Fall 2023 M&A Update

In this week’s post, we take a look at recent trends in private company transaction activity up to this point in 2023.

Middle-market transaction activity fell in the second quarter of 2023, continuing an ongoing decline in transaction activity in the middle market. The decline was seen across the entire market — as activity by both strategic and financial buyers declined in the quarter. Pricing multiples, which had shown resiliency in recent quarters, declined with overall deal activity — hampered by further interest rate increases and general economic uncertainty in the second quarter. We look at these trends and their implications in the following sections.

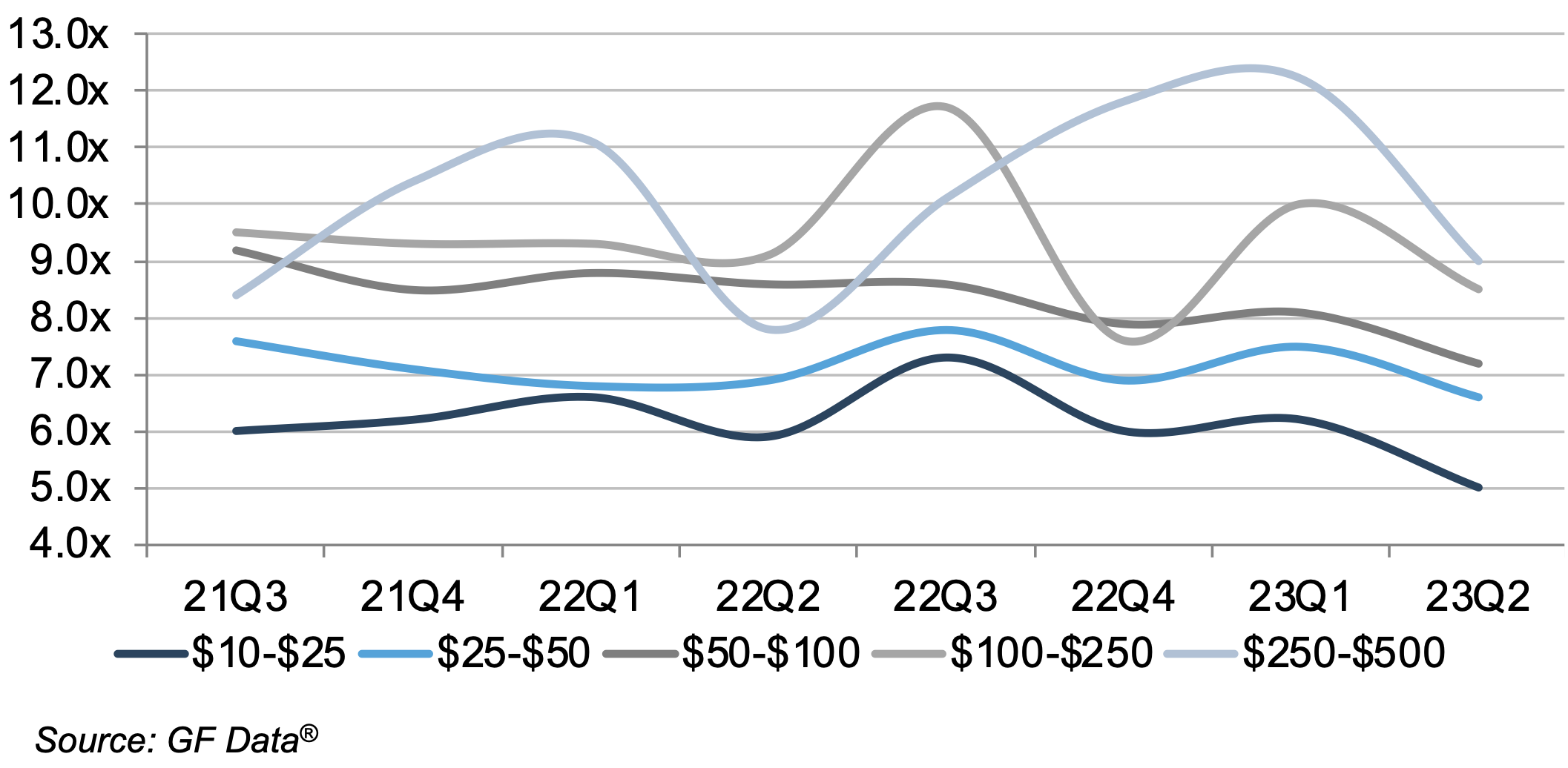

