Home Depot Announces SRS Distribution Acquisition

An M&A Case Study

The Fed’s efforts to rein in inflation from early 2022 through the middle of 2023 also reined in middle market M&A activity. Middle market transaction data provider GF Data reported data on 269 sub-$500 million acquisitions by private equity firms in 2023, compared to 464 such deals in 2021 (a 42% decrease). Some of those “missing” deals may never happen, but we suspect most were simply deferred, leading to more robust transaction volumes as buyers and sellers acclimate to the new “normal” interest rate environment.

Home Depot’s recent announcement that it was acquiring roofing and construction material distributor SRS Distribution may signal the return of more robust deal activity. Even if your family business has nothing to do with construction materials, there is plenty to note in this deal.

Home Depot :: M&A in Service of Strategy

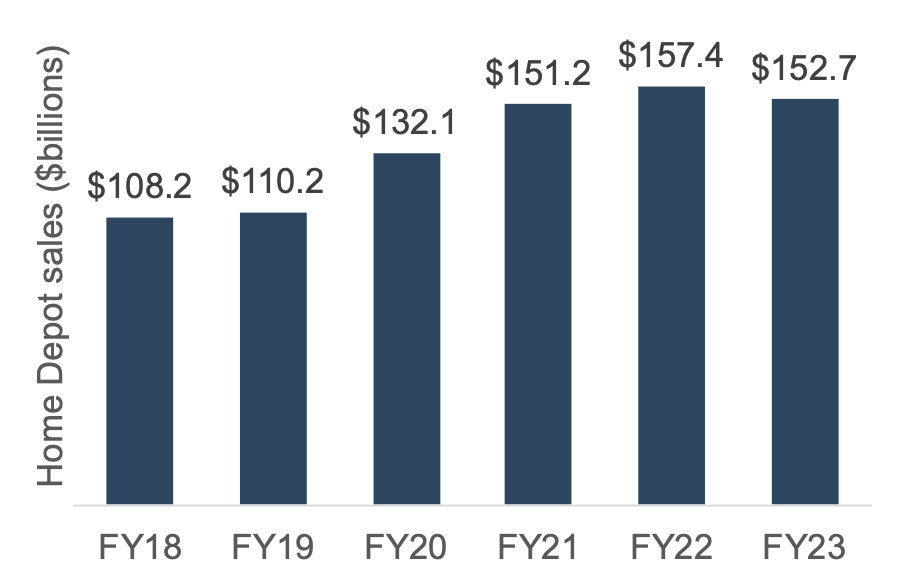

The pandemic was good for Home Depot. Being at home under “shelter in place” opened many eyes to all the shortcomings of their shelter that a trip to the Home Depot could remedy. As a result, Home Depot’s sales grew from $110 billion in FY19 to $132 billion in FY20 (+20%). Inflation-fueled growth in average ticket amounts kept the party going in FY21 ($151 billion, +14%) despite a flat overall transaction count. Consumer fatigue set in during FY22, with transaction count falling by 5.4% but continuing inflationary pressures supporting revenue growth of 4.1%. Amid subdued inflation and continued contraction in transaction counts, revenue decreased 3.0% in FY23.

So, where to find momentum? With market share gains in the mature consumer market likely hard to deliver, Home Depot has locked onto the “Pro” market as its growth engine. The Company allocated 328 words to describe their “Pro” customers in the FY23 annual report, compared to 190 words in the FY20 annual report. Following Home Depot’s $8.7 billion December 2020 (re)purchase of HD Supply, the $18.3 billion acquisition of SRS Distribution continues the Company’s strategic push into the “Pro” market.

Home Depot’s press release for the SRS deal does not emphasize synergies but rather foregrounds the growth in the company’s total addressable market from the deal. At a reported multiple of 16.1x adjusted EBITDA, the transaction is not an easy value-add for Home Depot, which is currently trading at ~17x adjusted EBITDA.

Investor response to the acquisition was tepid, with HD shares shedding 1.7% during the week following the deal announcement. Time will tell if the “Pro” strategy will pay off for Home Depot, but using M&A allows the company to bring that strategy to scale much faster than an organic approach would.

