Family Business Dividend Survey Results

This summer, we partnered with Family Business Magazine to conduct our inaugural survey of dividend practices at family-owned businesses. This week, we feature an article that we wrote for the magazine summarizing the survey results. We hope you enjoy and gain some insights that can help you and your family evaluate your current policy and make plans for the future.

Determining what portion of earnings should be distributed to family shareholders each year can be perilous.

Few decisions faced by family business leaders are as perilous as determining what portion of earnings should be distributed to family shareholders each year. Pay too little, and shareholders having no other source of liquidity from their shares may grow restive. Pay too much, and attractive opportunities for growth may wither on the vine, imposing a hard to define, but very real, cost on future generations. As a result, maintaining the appropriate balance between current income for existing shareholders and reinvestment for future generations can feel like a tightrope walk for family business leaders.

When embarking on such a high-stakes endeavor, prudent leaders want to learn as much as they can from others in similar situations. To help family business leaders learn from one another, Mercer Capital partnered with Family Business Magazine to administer a survey on dividend practices at family businesses. Nearly 300 enterprising families responded, and we provide a summary of what we learned in this article.

Are There Any Families Like Mine?

The respondents to the survey represent a diverse group of family businesses, in terms of age, industry, size and geography. The median age of the family businesses in our sample was about 70 years, with nearly half being founded prior to 1950. The largest industry concentrations were in manufacturing (30% of respondents) and real estate (12% of respondents). About half of respondents reported revenue of less than $100 million, and approximately 10% reported more than $1 billion of annual revenue.

What’s the Plan?

Unlike shareholders in public companies, family shareholders can’t easily access the value of their shares by selling on the open market. Dividends are the most tangible expression of what can often feel like merely “paper” wealth. It’s nice to be rich; it’s even better to have money. Given this dynamic, it is not surprising that family businesses are more likely than public companies to pay dividends. Whereas about half of public companies pay dividends to shareholders, over 80% of the family businesses responding to our survey indicated that they do. However, nearly half of respondents reported not having a formal dividend policy. In other words, a significant group of family businesses are paying dividends, but they’re not sure why.

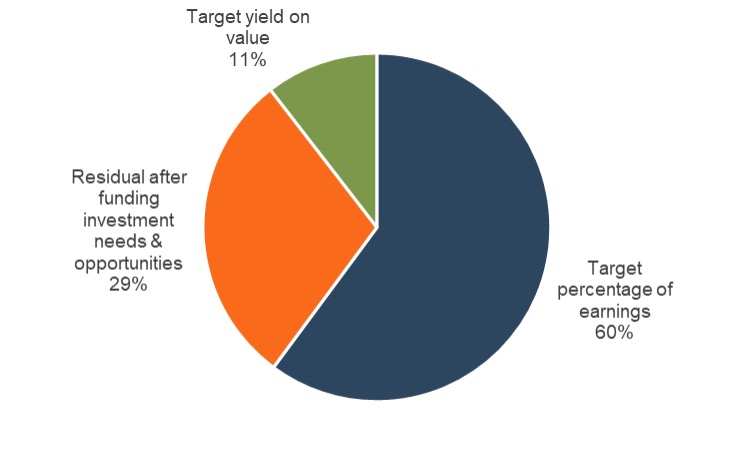

Those who do have a formal dividend policy reported a few different policy objectives. As shown in Exhibit 1, the most common dividend policy identifies a target payout ratio of earnings (net earnings for C corporations, or earnings after tax distributions for pass-through entities). While family businesses prioritize paying dividends, overall payout ratios tend to be modest, with the target payout ratio for 60% of respondents at less than 25% of earnings. This suggests to us that most family businesses are wary of killing the golden goose.

Exhibit 1

Dividend Policy Objectives

Nearly 30% of dividend policies prioritize the investment needs of the business and treat dividends as a residual amount after attractive investment opportunities have been funded. Finally, a smaller minority of respondents prioritize shareholder returns in the form of establishing a target dividend yield (generally on the order of 2% to 4% of value).

What Signal Are You Sending?