Deal multiples across all size tranches fell in the second quarter of 2023, as reported by GF Data. They reported the number of private equity deals fell from 78 deals in the first quarter of 2023 to 57 deals in the second quarter, which is also down from 76 reported deals in the second quarter of 2022. Average multiples on all completed deals fell from 7.7x EBITDA in the first quarter of 2023 to 6.4x, the lowest reported average multiple since Q3 2020. The 6.4x average multiple in the second quarter is also down a full turn from the 7.4x average multiple reported by GF Data a year ago. Deal volume for both strategic and financial deals presents a similar picture.

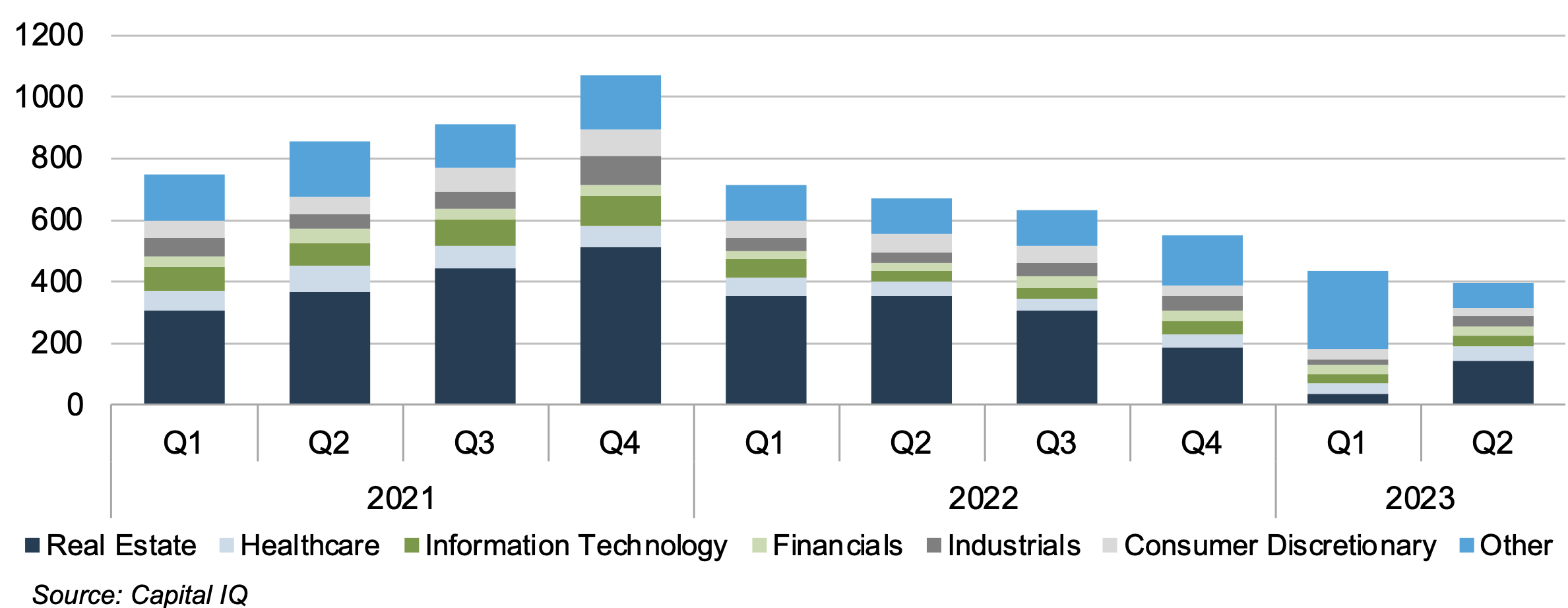

The chart below highlights overall deal value and volume, including strategic deals. The second quarter of 2023 represents the lowest levels of value and volume across the period analyzed.

