Navigating the Estate Tax Horizon

The Time Is Now

Looking for a golden opportunity? A recent series of articles from the Wall Street Journal suggests that one exists, but time is of the essence. There is an urgency to consider a range of estate tax strategy options in order to maximize gifting family wealth rather than family drama.

The options range from straightforward gifts to heirs, accelerated gifting, use of irrevocable trusts, and other estate freeze tactics to lock in assets at current value and transfer future appreciation to heirs without triggering additional taxes. This series provides better and more creative ways to plan and divide family assets that can avoid family squabbles over Grandpa’s signed Babe Ruth baseball or Pawpaw’s 1961 Ferrari 250 GT California Spyder.

The Estate Tax

In the realm of fiscal policy and wealth transfer, few subjects are as controversial as estate taxes. One side coins the practice a “death tax,” unfairly taxing people on their exit from the world and ascension to the pearly gates. The other sees the current estate tax regime as a crucial element of tax policy, redistributing wealth and ensuring an equitable distribution of society’s resources.

Since being enacted over 100 years ago, estate taxes have been levied at varying percentages and provided for wide-ranging exemption amounts to taxpayers.

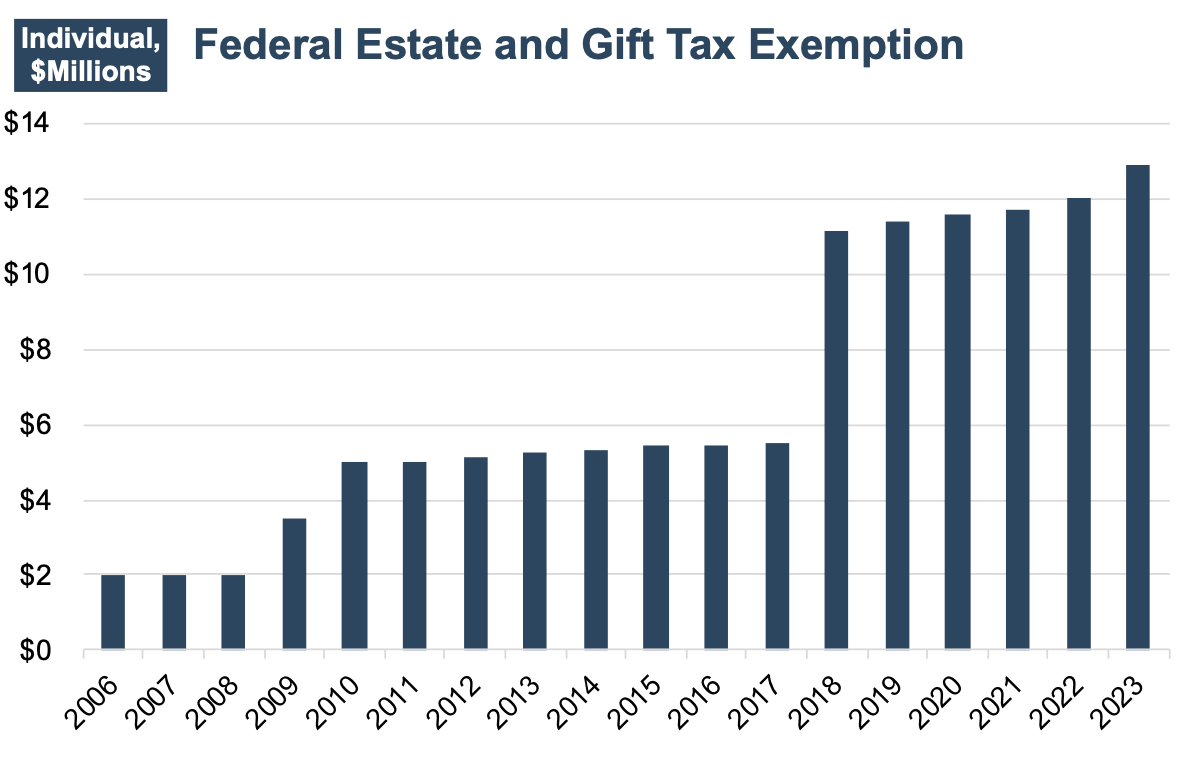

In more recent times, the trend has moved toward larger and larger exemptions, with a significant step-up in the applicable exemptions occurring during President Obama and Trump’s respective tenures, figuring into the complicated political calculus on the issue. Figure 1 highlights the federal estate and gift tax exemption for an individual filer in more recent periods.

Figure 1 :: Federal Estate and Gift Tax Exemption

Sunsetting provisions are time-limited conditions that set an expiration date for a particular statute or regulation. These provisions are designed to encourage periodic review of the law’s relevance, necessity, and effectiveness.

