Review of Key Economic Indicators for Family Businesses

With economic data for 2Q22 trickling in, we take a look at a few key trends that developed during the quarter. Volatile equity markets, ongoing inflationary concerns, and rising interest rates drove headlines in the second quarter of the year. The information in this post provides a concise and unbiased look at some of the trends that manifested themselves during the quarter. Data and commentary are largely sourced from Mercer Capital’s National Economic Review (subscription required), which is published on a quarterly basis and summarizes macroeconomic trends in the U.S. economy.

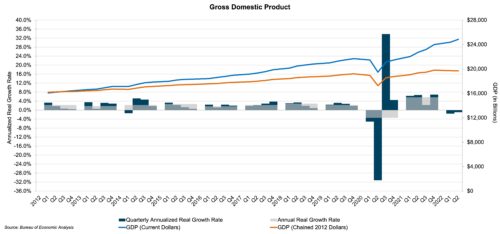

GDP

According to advance estimates by the Bureau of Economic Analysis, GDP growth in the second quarter of 2022 decreased at an annualized rate of 0.9%. The decrease was driven by declines in private inventory investment, residential and nonresidential fixed investment, and government spending (local, state, and federal). Mitigating factors to the decrease in GDP were increases in personal consumption expenditures and exports. Imports, which are subtracted from national income and product accounts, increased in the second quarter of the year, which also led to the decline in GDP growth in the second quarter of the year.

Economists expect GDP growth to resume in the next two quarters, albeit at slower rates than previously forecast. A survey conducted by The Wall Street Journal in July reflects an average GDP forecast of 1.5% annualized growth in the third quarter of 2022, followed by 1.1% annualized growth in the fourth quarter.

Click here to enlarge the image above

Inflation

Estimates from the Bureau of Labor Statistics released last week reveal that the Consumer Price Index (“CPI”) was unchanged in July 2022 on a seasonally adjusted basis after rising 1.3% in June. On a year-over-year basis, the CPI increased 9.1% from June 2021 to June 2022, which is the largest year-over-year increase since November 1981. The index increased 8.5% on a year-over-year basis in July. Notably, the gasoline index fell 7.7% in July, which offset increases in the food and shelter indexes, leading to the unchanged overall index. The Wall Street Journal survey reveals the expectation that inflation will remain persistent through the balance of 2022, as respondents predicted, on average, an annual rate of 6.9% in December 2022 before falling back to 3.9% by June 2023.

The Producer Price Index (“PPI”) is generally recognized as predictive of near-term consumer inflation. The PPI decreased 0.5% month-over-month in July 2022 and increased 9.8% in the twelve months ended July 2022.

Monetary Policy and Interest Rates

The Federal Reserve’s Open Market Committee, or FOMC, raised interest rates at both of its meetings in the second quarter. At its May meeting, FOMC members voted unanimously to raise the benchmark rate by 0.50%, placing the benchmark rate in a range of 0.75% to 1.00%. This was the largest such rate increase since 2000. Additionally, FOMC members approved a plan to shrink the Fed’s $9 trillion asset portfolio by allowing billions of dollars in treasury and mortgage bonds to mature each month through the balance of 2022 without reinvesting the proceeds into new securities. Following the meeting, Chairman Powell indicated that FOMC members broadly agreed that additional half-point rate increases could be warranted at the FOMC’s June and July meetings.

The FOMC raised rates by 0.75% at its June meeting, leaving the benchmark federal-funds rate in a range of 1.50% to 1.75%. This was the largest rate increase enacted by the Fed since 1994. According to projections released after the June meeting, all eighteen members of the FOMC anticipated raising the benchmark rate to at least 3.00% by the end of 2022. Further, more than half of the FOMC members indicated that the fed-funds rate could increase to 3.375% by the end of 2022. Following the meeting, Chairman Powell acknowledged the increasing difficulty the Fed could face in executing a “soft landing” in which the economy slows enough to harness inflation without inciting a recession. Observers interpreted this acknowledgment as an implicit concession by the Fed of the downside risks that could manifest themselves as the economy acclimates to a rapidly tightening monetary policy environment.

The Fed appears to be willing to take a cool down in inflation in exchange for a weaker short-term outlook in terms of GDP and overall economic growth

While the U.S. economy has not yet officially fallen into a recession (despite two straight quarters of decline in GDP), most Fed watchers agree that Fed Chair Powell and the FOMC won’t relent in their fight to bring down inflation even if it does cause a recession. In short, the Fed appears to be willing to take a cool down in inflation in exchange for a weaker short-term outlook in terms of GDP and overall economic growth. All eyes will be on Mr. Powell this week as he delivers his remarks at the Fed’s annual economic conference in Jackson Hole, Wyoming, on Friday morning. Astute family business directors and management teams would be well-served to pay attention to these remarks, as they will likely shed light on the magnitude and timing of rate increases through the rest of the year, as well as the overall direction of the U.S. economy.

Family Business Director

Family Business Director