FAQ: How Should Financing Affect Capital Budgeting Decisions?

Family business directors must properly distinguish between capital structure and capital budgeting decisions to make the best decisions. In this week’s post, we answer a frequently asked question that leads us into a discussion of what is known as the “separation principle.” In short, what are the relevant cash flows for capital budgeting analysis? And, when is it appropriate to combine investing and financing decisions? If you have ever struggled with these questions, this week’s post has the answers you need.

Q: Should we deduct interest expense when calculating the IRR on a project?

A: No. For most capital budgeting applications, interest expense should not be deducted from forecast cash flows when calculating IRR. When the hurdle rate reflects the weighted average cost of capital, the relevant measure of return should reflect cash flows available to both debt and equity holders (i.e., before deducting interest expense).

As a general rule, family business directors should strive to keep investing decisions separate from financing decisions. There are two primary rationales for this “separation principle”:

- The operating managers responsible for selecting and executing capital projects generally have no control over the family business’s financing decisions. Considering potential capital projects on a debt-free basis aligns the analysis with the perspective of the responsible manager. The specific financing used to fund a given capital project is rarely the responsibility of an operating manger, but is ultimately the decision of corporate directors.

- The actual funding sources used to finance the specific project are not relevant to the decision to accept or reject the project. At first blush, this is counter-intuitive – surely the funding sources actually used are what matter the most. The flaw with this reasoning is that family business capital structures can generally be modified independently of investment activity.

Let’s consider a simple example to illustrate. Assume a family business has a target capital structure of 75% equity and 25% debt. Following a couple very profitable years, the company’s actual capital structure has drifted to approximately 80% equity and 20% debt. As a convenient means of moving back toward the target, the company plans to finance 100% of a proposed $5 million capital project. What is the appropriate hurdle return for this project? The appropriate hurdle return is the weighted average cost of capital (75% equity / 25% debt) despite the fact that the actual financing will rely on 100% debt. Failing to do so would inadvertently give this project credit for the fact that the company was under-leveraged at the time the project happened to be under consideration. Undertaking this capital project is not the only means by which the company can re-lever its capital structure. Through a refinancing transaction, the company can “fix” its capital structure problem without engaging in any capital investment.

Are there any exceptions to the separation principle? Yes, a couple. First, occasionally projects include access to financing not otherwise available to the family business. For example, if a proposed project would be eligible for uniquely advantageous bond financing through a municipality, it may be appropriate to evaluate that project on an equity basis. Second, real estate investments are often evaluated net of the leverage that will be used to finance the project. For many real estate investors, individual projects stand or fall on their own, in contrast to family businesses for which capital projects form an integrated portfolio of activities which are financed as a whole. Furthermore, since many real estate investors are tax pass-through entities, it is customary to calculate returns on real estate on a pre-tax basis.

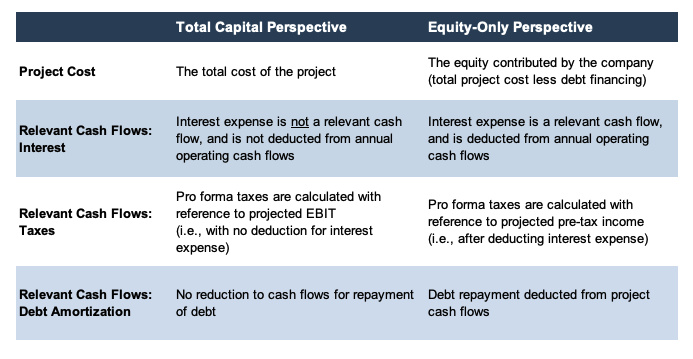

Whether calculating the internal rate of return on a total capital or equity-only basis, it is essential to ensure consistency among the project cost, the relevant cash flows, and hurdle rates, as summarized in the following table.

