Review of Key Economic Indicators for Family Businesses

Before we dig into our turkey and dressing later this week, we look at Q3 2023 economic data in this week’s post. The U.S. economy continued to prove resilient during the third quarter, with headline GDP growth at 4.9%. Despite this growth, leading economic indicators still point to a possible slowdown on the horizon in 2024, as The Conference Board’s Leading Economic Index, which serves as the government’s primary forecasting gauge, fell 3.3% in the six months ended October 2023. The following sections provide a brief look at these trends and more. We sourced data and commentary from Mercer Capital’s National Economic Review, which is published quarterly and summarizes macroeconomic trends in the U.S. economy.

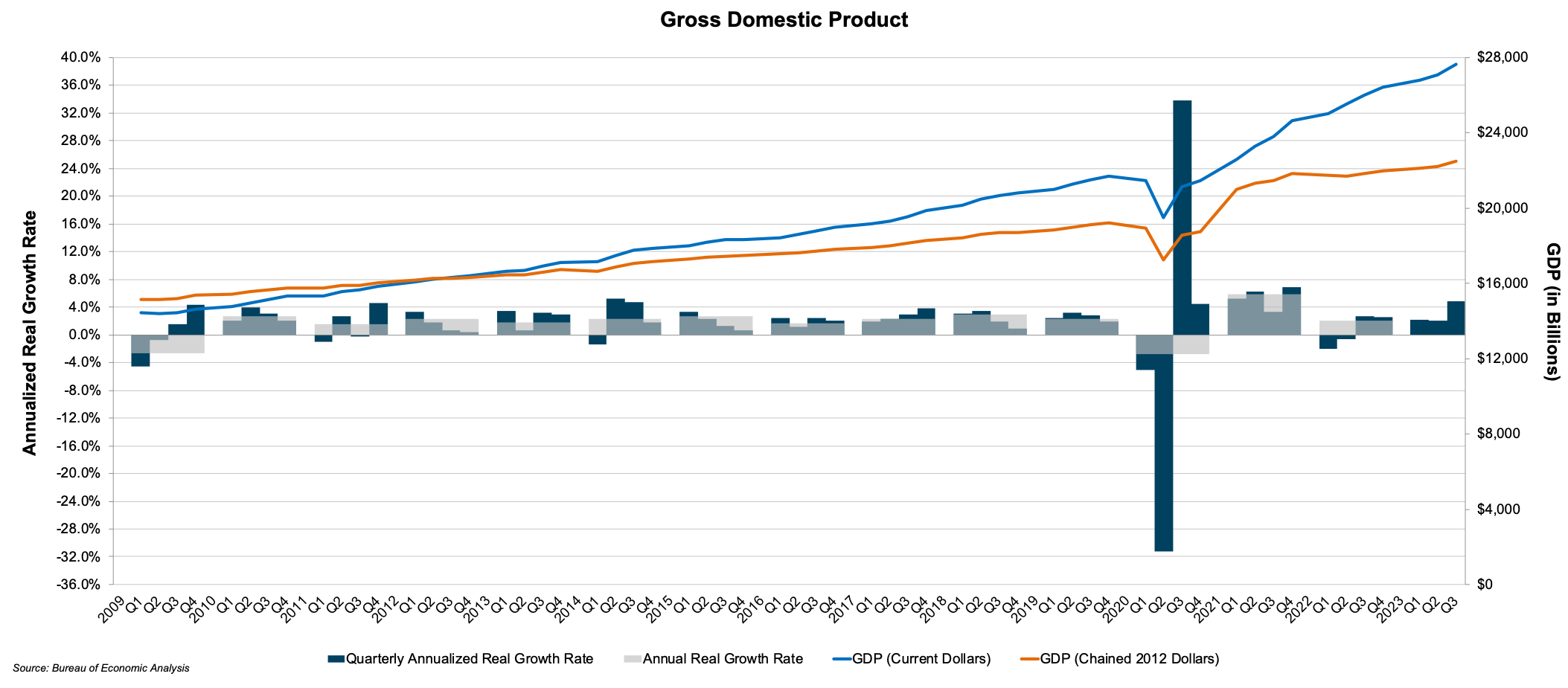

GDP

According to advance estimates released by the Bureau of Economic Analysis, GDP increased at an annualized rate of 4.9% during the third quarter, which follows an increase of 2.1% in the second quarter. The third quarter increase was primarily driven by a 4.0% increase in personal consumption expenditures, as well as increases in private inventory investment and exports. A decline in nonresidential fixed investment tempered the GDP increase during the third quarter. The 4.9% advance in GDP came in well above economists’ consensus expectations for growth of 3.6% in the third quarter.

Economists expect GDP growth to slow in the next two quarters. A survey of economists conducted by The Wall Street Journal reflects an average GDP forecast of 0.9% annualized growth in the fourth quarter, followed by annualized growth of 0.4% in the first quarter of 2024.

Click here to expand the image above

Inflation

Estimates released last week from the Bureau of Labor Statistics reveal that the Consumer Price Index (“CPI”) was unchanged in October on a seasonally adjusted basis after rising 0.4% in September. On a year-over-year basis, the CPI increased 3.2% from October 2022 to October 2023, which is down from annual measures seen through much of 2022, a sign that the effects of higher interest rates are beginning to manifest themselves in the economy. A Wall Street Journal survey reveals that respondents expect inflation to continue to decline in 2024, as consensus estimates project CPI to have increased 2.8% in the year ended June 2024 before falling to 2.4% by December 2024.

The Producer Price Index (“PPI”) is generally recognized as predictive of near-term consumer inflation. The PPI fell 0.5% month-over-month in October 2023 and increased 1.3% in the twelve months ended October 2023.

Monetary Policy and Interest Rates

In light of improving inflation data, the FOMC paused its rate-hiking campaign in recent meetings. After raising the benchmark rate by 0.25% to a range of 5.25% to 5.50% at its late July meeting, the FOMC neither raised nor lowered the benchmark rate at meetings in late September and late October. At its most recent meeting, which occurred October 31st – November 1st, Fed officials voted unanimously to leave rates unchanged at 5.25% to 5.50%, representing a 22-year high. In comments following the Fed’s most recent meeting, Jay Powell hinted that the Fed could be finished raising rates but was careful not to rule out further increases. Three key data points have informed the Fed’s decision to pause at its last two meetings: GDP growth (increased economic activity), cooling inflation, and increases in long-dated treasury yields, boosting the costs of mortgages, home loans, and business loans. It appears that the FOMC has reached a bit of an inflection point in its fight against inflation — while inflation data has improved in recent months, the FOMC is in “wait and see” mode as it continues to observe the effects of rate hikes through the U.S. economy and assess what it believes to be the correct path forward.

The bogey for the Fed now revolves around what FOMC officials are looking to see going forward in terms of economic metrics and data as the effects of the rate hikes filter through the economy. A continued slowdown in inflation would likely allow the Fed to hold rates steady for some time (or even cut rates), while another ramp-up in pricing pressures could lead to further hikes. When the Fed meets for the final time in 2023 on December 12th, markets expect the FOMC to hold rates steady at this meeting, as the CME FedWatch Toll gives only a 1 in 20 chance that the Fed raises rates at this meeting as of this writing. That said, it appears we can close the book on the rate-hiking phase of the FOMC’s fight against inflation for now. The next several months will be crucial in determining the next phase of FOMC’s monetary policy as we head into 2024.

Family Business Director

Family Business Director