How Much Money Do Family Businesses Like Ours Make?

The goal of “maximizing shareholder value” is fast assuming its rightful place in the dustbin of financial history as more families embrace a broader vision of relevant stakeholders for their enterprises. The freedom to develop a balanced scorecard of performance objectives that includes both financial and non-financial goals is one of the most rewarding aspects of family business.

Embracing non-financial objectives does not mean, however, that a family business can be unconcerned about their profitability. After all, operating efficiency helps to underwrite the various non-financial goals and values the family chooses. So, our first comparison when benchmarking performance for a family business is to evaluate profitability.

Why Do People Talk About EBITDA So Much?

Profitability describes the relationship between earnings and revenue: how much does the business earn per dollar of revenue? Profitability is a good proxy for how efficiently a business operates.

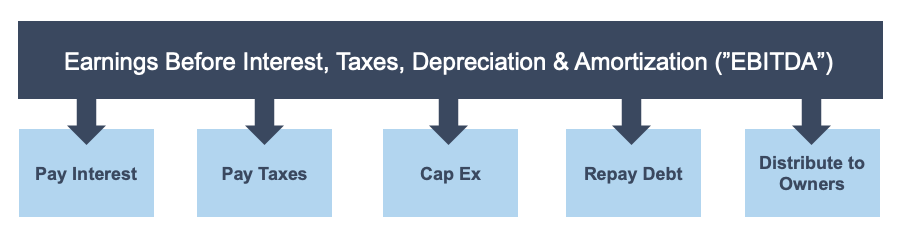

For operating businesses (i.e., not banks or holding companies), EBITDA, or earnings before interest, taxes, depreciation and amortization is the most commonly referenced measure of earnings. Interest, taxes, depreciation and amortization are very real expenses, so why is it okay to talk about earnings as if those expenses don’t exist (even though they do)?

While the “ITDA” expenses are real, none of them are directly related to how efficiently the business is operating. Investors and others calculate EBITDA because it is a handy proxy for the discretionary cash flow generated by the operations of the business.

As illustrated below, EBITDA represents the cash flow available to fulfill a variety of corporate obligations, such as making interest and principal payments on borrowed funds, paying taxes, funding maintenance capital expenditures, and providing distributions to owners.

EBITDA promotes comparison across companies because is unaffected by three characteristics that are not directly related to the operations of the business.

- Capital structure. A company’s choice of debt or equity financing does not directly affect business operations, but it does determine how much interest expense a company will report. Referencing EBITDA neutralizes the impact of the financing decision on the company’s profitability.

- Tax status. Many family businesses are structured as tax pass-through entities, while others are C corporations. While tax status is obviously critical to overall shareholder returns, it does not directly influence how the business operates. Focusing on EBITDA allows for “apples to apples” comparisons of tax pass-through entities with C corporations.

- Growth strategy. Some family businesses grow organically, while others elect to pursue acquisitions, which can give rise to amortization expense. EBITDA places companies on an equal footing regardless of whether they have “built” or “bought” to achieve growth.

What Are the Ingredients of Profitability?

To be worthwhile, benchmarking analysis should go beyond the mere “what” of how the performance of the subject company compares to its peers to the “why” that explains the comparison. When benchmarking EBITDA margins, directors need to understand the factors that influence a company’s profitability. We can summarize the basic ingredients of profit margin under three headings: strategy, scale, and skill.

Ingredient #1 – Strategy

By strategy, we mean the decisions regarding long-term capital investment. Companies that emphasize capital inputs over labor tend to have higher EBITDA margins. Indeed, they need to because machinery and equipment does wear out and need to be replaced. Depreciation may be a non-cash expense, but the bill does eventually come due.

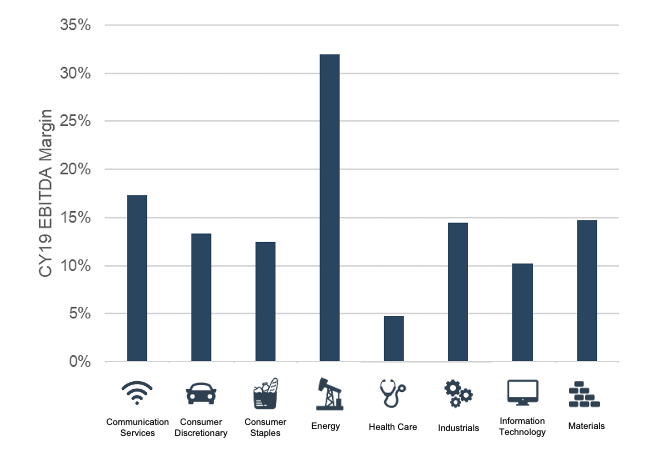

At a high level, industry provides a decent proxy for capital intensity. As shown below, industries that require large amounts of capital expenditures – like communications, energy, industrials, and materials – generate higher EBITDA margins than the other, less capital-intensive industries.

Ingredient #2 – Scale

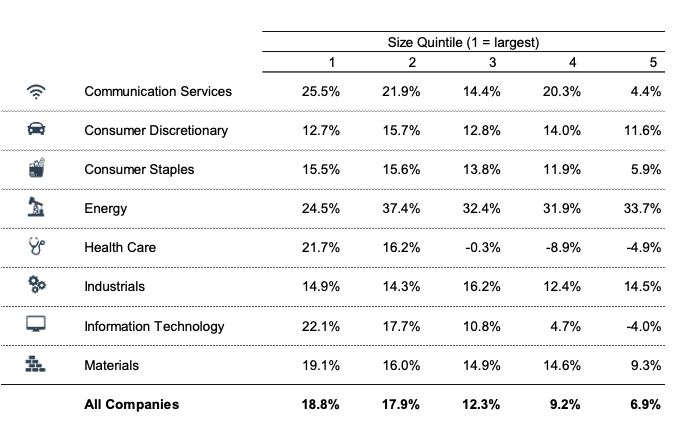

Economies of scale are real. As companies get larger – whether through acquisition or organic growth – the ability to gain operating efficiencies increases. As a result, it is common for larger companies in each industry to generate higher EBITDA margins than their smaller peers. The opportunity to achieve economies of scale undergirds many acquisition strategies. As shown in the following table, the median EBITDA margin for the largest companies in our dataset (18.8%) exceeded that for the smallest (6.9%) by nearly twelve percentage points.

Ingredient #3 – Skill

While strategy and scale are important, skill is what ultimately separates the winners from the losers. By skill, we refer to a management team’s ability to operate efficiently – to wring the most profit out of a dollar of revenue – given the strategy adopted and the existing scale of the enterprise. One goal of benchmarking profitability is to help directors screen out the influence of strategy and scale on margin to better isolate the impact of skill in generating profits.

Conclusion

How does your family business stack up when it comes to profitability? Are differences in profitability between your family business and the peer set attributable to strategy, scale, or skill? Is your family business pursuing the right strategy? Is your family business operating at an optimal scale? Is your management team demonstrating an appropriate degree of skill? Given your family’s overall objectives for the business, is profitability where it needs to be? If you need help conducting a more detailed analysis of the profitability of your family business, give one of our professionals a call today.

Family Business Director

Family Business Director