Review of Key Economic Indicators for Family Businesses

Now that economic data for the second quarter of 2023 has been released and made available over the last several weeks, we take a look at the tale of the tape in this week’s post.

The U.S. economy continued to flourish in the second quarter of 2023, bolstered by growth in GDP above consensus estimates and continued low levels of unemployment. These favorable developments flew in the face of the Fed’s ongoing rate hiking campaign, as the Fed again raised rates by 25 basis points at its May meeting before pausing the rate hikes at its June meeting. At their most recent July meeting, the Fed resumed the rate hikes with another 25-basis point increase.

The following sections provide a brief look at these trends and more. We sourced data and commentary from Mercer Capital’s National Economic Review, which is published quarterly and summarizes macroeconomic trends in the U.S. economy.

GDP

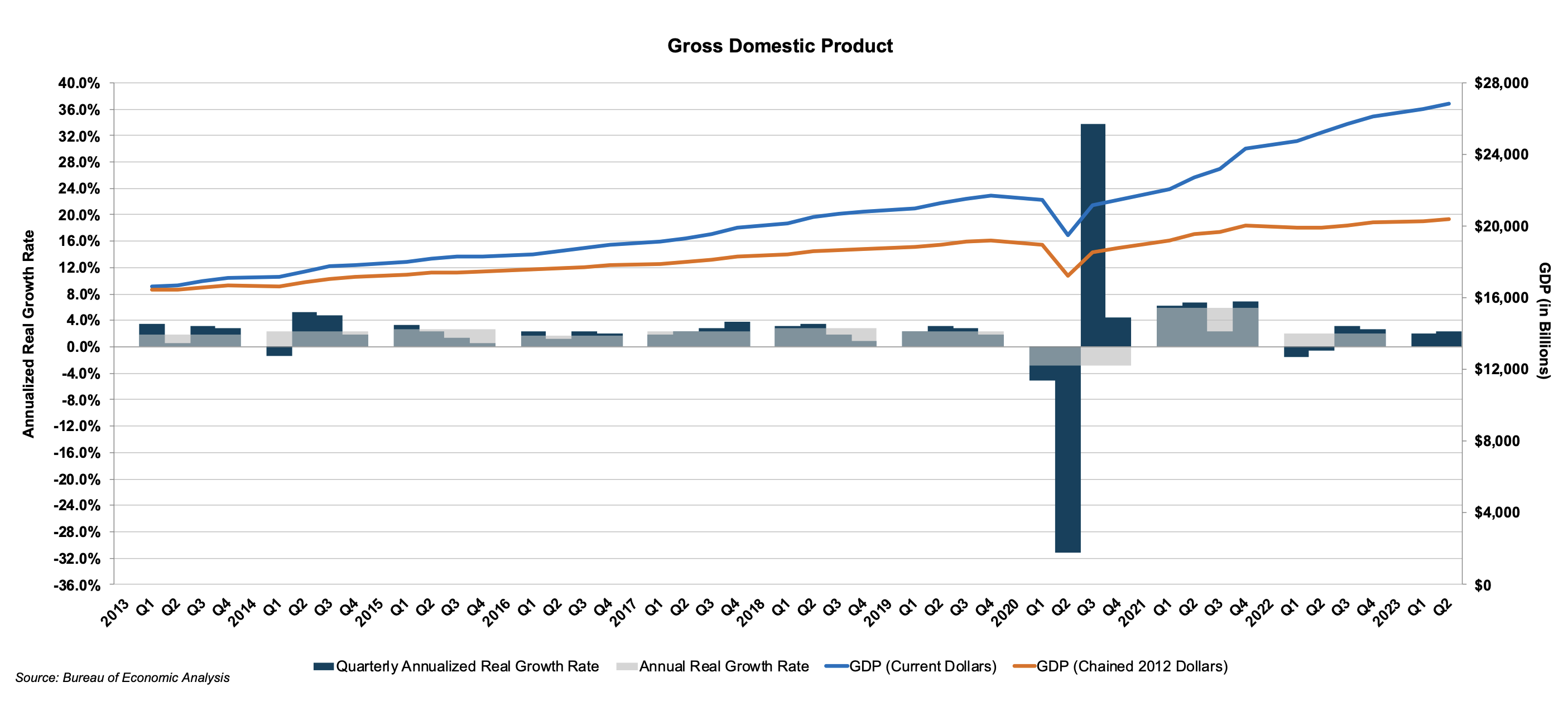

According to advance estimates released by the Bureau of Economic Analysis, GDP increased at an annualized rate of 2.4% during the second quarter, which follows an increase of 2.0% in the first quarter.

