Review of Key Economic Indicators for Family Businesses

In this week’s post, we look at recent economic data and the implications of this data regarding the Fed’s monetary policy actions in the coming months. GDP growth in the U.S. economy slowed to 1.6% in the first quarter of 2024, lagging measures of 4.9% and 3.4% recorded in the final two quarters of 2023. Leading economic indicators point to a further slowdown on the horizon in 2024, as The Conference Board’s Leading Economic Index, which serves as the government’s primary forecasting gauge, fell 2.2% in the six months ended March 2024. The following sections provide a brief look at these trends and more. We sourced data and commentary from Mercer Capital’s National Economic Review, which is published quarterly and summarizes macroeconomic trends in the U.S. economy.

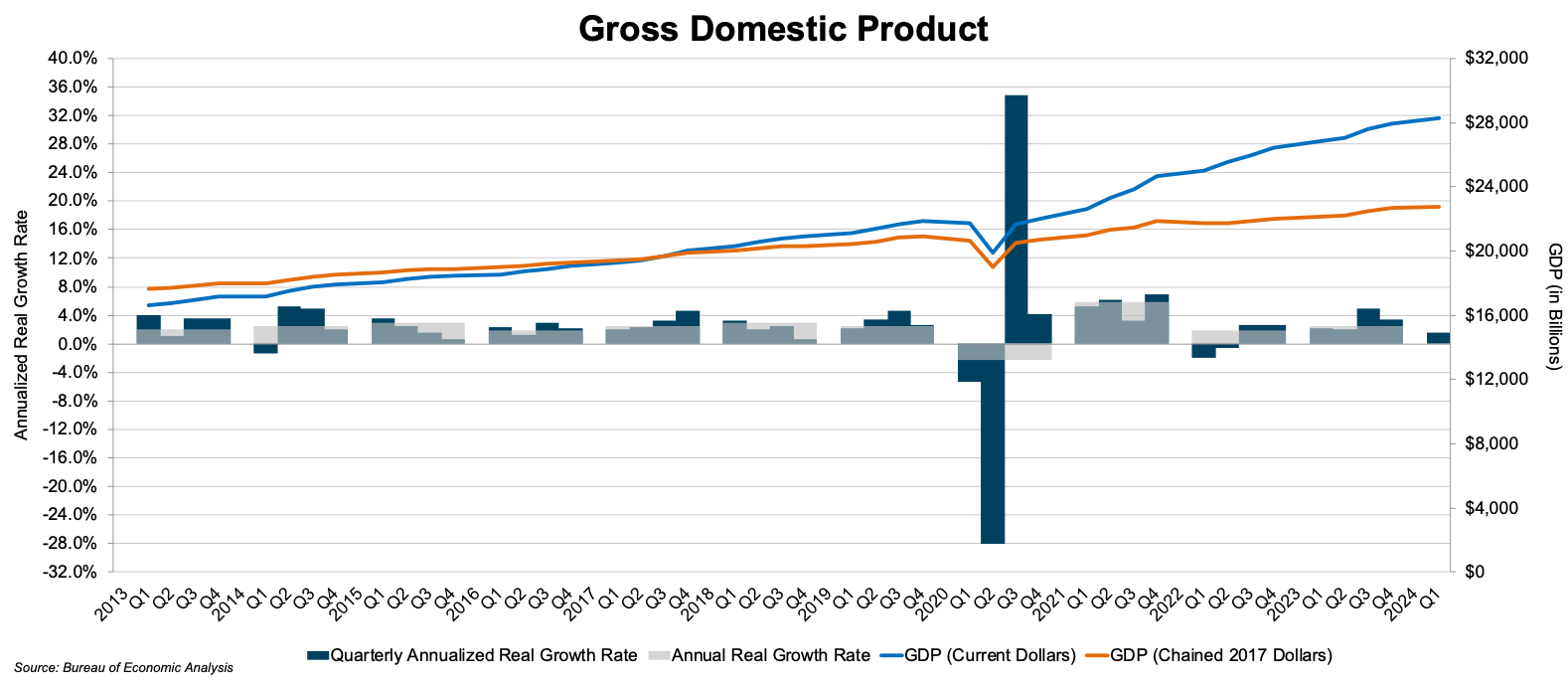

GDP

According to advance estimates released by the Bureau of Economic Analysis, GDP increased at an annualized rate of 1.6% during the first quarter, which follows an increase of 3.4% in the fourth quarter of 2023. The recent shift in consumer spending from goods to services continued in the first quarter of the year, as personal consumption expenditures on services increased 4.0% while spending on goods declined 0.4%. The 1.6% advance in GDP came in below economists’ consensus expectations for growth of 2.2% in the first quarter.

Economists expect GDP growth to stagnate in the next two quarters. A survey of economists conducted by The Wall Street Journal reflects an average GDP forecast of 1.6% annualized growth in the second quarter of 2024, followed by 1.4% annualized growth in the third quarter.

Click here to expand the image above

Inflation

With inflation data for April 2024 being released later this week, the Bureau of Labor Statistics estimates reveal that the Consumer Price Index (“CPI”) increased 0.4% in March after increasing 0.3% in January and 0.4% in February. On a year-over-year basis, the CPI increased 3.5% from March 2023 to March 2024, which is above annual measures seen through much of 2023, signaling that inflation in the U.S. economy may be “stickier” and more persistent than observers realized in 2023. A Wall Street Journal survey reveals that respondents expect inflation to decline marginally in 2024, as consensus estimates project CPI to have increased 3.1% in the year ended June 2024 before falling to 2.7% by December 2024, which is still above the Fed’s long-run inflation target of 2%.

Monetary Policy and Interest Rates

The FOMC met in early May, where it was tasked with determining the future course of interest rates and monetary policy against the backdrop of a surprisingly persistent inflationary environment in the U.S. economy. After raising the benchmark fed funds rate to a two-decade high of 5.25% to 5.50% in July 2023, the FOMC has held rates steady at this level for months. Through the end of 2023 and early months of 2024, amongst a run of benign inflation data, there was widespread belief held by market observers that the Fed would cut rates multiple times in 2024. Recent inflation readings have moderated these hopes, and in his comments following the May FOMC meeting, Fed Chair Jay Powell signaled that interest rates will likely stay higher for longer than FOMC officials and market observers initially believed at the onset of 2024. While Powell did not take further rate hikes completely off the table, he did concede that further hikes were “unlikely” if inflation remains at its current levels.

On the other hand, nearly two-thirds of economists polled in a recent survey conducted by Reuters believe that the FOMC will still cut rates twice in 2024, beginning at the September FOMC meeting. The broad consensus among observers is that the FOMC will need to see multiple months of declining inflation data to bring rate cuts back into play, which could begin with this week’s April 2024 inflation data release (of note, the CPI is forecast to have increased 0.4% in April, in line with March’s reading).

The specter of a contentious presidential election in November also looms over the Fed’s decision-making process, as any FOMC decisions Fed could be tinged with accusations of being politically motivated, which would violate the central bank’s independence and objectivity in its pursuit of maximum employment and stable prices as mandated by Congress in the Federal Reserve Act of 1913. With these considerations in mind, the Fed will likely remain in “wait and see” mode regarding future hikes or cuts absent any exogenous shocks. Family business owners would be well-served to do the same with regard to capital budgeting and investment decisions until the future path of interest rates becomes clearer.

Family Business Director

Family Business Director