Review of Key Economic Indicators for Family Businesses

In this week’s Family Business Director post, we look at a few key macroeconomic trends that developed in the fourth quarter of 2022 and early 2023 and their impact on family businesses.

In the final quarter of 2022, the effects of the Fed’s rate hiking campaign began to permeate throughout the economy, particularly in inflation readings. Still, GDP outpaced consensus estimates, and U.S. equity markets reacted positively to signs of slowing inflation in October and November.

The Fed continued to raise the benchmark rate with a 75-basis point increase in November and a 50-basis point increase in December.

The following sections provide a brief look at these trends. We sourced data and commentary from Mercer Capital’s National Economic Review, which is published quarterly and summarizes macroeconomic trends in the U.S. economy.

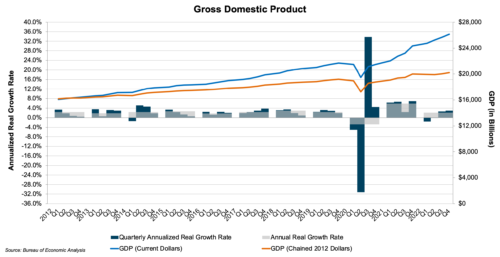

GDP

According to advance estimates released by the Bureau of Economic Analysis, GDP increased at an annualized rate of 2.9% during the fourth quarter of 2022, which follows an increase of 3.2% in the third quarter. The fourth quarter increase was primarily driven by gains in private inventory investment, personal consumption expenditures, and government (federal, state, and local) spending. The GDP increase was tempered by declines in residential fixed investment and exports during the fourth quarter. The 2.9% advance in GDP outpaced economists’ consensus expectations for growth of 2.2% in the fourth quarter (Wall Street Journal Survey). Overall, GDP increased 2.1% in 2022.

Economists expect GDP growth to stagnate in the next two quarters. A survey of economists conducted by The Wall Street Journal reflects an average GDP forecast of 0.1% annualized growth in the first quarter of 2023, followed by an annualized decline of 0.4% in the second quarter of 2023. As we highlighted at the end of 2022, family business owners and directors may need to take steps to ensure their businesses continues to thrive even as the overall economy slows.

Click here to expand the image above

Inflation

Estimates from the Bureau of Labor Statistics released last week reveal that the Consumer Price Index (“CPI”) increased 0.5% in January 2023 on a seasonally adjusted basis after rising 0.1% in December. On a year-over-year basis, the CPI increased 6.4% from January 2022 to January 2023, a slight decline from the annual change in December of 6.5%. Both of these measures are down from annual measures seen throughout much of 2022, a sign that the effects of higher interest rates are beginning to manifest themselves in the economy.

The Wall Street Journal survey reveals that respondents expect inflation to continue to recede in 2023, as consensus estimates project CPI to have increased 3.6% in the year ended June 2023 before falling to 3.1% by December 2023.

The Producer Price Index (“PPI”) is generally recognized as predictive of near-term consumer inflation. The PPI increased 0.7% month-over-month in January 2023 and increased 6.0% in the twelve months ended January 2023. There are both short- and long-run considerations for businesses to consider in a higher-than-normal inflationary environment, including price increases, the cost of borrowing, and defending margin.

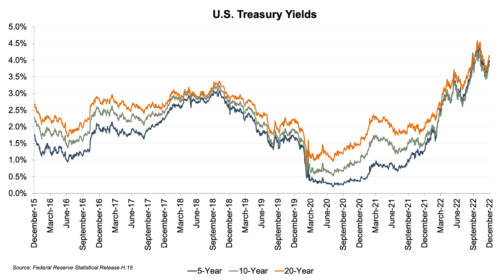

Monetary Policy and Interest Rates

The FOMC met in November and December during the fourth quarter of 2022. At the November meeting, FOMC members elected to again raise rates by 0.75%, marking the fourth consecutive 75-basis point increase enacted by the Fed. This increase raised the benchmark federal funds rate to a range of 3.75% to 4.0%.

The FOMC raised rates by 0.50% at the December meeting, which brought the benchmark rate to a range of 4.25% to 4.50%, a 15-year high. While this increase represented a smaller incremental hike than the previous four rate increases, projections from the FOMC released after the December meeting indicated that the benchmark rate would rise to 5.00% to 5.50% by the end of 2023 and remain there until an unspecified time in 2024. This was an upward revision from the September projections, which penciled in the benchmark rate to peak at 4.6% in 2023.

At its recent February meeting, the FOMC again tempered the pace of rate increases, raising the benchmark rate by 0.25%. In his comments following this meeting, Powell acknowledged that while inflation measures have trended downward in recent months, the Fed would continue to raise rates at its March meeting, cautioning investors and observers that the fight against rampant inflation was not yet won.

Click here to expand the image above

The unknown for family business managers and directors in forecasting FOMC activity in 2023 will be whether FOMC members believe that there are short or long lags in their rate increases and their effects on inflation. Longer lags imply that the Fed’s rate-raising policies of 2022 are just beginning to work their way into the economy and hamper inflation, suggesting that the Fed won’t have to keep raising rates for much longer. Shorter lags imply that previous rate hikes have already taken effect, and the Fed could be forced to continue to raise rates or hold them at their currently elevated levels to achieve the mandate of reducing inflation to 2% in the long run. Opinions among economists regarding these lags vary, but what has become clear over the past couple of months is that economic activity and inflation are slowing, and prospects for economic growth in 2023 are meager.

While these opinions drive firms’ decision-making processes in the near term, it will ultimately be up to Chairman Powell and the FOMC to determine whether 2022’s rapid rate increases have already had their intended effect or if further increases in 2023 are necessary. The path the FOMC chooses remains to be seen and will ultimately tell the tale for the U.S. economy and equity and bond markets in 2023.

Family business directors and management teams would be well-served in the coming months to keep an eye on headline economic growth, inflationary trends, and Chairman Powell’s hawkish devotion. Our family business advisory professionals have lived and worked through both economic boons and busts. Give us a call to discuss positioning your family business for the future, today.

Family Business Director

Family Business Director