Crown Castle’s Lessons for Family Businesses

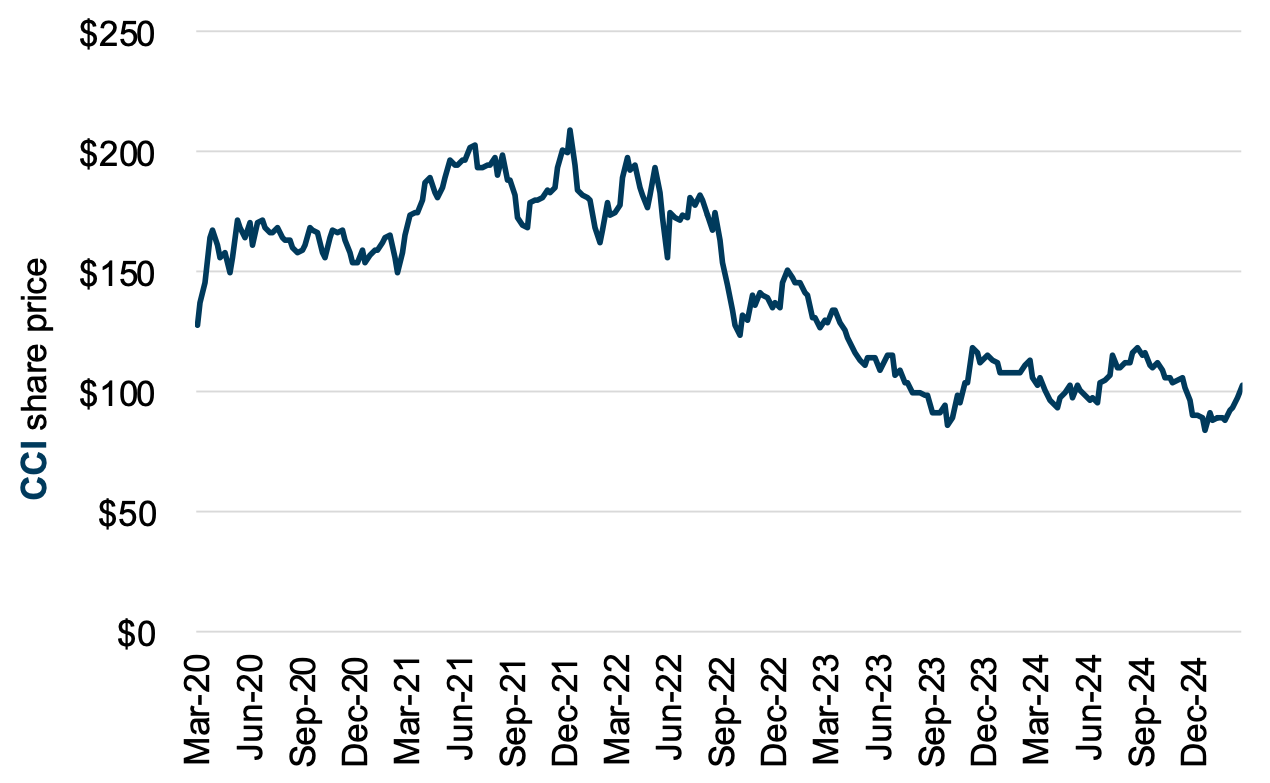

Last week’s news that the publicly traded REIT Crown Castle (ticker: CCI) had agreed to divest its Fiber segment was a bit of a perfect storm of the issues we focus on here at Family Business Director: capital allocation and strategy, return on invested capital, valuation, and dividend policy. After years of underperformance and stagnating dividends, Crown announced a “strategic review” of its fiber business in December 2023. That process culminated in Thursday’s announcement that CCI’s fiber segment would be sold to two buyers (EQT Active Core Infrastructure and Zayo) for an aggregate purchase price of $8.5 billion.

