Review of Key Economic Indicators for Family Businesses

Coming off a run of economic data releases in the last few weeks, we take a look at the numbers and some of their implications for the broader economy in this week’s post. GDP growth in the U.S. economy measured 2.8% in the second quarter of 2024, outpacing growth of 1.4% in the first quarter. Following persistently elevated measures in the first quarter, recent inflation readings have cooled. The following sections provide a brief look at these trends and their implications. We sourced data and commentary from Mercer Capital’s National Economic Review, which is published quarterly and summarizes macroeconomic trends in the U.S. economy.

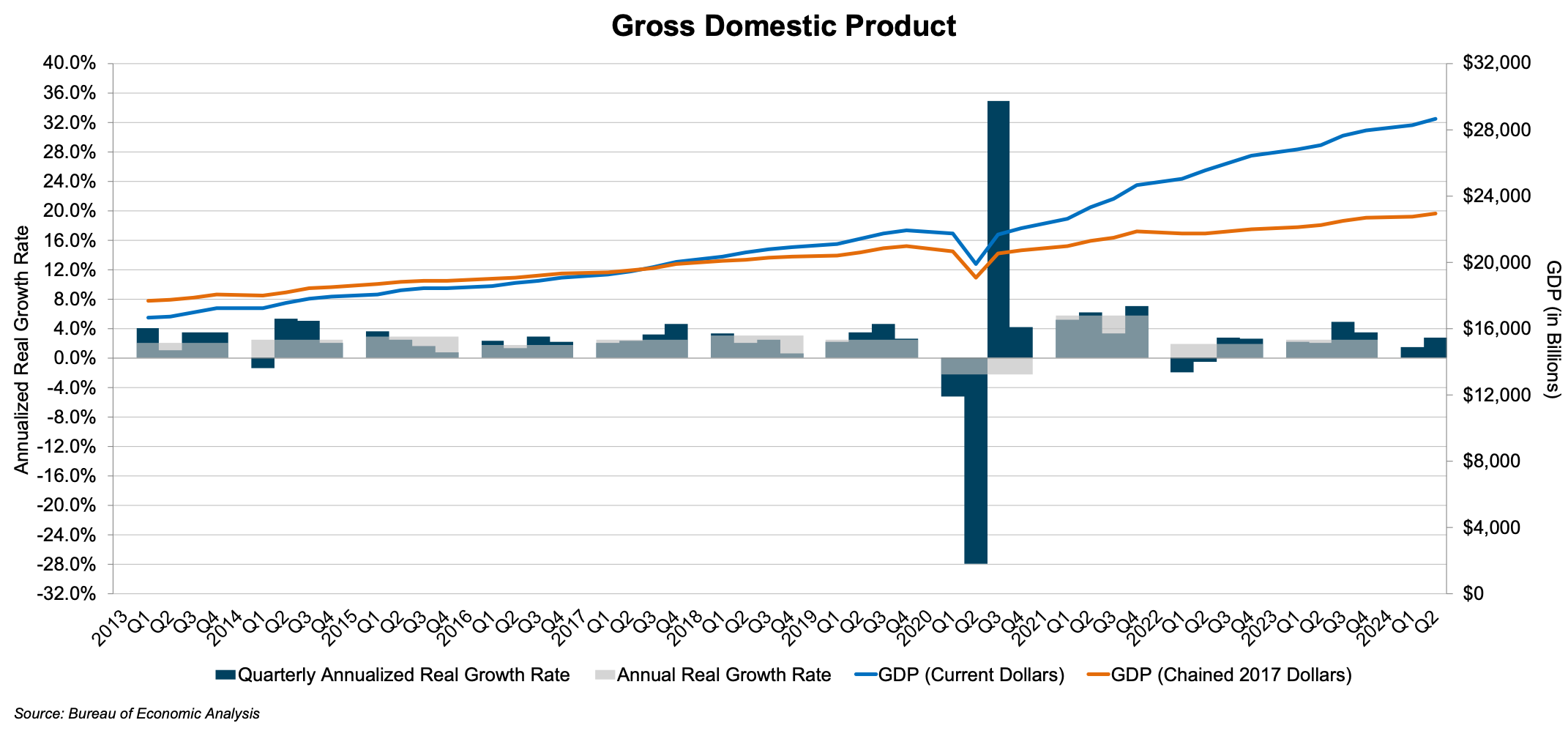

GDP

According to advance estimates released by the Bureau of Economic Analysis, GDP increased at an annualized rate of 2.8% during the second quarter, which follows an increase of 1.4% in the first quarter. Consumer spending, representing roughly 70% of total economic activity, increased again in the second quarter and reflected increased expenditures for both goods and services. Leading contributors within services included health care and housing and utilities, while motor vehicles and parts were the leading expenditure within goods. The 2.8% advance in GDP came in above economists’ consensus expectations for growth of 1.8% in the second quarter.

Economists expect GDP growth to slow in the next two quarters. A survey of economists conducted by The Wall Street Journal reflects an average GDP forecast of 1.6% annualized growth in the third quarter of 2024, followed by 1.5% annualized growth in the fourth quarter.

Click here to expand the image above

Inflation

Inflation data for July, released last week, came in cooler than economist projections. The CPI rose 2.9% from July 2023, marking the lowest year-over-year reading since 2021. Core CPI, which excludes food and energy prices, measured 3.2%, which is also a three-year low. July’s CPI reading follows an increase in the year-over-year CPI of 3.0% in June. These readings are improvements from earlier measures in 2024, somewhat quelling the fears of observers that inflation may be “stickier” than initially believed and could hamper the Fed’s attempt at a “soft landing.” Economists surveyed by The Wall Street Journal anticipate further cooling in CPI readings in the near term, with the consensus projected reading in December 2024 being 2.8%, followed by 2.4% in June 2025.

Monetary Policy and Interest Rates

With softening inflation and an increasing unemployment rate, the stage is set for the FOMC to execute a rate cut at its upcoming September meeting. Following the latest FOMC meeting in late July, Fed Chairman Jay Powell commented: “The broad sense of the committee is that the economy is moving closer to the point at which it will be appropriate to reduce our policy rate. A reduction in the policy rate could be on the table as soon as the next meeting in September.” While equity markets have had this expectation priced in for some time, stocks still posted broad gains following Powell’s remarks.

Investors expect an initial cut of 25 basis points in September, followed by further cuts at the November and December meetings to close out 2024. Still, this path could change depending on movements in the labor markets and further inflation readings. A return to higher-than-expected inflation readings (consecutive y-o-y CPI in excess of 3.0%) could cause the Fed to slow the rate-cutting cycle and leave rates near their current levels. Acute weakness in labor markets, which are beginning to soften, could cause the Fed to speed up the rate-cutting process to stem rising levels of unemployment.

While inflation has been the Fed’s primary target in its policy-making decisions over the past several years, recent revisions to the Fed’s policy statement acknowledge the FOMC’s progress in the fight against inflation and downgrade the emphasis on inflation in the statement. Notably, this signals that the Fed is putting inflation and labor markets on equal footing in its policy decisions for the first time since they started raising rates two years ago to battle soaring inflation. Fortunately, FOMC officials can undertake this balancing act and potentially pull off a “soft landing” against the backdrop of a sturdy economy, as seen in recent measures of GDP.

Family Business Director

Family Business Director