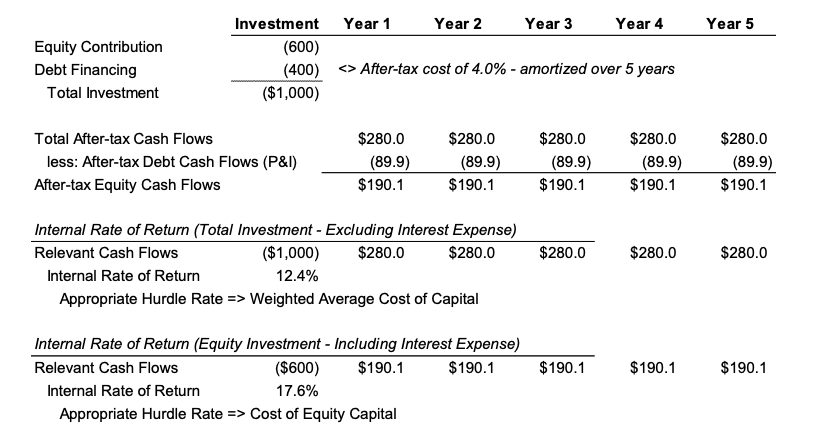

The following simple example illustrates proper alignment between the components of the internal rate of return analysis described in the preceding table.

From a total capital perspective (the traditional and preferred viewpoint for capital budgeting), the total investment is the relevant cash outflow against which returns are measured. The aggregate (pre-interest and debt service) cash flows result in a 12.4% internal rate of return. From a financial point of view, the project is acceptable if the weighted average cost of capital for the family business is less than 12.4%.

From an equity perspective (appropriate for the exceptional cases noted above), the relevant cash outflow is only the equity contributed by the family business to the project. Annual project cash flows are reduced by both principal and (after-tax) interest payments on the assumed debt, yielding an internal rate of return of 17.6%. While this IRR is higher than that under a total capital approach, the relevant hurdle rate for evaluating the acceptability of the project is the family business’s cost of equity (which will exceed the weighted average cost of capital).

Why Does This Matter?

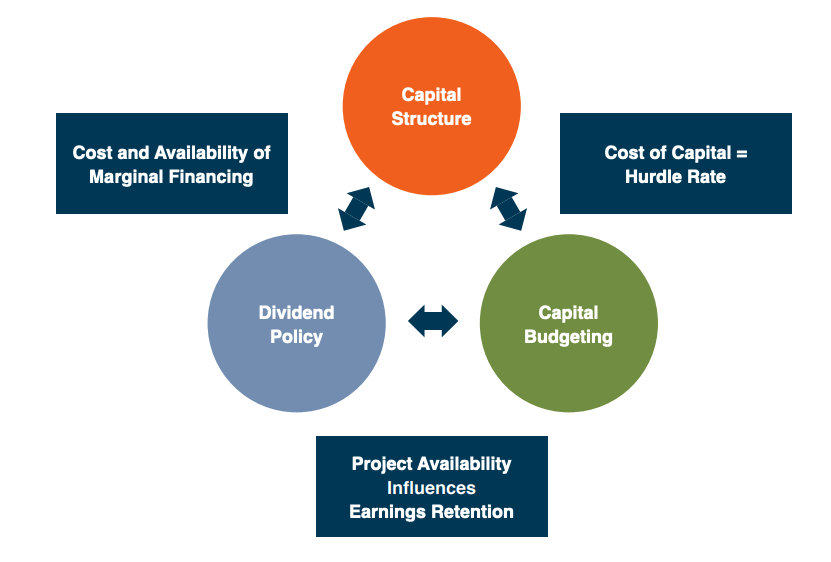

Family business directors face three principal inter-related strategic financial questions:

- Capital Structure: How should is the appropriate mix of debt and equity financing for our family business?

- Capital Budgeting: What are the optimal reinvestment decisions for our family business?

- Dividend Policy: What form should returns to our family shareholders take?

As depicted in the preceding chart, the answers to each of these three questions have consequences for the others, and family business directors should strive to answer these questions on an integrated, rather than piecemeal, basis.

Family Business Director

Family Business Director