Five Questions Family Business Directors Should Think About as 2020 Begins

The new year provides a natural opportunity for family business directors to think about the current condition of their family business and ponder what the future might hold. In this first post of 2020, we identify a handful of questions that family business directors would do well to think about.

1. What is our Family Business Worth?

In contrast to more liquid investments, like a portfolio of marketable securities, the value of a family business cannot be known with precision. The good news is that a precise value isn’t nearly as important as an accurate estimate. And reasonably accurate estimates can be developed.

If the family has no intention of selling, why is it important to know what your family business is worth? There are lots of reasons, but we’ll address three of the most important in this post.

- An accurate valuation helps shareholders better manage their own personal finances. No one would tolerate a financial advisor that refused to divulge the value of your investment portfolio because you’re not going to spend it all this year. Knowing the value of all the assets that you own (liquid and illiquid) is essential to prudent personal financial planning and decision making.

- An accurate valuation helps facilitate intra-family transactions. Even if the family does not plan to sell the business, certain shareholders may desire to transfer (through gift or sale) shares to other family members. An accurate, up-to-date valuation helps minimize the likelihood that intra-family transfers will unintentionally create economic winners and losers within the family. Some family businesses opt to sponsor redemption programs as a mechanism for providing shareholder liquidity. An accurate contemporaneous valuation is essential for such programs.

- An accurate valuation helps prepare the family for unsolicited acquisition offers. Capable and motivated buyers can offer to buy the family business even if it is not for sale. Once such an offer hits the table, deciding how to respond often becomes emotionally-charged. A third-party assessment of value that is performed outside the “heat of battle” can go a long way toward ensuring that the board formulates a rational and measured response to any unsolicited acquisition offers.

These different applications highlight the importance of understanding the various “levels” of value. The value of a controlling interest is likely higher than the value of a liquid minority interest, which is in turn likely higher than the value of an illiquid minority interest. An experienced, qualified business appraiser will help directors understand the value of the family business at each “level” and the economic factors that contribute to the resulting discounts and premiums.

2. What Return Should our Family Shareholders Expect?

Family shareholders are entitled to a future return on their investment in the family business. While the actual returns achieved over a given period are influenced by a host of factors (some of which are within management’s control and some of which are not), what is a reasonable expectation for future returns?

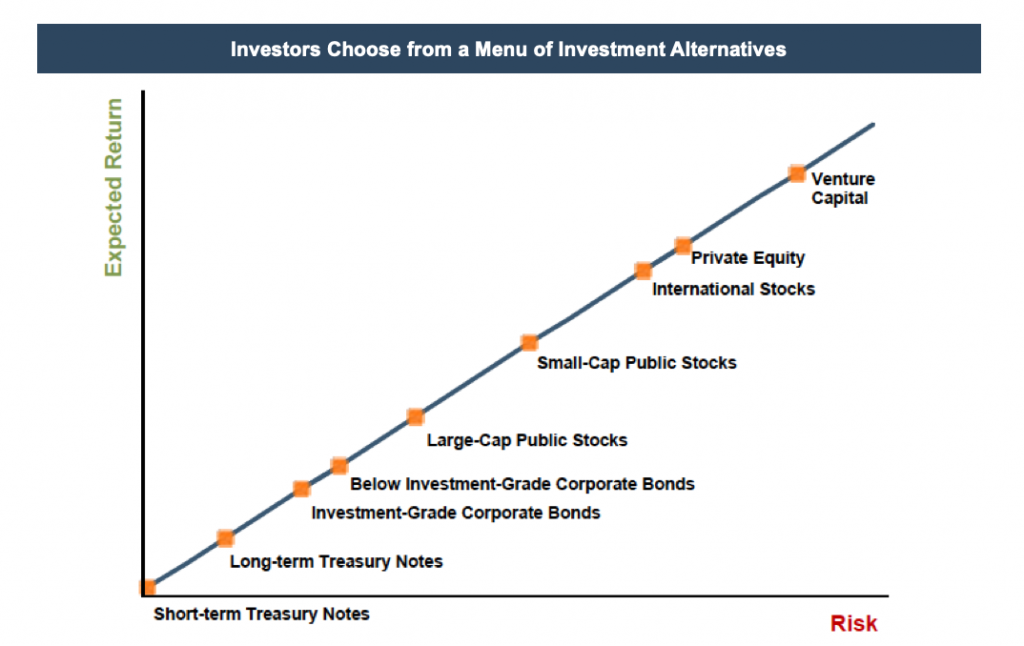

Return follows risk. So determining what return family shareholders should expect ultimately comes down to identifying alternative investments of comparable risk. Family business directors should carefully evaluate the risks facing family shareholders relative to a range of potential alternative investments.

Establishing the expected return is important for both shareholders and the managers and directors of the family business. For shareholders, the expected return provides an important benchmark for evaluating the performance of their investment over time. For managers and directors, the expected return is a critical component of weighing shareholder distributions against potential available investments. Family capital will eventually flow to its most productive use, whether that is inside or outside the family business, and the expected shareholder return is a key component of capital allocation for the family.