Dividends are powerful signals about management’s outlook for the family business. Annual reports and shareholder letters may or may not get read, but dividend checks always get cashed. Because of this “signaling effect,” public company managers are loath to cut dividends in the face of a short-term earnings crunch and are hesitant to raise dividends beyond a level that they are confident they can maintain. In contrast, nearly half of the family business survey respondents indicated that dividends fluctuate from year to year, and only 20% reported having a mechanism in place to smooth out dividends amid volatile earnings. Without strong, well-cultivated shareholder consensus and engagement around the dividend policy, dividend volatility can reduce the “value” of the dividend stream to shareholders. Uncertainty regarding the dividend stream makes it harder for shareholders to make reliable personal financial plans. Dividend uncertainty also presents challenges for family business managers who need to plan significant capital investments years in advance.

Public companies can emphasize dividend stability amid volatile earnings using share repurchases. Buying back shares and paying dividends are both tools to return capital to shareholders. Public companies tend to allocate more capital to share repurchases than to dividend payments. There are likely several reasons for this, one of which is that when earnings are down and capital is scarce, slowing the pace of share repurchases is less of a negative signal to investors than cutting the dividend. In other words, share repurchases serve as a release valve for volatile earnings at public companies. However, only 21% of our survey respondents reported having a formal share repurchase program available to provide liquidity to family shareholders. Without this release valve in place, it should not be too surprising that families report a higher degree of dividend volatility. We suspect that more family businesses will institute share repurchase programs in the future.

Pandemic Blues

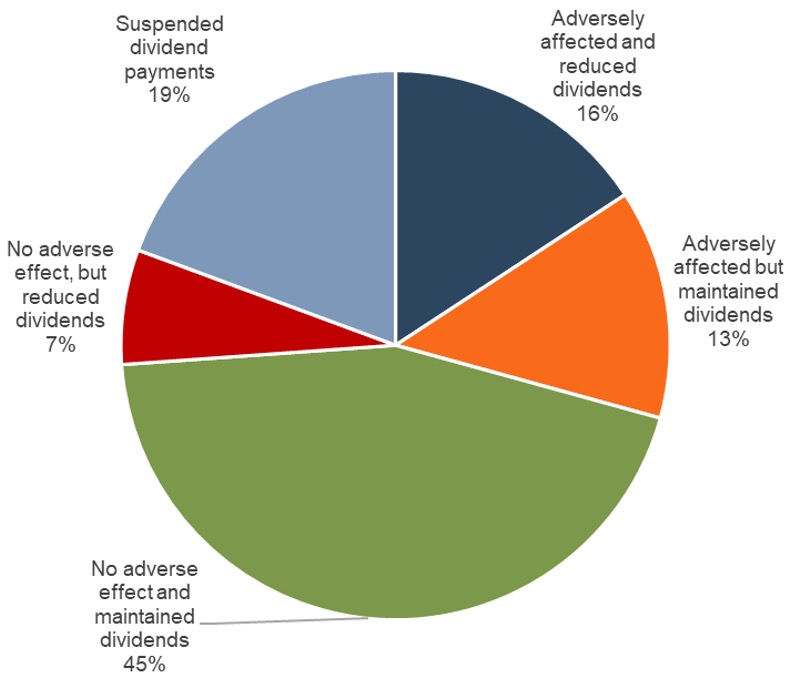

The COVID pandemic presented a (hopefully) once-in-a-generation challenge for family businesses. Much like the broader economy, the pandemic did not affect all family businesses in the same way. We asked survey participants to describe what effect the pandemic had on the performance of their family businesses and their dividend decisions. Exhibit 2 summarizes the responses.

Exhibit 2

Effect of Pandemic on Family Business Dividends

- Just over half of respondents indicated that the pandemic had no adverse effect on the financial performance of their family business. As a result, a significant majority of these respondents did not modify their dividend practices in response to the pandemic. Nonetheless, nearly 15% of those family businesses reporting no ill effects from the pandemic on financial performance reduced dividends, presumably to preserve family business capital in the face of grave economic uncertainty.

- Among family businesses that did see their financial performance suffer during the pandemic, there was a mix of dividend responses. Approximately 27% of such family businesses elected to maintain their dividend, signaling to family shareholders that they were confident in the long-term prospects of the family business. The remaining companies either cut dividends or suspended them entirely.

