Shareholder Redemptions in Family Businesses

Are They Good or Bad?

Over the weekend, the New York Times published an opinion column by Chuck Schumer and Bernie Sanders in which the senators decried the increasing prevalence of stock buybacks among the country’s largest publicly traded companies. On Messrs. Schumer and Sanders’ reading, share repurchases epitomize a corporate philosophy that prizes shareholder value at all costs and gives short shrift to the long-term sustainability of such companies, negatively affecting workers and other stakeholders. Whatever the public policy merits of the positions outlined in the column, it does acknowledge and highlight two essential characteristics of share buybacks. First, from the perspective of the business, redeeming shares is economically equivalent to paying dividends. Second, using capital to repurchase shares can limit the amount of capital available for investment to grow the business.

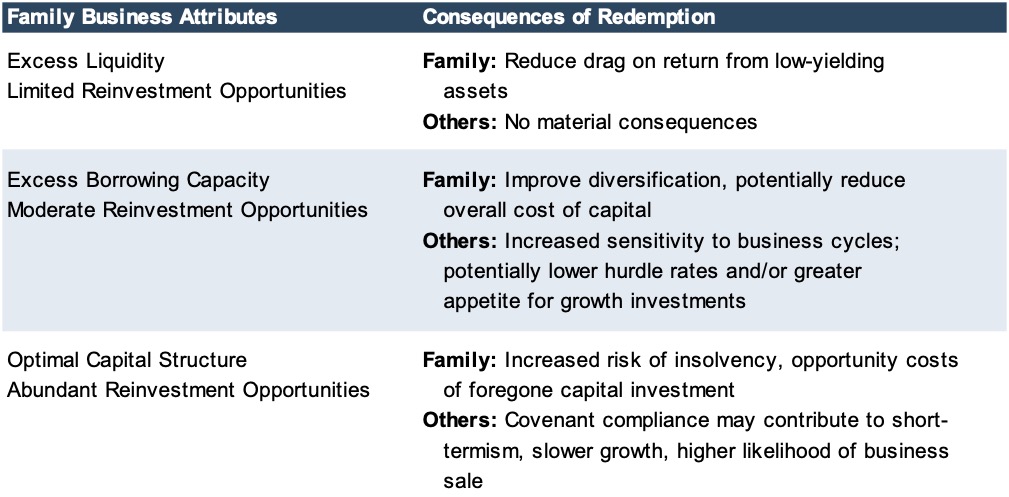

Reading the column made us think about shareholder redemptions for family businesses: Do shareholder redemptions hurt or help family businesses? Of course, that question does not have a simple answer. Not all shareholder redemptions are created equal, so in this post, we’ll outline three possible redemption scenarios and identify what attributes suggest whether a given shareholder redemption will help or hurt a family business and its relevant stakeholders.

Scenario #1 – Excess Liquidity and Limited Reinvestment Opportunities

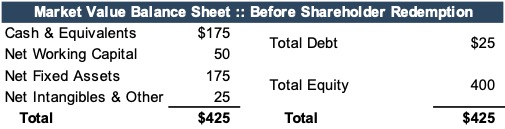

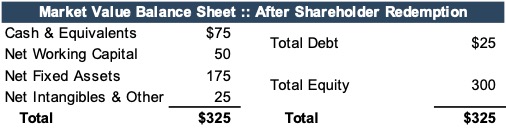

The family business in our first scenario has historically retained all earnings. As the company has matured, attractive investment opportunities have become increasingly scarce, and management has successfully avoided the temptation of investing in capital projects promising inadequate returns. As a result, the family business has accumulated excess liquidity.

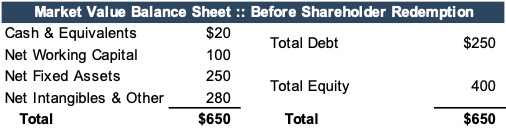

The company elects to redeem one branch of the family shareholder tree that is geographically and socially removed from the rest of the family and has expressed a desire to achieve liquidity. The shareholder group collectively owns 25% of the outstanding shares and can be redeemed for $100. Following the redemption, the market value balance sheet now looks like this:

Following the transaction, the remaining shareholders endure less of a drag on returns from low-yielding cash assets, and the company retains ample financial flexibility to meet strategic investment opportunities that may arise. In this case, the shareholder redemption was clearly a positive outcome for all the shareholders, and did not trigger any negative consequences for employees or other interested stakeholders.