Current Basic Exclusion Amount to Sunset in 2026

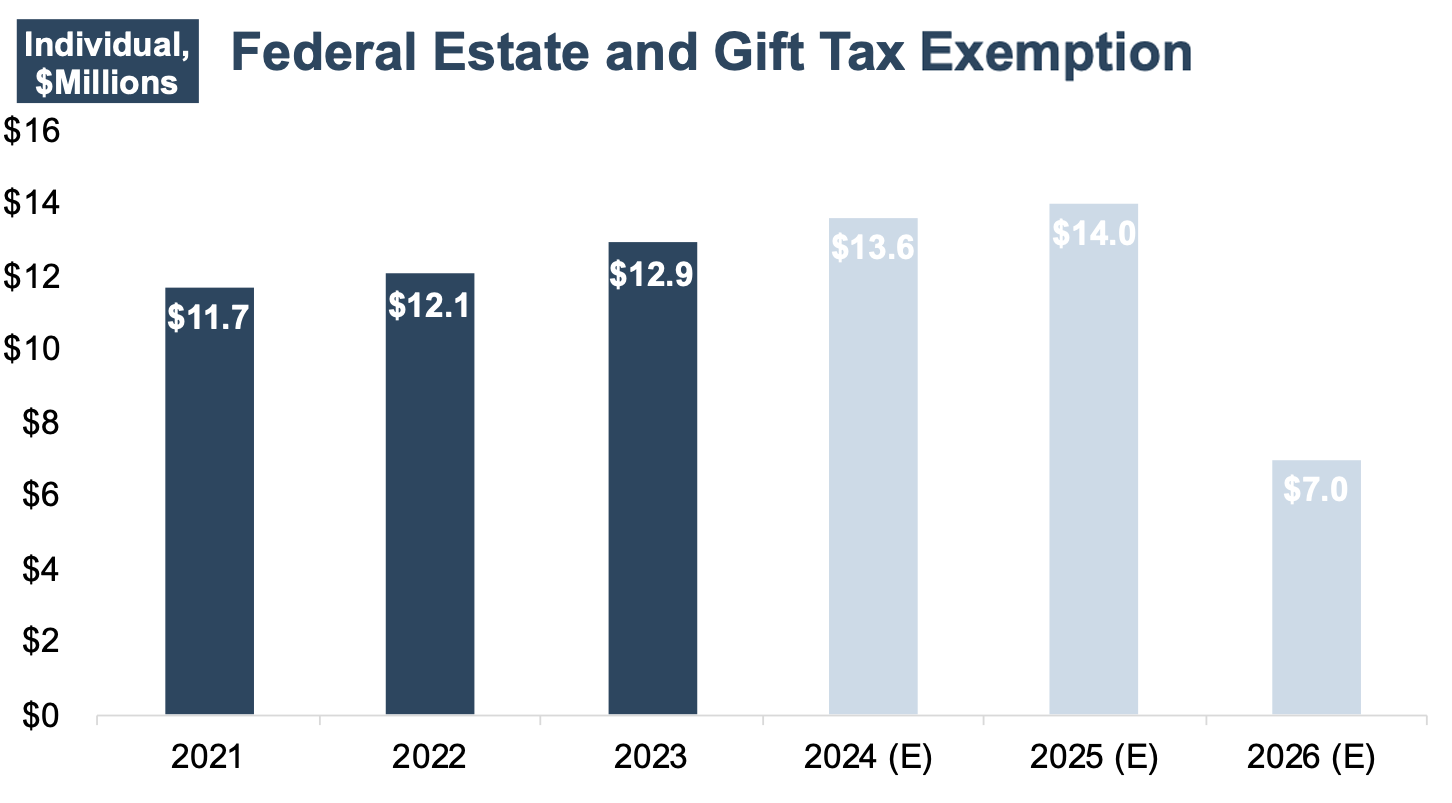

The Tax Cuts & Jobs Act of 2017 (“TCJA”) doubled the basic exclusion amount individuals could give away without paying estate taxes for tax years 2018 through 2025. For 2023, the combined gift & estate tax exemption is $12.92 million per individual or $25.84 million per married couple.

In 2026, the basic exclusion amount is due to sunset to its pre-TCJA level of $5 million, as adjusted for inflation.

In the context of estate taxes, sunsetting provisions will significantly increase potential estate tax liabilities and motivate wealthy taxpayers to re-evaluate their inheritance planning strategies.

Ashlea Ebeling explains that if a couple transfers their full exemption amount — estimated to be $28 million by 2025 before the law’s sunset — they will generate $5.6 million in tax savings. If they make gifts to grandchildren, skipping a generation, there would be nearly $9 million in tax savings. These tax savings could be significantly larger over time, as the appreciation is exempt from transfer tax.

What Does the Past Tell Us?