- Nearly 20% of all survey respondents reported suspending dividends altogether because of the pandemic. Given the significance of dividend payments to family shareholders, the decision to suspend dividends reveals the gravity of the threat the pandemic posed to some family businesses. Deciding when and how to reintroduce dividend payments will be a significant challenge for these families.

What’s It Mean to You?

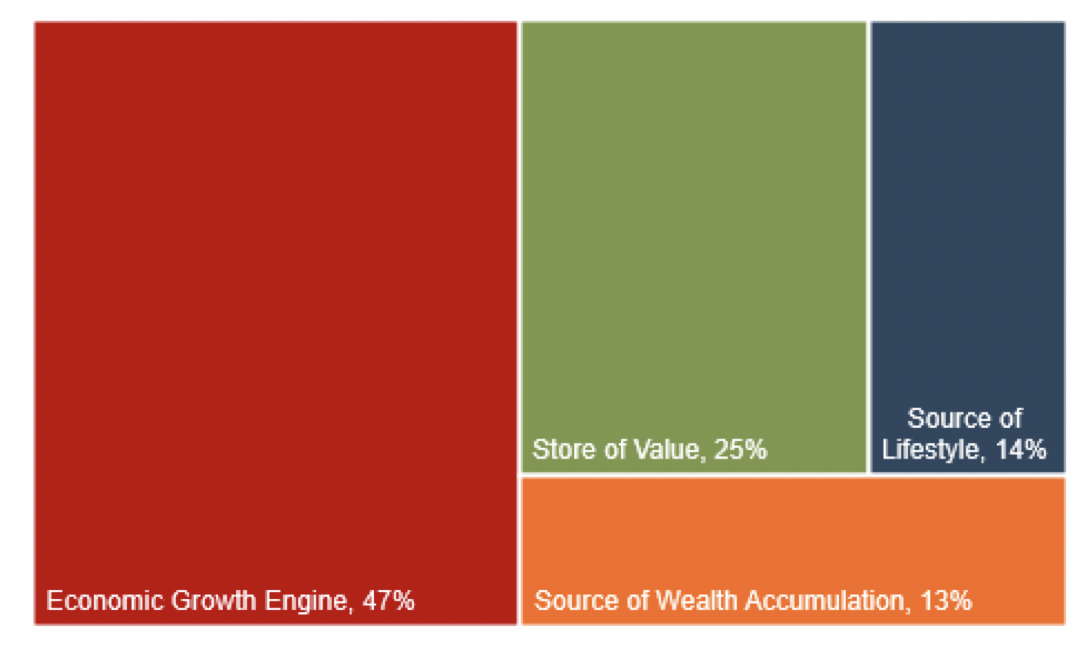

Crack open a standard finance textbook, and dividend policy will look easy. Simply invest in all available positive investments with a positive net present value, maintaining an optimal mix of debt and equity financing, and distribute what is left over. Unfortunately, that theory assumes that shareholders are economic robots. However, most family shareholders are people. Unlike robots, people invest things (including family businesses) with meaning. We asked survey participants to describe what their family business means to them, and the responses are summarized on Exhibit 3.

