Launching the Family Business Director Blog

Corporate Finance & Planning Insights for Multi-Generational Family Businesses

This is the inaugural post for our Family Business Director blog. By way of introduction, we thought we would anticipate a few questions that you might have.

Who Are You Writing this Blog for?

We are writing this blog for directors of family businesses. Family business directors face a unique set of challenges: the strategic and long-term decisions that fall to any corporate director are overlaid with often complex family dynamics.

Directors need to acknowledge the diversity of shareholder needs and preferences.

For public company directors, shareholders are a nameless, faceless group of individuals and institutions “out there,” each of whom can come and go at their leisure. By contrast, family business directors bear a fiduciary responsibility to a finite group of siblings, aunts, uncles, cousins, and other kin, with whom they are likely to have some form of ongoing relationship outside of the family business. These very specific shareholders are likely to have very specific preferences and perspectives on the family business. Even non-family, or independent, directors will find that family dynamics intrude upon their decision-making. We suspect the pressures and challenges associated with sitting at the intersection of business and family are under-appreciated.

What Will You Be Writing About?

Owning a successful business can serve as the “glue” that holds a family together across generations and different branches of the family tree. Unfortunately, it can also be a source of contention, strife, and hostility. Within just a couple generations, it is not uncommon for economic interests and preferences among family members to diverge. If family harmony is a good worth pursuing – and we think it is – directors need to acknowledge this diversity of shareholder needs and preferences.

Dividend policy touches on the core of what the family business “means” to the family.

Dividend Policy

In our experience, the most consequential decisions that family business directors make relate to dividend policy. But dividend policy for family businesses is never just about dividends. Dividend policy touches on the core of what the family business “means” to the family. Does your family business exist to grow, keeping up with the growth of your family as generations multiply through time? Or, does your family business exist to provide financial independence to current family members through substantial dividends?

