Is Your Family Business Risky Enough?

The latest issue of the Harvard Business Review includes a provocative article entitled “Your Company Is Too Risk-Averse.” The authors (three McKinsey consultants and Nobel laureate Daniel Kahneman) contend that companies suffer significant opportunity costs because of loss aversion among mid-level managers.

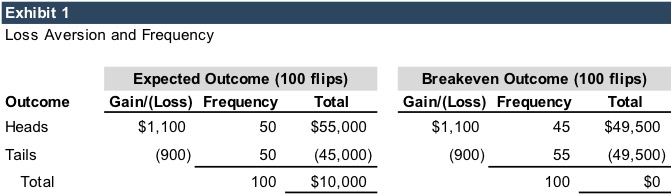

Loss aversion describes the tendency to avoid making investments because the pain of loss outweighs the satisfaction that accompanies positive outcomes. Loss averse investors are unwilling to accept risks that offer a probability-weighted positive outcome. For example, if you declined to participate in a coin flip that would pay you $1,100 dollars for heads, but cost you $900 for tails, you are exhibiting loss aversion. The probability-weighted outcome is positive [($1,100 x 50%) – ($900 x 50%) = $100], but the pain associated with losing $900 is sufficient to cause many people to decline the offer.

There is no “right” level of loss aversion. Even for the same individual, loss aversion is not a constant.

- When the potential loss is small relative to income or wealth, loss aversion can essentially disappear (after all, lots of people buy lottery tickets). But as the magnitude of the potential loss increases, people tend to exhibit greater loss aversion.

- Loss aversion also diminishes as the number of risk-taking opportunities increases. Consider our coin-flip example. For most of us, the prospect of losing $900 is painful enough to give us some pause before accepting the bet. But if you could play the game 100 times, your loss aversion really should evaporate. In that case, you would lose only if heads came up 44 or fewer times, which would be an extraordinary run of bad luck (as illustrated in Exhibit 1).

These two factors (size of loss, and number of risk-taking opportunities) explain why the authors conclude that companies do not take enough risk. Without intentional efforts to modify normal incentives, the perspective of individual managers does not match up with that of the company as a whole.

- For an individual manager championing or sponsoring a risky investment, the magnitude of the potential loss can be significant (loss of status/influence within the company, or potentially even loss of employment). But from the perspective of the company as a whole, the potential loss from a bad outcome may not be that significant.

- Many mid-level managers do not make high-frequency decisions. In other words, they don’t get to play the game again and again, and therefore can’t get bailed out by the law of large numbers. For sizable companies, however, the ability to effectively roll the dice repeatedly means that the degree of loss aversion should be much lower.

In short, individual managers are often unwilling to accept risks that would be beneficial to the company as a whole, and this misalignment represents a significant opportunity cost for the company. The authors propose several strategies for bridging the natural loss aversion gap between managers and the company as a whole. But what most intrigued us about the article was how it might apply in the context of a family business.

The authors make the following statement supporting their contention that companies don’t take enough risk:

“In economic theory, unless a failed investment would trigger financial distress or bankruptcy, companies should aim to be risk-neutral, because investors can diversify risk across companies.” (emphasis added)

While the last clause makes sense for public companies, it is problematic for many family businesses. Often, family shareholders cannot, in fact, diversify risk across companies, because substantially all of their wealth is concentrated in the illiquid shares of the family business. Whether explicitly acknowledged or not, we suspect this fact explains why many family businesses can become excessively loss averse in the second and third generation, even when doing so may carry a significant opportunity cost.

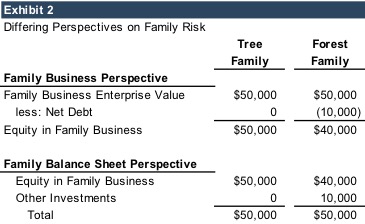

We are not suggesting that there is a “right” level of loss aversion for families. However, in our experience, some families assess risk too narrowly. Consider the two families in Exhibit 2.

Both families are transitioning from the second to the third generations. The Tree family prides itself on minimizing the risk of the family business by scrupulously avoiding debt financing, while the Forest family has incurred a prudent amount of debt at the family business to support more significant distributions over the years. Some families elect to make a one-time, special, dividend instead.

- If we limit our perspective to the family business (the top panel of Exhibit 2), the Tree Family bears less risk. But if the Forest Family has used its “excess” distributions over the years to accumulate a portfolio of other investments that are uncorrelated to the family business, the risk assessment shifts. While the risk of the Forest family business is higher because of the additional debt, the overall family balance sheet for the Forests may actually be less risky than that of the Trees.

- Furthermore, the managers of the Tree family business may be hesitant to accept risky projects because they know that the Tree family’s wealth is concentrated in the Tree family business. Since there is no other source of diversified wealth for the shareholders, the managers of the Tree family may pass on projects that really would be advantageous for the business. As described in the Harvard Business Review article, the opportunity costs associated with such behavior can create a substantial drag on the value of the business over time.

Of course, we are not suggesting that such risk analysis is straightforward. There are other stakeholders (employees, suppliers, communities, etc.) that should be considered. The point is simply this: family business directors should carefully consider how to integrate the risk of the family business with the risk of the family as a whole. Like their publicly traded brethren, it may turn out that some family businesses aren’t risky enough.

Family Business Director

Family Business Director