Capital Allocation and Strategy

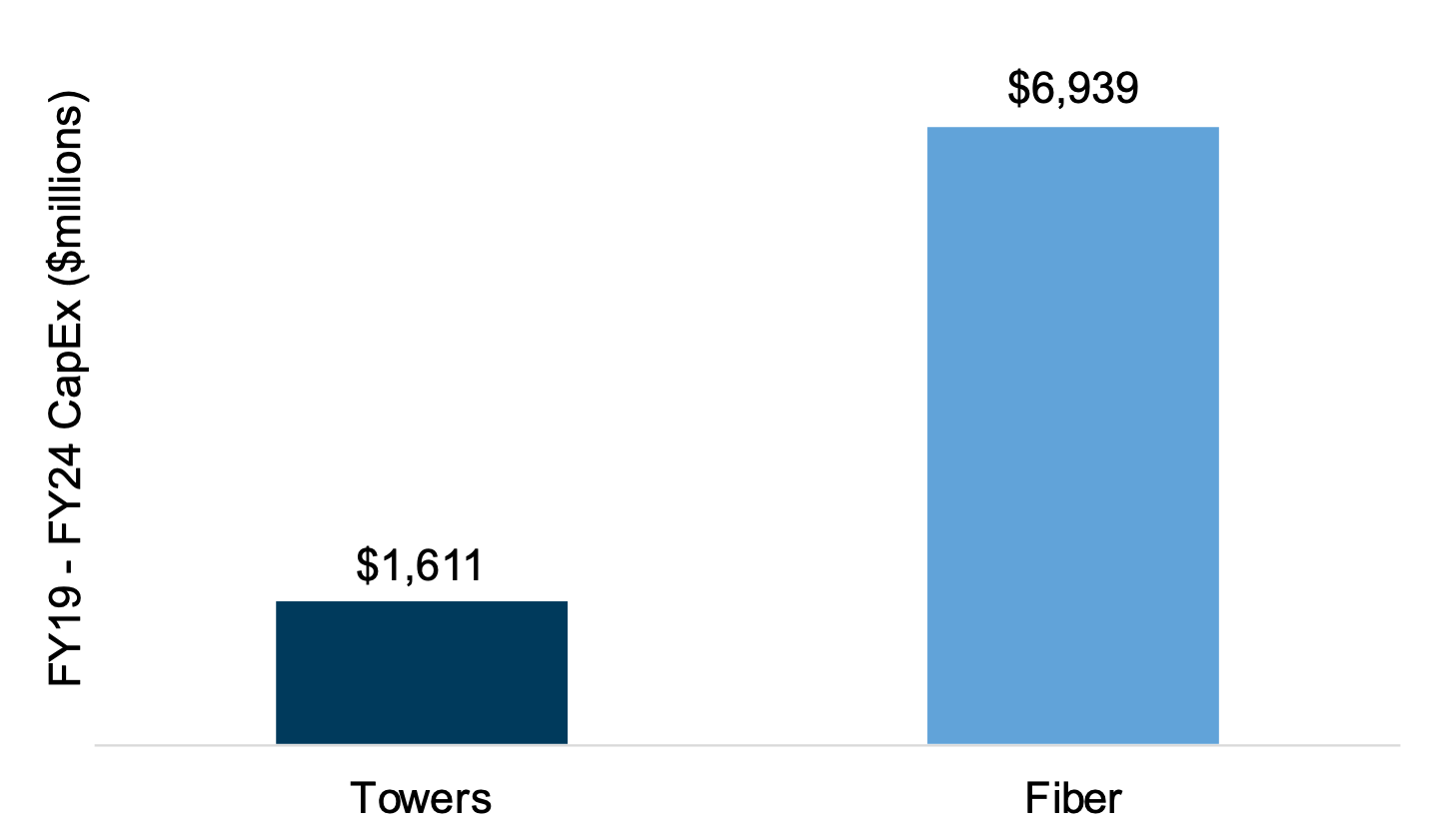

Crown Castle is a legacy owner of cell phone towers. Beginning in the mid-2010s, CCI embarked on a strategy of acquiring and building a fiber business to complement its cell tower portfolio. Through 2024, the company invested heavily in its fiber segment, with aggregate capital expenditures for the six years from 2019 through 2024 of $6.9 billion for the Fiber segment, compared to $1.6 billion for its Towers segment.

When we speak with clients about capital budgeting and allocation, we like to emphasize that bare financial feasibility is a necessary, but not a sufficient, condition for investing in a capital project. If a proposed project promises attractive financial returns but does not cohere with the company’s broader strategy, it should be avoided. Far better to have a clear strategy to help screen which projects to consider rather than simply attempting to craft a strategy around capital projects that happen to show up.

Crown Castle’s SEC 10-K filings include a section entitled “Strategy,” which offers this description of its asset portfolio:

“We believe our product offerings of towers and small cells through our shared communications infrastructure model provide a comprehensive, efficient, and cost-effective solution for our wireless tenants’ growing networks. Additionally, we believe our ability to share our fiber assets across multiple tenants to both deploy small cells and offer fiber solutions allows us to generate cash flows and increase stockholder return.”

