In the world of family-owned and other private businesses, most everyone looks to EBITDA (earnings before interest, taxes, depreciation, and amortization) as an indicator of financial performance.

Legendary investor Warren Buffett, however, holds a long-standing grudge against EBITDA.

Here at Family Business Director, we believe there is a time and a place for EBITDA in financial analysis, but Mr. Buffett does have a point — some EBITDA is better than others. But why?

What Is EBITDA and Why Does It Matter?

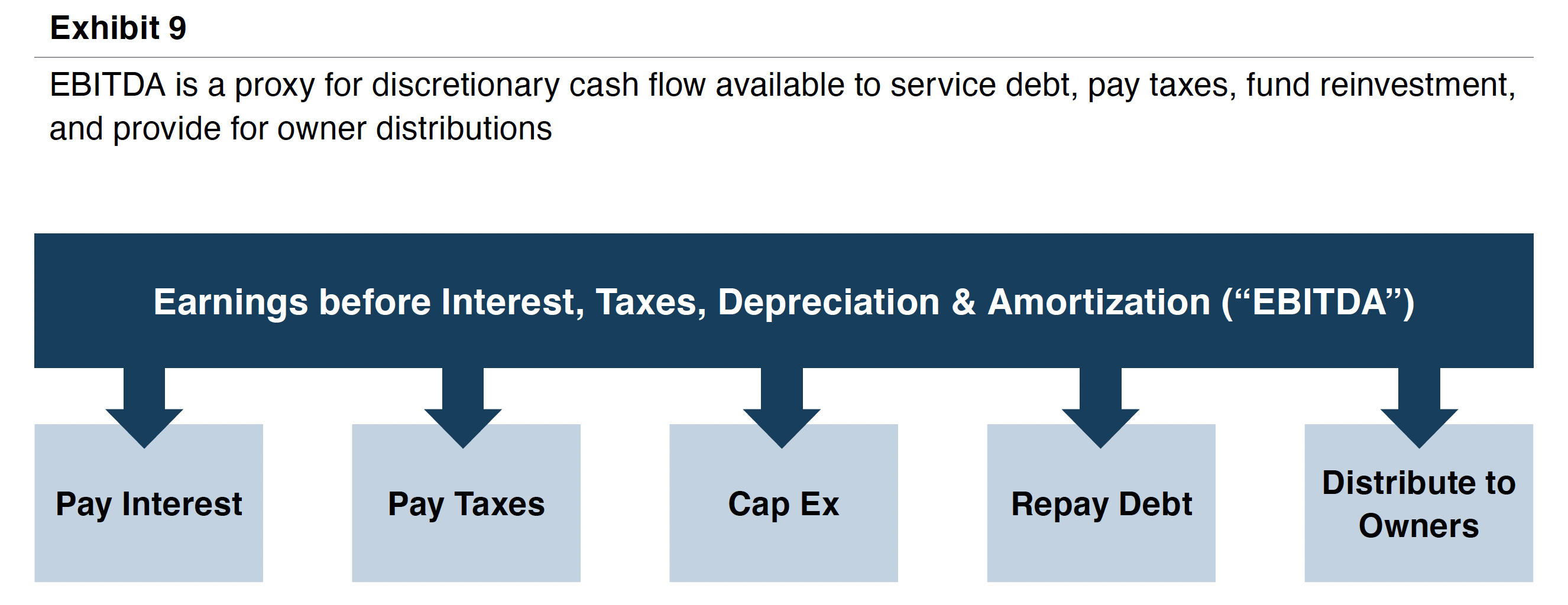

EBITDA is an example of a non-GAAP performance measure, meaning it is not a line item on audited financial statements. EBITDA gets a lot of attention because it is a proxy for the operating cash flow that is, in turn, available for a broad variety of corporate purposes. EBITDA is especially popular in the M&A markets because it measures the discretionary cash flow available to a potential buyer of a business.

EBITDA also promotes comparability across firms by “normalizing” for structural features of how those companies are organized, financed, and assembled. This is best seen by considering the various adjustments to net income that are made to arrive at EBITDA. We will start from the bottom of the income statement.

Income Taxes– Many family businesses are organized as tax pass-through entities (S corps or LLCs) and report no corporate income tax expense. Because taxes are excluded from EBITDA, all companies are on equal footing, regardless of their tax structure.

