How Long Will It Take to Sell My Family Business?

That Depends on the Type of Transaction …

In this week’s Family Business Director, Tim Lee, ASA, Managing Director of Corporate Valuation and John T. (Tripp) Crews, III, Senior Financial Analyst, discuss expectations around the timeline for your business transition or sale and summarize key points to keep in mind when driving towards an internal or external sale.

Ownership transitions, whether internal among family and other shareholders or external with third parties, require effective planning and a team of qualified advisors to achieve the desired outcome. In this article, we examine some “typical” timelines involved in various types of transactions and expectations you can share with your family board members.

Internal Transitions

In this section, we discuss the importance of a buy-sell agreement in a sale to the next generation. Then we take a brief look at employee stock ownership plans as another potential avenue to an internal transition.

Sale to Next Generation

Internal transitions are often undertaken in accordance with provisions outlined in the Company’s existing or newly minted buy-sell agreement. A buy-sell agreement is an agreement by and between the family members and other shareholders of a closely owned business that defines the terms for the purchase when an owner requires liquidity. Buy-sell agreements typically specify how pricing is determined, including the timing, the standard of value used, the level of value, and the appraiser performing the valuation.

A buy-sell agreement is an agreement by and between the family members and other shareholders of a closely owned business that defines the terms for the purchase when an owner requires liquidity.

As a matter of practicality, the timing for transfers using an existing buy-sell agreement is often dependent on the readiness of financing and the service level of the assisting legal and valuation advisory professionals. Experience suggests this can take as little as four to eight weeks, but often involves processes that can require three to six months to carry out.

In circumstances where a newly crafted buy-sell agreement is being developed, you should expect a lengthier process of at least several months so that the attending financial, valuation, and legal frameworks are satisfactorily achieved.

Mercer Capital has published numerous books on the topic of buy-sell agreements, which readers of this article should avail themselves of, or better yet, contact a Mercer Capital valuation professional to make sure you get directed to the most useful content to assist in your circumstance.

Family-owned companies with an existing buy-sell agreement and those that obtain regular appraisal work, stand the best chance of achieving a timely process. Those Companies that are embarking on their first real valuation process, and that have stakeholders who require a thorough education on valuation and other topics, should allow for a deliberate and paced process.

In the event of an unexpected need for ownership transfer (death and divorce to name a few), it is sound advice to retain a primary facilitator to administer to the potentially complex sets of needs that often accompany the unexpected.

Employee Stock Ownership Plans

The establishment of an Employee Stock Ownership Plans (ESOP) is a necessarily involved process that requires a variety of analyses, one of which is an appraisal of the Company’s shares that will be held by the plan.

For a family business with well-established internal processes and systems, the initial ESOP transaction typically requires four to six months. In a typical ESOP transaction, the Company will engage a number of advisors who work together to assist the family and its shareholders in the transaction process. The typical “deal team” includes a firm that specializes in ESOP implementation, as well legal counsel, an accounting firm, a banker, and an independent trustee (and that trustee’s team of advisors as well).