SRS Distribution :: The Private Equity Playbook

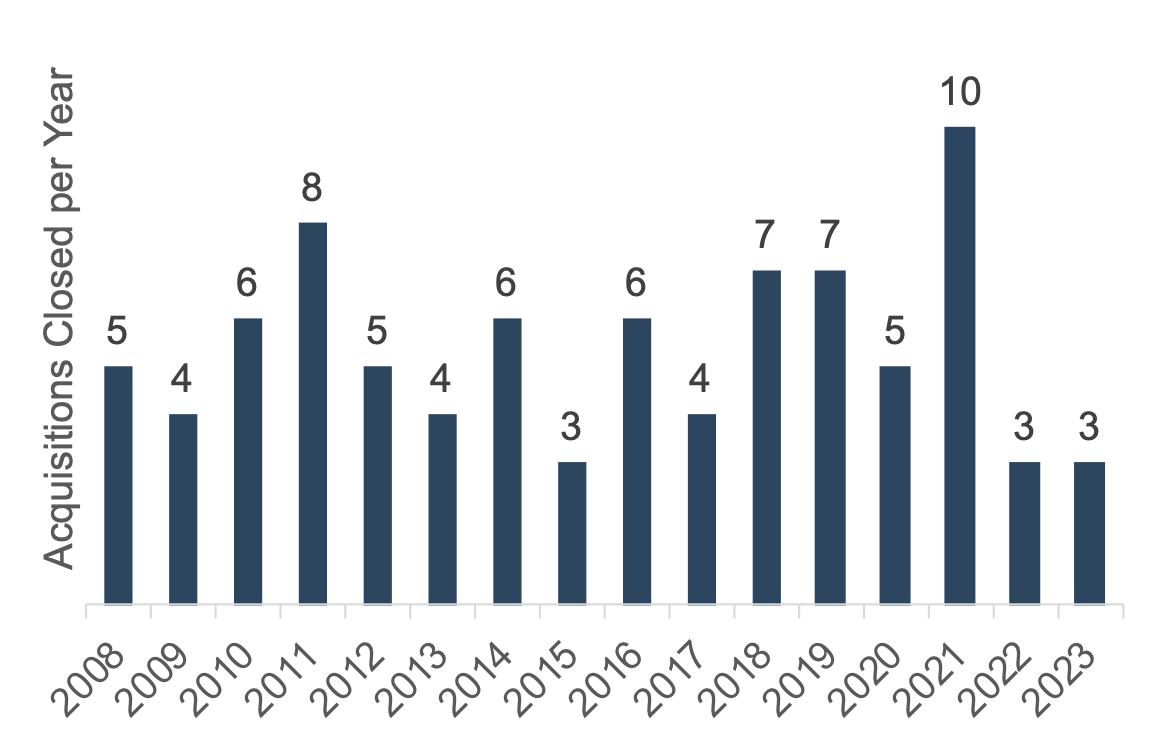

From its founding in 2008, SRS has grown to a 760-branch network with annual revenue exceeding $10 billion. How? Through an aggressive M&A strategy. As detailed on SRS’s website, the company has closed at least three, and up to ten, acquisitions each year since 2008.

That level of M&A activity requires a committed capital partner. SRS has had three over its history:

- AEA Investors. AEA Investors capitalized SRS in 2008. After concluding that roofing materials distribution was an attractive sector ripe for a consolidation strategy, AEA Investors recruited an experienced industry executive (Ron Ross) to evaluate potential “platform” acquisition candidates. They eventually settled on Suncoast Roofers Supply, which had seven branch locations in Florida. That acquisition was followed by twenty-seven more acquisitions prior to AEA’s exit in 2013, building SRS to approximately $650 million of annual revenue.

- Berkshire Partners. Berkshire Partners acquired SRS from AEA Investors in February 2013. The change in ownership did not portend a change in acquisition philosophy, however. Under Berkshire’s stewardship, SRS completed another twenty-six acquisitions through April 2018, growing the company’s branch network to more than 200 locations and sales of approximately $2.3 billion.

- Leonard Green & Partners. In June 2018, buyout firm Leonard Green & Partners acquired a controlling stake in SRS at an implied enterprise value in excess of $3 billion. Berkshire Partners retained a minority stake in SRS following the transaction. Acquisitions continued apace, with over 30 additional deals completed through the end of 2023.

The SRS Distribution story is straight from the textbook private equity playbook. Four of the primary components of that playbook include:

- Partner with and incentivize a high-quality, experienced management team. Private equity firms typically use equity compensation to ensure portfolio company management teams are economically aligned with the PE investor.

- Scale the business quickly through acquisitions and optimize operating margins by taking advantage of that scale in purchasing and back office functions. Home Depot’s press release announcing the transaction indicates that SRS generates an adjusted EBITDA margin on the order of 11%, consistent with that of large, publicly traded industrial distributors.

- Use other people’s money (i.e., debt). SRS started in the depths of the Great Recession and has enjoyed historically low borrowing costs throughout its history.

- Take advantage of multiple arbitrage. Bigger companies generally get bigger deal multiples. Home Depot is paying 16.1x adjusted EBITDA for SRS. While the financial terms of SRS’s many acquisitions since 2008 are not publicly available, we can say with a great deal of confidence that SRS paid considerably lower multiples when buying individual roofing materials distributors. Buying low and selling high is a winning strategy in any market environment.

Takeaways for Family Business Directors

Few of our readers will sell their family business to a company like Home Depot for $18 billion. Even so, there is plenty for directors to chew on from this transaction. We’ll highlight three in closing.

#1 – Don’t underestimate the power of M&A in strategy execution.

Many families are (rightly) proud of their organic growth story. Slow and steady often does win the race, especially when success is measured over generations rather than quarters. Yet, industry and competitive dynamics don’t always wait. Remember that great-grandpa was an innovator in his day. If your family business is losing momentum, prudent M&A can open up strategic market adjacencies and reaccelerate growth for the next generation.

#2 – Look at your family business like an acquirer would.

We’ve long advised clients to ask themselves if their businesses are “ready for sale.” This does not mean that we think our clients should sell, it just means that they will find owning the business more rewarding if they think like a seller and do the things that make businesses attractive to buyers now rather than later. SRS’s website includes a description of their ideal acquisition candidate that aligns very well with our READY framework.

#3 – Think like a private equity firm.

This may seem a bit scandalous to many family business leaders. However, we are not suggesting that family businesses should shed their legacies and start acting like ruthless corporate raiders. Rather, it is simply a reminder that family capital is scarce, and your family shareholders bear an opportunity cost when they let you manage that capital by keeping it in the family business. The private equity “playbook” components noted above can generally be adapted to your family business in a way that fits your culture, legacy, and preferences.

- Do you have a process for evaluating, recruiting, and incentivizing senior managers?

- Do you have a process for benchmarking profitability against a relevant set of peers to identify best practices for operating efficiency?

- Do you have a process for soliciting family shareholder preferences regarding capital structure and leverage decisions?

- Are you evaluating opportunities to enhance the value of your family business through accretive acquisitions?

Our readers in the construction materials space should definitely take some time to think about what the Home Depot / SRS deal means for them. However, as outlined in this post, the transaction offers ample food for thought for any family business.

Family Business Director

Family Business Director