Down, But Not Necessarily Out

In this week’s post, we attempt to divert your attention from interest rates and banking crises by looking at recent private company transaction multiples and some implications of these measures.

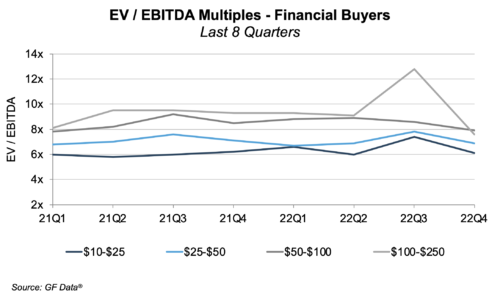

As detailed in the latest edition of Mercer Capital’s Middle Market Transaction Update, transaction activity, both in terms of deal values and volume, ended 2022 with a thud, as expected. Multiples on deals across all size tranches in the middle market (which we define as deals with total enterprise value between $10 million and $250 million) fell to close the year—implying a broad decline in private company valuations in that time. However, asset prices across most classes were susceptible to these declines, creating opportunities for prudent family business managers and directors to evaluate potential transactions in a “down” market.

While deal multiples are down across the board, we look at an illustrative case showing that despite the recent decline in multiples, current conditions could still make this a good time for family business owners to pursue liquidity options. We preface this illustration by urging would-be sellers to remember that investment decisions should be considered within the context of other available alternative investments. The value of a business (and the multiple it could generate in a sale) may be lower today than it was a year ago, but again, keep in mind that this is a common theme affecting both privately-held and publicly-traded companies.

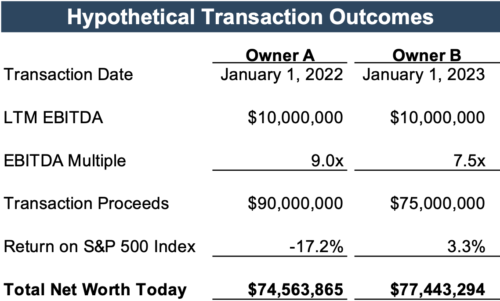

In our example, let’s consider two family business owners. We’ll call them Owner A and Owner B. Owner A and Owner B each own 100% interests in identical companies that have generated remarkably stable EBITDA of $10 million in each of the past three years. On January 1, 2022, a buyer approached Owner A and Owner B, offering to purchase their family business for 9.0x EBITDA, payable in cash.

Owner A has been looking to cash in for some time and gladly takes his $90 million in transaction proceeds (for simplicity’s sake, we will assume that taxes do not exist in our hypothetical transaction). With his newfound pile of cash, Owner A, having already built his dream homes, funded his children’s educations, and made considerable charitable contributions to a number of organizations over the years, decides to invest all $90 million of his transaction proceeds into an index fund that tracks the performance of the S&P 500. While this strategy is obviously ill-advised from a diversification standpoint, Owner A ultimately decided that active management is inefficient over the long run and fixes on this course.

Meanwhile, Owner B has elected not to take the offer made to him on January 1, 2022, and continued to operate his company through 2022. Coincidentally, his company once again generated $10 million in EBITDA in 2022, and the same buyer returned on January 1, 2023, looking to purchase Owner B’s company. However, the potential buyer is also an informed buyer and only offered Owner B 7.5x EBITDA in his most recent offer. Still, Owner B agrees to sell this time, taking 7.5x EBITDA and total transaction proceeds of $75 million. Owner B, like Owner A, has also already accomplished all his financial goals and is similarly unconvinced of the merits of active trading, so he too decides to invest all of his transaction proceeds into an index fund that tracks the S&P 500.

Now, let’s examine the performance of Owner A and Owner B’s transaction proceeds as of March 2023. Owner A and Owner B both still hold all the proceeds from their transactions in an index fund that tracks the S&P 500. However, this fund, whose returns are identical to those of the S&P 500, is down approximately 17% from when Owner A invested in early 2022. On the other hand, Owner B has benefitted from an approximately 3% YTD gain in the S&P 500 thus far in 2023.

As shown in the chart below, Owner B is better off today than Owner A in our simple example, despite having taken a whole turn and a half less of multiple in his transaction, yielding $15 million less in proceeds than Owner A’s transaction. In short, Owner B was able to take advantage of an opportune time to have ample liquidity by selling his business for a “cheap” price relative to recent multiples and reinvesting the proceeds even “cheaper,” which may well make up for the discounted multiple he took in the sale in the long run.

The hypothetical outcomes in this simple example were obviously created by our assumptions (and, arguably, the questionable investment decisions of Owner A), but hopefully, the point still stands. While acquisition multiples in the middle market are trending downwards, valuations in nearly all other asset classes are as well. This should present favorable reinvestment opportunities for family business owners looking to sell their businesses. Selling at what is a lower multiple (relative to recent history) is not always a terrible option when you can reinvest at similarly reduced pricing levels.

Family business owners should not bury their heads in the sand regarding the current environment–one of the most important facets of a successful transaction is that sellers have reasonable and informed expectations of what their business may command in the market. These reasonable and informed expectations are difficult to develop without a solid understanding of current market conditions for privately held businesses. Our Family Business Advisory team has a deep bench of seasoned professionals with decades of combined experience helping family business owners and boards develop these informed expectations.

Family Business Director

Family Business Director