Interest Expense – Financing operations with debt rather than equity does not directly influence the operating results of the business. As with taxes, interest expense is excluded from EBITDA, allowing direct performance comparison by different companies with different capital structures.

Depreciation Expense – Depreciation expense is a non-cash charge that accountants use to allocate the cost of long-lived assets to the accounting periods during which the assets are expected to be used. As you might guess, a lot of assumptions go into those calculations, each of which potentially impairs the comparability of reported earnings to those of other companies that may make different assumptions. Since EBITDA ignores depreciation charges, it erases that potential obstacle to comparability.

Amortization Expense – Some companies grow through acquisition, while others grow organically. If acquirers pay more than the value of the net tangible assets of the target companies, they must write off the excess in the periods following the acquisition. Companies growing organically do not have comparable amortization expenses. Thus, EBITDA is comparable for businesses, whether they grow through acquisition or organically.

Limitations of EBITDA

The following chart (Exhibit 9 from our whitepaper Basics of Financial Statement Analysis) illustrates the five basic uses of EBITDA.

Importantly, only three of these five uses provide direct returns to capital providers: paying interest, repaying debt, and distributing to owners. The other two, paying taxes and capital expenditures, do not directly accrue to the benefit of shareholders. This is generally obvious regarding taxes but requires more finesse for capital expenditures. We can divide capital expenditures (in the economic rather than accounting sense) into two groups: Maintenance Capital Expenditures – Family businesses focused on sustainability recognize that a portion of operating cash flow must be set aside each year to maintain productive capacity. Depreciation expense is an imperfect proxy for this obligation. The reality of this maintenance capex burden lies at the heart of Buffet’s infamous tooth fairy warning on EBITDA. Growth Capital Expenditures – But not all capex is maintenance capex. Family businesses also invest to grow (whether through M&A or organic investments). Since these investments should only be made if the expected returns exceed the company’s cost of capital, these “elective” expenditures are made in lieu of distributions to capital providers in the expectation that they will generate long-term benefits that more than make up for the deferral in distributions. The point of all this is that a dollar of EBITDA is not just a dollar of EBITDA. The quality of a dollar of EBITDA depends on how much of that dollar is allocable to taxes and maintenance capital expenditures. Consider the two companies summarized in the following chart.

