Earnings Season

Quarterly earnings season kicks off this week with what is expected to be a third-straight quarterly profit drop. In 2023, U.S. stocks have defied expectations, with the S&P 500 up 15% and the Nasdaq Composite up 31% – logging its best start in the past four decades.

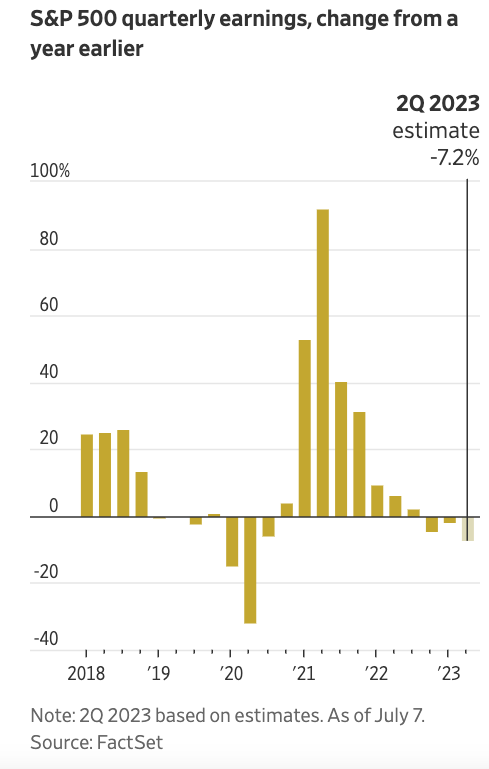

Analysts expect companies in the S&P 500 to report a third consecutive decline in quarterly earnings; profits are projected to drop 7.2% from the same period a year earlier, according to FactSet.

“Rarely can you injure yourself falling out of a basement window,” said Sam Stovall, chief investment strategist at CFRA Research. Due to Wall Street’s bleak outlook, there is optimism for stocks due to companies having a low bar to clear. However, investors remain uncertain as there are still many question marks like when the Fed rate hikes will end, when the recession will begin, and how deep it will be.

As a private family business, earnings season may not look the same as it does for Elon Musk or Mark Zuckerberg (cage match anyone?), as there are fundamental differences between large public companies and family businesses.

But this does not mean successful family businesses should ignore the Street’s earnings season dance. Family business leaders should use some characteristics from earnings season as an opportunity to ask their family board these questions.

How Do We Communicate More Effectively with Shareholders?

Ironically, family businesses, whose shareholders share the same family tree, often fall short of the millions of seemingly anonymous shareholders of their public counterparts. Public companies provide a great road map for a multi-generation family business in reporting. While public companies are legally mandated to report every quarter, forward-thinking public companies view this as an opportunity to tell their story compellingly. Communication determines the success of any relationship, and the relationships among shareholders of multi-generation family businesses are no exception. For a multi-generation family business, communication is not optional. A failure to communicate is a communication failure.

Determining the frequency of communication is vital. Depending on the nature of the business and the desires of the shareholder base, less frequent communication than public companies may be appropriate for your family business. There is no one-size-fits-all frequency, but what is most important is consistency.

The level of detail needs to be presented to shareholders with sufficient context regarding the company’s historical performance and conditions in the relevant industries and economy. To that end, the emphasis of shareholder communication should not simply be the bare reporting of historical results but should emphasize what the results mean in terms of future strategy and outlook. A helpful place to look may be at a public company in your industry space. What does their earnings release memo look like? What are they discussing? What story are they trying to tell? Likely they are facing some of the same industry forces and market factors your family business is facing. As we’ve noted before: It is probably impossible to re-tell the company’s story too many times.

Next Quarter or Next Generation?

Readers of the Family Business Director know that one of the strengths of family businesses is their ability to make tough decisions for the long-term health of their businesses despite possible negative, near-term impacts. Publicly traded companies often lack this advantage (or grace), as earnings season has a way of bringing the focus back to the here and now.

The 1-cent earnings misses that send stock prices crashing through the floor are too many to enumerate. But long-term-minded family businesses can (usually) take heart that small misses on the road to riches are met with more patience than public companies are afforded.

Patience. When was the last time you or your family board asked for patience? Knowing the time or season for your family business will help you gauge how patient or impatient you need to be. Is it “planting” season or “harvesting” time? Planters are family businesses currently investing more cash flow in future growth than their existing operations generate. In contrast, harvesters generate more cash flow from current operations than they invest for future growth.

The goal of planting is to generate a future harvest. But as any farmer knows, the future harvest is a promise, not a known fact. You have to plant before you harvest. As a result, the principal peril of planting time is the risk that the harvest will turn out less attractive than expected. In contrast, harvest time allows families to finally reap the benefits of the risks and investments but potentially at the expense of under-investing in the business.

Family businesses should take a step back and check what time it is for their family business and if a change of posture is in order for the long-term benefit of the family enterprise.

Private family businesses can use earnings season as an opportunity to ask vital fundamental questions and assess if they are over-harvesting or over-planting. Through our family business advisory services practice, we work with families facing issues like these every day. Give us a call to discuss your needs in confidence.

Family Business Director

Family Business Director