Financing Options Abound for Family Businesses in 2021

A long-time Wall Street saying speaks to the availability of credit for mid-size and larger family businesses that seek to raise debt capital in 2021:

If the ducks are quacking, feed them.

Barring a change in the economic backdrop, as uncertain as it is, the availability of debt financing for most family businesses in 2021 is good. Further, the cost of credit will be low and most likely the terms will be lenient by historical standards.

There are exceptions, of course. Hotels, retail CRE, restaurants, and tourism-related businesses face greater scrutiny. Retail malls and strip centers without a grocery or other essential business are tough financing propositions. Trepp, which tracks the commercial mortgage-backed security (“CMBS”) market, reports that it is not uncommon for servicers to sell troubled retail CRE loans at huge discounts and to auction large albatross retail properties in which no one shows up to bid.

At the other extreme are companies such as Carnival Corporation, which operates multiple cruise lines. Carnival raised $3.5 billion on February 10 via a 5.75% senior unsecured offering due March 2027. Demand was sufficiently robust to boost the offering from a planned $2.5 billion. During July 2020 Carnival sold $775 million senior secured second priority notes due February 2026 with a 10.50% coupon.

Four Options to Obtain Debt Capital

Family businesses have four broad options to obtain debt capital:

- Commercial banks

- Non-bank commercial finance companies

- Private credit funds

- Corporate bond market

Each financing option has its pluses and minuses.

Commercial Banks

Historically, commercial banks offered the cheapest source of funding to family businesses albeit with plenty of covenants and perhaps personal guarantees compared to more expensive unsecured long-term financing available from the bond market. Those precepts are changing in a yield-starved world in which investors (and banks) accept lower yields with fewer covenants (i.e., “covenant-lite” is now a standard for syndicated leverage loans).

Non-Bank Commercial Finance Companies

Non-bank commercial finance companies differ from banks in that they do not have deposit funding, are less levered than commercial bank and generally charge higher rates than banks to produce a competitive ROE. Commercial finance companies offer deep expertise in a given asset class to be financed, and the subject asset rather than a blanket lien on the firm’s assets and cash flow serves as the collateral.

Private Credit Funds

Private credit, which runs the gamut from publicly traded BDCs to funds sponsored by private equity firms, has existed in its current form for a few decades; however, private credit has exploded as a major source of financing since the 2008 recession because leverage lending by banks was restricted somewhat by regulators and because investors can earn attractive yields on capital that is levered by the manager. Plus, the sponsors earn management fees on the assets in addition to the coupon on their capital. Family businesses may find credit funds to be expensive, but generally, they can move quickly and will allow for more leverage than a commercial bank that originates loans for its balance sheet. There also is an advantage to having an ongoing dialogue with the fund that can make decisions to modify a loan or advance additional funds, unlike a bond offering.

Corporate Bond Market

For financing needs that are sufficiently large, a corporate bond offering that is broadly distributed or privately placed with a few investors offers family businesses multi-year fixed rate financing at historically low rates though not as low as short-term commercial bank borrowings. Also, corporate bonds usually entail interest only payments until the bond matures at which point the issue will have to be refinanced or repaid with existing corporate liquidity. Among the downsides of a corporate bond financing is limited flexibility should something go awry at the company whereas a loan from one or a few banks will entail more flexibility to renegotiate terms.

Are We Currently in a Borrower’s Market?

There is so much capital available for lending, yet loan demand is weak because the U.S. is (or was) in a recession.

Loans in the commercial banking system declined for the first time in a decade in 2020 and only the second time in 28 years while deposits increased over 20%. Some of the reduction reflected corporate customers tapping the bond market to raise cheap long-term capital to refinance existing indebtedness. Further, banks have tightened commercial and CRE loan standards since last March based upon the Federal Reserve’s quarterly survey of senior lenders.

Tighter standards at commercial banks notwithstanding, there is a basic reason why the ability to obtain financing in 2021 should be a borrower’s market: cash and near-cash equivalents yield nothing while government and corporate bonds yield little. Banks and investors are sitting on sizable cash piles that must be lent to produce a return.

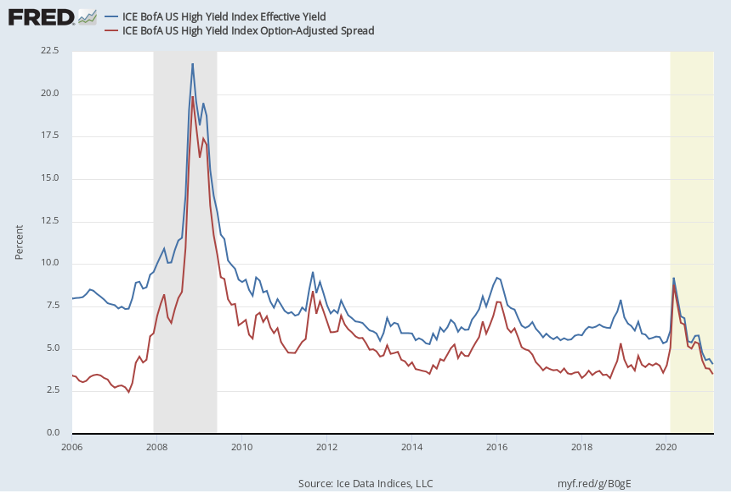

To get a sense of the pressure on yields, consider high yield corporate bonds (rated BB+/Ba1 or lower). The ICE BofA High Yield Index yielded 4.10% on February 10, well below prior lows seen in mid-2014 and early 2020 of ~5.25%. The peak yield of ~22% occurred in November 2008. This time around, yields grew to approximately 9% in late March 2020 before the Fed announced a plan to buy corporate credit and thereby restore liquidity to what had become a very illiquid market.

Also, the yield investors demand over comparable duration U.S. Treasuries (i.e., the option adjusted spread) is near a record low.

Investors are all-in, and our assumption is that commercial banks will not be willing to sit too long on excess deposits because revenue pressures are intense at banks amid an extremely low yield environment.

Conclusion

We conclude with two final points for family businesses about what the bond market is saying about credit.

- First, the message of the U.S. Treasury market yield curve conveys is positive (assuming the Fed has not completely distorted market pricing). Typically, the shape of the yield curve points to investor expectations about future economic activity. A steeper curve as measured by the spread between market determined long-term rates and short-term rates that are heavily influenced by Fed policy rates points to a stronger economy in 12-18 months. Since Pfizer made the first vaccine announcement the curve has steepened. A flatter or inverted curve indicates a slowing or recessionary environment.

- Second, Fed Chair Powell has been emphatic the Fed will not raise short-term policy rates until after 2023, even if inflation takes off. Following the 2008 recession, the Fed first raised rates in December 2015, seven years after the zero-interest rate policy (“ZIRP”) was adopted. The futures market for Eurodollars, one of the most liquid markets in the world that settles based upon 90-day LIBOR, has priced in only 75-100bps of an increase by the mid-2020s.

For family business directors, 2021 is an opportune time to evaluate financing needs to support growth investments and shareholder redemptions, and diversification needs.

Family Business Director

Family Business Director