The second quarter increase was primarily driven by a 1.6% increase in personal consumption expenditures, as well as increases in nonresidential fixed investment and state and local government spending.

Exports and residential fixed investment declines tempered the GDP increase during the second quarter. The 2.4% advance in GDP came in well above economists’ consensus expectations for growth of 1.5% in the second quarter.

Economists expect GDP growth to stagnate in the next two quarters. A survey of economists conducted by The Wall Street Journal reflects an average GDP forecast of 0.6% annualized growth in the third quarter, followed by an annualized decline of 0.1% in the fourth quarter.

Click here to expand the image above

Inflation

Estimates from the Bureau of Labor Statistics released last week reveal that the Consumer Price Index (“CPI”) increased 0.2% in July on a seasonally adjusted basis after rising 0.2% in June.

On a year-over-year basis, the CPI increased 3.2% from July 2022 to July 2023, a slight increase from the annual change in June of 3.0%.

These measures are both down from annual measures seen through much of 2022, a sign that the effects of higher interest rates are beginning to manifest themselves in the economy.

The Wall Street Journal survey reveals that respondents expect inflation to remain subdued through the balance of 2023 and into 2024, as consensus estimates project CPI to have increased 3.2% in the year ended December 2023 before falling to 2.6% by June 2024.

The Producer Price Index (“PPI”) is generally recognized as predictive of near-term consumer inflation. The PPI increased 0.3% month-over-month in July 2023 and increased 0.8% in the twelve months ended July 2023.

Monetary Policy and Interest Rates

At the FOMC’s meeting on May 2-3, 2023, Federal Reserve officials again elected to raise rates by 0.25%, bringing the benchmark rate to a range of 5.00% to 5.25%, which is a 16-year high. The increase in May also marked the tenth straight rate increase enacted by the FOMC.

After ten consecutive rate increases, the FOMC elected to pause its rate hiking campaign at its June meeting, holding the benchmark rate in the range of 5.00% to 5.25%. Despite this pause, projections released following the June meeting suggested that Fed officials planned to slow down the rate increases rather than pause the increases altogether in future meetings. According to the projections, most FOMC officials penciled in two more rate increases in 2023, which would lift interest rates to a 22-year high. At its recent July meeting, the FOMC resumed its rate hiking campaign, raising rates by another 25 basis points, which brought the benchmark rate to a 22-year high.

With this background and context in mind, we can turn our attention towards more recent events — namely Jay Powell’s speech last Friday at the Kansas City Fed’s Jackson Hole Symposium. Powell echoed his recent messaging, underscoring the Fed’s attempt at trying to thread the needle between restraining the economy enough to continue to cool inflation without needlessly causing a recession. Indicating twice that the Fed would “proceed carefully,” Fed observers posited that this language signaled Powell and the Fed’s intentions to hold rates steady at the upcoming September meeting.

Following the speech, investors in the interest-rate futures market were pricing in a roughly 20% likelihood that the Fed would raise rates at the September meeting, though the likelihood that the Fed would raise rates at either the November or December meetings was floating around 50% according to the futures markets. While inflation data has improved in recent months, Powell explicitly stated that the Fed has not altered its 2% inflation target.

As Powell and the FOMC appear to be laser-focused on doing whatever is necessary to achieve this target, general investor sentiment reflects two concerns regarding this path. First, the rate increases of the past year are continuing to filter through the economy, and further rate increases could unnecessarily weaken the economy further by driving up borrowing costs for consumers and companies. Second, continued favorable economic growth could cause inflation to decline more slowly than anticipated if the Fed doesn’t continue to raise rates.

Powell’s cautious tone at the Jackson Hole Symposium did little to assuage the concerns of either of these camps and reflects the delicate balancing act currently being attempted by the FOMC. Powell and the Fed appear to be content to stay in “wait and see” mode in the near term; their actions over the next several months are anyone’s guess, as evidenced by the 50/50 shot investors are pricing in on rate increases in November and December.

As family business owners and directors begin to think about 2024, budgeting for multiple interest rate scenarios would be a wise move, as Powell and the FOMC’s next moves seem as undecided as any point in the rate hiking campaign of the past year and a half.

Family Business Director

Family Business Director