Exhibit 3

Family Business Meaning

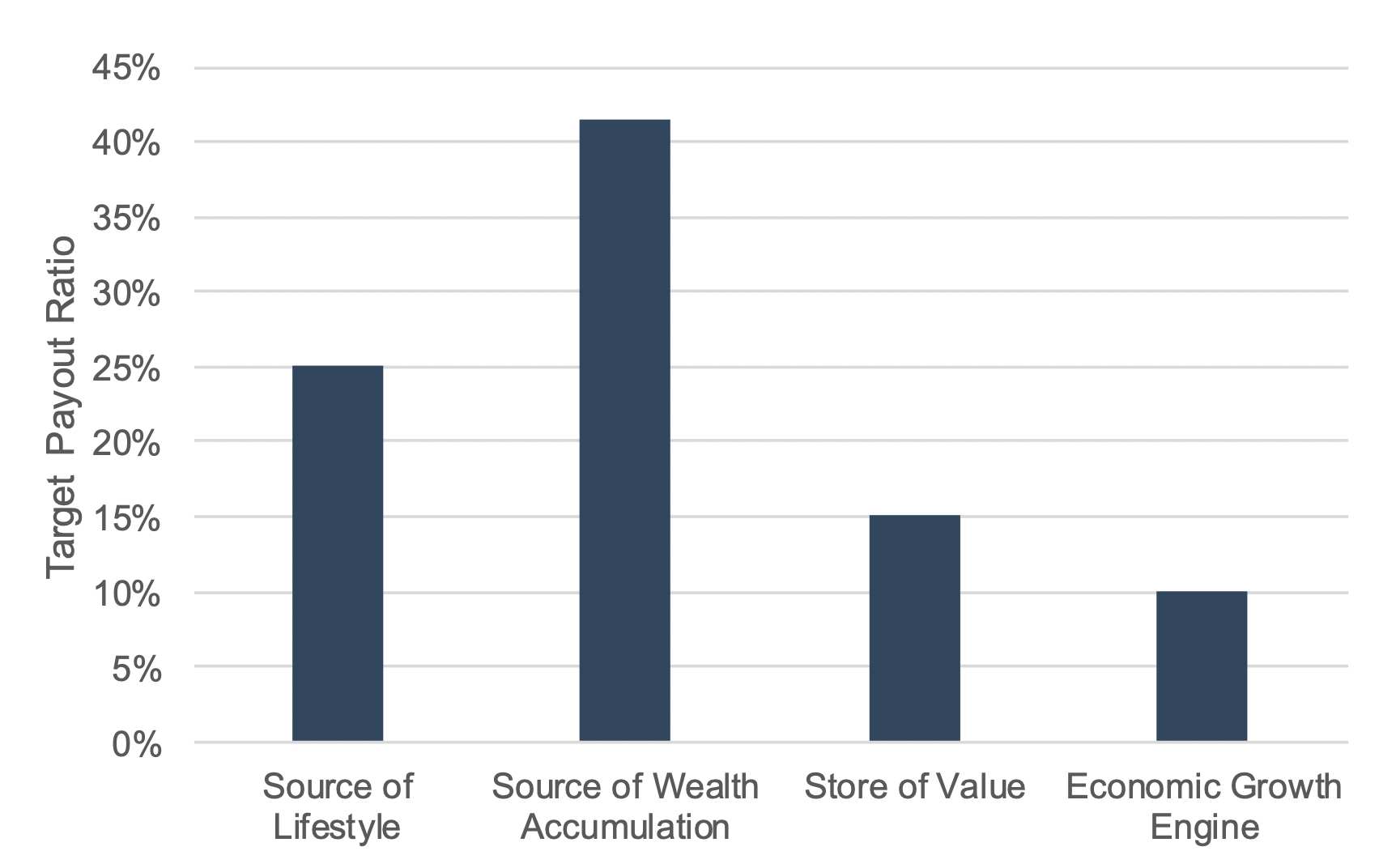

In our experience, the most successful (and peaceful) enterprising families are those in which there is consensus regarding what the family business means to the family. When there is alignment on meaning, it is easier to find alignment on dividend practices. This is borne out when we examine the median target payout ratios for businesses sorted by the different family business meanings noted in Exhibit 3. As shown in Exhibit 4, there is a clear correlation between what the family business means to the family and dividend practice.

Exhibit 4

Family Business Meaning and Target Payout Ratio

If the family business serves as a source of wealth accumulation and diversification for family members, it makes sense that payout ratios would be relatively high. In contrast, if the family business is perceived as an economic growth engine for future generations, large dividend payments will detract from that goal. Misalignment on meaning can trigger shareholder discontent: Individual shareholders who want the company to be a source of wealth accumulation will likely be frustrated if the rest of the family views the company as an economic growth engine and makes dividend decisions accordingly.

The Last Word

Many survey respondents provided additional comments that were illuminating. We will close with one that we think expresses the sentiments of many family shareholders: “I feel that maybe some businesses don’t discuss dividends openly. I feel that we are one of these. It is ‘undiscussable.’”

Don’t let dividends be an “undiscussable” in your family. We hope the results of this survey can provide a starting point for healthy dividend discussions at your family business.

Family Business Director

Family Business Director