Scenario #2 – Excess Borrowing Capacity and Moderate Reinvestment Opportunities

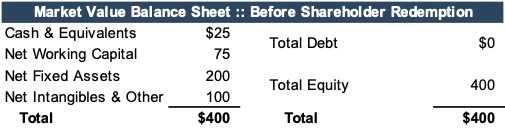

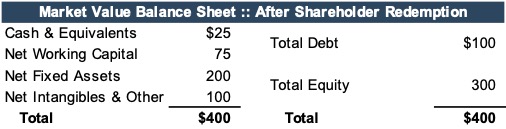

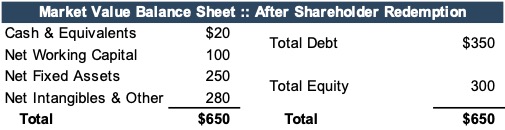

In our second scenario, the family business operates in a growing industry presenting moderate reinvestment opportunities. The founding and second generations have been averse to debt, seeking to repay outstanding balances as quickly as possible. At present, there is no debt outstanding. The market value balance sheet is summarized below.

As the third generation has assumed primary leadership of the family business, they have prioritized diversification and reducing the concentration of family wealth in the business. In order to fund investments outside the business, the directors elect to redeem 25% of the outstanding shares, funding the redemption through a bank loan. The post-redemption market value balance sheet is summarized below.

In this case, the shareholder redemption accomplished two things: (1) helped secure the family’s financial foundation by establishing a basket of wealth that is not tethered to the fortunes of the family business, and (2) potentially reduced the family business’s overall cost of capital through the prudent use of available financial leverage.

From the perspective of other employees and other interested stakeholders, the outcome is perhaps a bit more mixed.

- While the post-redemption financial leverage is by no means imprudent, the risk of financial distress in the event of softening economic conditions is heightened. As a result, employment levels and wages may be under greater scrutiny if a recession were to occur.

- At the same time, use of a more optimal capital structure may reduce the hurdle rate used to evaluate capital investments, making growth opportunities relatively more attractive.

- Further, since the family has reduced its financial dependence on the business, the shareholders may actually be more willing to take risk inside the business and pursue growth more aggressively, with positive consequences for employment and wages.

- Finally, depending on what form the family’s diversifying investments outside the business take, there may be positive externalities for the community at large through investment in start-up enterprises, real estate development, or other activities.

Scenario #3 – Optimal Capital Structure and Abundant Reinvestment Opportunities

In our final scenario, the family shareholders of a growing family business have been feuding for years. With tensions reaching a breaking point, the directors have concluded that redeeming the dissenting group’s 25% ownership interest is the only way to preserve family ownership of the business. Industry fundamentals are attractive, and the family business has identified a strategy that promises abundant opportunities for financial rewarding capital investment. The company has relied heavily on debt financing in recent years to execute on its growth strategy.

The Company’s existing lenders have little appetite for extending further funds to finance the $100 redemption. The family has no desire to accept equity investment from outside sources, so the redemption is financed with a high-yield loan from a so-called mezzanine lender. The loan is costly both with respect to the interest rate and the inclusion of equity warrants, which the family business has the right to redeem at exercise. The market value balance sheet following the purchase is summarized below.

For the remaining shareholders, the redemption has defused a volatile family situation, but at the cost of assuming a much riskier ownership position. The greater post-transaction financial leverage has magnified both the potential upside and downside for the remaining shareholders. Of perhaps even greater significance, the obligation to use operating cash flows to service the redemption financing will “crowd out” capital investment, and may impair the company’s ability to execute on its strategy. This diversion of cash flow away from attractive investment opportunities is a very real opportunity cost to the remaining shareholders, which we can think of as the cost of family dysfunction.

For employees and other stakeholders, the repercussions of this shareholder redemption are uniformly negative. The elevated financial risk increases the exposure of the company to even temporary downturns, as lender covenants may force management to adopt more of a short-term perspective than it otherwise would. The limited financial flexibility is likely to cause growth to slow, shrinking opportunities for promotions and wage growth. Finally, the post-redemption capital structure may increase the likelihood of the business being sold. Depending on the characteristics of the buyer, a sale of the business may have negative consequences for both employees and the local community. In other words, the costs of family dysfunction are not confined to the family.

Conclusion

Sizable shareholder redemptions can serve a number of purposes in a family business. Though clearly not an exhaustive list, in this post we have laid out three representative scenarios for major shareholder redemptions and the likely consequences for both family shareholders and other stakeholders.

Your family business is unique. If you are contemplating a shareholder redemption, our experienced family business advisory professionals can help you and your fellow directors assess the likely outcomes for all the relevant parties and chart the best path forward.

Family Business Director

Family Business Director