Review of Key Economic Indicators for Family Businesses

Family business directors are often afforded a luxury that their publicly traded counterparts are not: the ability to focus on and plan for the long term rather than solely the next quarter’s earnings report. While this dynamic can provide some respite from having to keep the TV tuned to CNBC theatrics all day, it is important that family business directors not totally insulate themselves from the surrounding macroeconomic environment outside of their industry. Family business directors should be aware that their operations are subject to the same macroeconomic effects that often steer the results of the public companies in their respective industries.

While family businesses may not have the in-house economists and research departments of the larger public, it is crucial for the management and boards of family businesses to keep tabs on the overall economic environment in which they operate, as an understanding of the metrics and trends driving or hampering growth in the economy can inform effective and relevant strategic, tactical, and operational planning and decision making aimed at maximizing long-term shareholder returns. With that, we take a look at a few of the broad trends that bore themselves out in the U.S. economy through the end of 2021 and the first months of 2022.

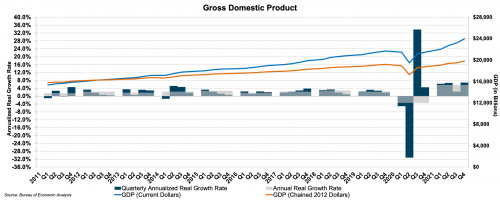

GDP

According to advance estimates by the Bureau of Economic Analysis, GDP growth in the fourth quarter of 2021 measured 6.9% over the third quarter. This increase was driven by gains in private inventory investment, exports, personal consumption expenditures, and nonresidential fixed investment. Mitigating factors to the increase in GDP were decreases in government spending (federal, state, and local) and imports, which increased and act as a deduction from the national income and product accounts. Overall, GDP increased 5.7% in 2021, which compares favorably to the 3.4% decline in GDP in 2020 and growth of 2.3% in 2019.

Overall, GDP increased 5.7% in 2021. Economists expect GDP growth to continue into the next two quarters.

Economists expect GDP growth to continue into the next two quarters. A survey of economists conducted by The Wall Street Journal in January reflects an average GDP forecast of 3.0% annualized growth in the first quarter of 2022, followed by 3.8% annualized growth in the second quarter. The forecasted growth in GDP of 3.0% in the first quarter of 2022 is down from previous estimates from the October survey, in which forecasters surveyed by the Journal estimated first quarter GDP to be 4.2%. This downgrade in expectations was the result of higher-than-expected inflation in the final months of 2021, ongoing supply chain constraints, and concerns surrounding the spread of the Omicron variant, which threatened to put a dent in consumer spending and exacerbate labor shortages, as workers are forced to call in sick.

Click here to enlarge the image

Inflation

Estimates from the Bureau Labor Statistics released last week reveal that the Consumer Price Index (“CPI”) increased 0.6% in January 2022 on a seasonally adjusted basis. On a year-over-year basis, the CPI increased 7.5% from January 2021 to January 2022. This annual increase was the largest since February 1982 and was well above the December year-over-year increase of 7.0%. For context, in the pre-pandemic days of 2019, the CPI increased at an annual rate of 1.8%. Economists generally agree that the recent record increases in inflation reflect not only supply constraints in the goods market, but also still elevated levels of demand for goods and services from U.S. consumers. The Wall Street Journal survey reveals expectations for some tapering in the annual rate of inflation, as economists surveyed forecast the year-over-year increase in June 2022 to be 5.0% and the December increase to be 3.1%.

The Wall Street Journal survey reveals expectations for some tapering in the annual rate of inflation.

The Producer Price Index (“PPI”) is generally recognized as predictive of near-term consumer inflation. While January 2022 estimates for the PPI were not available at this writing, the PPI increased 0.2% in December 2021 and 9.7% in 2021, which is the largest annual increase in PPI since the data were first calculated in November 2010. The most practical application of the current inflationary environment for family business owners and directors is the potential for price increases (perhaps in excess of those already no doubt put in place in 2021) aimed at protecting margin.

Labor Markets

Total nonfarm employment rose by 467,000 in January 2022, and the unemployment rate (U-3, total unemployed, seasonally adjusted) measured 4.0% according to the Bureau of Labor Statistics’ January release. For context, the unemployment rate was 6.4% in January 2021 and 4.7% in September 2021.

The unemployment rate was 4.0% in January 2022 (6.4% in January 2021 and 4.7% in September 2021).

The January 2022 employment figures outperformed expectations, as hiring demand continued to be high even as the Omicron variant surged. Still, the variant put a dent in the January employment figures. Nonfarm employment would have risen even higher if not for the surge in Omicron cases, as the Labor Department reported that nearly two million workers were prevented from looking for a job in January due to the rise in cases. With unemployment falling and wages increasing on inflationary effects, Fed watchers expect the FOMC to stay the course with regard to the potential for interest rate increases in 2022, which we discuss below.

Monetary Policy and Interest Rates

The FOMC met for the first time in 2022 in late January. Since the beginning of the pandemic in March 2020, Fed officials have pledged to hold interest rates near zero until inflation was forecast to moderately exceed 2% and labor markets returned to conditions consistent with maximum employment. In the aftermath of the January meetings, Fed officials signaled that these conditions have been met and that interest rate increases would begin in March. In his press conference following the meeting, Fed Chairman Jay Powell stated, “This is going to be a year in which we move steadily away from the very highly accommodative monetary policy that we put in place to deal with the economic effects of the pandemic … I think there’s quite a bit of room to raise interest rates without threatening the labor market.” These remarks led investors in interest-rate futures markets to fully anticipate a March rate increase of at least one-quarter of a percentage point. The CME Group also forecasts a nearly 70% chance of a second interest rate increase the Fed’s meeting in early May. If both of these rate increases come to pass, it will be the first time since 2006 that the Fed has raised rates at consecutive meetings.

The cheap financing environment of the past two years may be coming to an end.

As we saw earlier, inflation has easily surpassed the 2% target set out by the FOMC in recent months, but the sharp drop in the unemployment rate and widespread wage gains in labor markets have created greater urgency by the Fed to raise rates sooner than previously anticipated. With the conditions for rate increases achieved, family business directors and management should be keenly aware that the cheap financing environment of the past two years may be coming to an end. Various interest rates already reflect the prospect of increases to the fed funds rate, as the yield on 20-year treasury bills measured 2.37% last week, which is up from 1.77% at the beginning of December. Corporate borrowing rates have also increased in recent weeks, as the Moodys Baa Corporate Bond Yield measured 3.94% at its last reading. This is up from approximately 3% in early December.

Conclusion

The broader economic environment has certainly been more, shall we say, active, in recent months than even at times during the height of the pandemic. Now more than ever, family businesses directors and management must make informed decisions in the context of overall economic conditions. We hope this piece, and future posts, can be a resource and tool for doing just that.

Family Business Director

Family Business Director