US Deal Value and Volume

Q1-2021 to Q2-2023

TEV/EBITDA Multiples

Financial Buyers

Last 8 Quarters

While the state of the middle market, when viewed through the lens of deal activity in the second quarter, appears bleak, deals still have gotten done in the first half of 2023 — albeit under rapidly evolving macroeconomic and market conditions. The Federal Reserve continued to raise interest rates in the second quarter of 2023 to fight persistent inflation in the U.S. economy. U.S. equity markets posted broad gains in the second quarter while ongoing geopolitical tensions continued to percolate and unemployment in the U.S. remained historically low.

All that to say, the current macroeconomic environment appears to be teeming with contradictions and uncertainty, making planning and forecasting extremely difficult for companies. One potential aspect of this process — pursuing an acquisition or developing a corporate M&A strategy — becomes more precarious than usual in uncertain economic conditions.

Headlined by rising interest rates, we suspect that uncertainty of the U.S. economy’s future played an outsized role in the second quarter’s depressed middle market deal activity. It is also important to note that M&A deals do not get done in a single day, month, or typically even quarter. There is a lag between the deal agreement (letter of intent negotiation) and the transaction closing. The reduced number of closed deals and lower multiples of the second quarter partly reflect reduced market activity in the first quarter of 2023. While there has been no relief on the interest rate front, general economic sentiment appears to have improved as 2023 has progressed, alongside diminishing expectations of an imminent recession.

Despite these current challenges, quality businesses coming to market are still commanding multiples that have the potential to get deals done. There will always be a market for companies that can generate growth, have steady and predictable cash flows and margins, and achieve scale in their industry. Private equity investors still have large amounts of “dry powder” on hand and continue actively seeking returns in many areas of the available investment universe, including the middle market.

Family business owners looking to sell their business in the current environment will have to be prepared for the transaction process, given heightened levels of diligence and scrutiny from potential buyers and their lenders. User-friendly financial statements, well-crafted offering materials, and a deep knowledge of the value drivers in your business and industry are now more important than ever.

In addition to its Family Business Advisory team, Mercer Capital has a deep bench of seasoned transaction professionals with experience in all different types of market environments. If you are a family business owner contemplating a transaction on the buy side or the sell side, feel free to reach out to discuss your needs in confidence.

