Review of Key Economic Indicators for Family Businesses in Q1 2022

In this week’s post, we take a look at a few key macroeconomic trends that developed in the, shall we say, busy, first quarter of 2022. Between volatile equity markets, mounting global geopolitical tensions, raging inflation, and increasing interest rates, a lot went on in the year’s first quarter from a macro perspective.

We hope that the discussion below cuts through some of the “noise” and provides our readers with a concise and unbiased look at economic trends from the first quarter of 2022. Data and commentary are largely sourced from Mercer Capital’s National Economic Review, which is published on a quarterly basis and summarizes macroeconomic trends in the U.S. economy in each quarter.

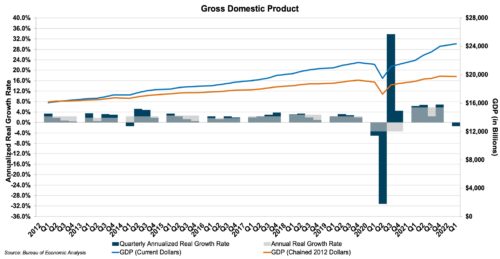

GDP

According to advance estimates by the Bureau of Economic Analysis, GDP growth in the first quarter of 2022 decreased at an annualized rate of 1.4%. The decrease was driven by declines in private inventory investment, exports, and government spending (federal, state, and local). Mitigating factors to the decrease in GDP were increases in personal consumption expenditures, nonresidential fixed investment, and residential fixed investment. Imports, which are subtracted from national income and product accounts, increased in the first quarter of the year, which also led to the decline in GDP growth in the first quarter of the year.

Economists expect GDP growth to resume in the next two quarters, albeit at slower rates than previously forecast

Economists expect GDP growth to resume in the next two quarters, albeit at slower rates than previously forecast. A survey of economists conducted by The Wall Street Journal in April reflects an average GDP forecast of 3.0% annualized growth in the second quarter of 2022, followed by 2.8% annualized growth in the third quarter. While these estimates call for GDP growth to resume in the next two quarters, respondents in the survey pegged the probability of a recession in the U.S. in the next 12 months at 28%, which is up from 18% in the January survey. The downgrade in GDP expectations and increased probability of a recession is primarily predicated on the surging rates of inflation seen in the first few months of 2022 and the Fed’s potential response to this rampant inflation. Still, a majority of survey respondents (63%) believe that the Fed will be able to rein in inflation without triggering a recession.

Click here to enlarge this image

Inflation

Estimates from the Bureau Labor Statistics released last week reveal that the Consumer Price Index (“CPI”) increased 0.3% in April 2022 on a seasonally adjusted basis after rising 1.2% in March. On a year-over-year basis, the CPI increased 8.3% from April 2021 to April 2022 following an increase of 8.5% annual increase in March 2022. Individual indexes that saw the greatest month-over-month increases in April were the shelter, food, airline fares, and new vehicles indexes. The Wall Street Journal survey reveals the expectation that inflation will remain persistent through the balance of 2022, as respondents predicted, on average, an annual rate of 7.5% in June 2022 and 5.5% by December 2022 before falling back to 2.9% by late 2023.

According to a Wall Street Journal survey, expectations are that inflation will remain persistent through the balance of 2022

The Producer Price Index (“PPI”) is generally recognized as predictive of near-term consumer inflation. The PPI increased 0.5% month-over-month in April 2022 and 11.0% in the twelve months ended April 2022.

Monetary Policy and Interest Rates

At its March meeting, the Federal Open Market Committee (“FOMC”) voted nearly unanimously to lift the benchmark federal-funds rate by a quarter percentage point to a range of 0.25% to 0.50%. After the meeting, Chairman Powell signaled the possibility of the FOMC raising rates in half-percentage point increments at some point in 2022 rather than quarter-percentage point increments, which the Fed has not done since 2000. The FOMC acted on this possibility at its recent May meeting, as it unanimously approved a rare half-percentage-point rate increase, which raised the benchmark federal-funds rate to a target range of 0.75% to 1%. Following the May meeting, Chairman Powell stated that FOMC members broadly agree that additional half-point increases could be warranted in June and July to continue to combat surging inflation in the economy.

Conclusion

In summary, the broad consensus among economists is that inflation remains the primary macroeconomic risk in the U.S. This has caused the Fed to respond aggressively thus far in 2022, as the speed and magnitude of rate increases have outpaced prior expectations for 2022, and the Fed appears primed to continue to aggressively increase rates. The balancing act for the Fed going forward will be attempting to thread the needle between cooling the economy enough to rein in record levels of inflation, but not so much that it accidentally creates a pullback in consumer spending and increases in unemployment.

Family business directors and management teams should keep an eye on upcoming FOMC meetings. Commentary from these meetings offers insight into the future direction of the U.S. economy.

Family business directors and management teams would be well-served in the coming months to keep an eye on upcoming FOMC meetings and subsequent commentary in the wake of these meetings. While this appears to be neither a glamorous nor exciting suggestion, commentary following these meetings does offer a great deal of insight into the future direction of the U.S. economy, given that the FOMC’s primary goal in executing its rate increases is to rein in inflation, which is almost certainly having real and tangible effects on nearly all family businesses right now.

Family Business Director

Family Business Director