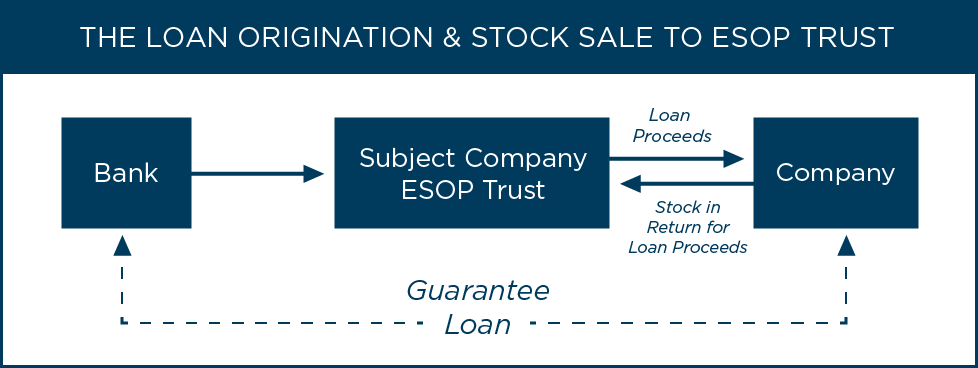

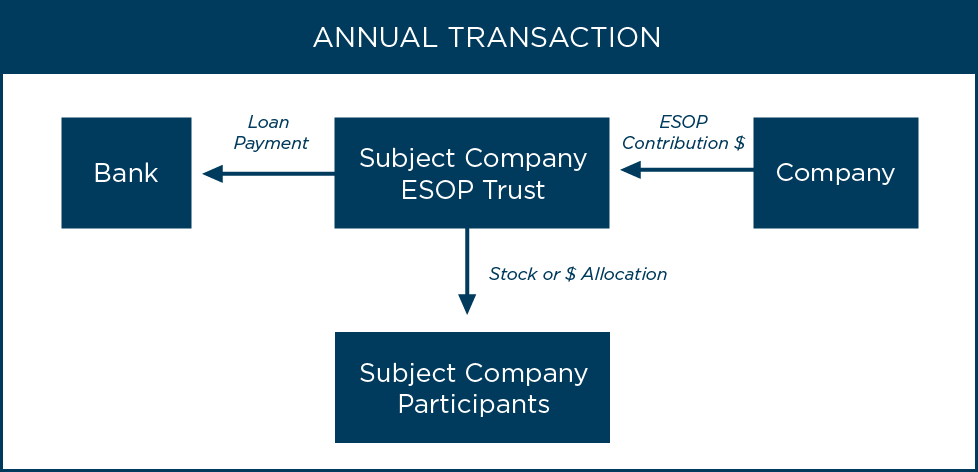

Most modern-day ESOPs involve complex financing arrangements

Most modern-day ESOPs involve complex financing arrangements including senior bankers and differing types and combinations of subordinated lenders (mezzanine lenders and seller notes). There are numerous designs to achieve an ESOP installation. In general, the Company establishes and then funds the ESOP’s purchase financing via annual contributions.

ESOPs are qualified retirement plans that are subject to the Employee Retirement Income Security Act and regulated by the Department of Labor. Accordingly, ESOP design and installation are in the least, a time consuming process (plan for six months) and in some cases an arduous one that requires fortitude and an appreciation by all parties for the consequences of not getting it right up front. The intricacies and processes for a successful ESOP transaction are many.

A more detailed assessment of ESOPs is provided here on Mercer Capital’s website.

The following graphics depict the prototypical ESOP structure and the flow of funds.

External Sales

Many families cannot fathom why success in business may not equally apply to getting a deal done. In most external transactions, there is a significant imbalance of deal experience: today’s buyers have often completed many transactions, while sellers may have never sold a business. Accordingly, family businesses need to assemble a team of experienced and trusted advisors to help them navigate unfamiliar terrain.

Without exception, we recommend retaining a transaction team composed of at least three deal-savvy players: a transaction attorney, a tax accountant, and a sell-side financial advisor. If you do not already have some of these capable advisors, assembling a strong team can require time to accomplish. Since many transactions with external buyers originate as unsolicited approaches from the growing myriad of private equity and family office investors, it is advisable to maintain a posture of readiness.

Up-to-date financial reporting, good general housekeeping with respect to accounts, inventory, real property maintenance, information technology, and the like are all part of a time-efficient transaction process. These aspects of readiness are the things that family business directors and managers can control in order to improve timing efficiency. As is often said in the transaction environment – time wounds all deals.

In most external transactions, there is a significant imbalance of deal experience … accordingly, family businesses need to assemble a team of experienced and trusted advisors to help them navigate unfamiliar terrain.

Sellers doing their part on the readiness front are given license to expect an efficient process from their sell-side advisors and from buyers. We do caution that selling in today’s mid-market environment ($10-$500 million deal size) often involves facilitating potentially exhaustive buyer due diligence in the form of financial, legal, tax, regulatory and other matters not to mention potentially open-ended Quality of Earnings processes used by today’s sophisticated investors and strategic consolidators. A seasoned sell-side advisor can help economize on and facilitate these processes if not in the least comfort sellers as to the inherent complexity of the transaction process.