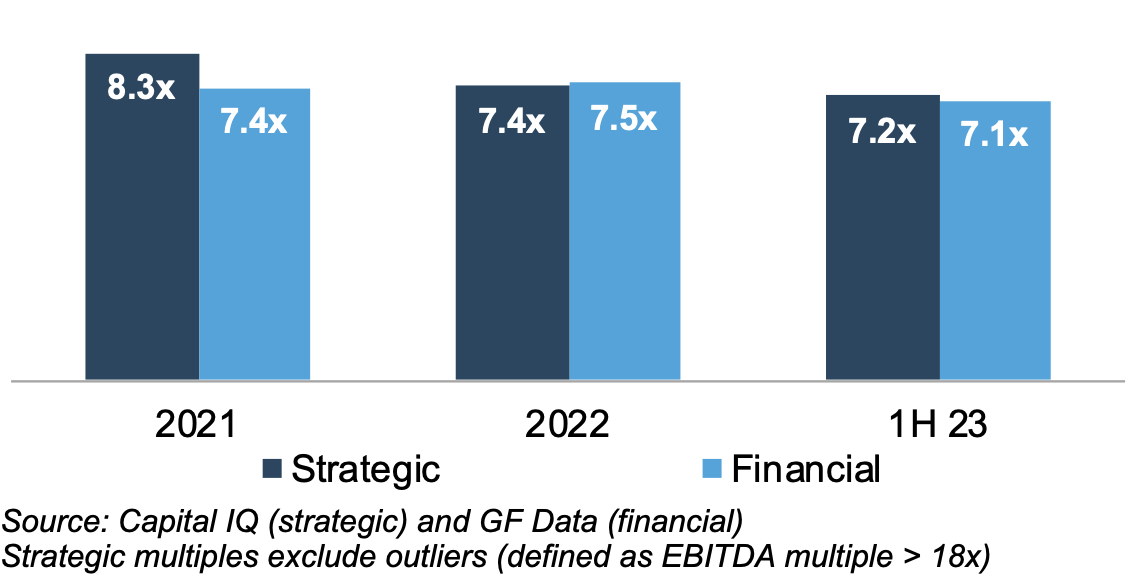

EBITDA Multiples by Buyer Type

2021 to YTD 2023

US Deal Volume by Industry

Q1-2021 to Q2-2023

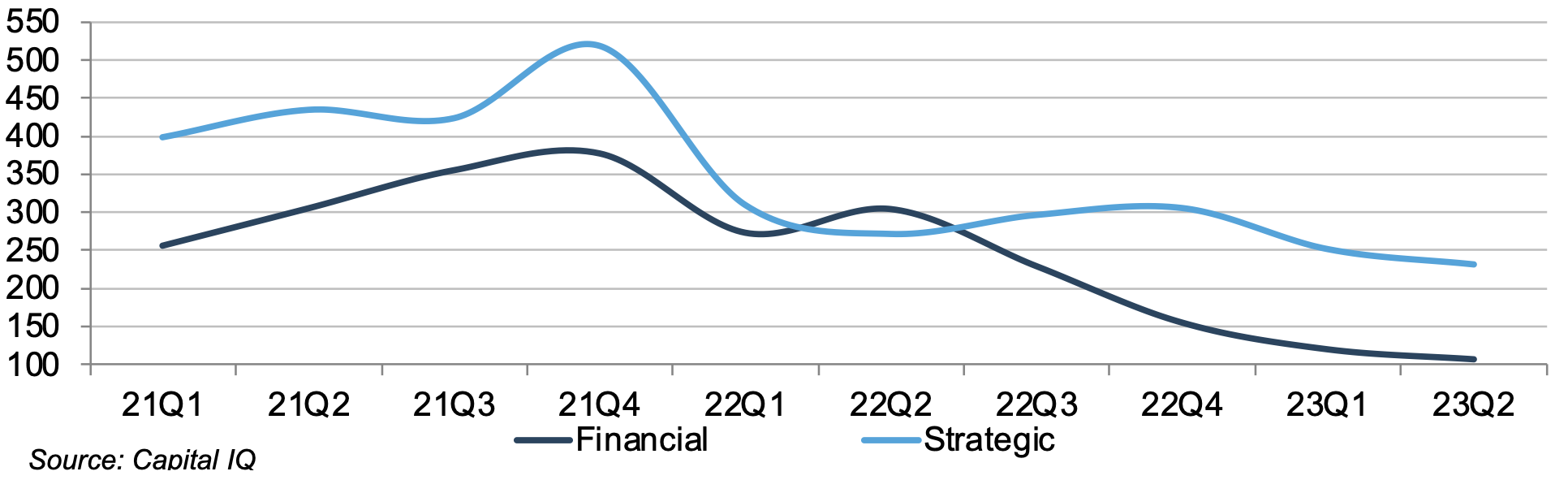

