Should I Stay, or Should I IPO?

Those are the lyrics…right? Last month, Birkenstock filed for an initial public offering with the U.S. Securities and Exchange Commission, and the listing is expected to go live this week. Birkenstock is a unique comfort shoe brand with consumers ranging from teenagers to their grandparents, even Barbie to Steve Jobs. Take that, Crocs!

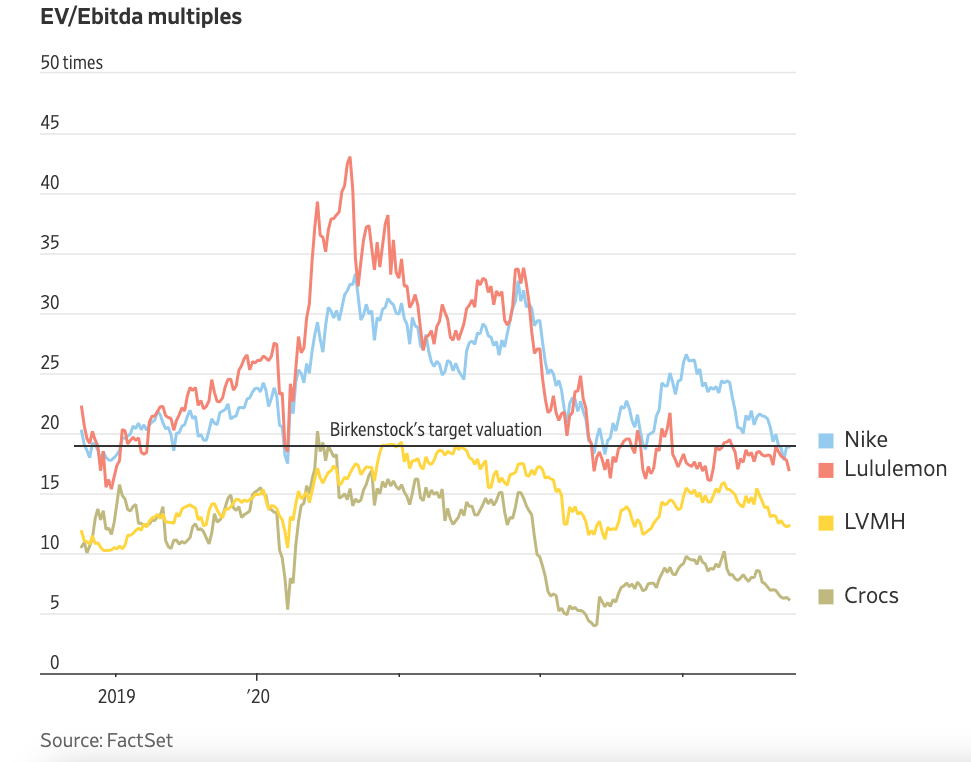

One of the consequences stemming from the pandemic was challenging the status quo dress code, trending toward casual fashion. Birkenstock has benefitted from this, as revenue rose by almost a third in the company’s last fiscal year as rejection of formal dress culture continues. However, stripping out sharp price increases, volumes grew just 5% over nine months through June — less than half the volume growth experienced during the pandemic. A worrying sign for an initial valuation of almost 20 times EV/volume below.

As illustrated in the preceding chart, investors clearly differentiate among shoe & apparel brands, with Nike and Lululemon trading at steep premiums to Crocs.

Birkenstock will have to convince investors that they are more synonymous with Nike and Lululemon than Crocs. As both Birkenstock and Crocs are viewed as quirky, eclectic shoe brands, persuading investors to think differently will be difficult.

Most family businesses will never consider listing their shares on a public exchange; nonetheless, Birkenstock’s IPO decision highlights a key recurring theme that all family businesses must consider. What kind of company are we? The topics discussed below can help define what kind of company you are, or better yet, may help outline the family business you want to be.

Dividend Policy

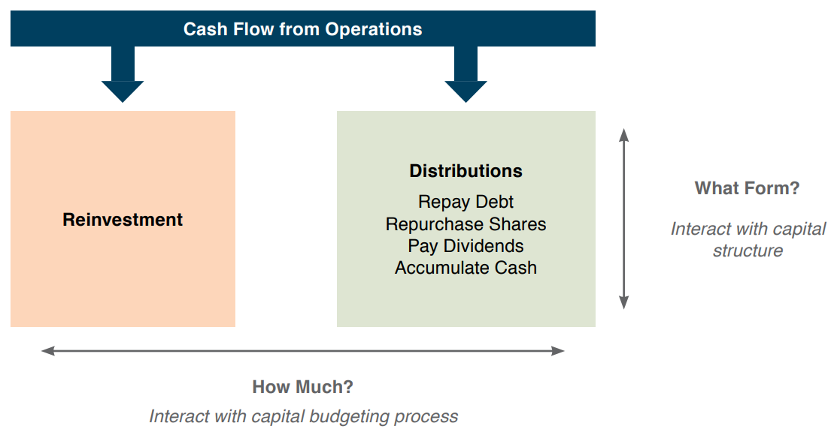

Dividend payments are the most transparent measure family shareholders have regarding the performance of their investments. Dividend policy addresses two questions: How much? and What form?