Rather than attempting to judge the merits of that particular potpourri of corporate-speak, we will only note that investors would likely take issue with the bit about increasing stockholder return (see chart above). In short, whether CCI’s fiber strategy made sense or not, the market was unpersuaded.

Family business directors need to prioritize communicating the company’s strategy to family shareholders in a clear and persuasive manner.

Return on Invested Capital

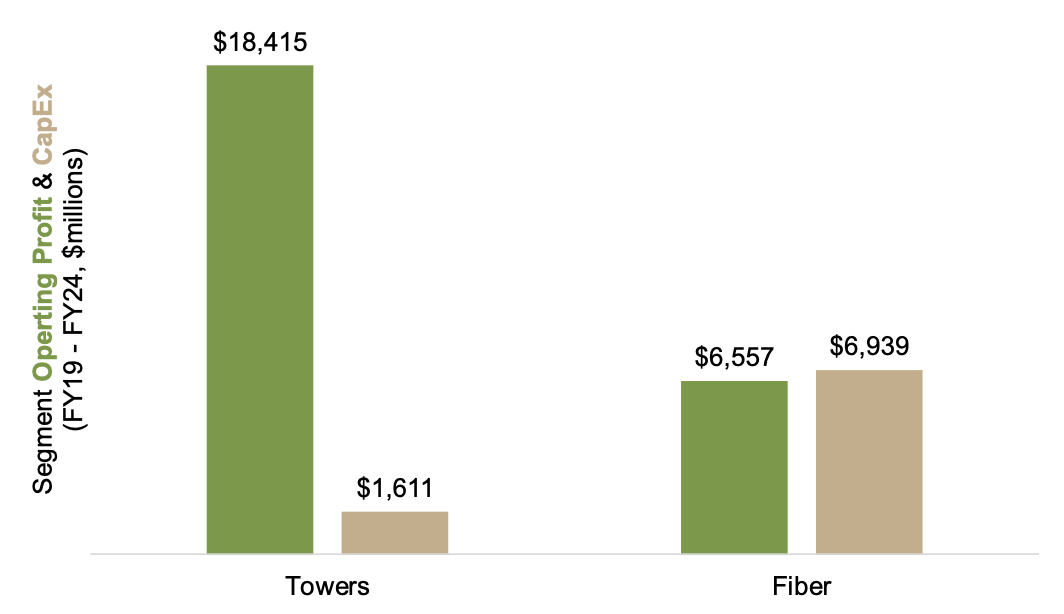

Loyal readers will recall that we are vocal advocates of return on invested capital (ROIC) as a business performance metric. While Crown Castle’s public filings don’t include enough information to reliably calculate an after-tax ROIC for the Towers and Fiber segments, comparing reported segment operating profit to total segment assets is instructive.

- Adding back a $5.0 billion goodwill impairment charge recognized in FY24, Fiber segment assets in December 2024 totaled $16.2 billion (43% of pro forma assets), compared to $20.8 billion for the Towers segment (55% of pro forma assets).

- In terms of reported segment operating profit (which appears to be akin to EBITDA), the Fiber segment contributed $1.2 billion in FY24 (26% of the total), compared to $3.3 billion for the Towers segment (74% of the total).

- Comparing segment operating profit to segment assets yields a “gross” return on investment of just 7.3% for the Fiber segment; in contrast, the same measure for the Towers segment is 21.2%.

Again, we don’t have enough data to make a direct comparison of segment ROIC to the weighted average cost of capital, but these figures suggest that whatever strategic merit the fiber business may have for CCI was not translating into attractive financial returns.

ROIC is a great tool for assisting family business directors in maintaining vigilance over capital allocations within the business. Trends in ROIC can serve as an early warning sign for emerging challenges.

