Ownership Succession and the NFL

Television ratings for Super Bowl LVIII are in, and the overtime thriller between the Kansas City Chiefs and the San Francisco 49ers will go down as the most-watched program in television history (until next year’s Super Bowl, at least). The Chiefs’ overtime victory averaged 123.7 million viewers across all streaming and television platforms it was broadcasted, topping last year’s average viewership of 115.1 million. Further demonstrating the extent to which the NFL and the Super Bowl are woven into American culture, the Super Bowl accounts for 19 of the 20 most-watched television broadcasts of all time. The sole outlier on that list is the series finale of M*A*S*H, which aired in 1983. Additionally, the NFL was responsible for 93 of the 100 most-watched television broadcasts in the United States in 2023, with only the State of the Union and the Macy’s Thanksgiving Day Parade breaking the league’s stranglehold on the top 50.

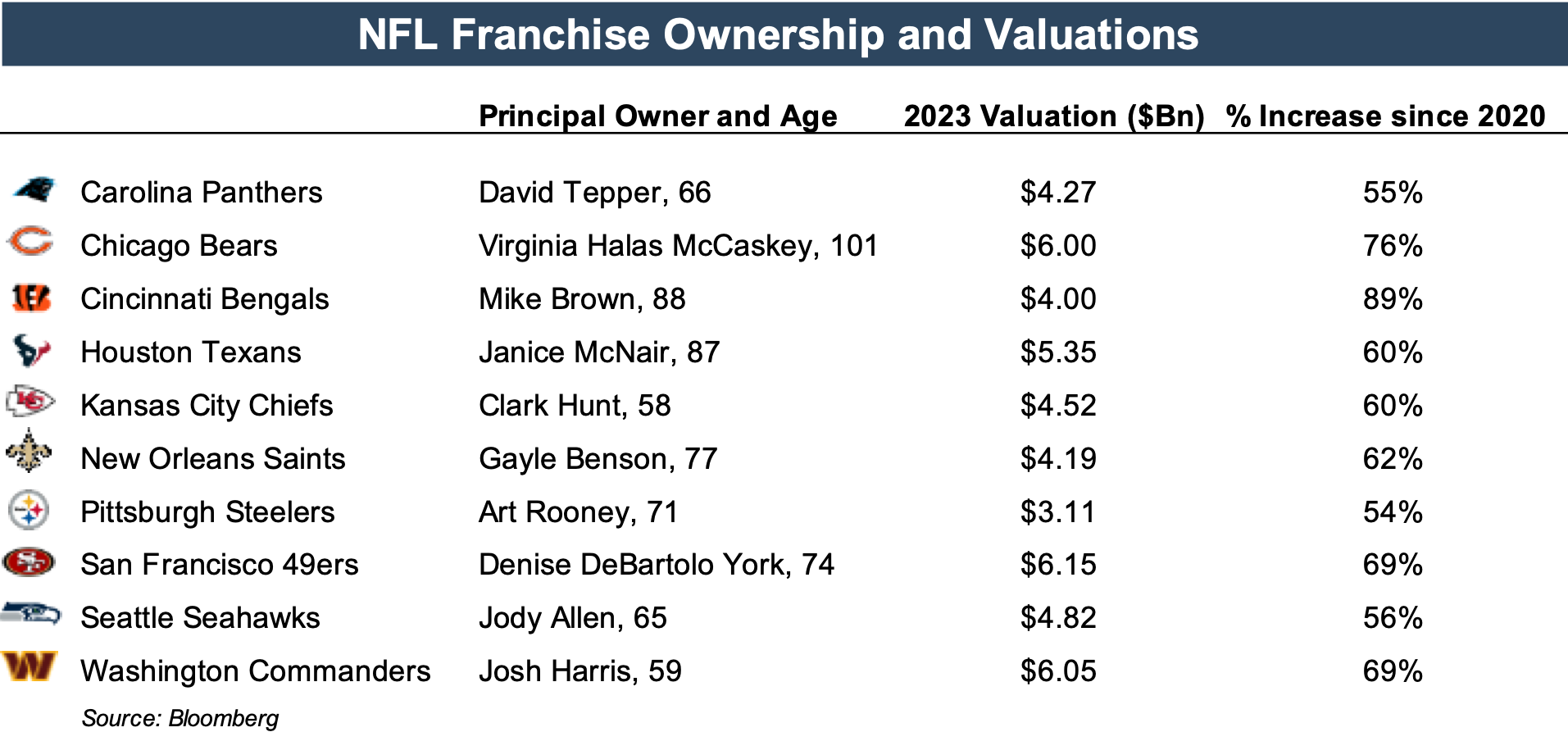

At its core, the NFL is made up of 32 franchises, many of which have been owned and operated by the same families since inception. In many ways, the league operates as a collection of family businesses. While NFL franchises may fiercely compete against one another on the field, off the field, the goal is more or less the same — to make money and increase franchise values. The league has done just that in recent years, as total revenues are forecast to approach $20 billion in 2023, and franchise values have increased on average 69% between 2020 and 2023. Still, the league has proactively taken steps to ensure that franchises remain structured as family businesses, given that the average age of the league’s 32 principal owners is 72 years old.

League rules have evolved in recent years to facilitate ownership transition within the principal owners’ families. Previously, principal controlling owners were required to individually hold at least a 30% interest in their franchise. Over the past twenty years, this requirement has been pared down to 1% as long as the prior minimum of 30% remains in the principal owner’s family. This allows owners to reduce the size of their taxable estate, which is often concentrated in illiquid interests in NFL franchises.

The massive increases in franchise values and aging NFL ownership base have combined to put estate tax planning front of mind for many league owners. Per a recent article from Bloomberg, the NFL will consider another change to its ownership rules at its league meetings next month — allowing private equity groups to take ownership stakes in teams, which has been strictly prohibited throughout the league’s history. Approval of this plan is expected at next month’s meetings, which could open the door to a flurry of deal activity for minority ownership positions in franchises. With these changes seemingly imminent, we take a brief look at some of the pros and cons of allowing private equity to enter NFL ownership structures and their broader applications to family businesses.

Pros

Access to Capital

