Mind the Margin

Why Margins Are an Important Metric for Your Family Business

The current economic state is driving operating costs higher for many businesses and eating into profits. Employers are combating this by reevaluating their hiring strategies, which include resetting labor costs, offering lower starting salaries, and, in some cases, seeking employees in lower-cost areas of the country.

A recent article published by the Wall Street Journal discusses the downward pressure on wages for new hires. This push reflects a power shift in the cooling hiring market as the unemployment rate ticks up. As the number of job seekers increases, employers have more options when selecting candidates, allowing them to decide who to hire and at what salary. Decision makers are questioning if they need top-tier talent or if an office workhorse will do.

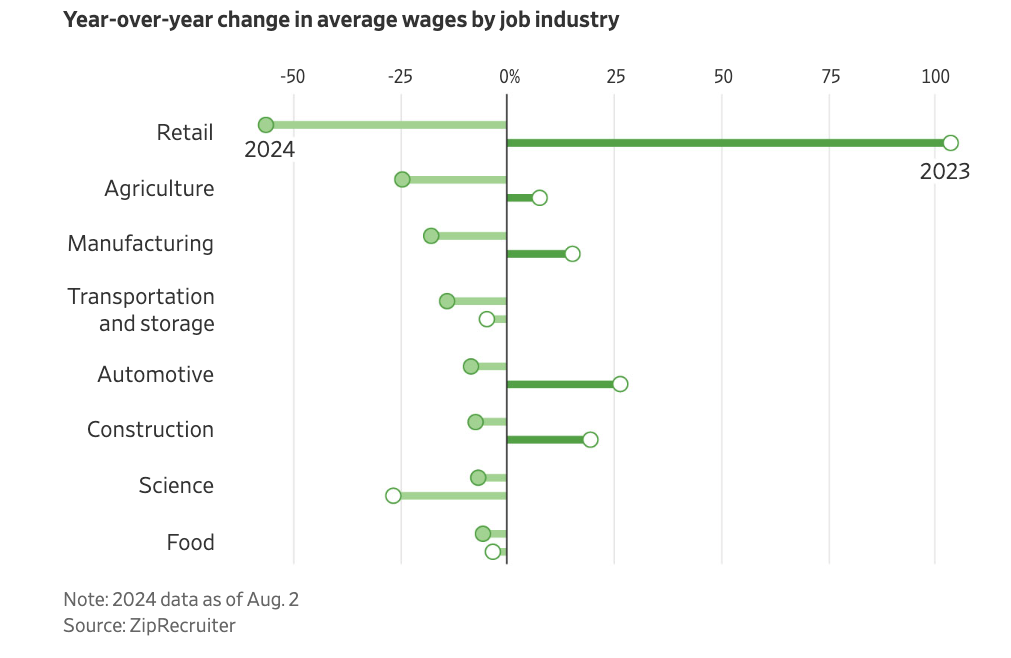

The graphic below shows the year-over-year change in average wages by job industry, with retail leading the way down ~56% from 2023.

Escalating operating expenses have put real pressure on profits for businesses across many different sectors. Managers and business directors are reacting to this by carefully identifying and cutting excess costs in order to preserve bottom-line profits. And due to the cooling job market, employers see wages for new hires and experienced workers as a potential path to higher margins.

Knee-jerk reactions in employee compensation can bring negative side effects, so we are certainly not suggesting that businesses should jump to cutting wages. However, we do feel that this may be a good time to reevaluate the expenses on your income statement and consider the margins at different levels.

A company’s income statement consists of a 1-on-1 battle: income vs. expenses, and variations in either category impact profits. Margins illustrate the relationship between the company’s revenues and expenses. By reviewing the details of the income statement, business directors can gain insight into their business performance and how to improve profits and margins.

- The first stop on the way to the bottom line is gross margin, which reflects the excess (or lack thereof) revenue generated over costs of goods sold. This margin presents the percentage of top-line revenue left after direct expenses (i.e., labor, materials, etc.).

Even Nvidia, a publicly traded company with nearly $3 trillion in market cap, is feeling the pressure from increasing costs, and shareholders are taking notice. Despite reporting record-high revenue growth in the second quarter, shares of Nvidia are down over 10% from their peak price. In Nvidia’s recent earnings call, their CFO & Executive VP, Colette M. Kress, addressed the dip in gross margin and cited increased production costs for new products as the culprit.

- Next up is the operating profit margin, which shows the percentage of top-line revenue remaining after COGS and operating expenses. This margin reflects all expenses, excluding tax and interest expenses.

On top of heightened COGS, Kress highlighted a 12% increase in operating expenses (primarily attributable to increased compensation costs), which further compressed Nvidia’s operating margin. She also noted that there will be continued expected growth in operating expenses as Nvidia plans to develop new products.

As demonstrated by Nvidia, fluctuations in margins can be driven by a variety of factors, and it is clear that shareholders are paying attention.

Margin analysis can be a beneficial tool for evaluating performance. Becoming familiar with the typical margins of your family business will provide a touchpoint for identifying where opportunities to preserve and grow profits exist for your family business. Since ‘typical’ margins vary from industry to industry, being able to benchmark to similar companies can give family businesses a better idea of where they stack up.

It is important to note that family businesses often have distinct cultures and are not always willing to cut costs for the sake of the bottom line. Family business directors have the unique task of understanding and preserving the character of the family enterprise while also maximizing profitability for the family shareholders. If you would like some help benchmarking your margins to available peer measures, call one of our family business professionals today.

Family Business Director

Family Business Director