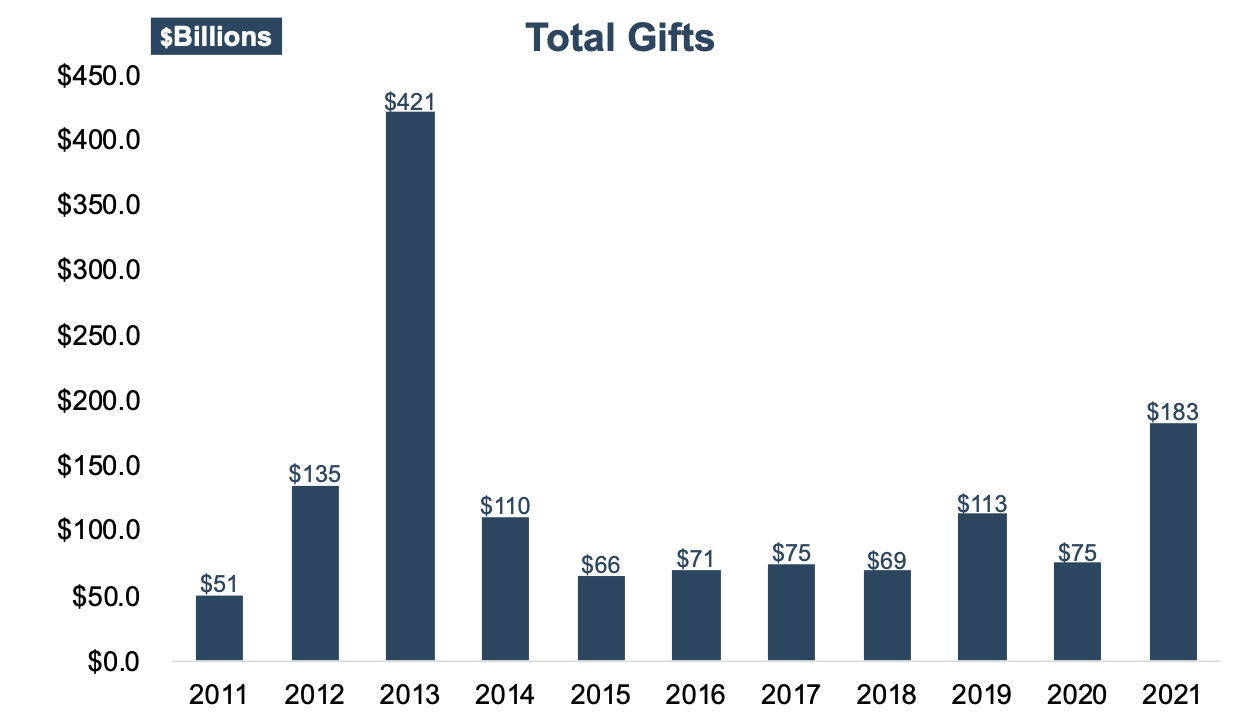

Figure 2 summarizes total gifts reported to the IRS from 2011 through 2021. Notice anything? The gifts made in 2013 were ~$421 billion — more than double those made in 2021. What happened in 2013? This was the last time there was serious doubt about the future of the gift & estate tax exemption.

Figure 2 :: Total Gifts Reported to the IRS

With the TCJA sunsetting provisions looming in 2026, a spike in estate planning transactions comparable to that seen in 2013 is likely to occur through the end of 2025, as the exemption is set to drop by 50% in 2026. Don’t wait to call your estate attorney on December 1, 2025.

The limit on annual-tax-free gifts for 2023 is $17,000. These gifts do not count against the larger $12.92 million combined gift & estate tax exemption. Carolina Mckay, a senior wealth strategist, stated she has clients who make gifts to such a large pool of relatives — grandchildren, nieces, nephews, and spouses — that they can move hundreds of thousands of dollars out of their estates each year.

The issue becomes more complicated for long-held stocks that have appreciated in value due to inheriting capital-gains taxes when the stocks are sold. Making gifts to a dynasty trust can preserve more wealth as the trust removes the assets from both your estate and your immediate heirs’ estates. Such trusts offer asset protection and can also benefit grandchildren and future generations. One thing to note is that these trusts are still subject to capital gains and other income taxes.

What Does the Future Hold?

While it is certainly possible that the higher estate-tax exemption amount could be extended or made permanent, wealthy taxpayers need to weigh the risk of inactivity if the sunset takes place. As one advisor quoted by the WSJ noted, “You have to assume the exemption amount is going down.”

Figure 3 :: Federal Estate and Gift Tax Exemption, estimated through 2026

The extension of the federal estate tax threshold amount will most likely come down to which party holds political power in Congress and the White House in 2026. It is a gamble to bank on the exemption staying at this heightened level in 2026, and you may potentially leave a lot of tax savings on the table.

Estate tax sunsetting provisions add an additional layer of complexity to the already intricate world of estate planning and taxation. While they encourage regular policy review and adaptation, they also introduce uncertainty for taxpayers and can lead to shifts in behavior and financial planning strategies.

Conclusion

As the estate tax landscape evolves, individuals, families, and advisors must stay informed and be prepared for potential changes resulting from sunsetting provisions. Our team of valuation professionals is ready to help you and your clients navigate the resulting valuation challenges.

Family Business Director

Family Business Director