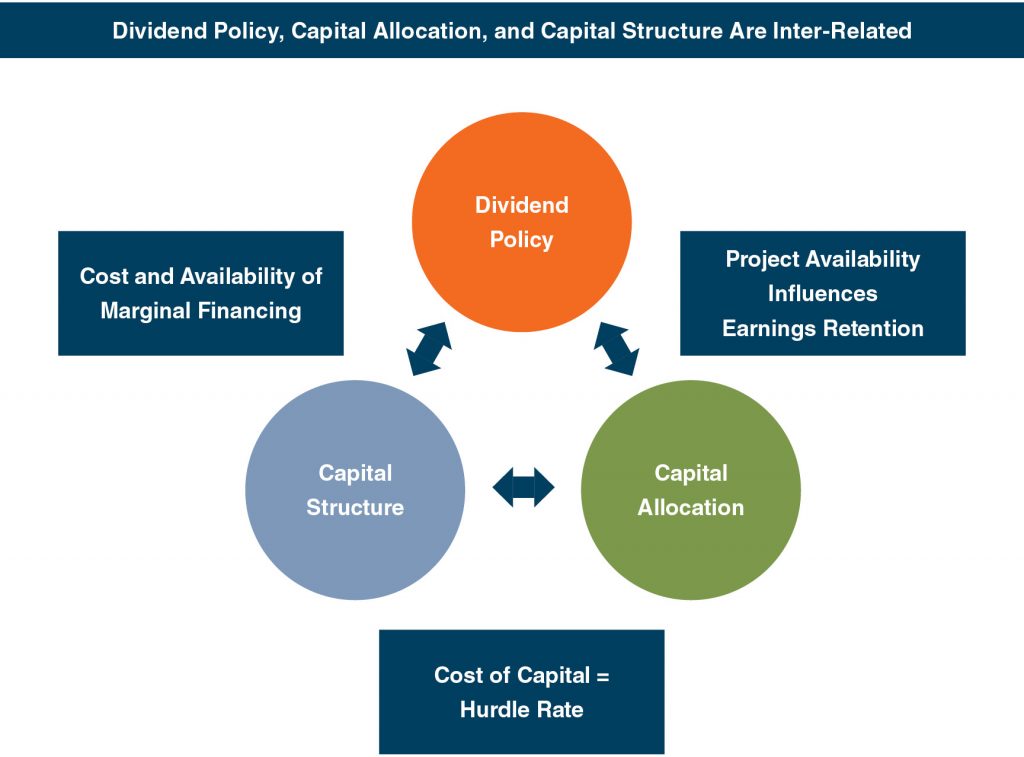

Capital Allocation

Dividend policy decisions are not made in a vacuum. If the quarterly dividend check is the picture that gets shareholder attention, corporate reinvestment is the negative image of that picture. Cash that is paid to family shareholders as dividends cannot be reinvested to grow the business, while cash reinvested in the business for future growth cannot be distributed to family shareholders. So, every decision about dividend policy is necessarily, and always, also a decision about corporate reinvestment. We refer to this as capital allocation.

Capital Structure

Capital structure is the release value when there are tensions between dividend policy and capital allocation. Family business directors are responsible for deciding how to finance the portfolio of assets that is the family business.

Dividend policy, capital allocation, and capital structure are so inter-related that disagreement about any of them is really disagreement about all of them. Every post we write will aim to help family business directors think about these fundamental corporate finance decisions in a fresh light, and apply these insights to their unique circumstances to enhance the sustainability of their family business and preserve family harmony.

For more on these topics, check out our recently published book, The 12 Questions That Keep Family Business Directors Awake at Night.

Who Are You?

We are Mercer Capital, a boutique financial advisory firm with offices in Memphis, Dallas, and Nashville. We have been working with multi-generation family businesses since 1982. After 36+ years and 11,000+ client engagements, there aren’t too many family business situations our senior professionals haven’t seen. In addition to consulting with family businesses regarding dividend policy, capital allocation, and capital structure, we provide independent valuation opinions, transaction advisory services, and litigation support services.

How Do You Help Family Business Directors?

We help family business directors make better dividend policy decisions based on the unique circumstances and needs of your family and business. We do this through the following services:

- Customized board consulting. We help you and your fellow directors understand the implications of the decisions you are called upon to make. We work with you to frame the decision to promote better outcomes, and help you formulate the relevant questions that need to be addressed and answered during board deliberations concerning your dividend policy, capital allocation, and capital structure decisions.

- Management consulting. We work with family business management teams to assess hurdle rates, develop sustainable capital budgeting processes, and evaluate potential acquisitions & divestitures.

- Independent valuation opinions. We provide independent, unbiased, and reliable valuation opinions for gift & estate tax planning, buy-sell agreements, and shareholder liquidity programs.

- Transaction advisory services. We help family business directors respond to acquisition offers, evaluate strategic alternatives, provide fairness and solvency opinions, and manage the marketing and sale of family businesses.

- Confidential shareholder surveys. By designing, administering, and summarizing the results of a confidential shareholder survey, we solicit relevant and timely shareholder feedback so you and your fellow directors can make fully-informed decisions in light of the preferences and risk tolerances of your family shareholders.

- Benchmarking / business intelligence. We turn available financial data from publicly-traded peers and other sources into relevant information that helps you and your fellow directors make better corporate finance decisions.

- Shareholder engagement. If your family business is to function as a source of unity rather than division, your family shareholders need to be positively engaged with the business. We help you do this by developing and providing customized financial education for your family shareholders. We present at family council meetings, shareholder meetings, and other gatherings on a wide variety of topics ranging from how to read your company’s financial statements to primers on the weighted average cost of capital, return on invested capital, and other topics.

- Shareholder communication support. Poor communication is the most common cause of family shareholder angst. We help family business directors identify the appropriate frequency, format, and content of financial reporting to shareholders. Making financial results accessible, understandable, and relevant to family shareholders is essential to achieving and preserving family harmony.

Thanks for trying us out. We’ve got lots of content that we are excited to share with you over the coming months and we look forward to getting to know you better. If you like what you see, please refer us to your fellow directors. It’s easy to sign up for weekly delivery straight to your inbox.

Family Business Director

Family Business Director