How Much Money Do Family Businesses Like Ours Invest?

The old bromide assures us that “You’ve got to spend money to make money.” Although obviously true at some level, how much should you spend, and what should you spend it on?

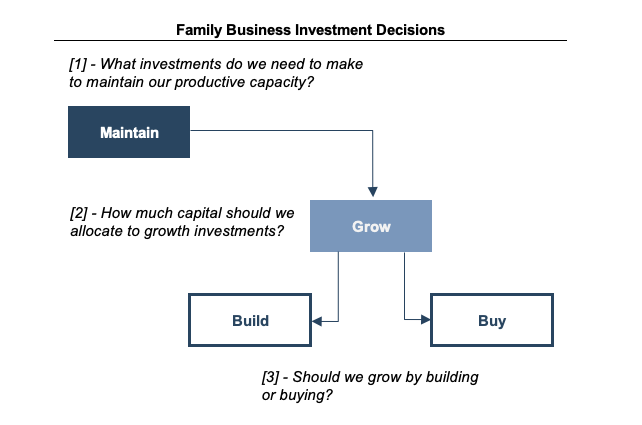

Investment Decisions

We tend to think of family business investments in terms of a series of three decisions.

- What investments do we need to make to maintain our productive capacity?

- How much capital should we allocate to growth investments?

- Should we grow by building or buying?

#1 – What investments do we need to make to maintain our productive capacity?

Maintenance capital expenditures are rarely exciting. But they are important. Successful families resist the urge to defer the unglamorous expenditures needed to maintain and enhance the productivity of their businesses. Companies that failed to make the necessary investments to keep their information technology infrastructure up-to-date and compatible with the latest remote work applications experienced a rude awakening when the pandemic sent their employees home.

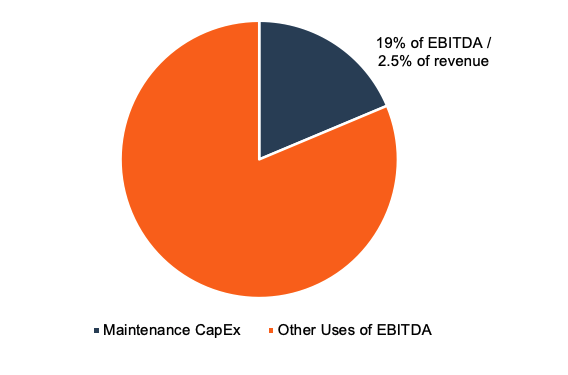

Companies are not required to disclose which of their investments are for maintenance purposes rather than for growth. However, depreciation expense is probably a decent proxy for maintenance capital expenditures. In the 2020 Benchmarking Guide for Family Business Directors, we examined maintenance capital expenditures for the companies in our sample. Over the period analyzed, maintenance investments accounted for nearly 20% of EBITDA (a proxy for cash from operations) and approximately 2.5% of revenue.

#2 – How much capital should we allocate to growth investments?

The investment decisions get progressively harder. After setting aside funds for maintenance capital expenditures, family business directors must allocate capital to incremental growth investments. Answering this question well requires directors to balance a variety of concerns, which include:

- Can we identify growth investments that align with our broader business strategy?

- Do the growth investments we identify present an attractive relationship between risk and reward?

- Do we have access to the capital required for the investments we identify?

- How do our family shareholders prioritize growth relative to current income?

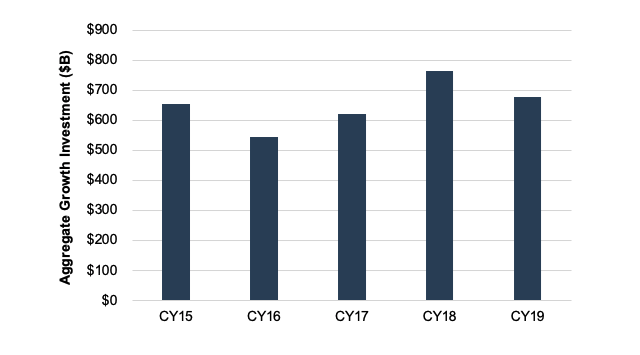

Risk influences the willingness of directors to commit capital to growth investments. The companies in our sample reduced spending on growth investments by more than 10% in 2019 compared to 2018. This may reflect some wariness on the part of directors regarding the durability of the economic expansion which was entering its second decade. Growth investments also fell in 2016, perhaps reflecting uncertainty regarding that year’s presidential election.

#3 – Should we grow by building or buying?

Growth investments come in two varieties: organic (building additional capacity from scratch) and acquisitions (buying existing capacity from someone else).

As growth strategies, building and buying present their own set of risks and potential benefits.

- Companies opting to build avoid the risk of overpaying for someone else’s goodwill and are assured that the default culture will be that of the family business. On the risk side of the ledger, builders should be concerned about whether the market really needs the additional capacity they are building. Builders also bear the opportunity costs of what are often extended investment periods during which more nimble competitors may be able to seize the first-mover advantage.

- Acquirers, on the other hand, often overpay for target companies and struggle to integrate the culture of the acquired entity. However, acquisitions can present opportunities for cost savings and revenue synergies that are not available with organic growth investments. Further, acquirers can begin capitalizing on the perceived market opportunity immediately.

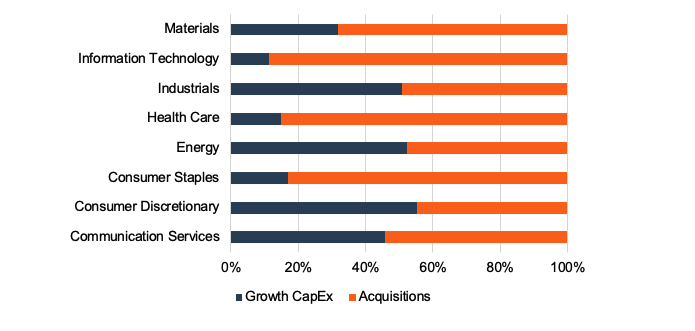

The public companies in our sample tend to allocate more of their growth capital to acquisitions than organic capital expenditures. Across all industries, acquisitions outpaced growth capital expenditures by a more than 2-to-1 margin during 2019. However, this relationship varied significantly by industry, as shown below.

Companies in the consumer staples, health care, and information technology sectors rely much more heavily on acquisitions than capital expenditures for growth.

We suspect that family businesses are, in general, less acquisitive than their publicly traded counterparts. While we have plenty of clients that grow by acquisition, our sense is that the cultural hurdles associated with acquisition cause other family businesses to prefer organic growth strategies.

Conclusion

To be sustainable, family businesses need to invest capital wisely. As directors, the answers you give to the investment questions today will help define what the family business looks like for future generations. Before making a significant investment decision that will be hard to reverse, it is a good idea to evaluate how other companies in your industry are answering the investment questions for themselves. If your answers are different, articulating why they are different and testing those reasons can help directors gain comfort that they are on the right path.

Family Business Director

Family Business Director