Valuation

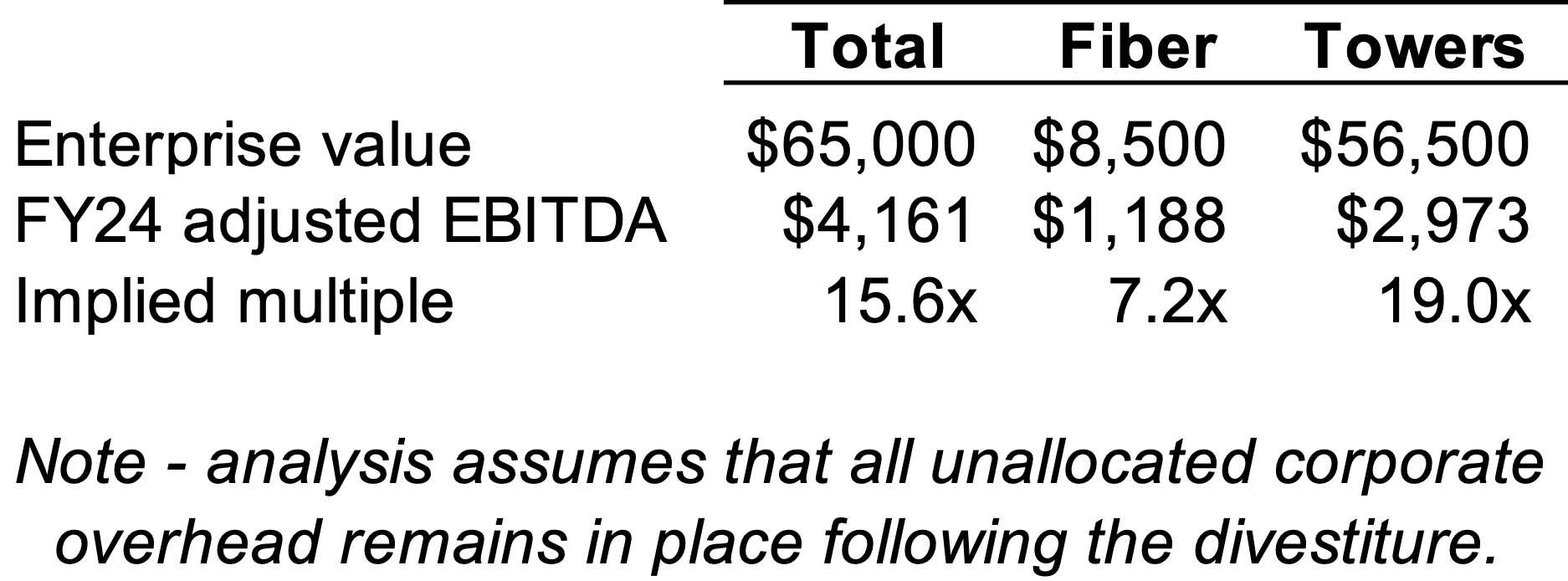

Prior to the divestiture announcement, CCI’s mid-$90s stock price implied an enterprise value on the order of $65 billion, or about 15.5x FY24 adjusted EBITDA of $4.1 billion. The $8.5 billion sales price for the Fiber segment suggests that the unit was weighing on the company’s multiple.

Why would the implied multiple for the Fiber segment (7.2x) be so much lower than that implied for the Towers segment (19.0x)? As we’ve discussed in recent posts, not every dollar of EBITDA is created equal. In the case of CCI, the Towers segment is a cash cow, while the Fiber segment is a cash incinerator.

- On an aggregate basis over the six years ending with FY24, capital expenditures for the Towers segment consumed just 8.7% of segment operating profit.

- In contrast, capital expenditures for the Fiber segment exceeded segment operating profit (capex of $6.9 billion, compared to segment operating profit of $6.6 billion).

Of course, rapid revenue and profit growth can make up for heavy reinvestment, but the Fiber segment had failed to deliver substantial growth. EBITDA is nice, but net cash flow matters a lot more to investors. CCI shares advanced modestly on the divestiture announcement.

Dividend Policy

As an REIT, Crown Castle’s dividend policy is largely determined by the requirement to distribute at least 90% of REIT taxable income each year. For REIT investors, steady dividend growth is a hallmark of success. CCI’s quarterly dividend payment grew from $1.13 per share to $1.565 per share from FY19 through FY22. However, the low return on continued fiber investments has caused dividends to stall at that level during FY23 and FY24. The company’s divestiture announcement included this comment on future dividend policy:

“To increase free cash flow generation and financial flexibility, we are updating our capital allocation framework, which is anticipated to result in a reduction to our annualized dividend to approximately $4.25 per share in the second quarter of 2025, and the expected implementation of an approximately $3.0 billion share repurchase program following the closing of the transaction.”

We suspect a more disciplined approach to capital expenditures in the Fiber segment would have allowed dividends to continue to grow. Once the divestiture is complete and the corresponding capital expenditure drag on CCI’s cash flow is eliminated, CCI shareholders’ hopes of dividend growth — albeit from the new lower level — may be restored.

Conclusion

Crown Castle’s divestiture of its Fiber segment offers plenty for family business directors to chew on. The story highlights the need for an integrated framework for directors to evaluate and monitor the key strategic finance decisions that influence family shareholder returns for the years and decades to come.

Family Business Director

Family Business Director