Review of Key Economic Indicators for Family Businesses

With economic data for 3Q22 beginning to trickle in, we look at a few key trends that developed during the quarter. The tale of the tape in the third quarter was the same as it has been for virtually all of 2022—volatile equity markets, ongoing inflationary concerns, and rising interest rates.

The sections below provide a concise and unbiased look at some of the manifested trends. We sourced data and commentary from Mercer Capital’s National Economic Review (subscription required), which is published quarterly and summarizes macroeconomic trends in the U.S. economy.

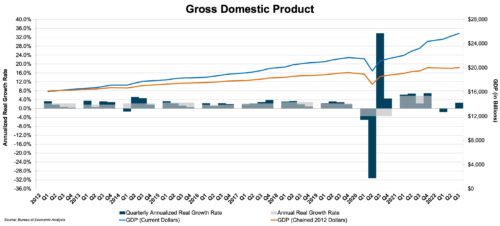

GDP

According to advance estimates released by the Bureau of Economic Analysis, GDP increased at an annualized rate of 2.6% during the third quarter of 2022. The increase in annualized GDP growth during the third quarter follows declines of 1.6% in the first quarter of 2022 and 0.6% in the second quarter. The increase was driven by gains in exports, personal consumption expenditures, nonresidential fixed investment, and government spending. Decreasing imports also boosted GDP (imports are deducted in the calculation of GDP). Mitigating factors to the increase in GDP were declines in residential fixed and private inventory investments.

Economists expect GDP growth to stagnate in the next two quarters. A survey of economists conducted by The Wall Street Journal reflects an average GDP forecast of 0.4% annualized growth in the fourth quarter of 2022, followed by an annualized decline of 0.2% in the first quarter of 2023.

Click here to expand the image above.

Inflation

Estimates from the Bureau of Labor Statistics released last week reveal that the Consumer Price Index (“CPI”) increased 0.4% in October 2022 on a seasonally adjusted basis after rising 0.4% in September as well. On a year-over-year basis, the CPI increased 7.7% from October 2021 to October 2022, a slower pace than in recent months, which generally appreciated. The Wall Street Journal survey reveals that respondents expect inflation to remain persistent throughout 2022, as they predicted, on average, an annual rate of 7.2% in December 2022 before falling back to 4.1% by June 2023.

The Producer Price Index (“PPI”) is generally recognized as predictive of near-term consumer inflation. The PPI increased 0.4% month-over-month in September 2022 and increased 8.5% in the twelve months ended September 2022.

Monetary Policy and Interest Rates

During the third quarter of 2022, the FOMC met in late July and September, raising rates by 0.75% at both meetings. At the July meeting, FOMC members voted unanimously to raise the benchmark federal-funds rates to a range between 2.25% and 2.50%. Equity markets rallied in the week of the meeting because Chairman Powell offered few specifics regarding the magnitude of future rate increases and signaled an eventual slowdown in the pace and magnitude of future rate increases. Still, the FOMC raised the benchmark rate again by another 0.75% at its September meeting, leaving the benchmark rate between 3.0% and 3.25%. Projections released after the September meeting revealed that FOMC officials nearly unanimously expected to raise rates to a range of 4.0% and 4.5% by year-end 2022, which would require sizeable increases again at the November and December meetings of the FOMC.

The Fed continued its rate-raising march at its recent November meeting, increasing the benchmark rate by another 75 basis points to a range between 3.75% and 4.0%. After the November meeting, Chairman Powell indicated that FOMC members could contemplate a smaller hike at the FOMC’s final meeting of 2022 in December but cautioned observers that borrowing costs could be higher in 2023 than previously projected. Chairman Powell also indicated that potentially reducing the size of rate increases would not necessarily equate to the FOMC pivoting away from its current monetary tightening policies.

The FOMC’s decision to raise rates again in November came against the backdrop of conflicting economic signals. The job market remains strong amid elevated inflationary pressures and despite domestic demand and housing market downturns. Widespread price increases in retail goods and services have not stifled consumer demand, likely due to generous savings cushions boosted by pandemic relief and elevated gains in asset prices over the past few years. With these conflicting signals in mind, keen Fed observers have posited that Chairman Powell is forced to choose between promoting growth and taming inflation.

Powell and the FOMC have decided to fight inflation head-on with historically significant rate increases, even at the expense of potentially curbing economic growth. Perhaps the tide will turn in 2023, but it has become increasingly evident that this won’t happen until inflation cools off. With pandemic dollars still percolating throughout the economy and contributing to inflation, the Fed will continue to make difficult decisions regarding interest rates. Some observers see the fed-funds rate topping out at 5.25% to 5.50%, which could trigger a U.S. recession. Adept and adroit family business owners and directors would be wise to begin planning now for this near inevitability in 2023. We’re reminded of the adage attributed to Benjamin Franklin: “By failing to prepare, you are preparing to fail.”

Family Business Director

Family Business Director