Allowing private equity dollars to enter the league would automatically open up new funding sources for NFL franchises. These dollars could be invested in strategic initiatives, such as stadium renovations, further expansion into global markets, and the creation of new revenue streams. For family business owners, private equity funding can help finance similar strategic goals, such as fixed asset investment, increased marketing reach, and the development of new lines of business. For league owners, this new access to capital would continue to drive year-over-year increases in franchise values, and family business owners could see similar increases as a result of private equity funding.

Succession Planning

For league ownership groups facing succession planning issues, private equity could provide liquidity for financial pressures like looming estate tax bills. Liquidity could be achieved through the sale of minority interests in franchises, which would allow principal owners to retain control in accordance with the 30% controlling ownership rule. If the private equity plan is approved, league observers expect several ownership groups to take advantage of this alternative in short order. Private equity can provide similar opportunities to family business owners who have a large portion of their wealth tied up in their business and are seeking liquidity options with estate planning goals in mind.

Cons

Preservation of Core Values

Historically, minority owners in NFL franchises have been friends of the controlling ownership family, former players, or local celebrities. These owners have typically looked at their investment in the team as a point of civic pride without necessarily being motivated by financial returns. Franchises’ core values and cultures have been nurtured and supported for decades under this model, and the entry of private equity into the league could cause this “secret sauce” to turn sour. Family businesses considering private equity investors should consider the effects of return-motivated investors on a company’s overall culture and values.

Short-Termism

One advantage of family-owned businesses over publicly traded companies is the ability to focus on long-term goals and outlooks without having to answer to investors in quarterly earnings reports. NFL franchises and ownership groups are no different under the current model. Introducing private equity into ownership groups could prioritize profitability and returns over on-field success and fan engagement, which have created healthy franchises with rising valuations in recent periods. NFL owners and family businesses alike should be wary of sacrificing the long-term stewardship of the business for return-motivated private equity dollars.

Conclusion

The NFL has functioned as a family business incubator of sorts throughout its decades of existence. While other major U.S. professional sports leagues have embraced private equity ownership in recent years, the NFL has held out in favor of the family-owned model. While the proposed changes to ownership structures would still require principal ownership families to hold 30% of a given franchise, the introduction of private equity into the league will have far-reaching effects, both positive and negative. Like the NFL, family business owners considering private equity investment should weigh these and other factors before bringing PE firms into ownership groups.

Family Business Director

Family Business Director