How to Communicate Risk to Family Shareholders

Drug maker Abbvie is reported to have spent $460 million on television ads for Humira during 2019. Like all pharmaceutical ads, the TV spots for Humira try to accomplish two things: demonstrate the benefits of taking the drug and acknowledge the risks of taking the drug. In one 60 second ad, the risk disclosures begin at the 27 second mark, meaning that slightly more time is spent on risk disclosure than on drug benefits. And yet, how effective is the risk disclosure? Do ad viewers have any basis for knowing how to incorporate the fact that “blood, liver, and nervous system problems” have happened into their decision-making process?

Communicating risk effectively is not just a challenge for drug companies. All companies deal with risk and uncertainty. Making too much of the risk can alienate customers and erode the credibility that might be critical when a threat actually materializes (i.e., “Chicken Little” and “The Boy Who Cried ‘Wolf’”). On the other hand, insufficient risk disclosure can result in liability that threatens the company’s existence. A recent article in the Harvard Business Review addressed this challenge in customer communications. The authors of “The Art of Communicating Risk” offer three suggestions for communicating risk to customers more effectively. In this post, we will review those suggestions, and think about how they might apply to communicating risk to family shareholders.

#1 – Stop Improvising

Shareholder communications in many family businesses can best be described as haphazard. Managers and directors attempt to communicate with family shareholders when they feel like there is something important to say or when they have the time. This lack of structure builds uncertainty into the very fabric of a process that should exist to reduce uncertainty. The frequency of shareholder reporting will be different for each family; dependability is ultimately more important than frequency. Do your family shareholders know when they should expect to hear from you next? Furthermore, do you have a consistent format for communicating with family shareholders? Do they know what they can expect to hear from you? Following a consistent reporting format, even when management doesn’t think there is anything especially “newsy” to report signals that directors take the rights and needs of family shareholders seriously. Over time, this builds credibility with family shareholders.

#2 – Change the Metric for Success, and Measure Results

What constitutes success for family shareholder communication? Engagement is critical – if a shareholder risk is communicated but no one receives the message, does it really exist? For digital communications, families can easily measure engagement by tracking open and click-through rates over time. Relevance fuels engagement. What are the risk factors that matter most to family shareholders, and are those factors most prominent in your reporting? What risks should your family shareholders be concerned about? And do they know why those risks are important?

#3 – Design for Risk Communications from the Beginning

Those ubiquitous risk disclosures in pharmaceutical ads that we discussed at the outset are certainly regular (consumers know when they will appear in the ad) and are rigorously consistent (avid TV viewers may have them memorized). But do they actually help consumers? Similarly, we suspect that the laundry list of “Risk Considerations” in SEC filings is not terribly illuminating for many public company shareholders. So the challenge for family business directors is to convert vague warnings about abstract risks into concrete measures of the factors that give rise to risk and the historical frequency of occurrence. This will require carefully considering not only what risks need to be disclosed, but also how those risks can be quantified and put into context.

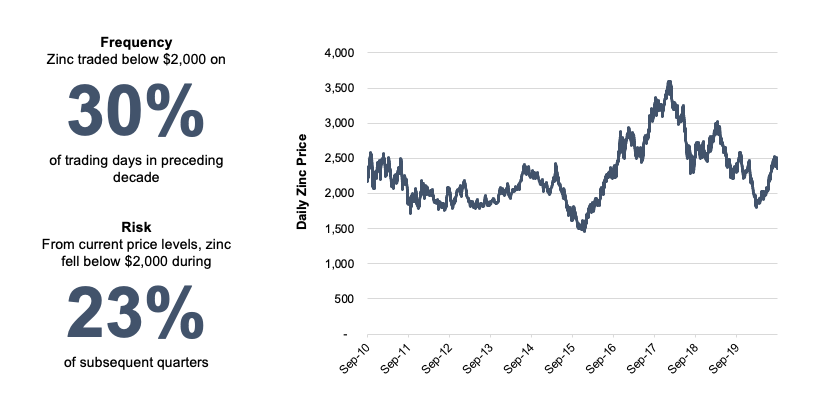

Companies with commodity exposures offer a ready example. Consider a family business whose earnings and financial condition are correlated to the price of zinc. If the company’s gross profit declines when the price of zinc falls below $2,000, a risk disclosure to the family shareholders might include both the percentage of time zinc has traded below that level in the past 20 years, and the frequency with which the price has fallen below $2,000 from the current price during the subsequent three months as shown below.

Framing the risk in this way helps provide more intuitive context for family shareholders to evaluate the risk of adverse zinc prices having a negative impact on the earnings and financial condition of the family business.

Conclusion

Communicating with family shareholders about risk is not easy, but it is inevitable. Choosing not to communicate about risk is still a communication strategy, just not a very good one. The goal of risk communication is to promote positive shareholder engagement, which is critical to sustaining the family business when adverse events happen.

Family Business Director

Family Business Director