Determining the Right Hurdle Rate

How Good is Good Enough?

From time to time on our blog, we will take the opportunity to answer questions that have come up in prior client engagements for the benefit of our readers.

If family business directors are going to make good capital allocation decisions, they need to know what the right hurdle rate is. If the hurdle rate is set too low, the family may experience weak future returns. Setting the hurdle rate too high, however, introduces the risk that the family business will pass on attractive investment opportunities. In this post, we consider how the hurdle rate relates to the weighted average cost of capital.

Should we set the hurdle rate for capital budgeting equal to the weighted average cost of capital (WACC), or should we set it higher than the WACC?

Legendary wag and journalist H.L. Mencken once said that professors must have theories as dogs must have fleas. While a theory-infested business professor likely has a quick answer to the hurdle rate question, the practical answer is not so tidy for a real-life family business director.

From a finance textbook perspective, the WACC is the theoretically correct rate to use when evaluating potential capital projects. Family business managers are stewards of capital entrusted to them by the family (and, potentially, lenders). The managers’ task is to allocate that capital to a portfolio of assets that earn returns in excess of the cost of capital. If a proposed capital project promises a return in excess of the cost of capital, taking on the project will increase shareholder wealth, and everyone goes home happy.

Yet, many family businesses flout the textbook prescription and use hurdle rates for project evaluation considerably higher than the WACC. This practice is so widespread that it cannot simply be the result of CFOs-to-be falling asleep during capital budgeting class. Why, then, are incremental hurdle rate premiums so common?

Why Premium Hurdle Rates Are Used

There are two primary reasons companies elect to use premium hurdle rates in their capital budgeting analyses. For some companies, doing so is a hedge against potentially inflated cash flow forecasts submitted by overconfident managers. Other companies rely on premium hurdle rates as a capital rationing tool.

Hedge Against Potentially Inflated Cash Flow Forecasts

Accurately projecting future cash flows is difficult. In addition to the real uncertainties regarding future market and economic conditions, financial projections are subject to a host of cognitive biases that contribute to overconfidence and overly optimistic projections. These cognitive biases are the subject of a good deal of academic research, much of which is summarized entertainingly in Thinking, Fast and Slow by Daniel Kahneman. In sum, these biases are real and ubiquitous, and do not reflect any lack of good faith; they are simply part of the mental baggage of being human. Whether explicitly framed this way or not, setting a hurdle rate at a premium to the WACC acknowledges the likelihood that projections will be too optimistic.

Ideally, however, family businesses should work to refine their capital budgeting process so that additional “projection risk” premiums are not necessary. If hurdle rates are set at a premium to the WACC, it is likely that managers’ cognitive biases will simply “recalibrate” to the new, higher, hurdle rate. In other words, a premium hurdle rate may work in the short term, but is ultimately an example of treating the symptoms rather than the disease.

Rooting out cognitive biases is not easy, but if done can provide long-term benefits to the company. A first step is to simply raise awareness that such biases are real. When decision makers acknowledge the biases exist and how they work, they can work to consciously overcome them. Another step is adopting a formal program of tracking actual post-investment results for projections. Regularly reviewing prior investment decisions helps managers identify the characteristics of prior decisions (whether they turned out well or poorly). Knowing that the current decision on the table will be subject to review in future periods helps managers think more critically about the risks of a project. Finally, emphasizing return on invested capital (ROIC) as a measure of management performance can help limit overconfidence. ROIC helps corporate managers adopt a shareholder perspective since ongoing performance is judged not just on the basis of future operating results, but also the capital required to support the business. Making managers accountable for the capital committed to a project can contribute to more realistic projections of future results.

Serve As a Capital Rationing Tool

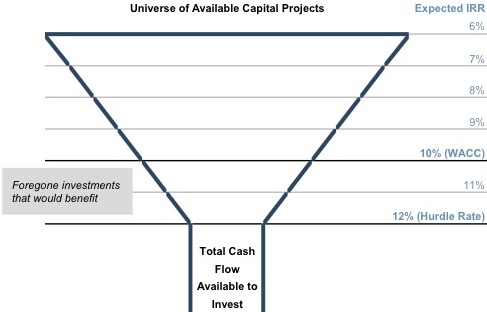

Unlike the imaginary companies that populate textbooks, real family businesses do not have access to unlimited amounts of capital. Even when there is a large pool of available capital, there may be other resource constraints that impose prudential limits on how many projects the company can undertake during a given period. In the face of capital (or other) constraints, using a premium hurdle rate can help narrow the list of potential capital projects to a manageable number. In other words, there are fewer projects with 12% returns than 8% returns.

Using a premium hurdle rate can be a perfectly suitable way to ration scarce capital resources. However, we offer a couple of cautions for this practice. First, if there really are an abundance of capital projects that promise returns in excess of the WACC (which is what capital rationing implies), family business directors may need to investigate ways to alleviate the capital constraints. In the context of the funnel depicted above, finding additional capital (or management, or other resources) would benefit shareholders by limiting the opportunity cost of foregoing attractive investment opportunities.

Second, family businesses should be wary of simply substituting a high hurdle rate for developing a clear strategy. For example, assume a company’s cost of capital is 10%. In our experience, a project with an 11% internal rate of return that advances the company’s strategy is preferable to a project which is expected to generate a 16% return, but does not promote the company’s strategy. In other words, a premium hurdle rate cannot replace a coherent strategy.

Ultimately, the size of your family business’s capital budget cannot be assessed in isolation, but intersects with other strategic decisions regarding dividend policy and capital structure.

Conclusion

So in the end, premium hurdle rates can be effective in taking into account that family businesses do not have the luxury of operating in the neat and tidy world of finance textbooks. However, it is critical that companies electing to use a hurdle rate premium not ignore the effect of cognitive biases on forecasting or the importance of corporate strategy in project selection. Treating the symptoms can be the right course of action in the short run, but family businesses concerned with long-term health should also treat the underlying disease.

Family Business Director

Family Business Director