3. What Form Should Shareholder Returns Take?

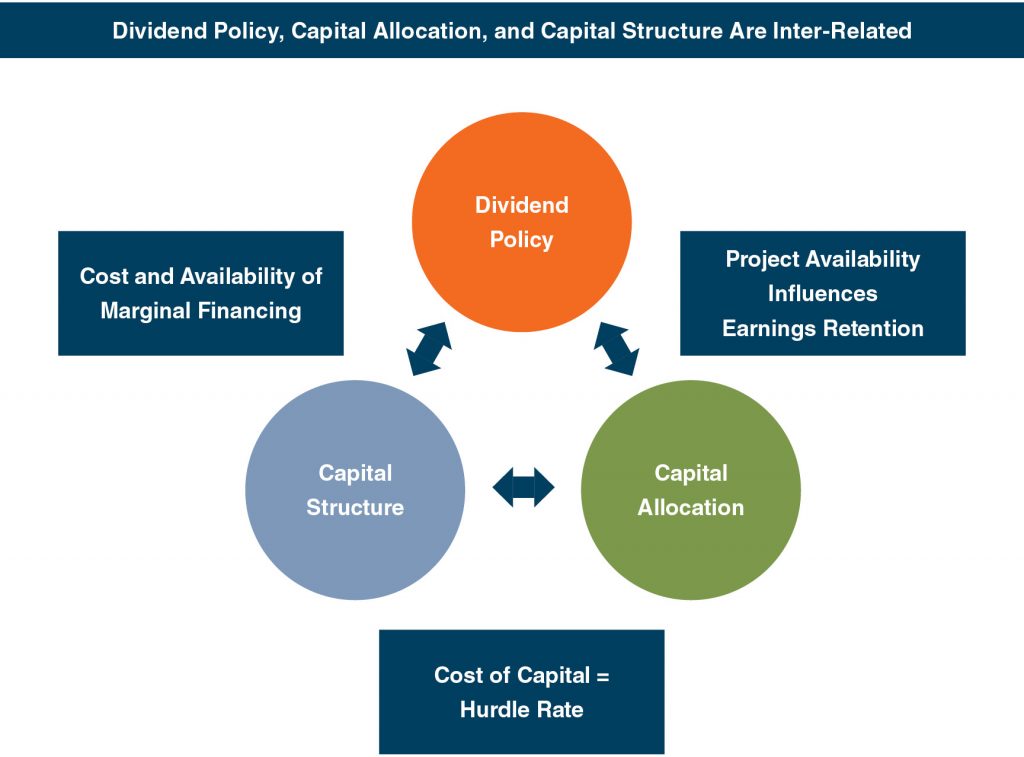

Shareholder returns come in two – and only two – forms: distribution yield and capital appreciation. Cash flow that is distributed to family shareholders cannot be reinvested in the business to fuel growth. Alternatively, cash flow that is distributed to family shareholders is no longer at risk of being lost in the family business. Given these tradeoffs, there is no single “right” dividend policy for a family business.

As a director, can you clearly articulate what your family business’s dividend policy is (and why it is what it is)? Nearly as important, have you and your fellow directors consistently communicated that policy to family shareholders such that they too understand it and can describe it? Individual shareholders may not agree with it, but you will never be able to make everyone happy. It is essential, however, that your family shareholders know that there is a guiding rationale rooted in thoughtful consideration of required shareholder returns, available investment opportunities, and shareholder preferences. If your dividend policy is perceived to be based on nothing more than the caprice of the board, it will inevitably breed distrust and acrimony.

4. What Investments Should our Family Business Make?

The process of making corporate investment decisions, referred to as capital budgeting, is essentially the flipside of dividend policy. Operating cash flow that is retained needs to be put to productive use lest it become “lazy.” From your perspective as a director, what segments of your family business seem most attractive for current investment given your family business’s strategy?

Capital budgeting should serve strategy. When management presents a significant investment opportunity to the board, can you discern a genuine organic link between the company’s pre-existing strategy and the proposed investment? Given what you, as a director, understand the family business’s strategy to be, what types of investments would make sense in 20202?

- Maintenance capital expenditures are investments in preserving (or, preferably enhancing the efficiency of) the business’s current productive capacity. Maintenance capital expenditures are not glamorous, but successful family businesses recognize their importance.

- Growth capital expenditures are investments in increasing the business’s productive capacity. These expenditures allow the family business to expand geographically, add complementary product or service offerings, or diversify away from the legacy business.

- Whereas growth capital expenditures add to overall industry capacity, mergers and acquisitions are investments that assimilate existing industry capacity to the family business. While a potential acquisition may be attractive on the basis of its own (standalone) investment merits, most M&A transactions are pursued in the belief that adding the acquired operations to the family business will result in enhanced cash flows beyond what either company could generate on its own.

5. How Much Debt is Appropriate for our Family Business?

Together with investment and dividend policy, financing policy is the third strategic financial decision facing family business directors.

Family businesses are financed with some combination of family equity and debt capital. Debt capital is attractive because lenders are generally content with a lower rate of return than equity holders. As a result, the prudent use of debt can reduce the overall weighted average cost of capital for your family business (and increase returns on the family’s equity capital). But the benefits of debt are not free: adding debt to the company’s capital structure increases the risk faced by the family shareholders. As a director, you should be careful considering how much debt is appropriate for your family business on the basis of the company’s asset base, earnings stability, economic and industry outlook, available borrowing terms, and family shareholder risk tolerances.

Conclusion

As 2020 begins, we encourage you to take the time to think about these five questions. Regardless of the issues you are facing that are specific to your family business, these questions are perennial and common to all businesses. Pondering these questions may simply confirm that the status quo in these areas remains appropriate, or it may trigger some needed new thinking in one or more of these areas.

Whether it is providing valuation calculations to estimate the value of your family business or serving as a neutral, independent sounding board in your deliberations, our family business professionals look forward to helping you develop appropriate answers to these questions for your family business. Give us a call today to discuss your needs in confidence.

Family Business Director

Family Business Director