Is Your Family Business Worthy of Its Name?

This week, McDonald’s was in the news with a new plan raising expectations for franchise operators. The more stringent renewal reviews will include an assessment of performance history and customer complaints. The company told its franchisees that “…receiving a new franchise term is earned, not given.”

Franchisees pay handsomely for the right to use the McDonald’s name, expecting that the goodwill associated with the golden arches will generate attractive returns for them as owner-operators. For its part, McDonald’s is dependent on the operations of its franchisees to maintain and enhance brand goodwill. After all, consumer perceptions of the brand are driven by their experiences in franchise-operated locations far more than activities at the corporate office. In other words, franchise operators are stewards of the McDonald’s brand. The company intends a more intensive review process to ensure that poor-performing or non-conforming operators do not reduce the value of the brand.

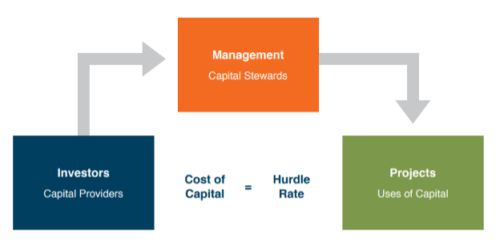

While it is rare for family businesses to license the family name for use, family business managers and directors are stewards of the family name and the family’s capital. Directors and managers use the family’s capital (both social and financial) to operate the family business with the goal of providing an attractive risk-adjusted return for family shareholders.

If your family business had to go through a renewal process to continue using the family’s name and capital, what factors would determine whether the business was worthy of renewal?

Stewardship Reporting

Periodic reporting to owners is a fundamental obligation of stewards. The content of that reporting will be unique to each family. However, there are some broad elements that should be considered for any stewardship reporting model.

- Capital allocation. How is the family’s capital being allocated? Is the family’s capital being invested in real estate, working capital, production equipment, rolling stock, or intangible assets like a tradename? How much of the family’s capital is allocated to assets that don’t directly support the operations of the family business? What is the rationale for the allocation decisions that have been made? How do those decisions further the company’s strategy?

- Risk. To what risks is family capital exposed? To what degree is family equity capital being blended with third-party debt capital to extend the reach and scale of the family’s resources? What are the economic, regulatory, and industry risk factors that could influence company performance in the future? What customer/supplier concentrations or key person dependencies could adversely affect the company? What steps are available to mitigate these risks, and are those steps financially feasible?

- Operating performance (over time). Is the family business growing or shrinking? Is it gaining or losing market share? Are there new products or markets that offer an attractive growth platform for the company? If the family business has momentum, what is it doing to keep it? If the family business doesn’t have momentum, what is it doing to gain it?

- Operating performance (relative to peers). How does the operating performance of the family business compare to available benchmark measures? What is the cause of significant variances – underperformance, overperformance, or a fundamental difference in the business model or strategy?

- Efficiency. How do operating results compare to the resources allocated to producing those results? While not perfect, return on invested capital (ROIC) is a useful performance measurement framework for many family businesses. How much revenue is the family business generating per dollar of invested capital? How much operating profit does the family business generate per dollar of revenue? What is the trend in these measures over time, and how do they compare with available benchmarks?

- Investment returns & valuation. Family capital could be invested elsewhere, so what investment returns are being generated by the family business over time? Calculating investment returns requires developing periodic estimates of the value of the family business – what are the controllable (company performance) and uncontrollable (market performance) factors influencing the value of the family business and investment returns?

- What returns are being generated by alternative investments? How does the risk of the family business compare to the risk of those alternatives? Does the resulting tradeoff between risk and return “fit” your family shareholders?

Conclusion

Family business directors and managers don’t have to submit to a renewal process to secure the right to continue using the family’s social and financial capital. But pretending that you did have to is not a bad exercise for directors and managers. What factors could you cite to support your continued stewardship of the family’s capital? Do you have a periodic reporting process in place that addresses those factors?

Designing a reporting process that is tailored to your family and business can help ensure that family capital continues to be put to good use. Give one of our family business professionals a call to discuss your reporting needs.

Family Business Director

Family Business Director