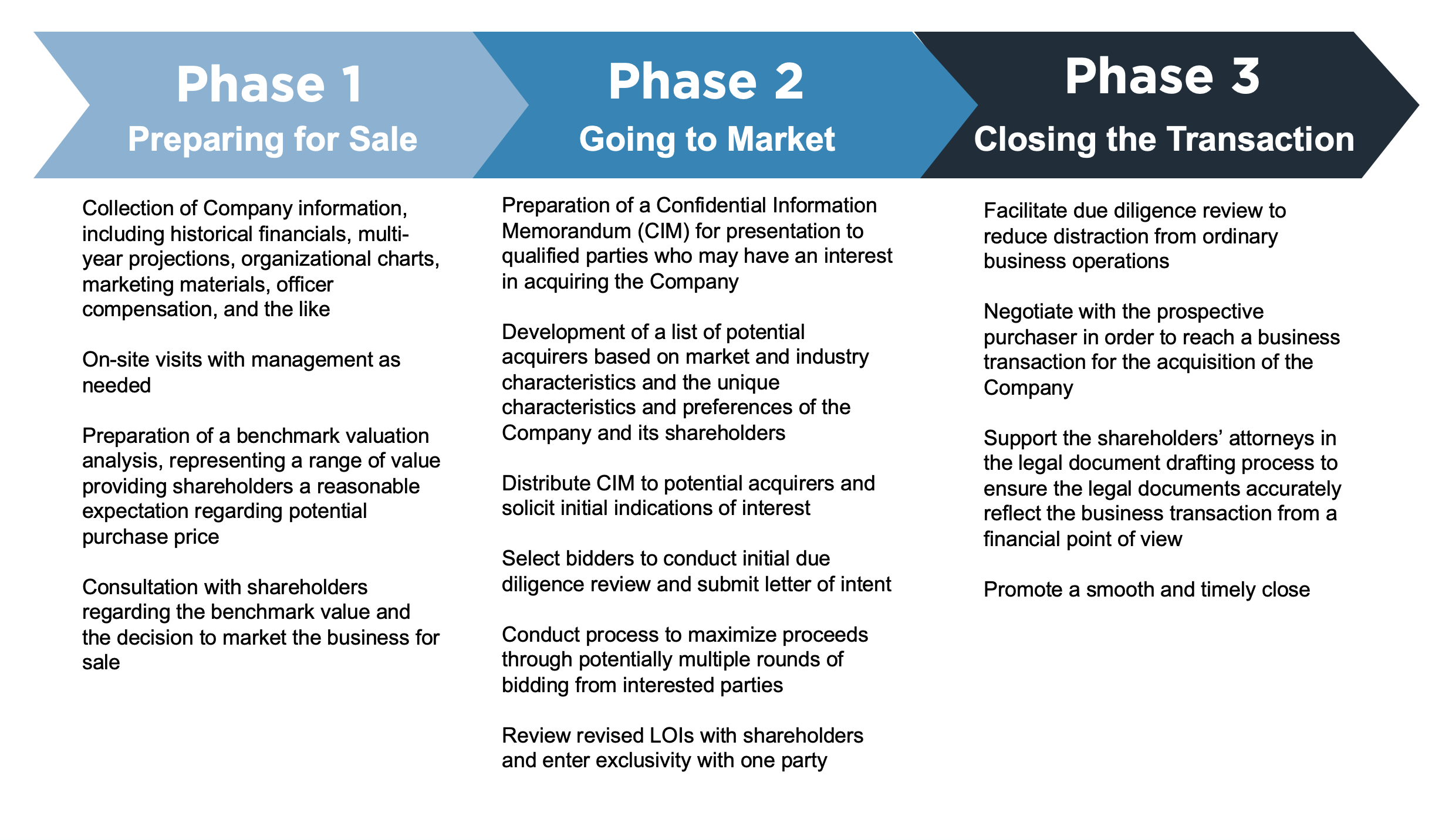

The sell-side advisor assists the family (or the seller’s board as the case may be) in setting reasonable value expectations, preparing the confidential information memorandum, identifying a target list of potential motivated buyers, soliciting and assessing initial indications of interest and formal bids, evaluating offers, facilitating due diligence, and negotiating key economic terms of the various contractual agreements.