Number of Deals by Buyer Type

Q1-2021 to Q2-2023

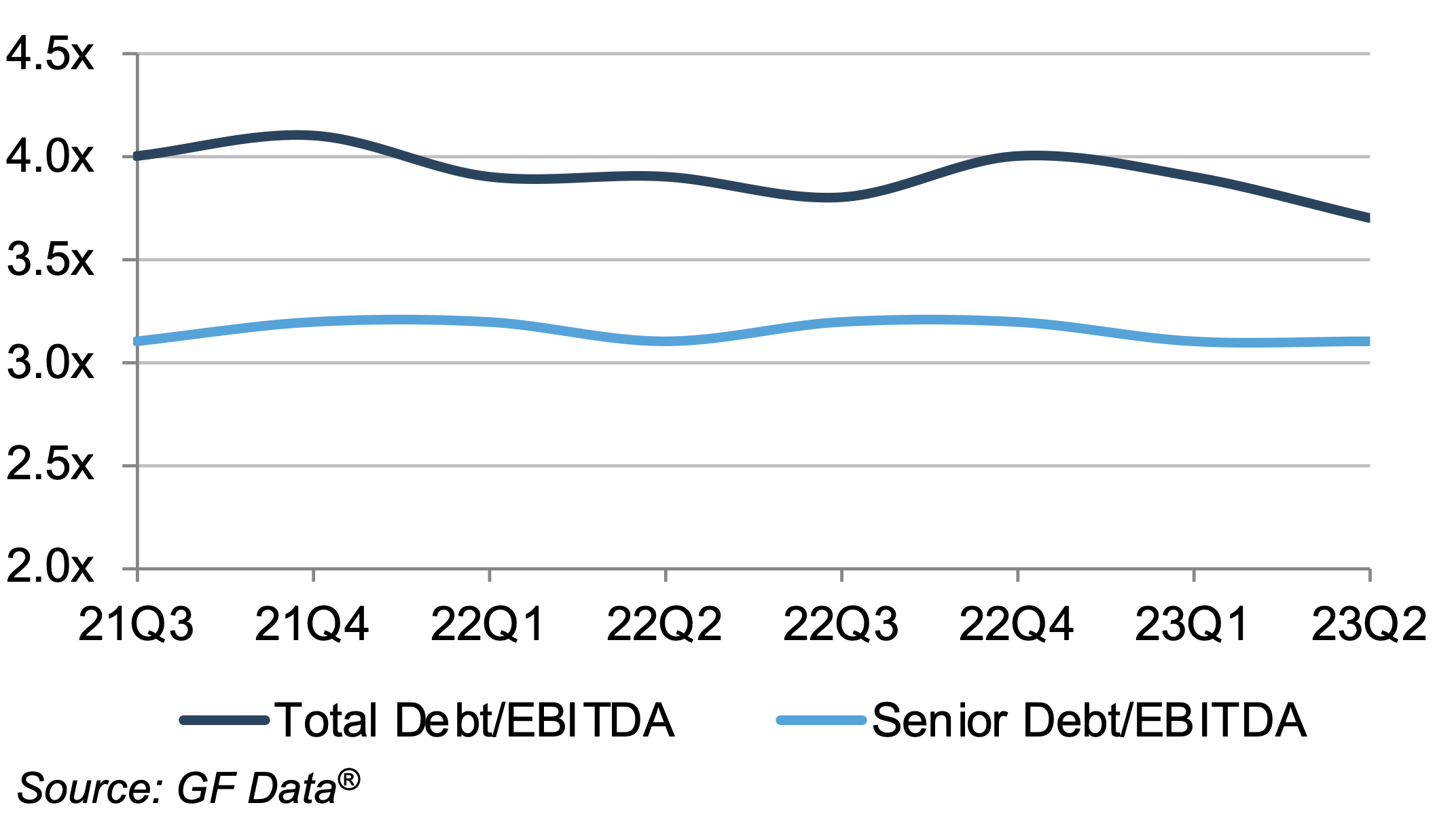

Debt Multiples

Financial Buyers

Through 2Q 2023

Family Business Director

Family Business Director