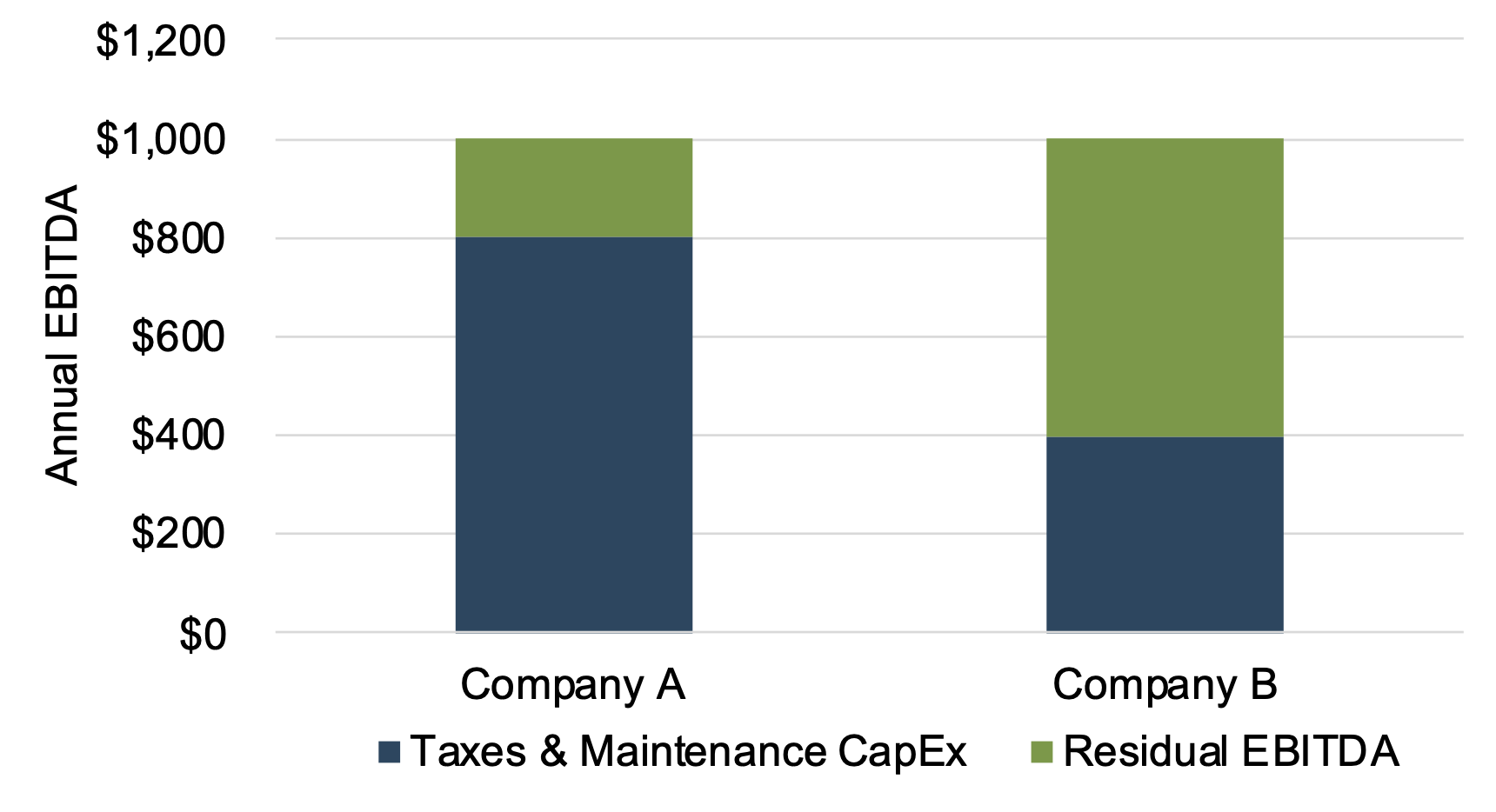

Importantly, only three of these five uses provide direct returns to capital providers: paying interest, repaying debt, and distributing to owners. The other two, paying taxes and capital expenditures, do not directly accrue to the benefit of shareholders. This is generally obvious regarding taxes but requires more finesse for capital expenditures. We can divide capital expenditures (in the economic rather than accounting sense) into two groups: Maintenance Capital Expenditures – Family businesses focused on sustainability recognize that a portion of operating cash flow must be set aside each year to maintain productive capacity. Depreciation expense is an imperfect proxy for this obligation. The reality of this maintenance capex burden lies at the heart of Buffet’s infamous tooth fairy warning on EBITDA. Growth Capital Expenditures – But not all capex is maintenance capex. Family businesses also invest to grow (whether through M&A or organic investments). Since these investments should only be made if the expected returns exceed the company’s cost of capital, these “elective” expenditures are made in lieu of distributions to capital providers in the expectation that they will generate long-term benefits that more than make up for the deferral in distributions. The point of all this is that a dollar of EBITDA is not just a dollar of EBITDA. The quality of a dollar of EBITDA depends on how much of that dollar is allocable to taxes and maintenance capital expenditures. Consider the two companies summarized in the following chart.  Company A and Company B both generate the same amount of EBITDA. Yet, Company B’s EBITDA is of much higher quality because taxes and maintenance capital expenditures consume a much smaller portion of EBITDA than for Company A. Accordingly, investors will likely assign a higher EBITDA multiple to Company B than Company A (all else equal).

Company A and Company B both generate the same amount of EBITDA. Yet, Company B’s EBITDA is of much higher quality because taxes and maintenance capital expenditures consume a much smaller portion of EBITDA than for Company A. Accordingly, investors will likely assign a higher EBITDA multiple to Company B than Company A (all else equal).

Final Thoughts

So, should family business directors be as dismissive toward EBITDA as Warren Buffett? We do not think so, although it is important for directors to take Mr. Buffett’s reservations to heart and understand that not every dollar of EBITDA is created equally. This is important for two reasons.

First, doing so helps directors take EBITDA multiples with the appropriate grain of salt. Since the value of a dollar of EBITDA depends on the quality of that dollar, quoted EBITDA multiples should be evaluated with due caution.

Second, this underscores the importance of incremental EBITDA. Once taxes and maintenance capital expenditures have been covered, marginal dollars of EBITDA are of the highest quality (and therefore most valuable).

As a result, improving EBITDA margins can have a multiplicative impact on your family business's value by both providing more EBITDA and justifying a higher multiple.