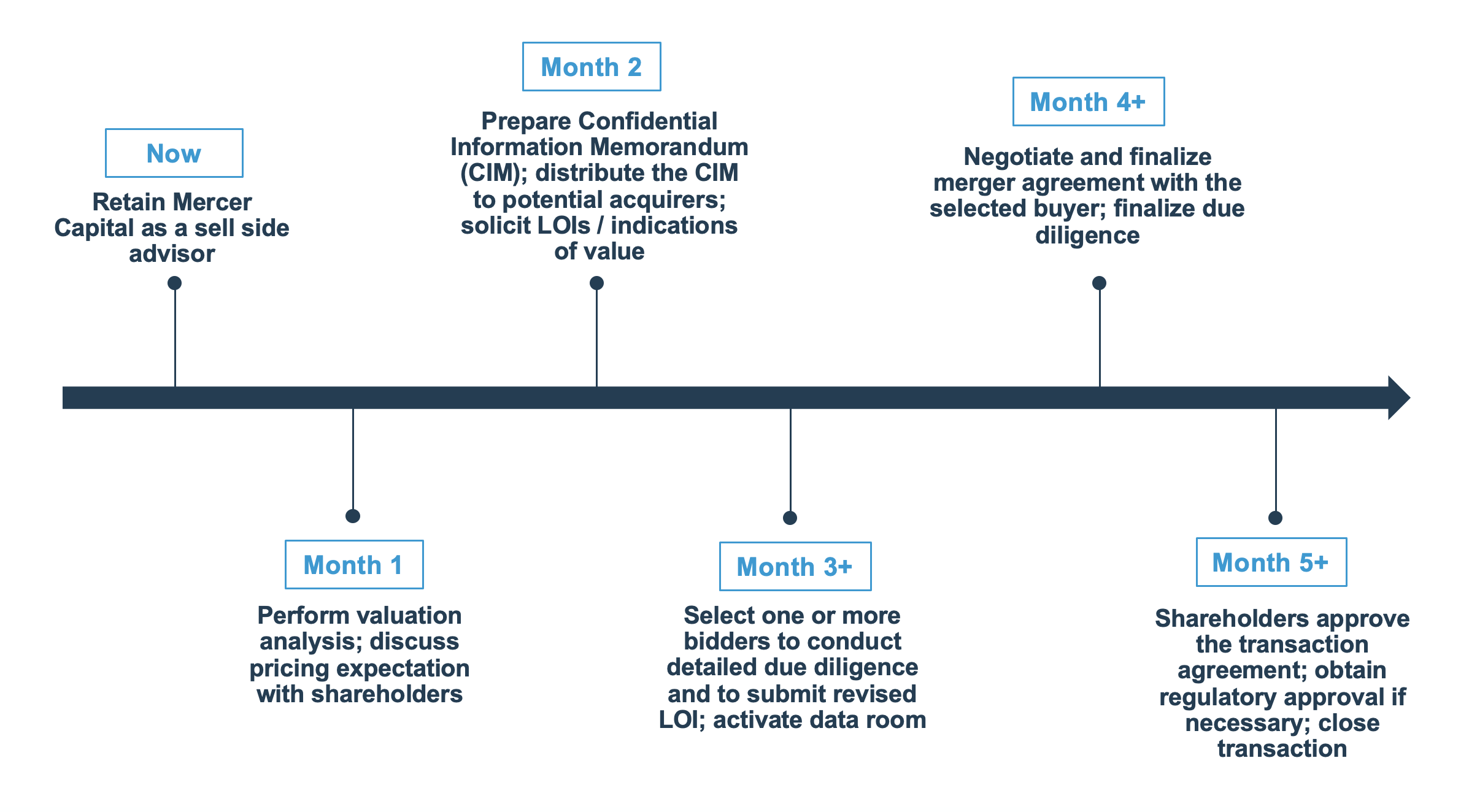

The typical external transaction process takes four to seven months and is done in three often overlapping and recycling phases. While every deal process involves different twists and turns on the path to consummation, the typical external transaction process takes five to seven months and is completed in the three phases depicted in the following graphics.

CLICK HERE TO ENLARGE THE IMAGE ABOVE

CLICK HERE TO ENLARGE THE IMAGE ABOVE

Conclusion

As seasoned advisors participating on both front-end and post-transaction processes, we understand that every deal is unique. We have experienced the rush of rapid deal execution and the trying of patience in deals that required multiple rounds of market exposure. A proper initial Phase I process is often required to fully vet the practical timing required for an external transaction process.

Mercer Capital provides transaction advisory services to a broad range of public and private companies and financial institutions. We have worked on hundreds of consummated and potential transactions since Mercer Capital was founded in 1982. We have significant experience advising shareholders, boards of directors, management, and other fiduciaries of middle-market public and private companies in a wide range of industries. Rather than pushing solely for the execution of any transaction, Mercer Capital positions itself as an advisor, encouraging the right decision to be made by its clients.

Our independent advice withstands scrutiny from shareholders, bondholders, the SEC, IRS, and other interested parties to a transaction. Our dedicated and responsive team stands ready to help manage your transaction.

Family Business Director

Family Business Director