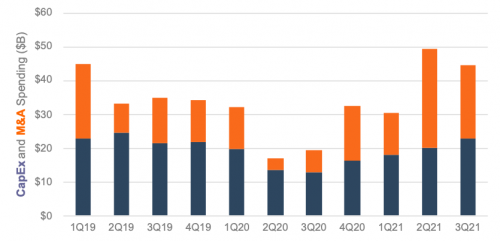

Responding to survey questions is one thing, cracking open the corporate checkbook is another. We examined capital investment data for small- and mid-cap public companies over the same period to get another perspective on corporate confidence.

Chart 2: Capital Investments for Small- and Mid-Cap Public Companies (2019 – 3Q21)

Corporate investment spending corroborates the OECD confidence index. M&A activity is more volatile, but corporate managers also slowed capital expenditures materially during the middle quarters of 2020. Circling back to the confidence of Elon Musk, we can track capital expenditures for Tesla over the same period.

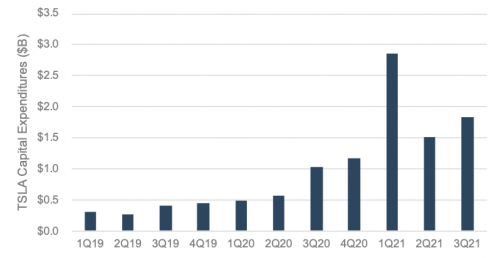

Chart 3: Tesla Capital Expenditures (2019 – 3Q21)

In contrast to most of the companies examined above, Mr. Musk was hitting the accelerator on capital spending during the pandemic, spending 134% more on capital expenditures during the middle quarters of 2020 than in the same period of 2019.

Clearly, Musk is a “unicorn” and most family businesses are not blessed (or cursed, depending on your perspective) with a personality like his. So what lessons can family business directors take from his confidence and disregard for normal risk management (as embodied by Mr. Rogers’ Gambler)?

No Blind “Confidence Premium”

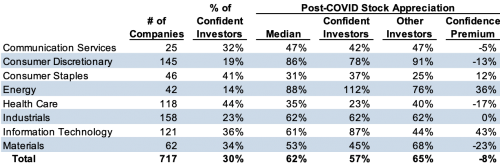

For public markets, share price performance is the ultimate scoreboard. As summarized in Table 4, confident investors (defined here as those companies that did not reduce capital expenditures during the middle quarters of 2020), on balance, did not fare as well as their more cautious counterparts. Knowing when to fold ’em appears to have paid off for most companies.

Table 4: Post-COVID Stock Appreciation of “Confident Investors”

Reality is messy, so easy answers don’t work. The data in Table 4 suggests that closing one’s eyes and being aggressive for the sake of being aggressive is not a great strategy. Our analysis of the data indicates that there is no automatic “confidence premium” available to more aggressive companies.

For family business directors, this means that there is no substitute for careful analysis of the available investment opportunities. We have previously proposed that – in addition to the financial metrics that serve as a gating function for potential investments – directors carefully evaluate the market opportunity, strategic fit, and constraints associated with a potential capital investment.

Rewarding Convictions

There may not be a “confidence premium,” but there is a clear reward for maintaining one’s investment convictions in the face of discouraging market returns. We wanted to see what impact, if any, prior stock price changes had on companies’ willingness to invest during the pandemic. For the most part, the companies that invested the most during the pandemic had experienced favorable stock price movements during 2019. In other words, the “confident investors” were to some degree chasing momentum, as shown in Table 5.

Table 5: Post-COVID Stock Appreciation of “Confident Investors”

There are two notable exceptions to this momentum story. Shares of the most confident investors in the Consumer Staples and Information Technology sectors had underperformed those of their industry peers during the pre-COVID period. These “conviction” investors bucked the broader trends in post-COVID returns in Table 4, generating premium returns of 12% (Consumer Staples) and 43% (Information Technology), respectively.

Contrarian investing requires thick skin and a steady stomach. In our experience, successful family businesses are often the best-suited players in their respective industries to invest at opportune times. Not being subject to the public stock market’s reaction to next quarter’s earnings release frees many family businesses to invest when others are holding back. Over generations, such enterprising families reap the rewards of investing with strategic conviction.

So, where does your family business find itself during the current planning cycle? Are there investing convictions that your family business should double down on like Elon Musk, or is it time to follow the Gambler’s advice and take some chips off the table? Sometimes an outside perspective can help bring clarity; call one of our family business professionals to discuss your investing outlook in confidence.

Family Business Director

Family Business Director