The “how much” question determines the amount of cash available to be distributed. Cash flow from business operations can either be reinvested into the business or distributed to the family shareholders. Once the “how much” question is answered, family business directors need to address the “what form” question. While it is common to restrict distribution policy to the actual payment of dividends, the other three forms of distributions presented above represent a use of cash for shareholders’ direct or indirect benefit.

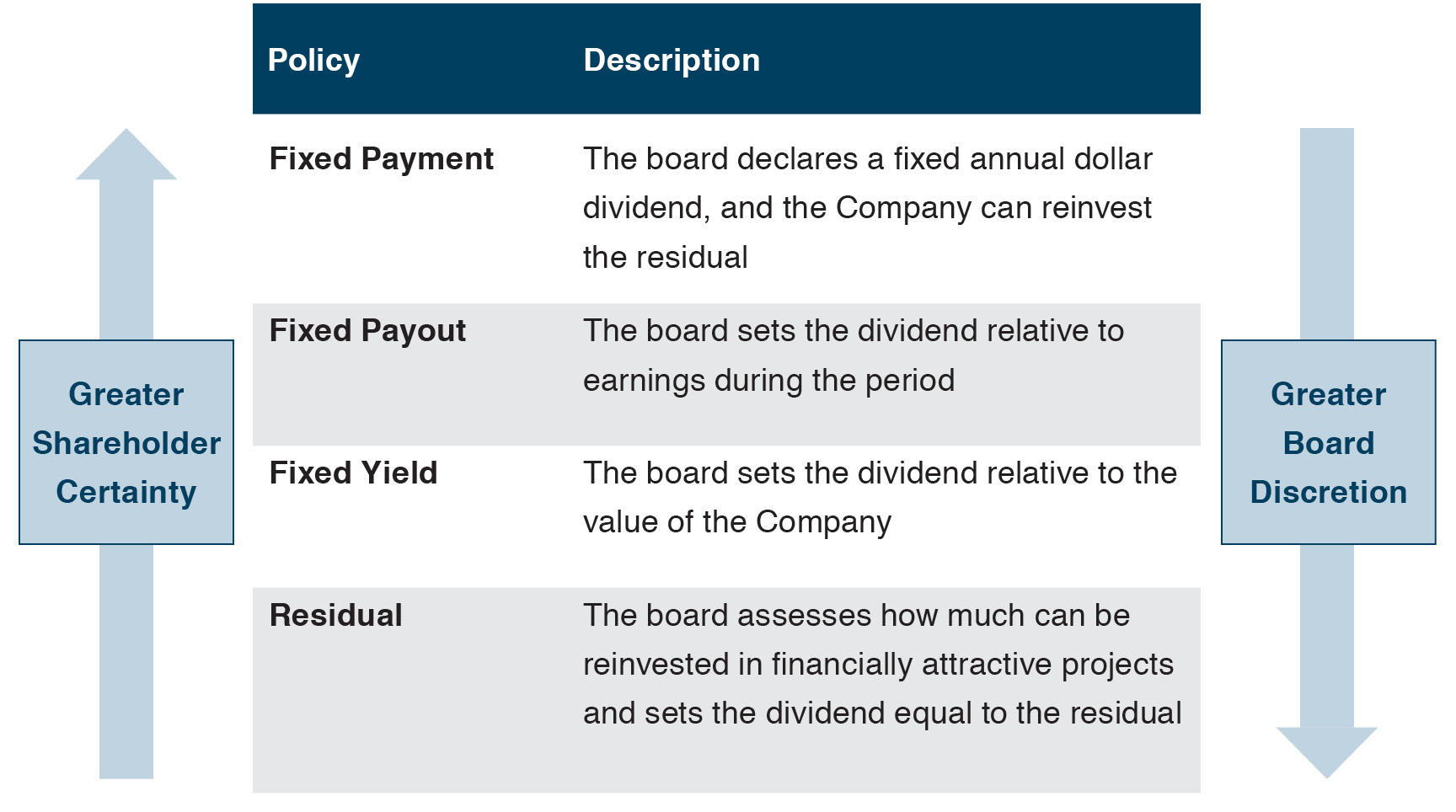

The question is not whether a dividend policy exists but rather what that policy is and how it is communicated with the family shareholders. As illustrated above, dividend policies can fall into four basic categories, and there is an inherent tradeoff between shareholder certainty and board discretion. There is no single dividend policy that makes sense for every family business.

Once the change in “meaning” has been embraced by the family, the change in distribution policy will more naturally follow. Answering the dividend policy question for your family business requires looking inward and outward. Looking inward, what does the business “mean” to the family? Looking outward, are attractive investment opportunities abundant or scarce? Considering the business and family shareholder attributes is critical to ensuring that the dividend policy you are communicating to your shareholders not only makes sense but also promotes the sustainability of the business and the positive engagement of your family shareholders.

Capital Allocation

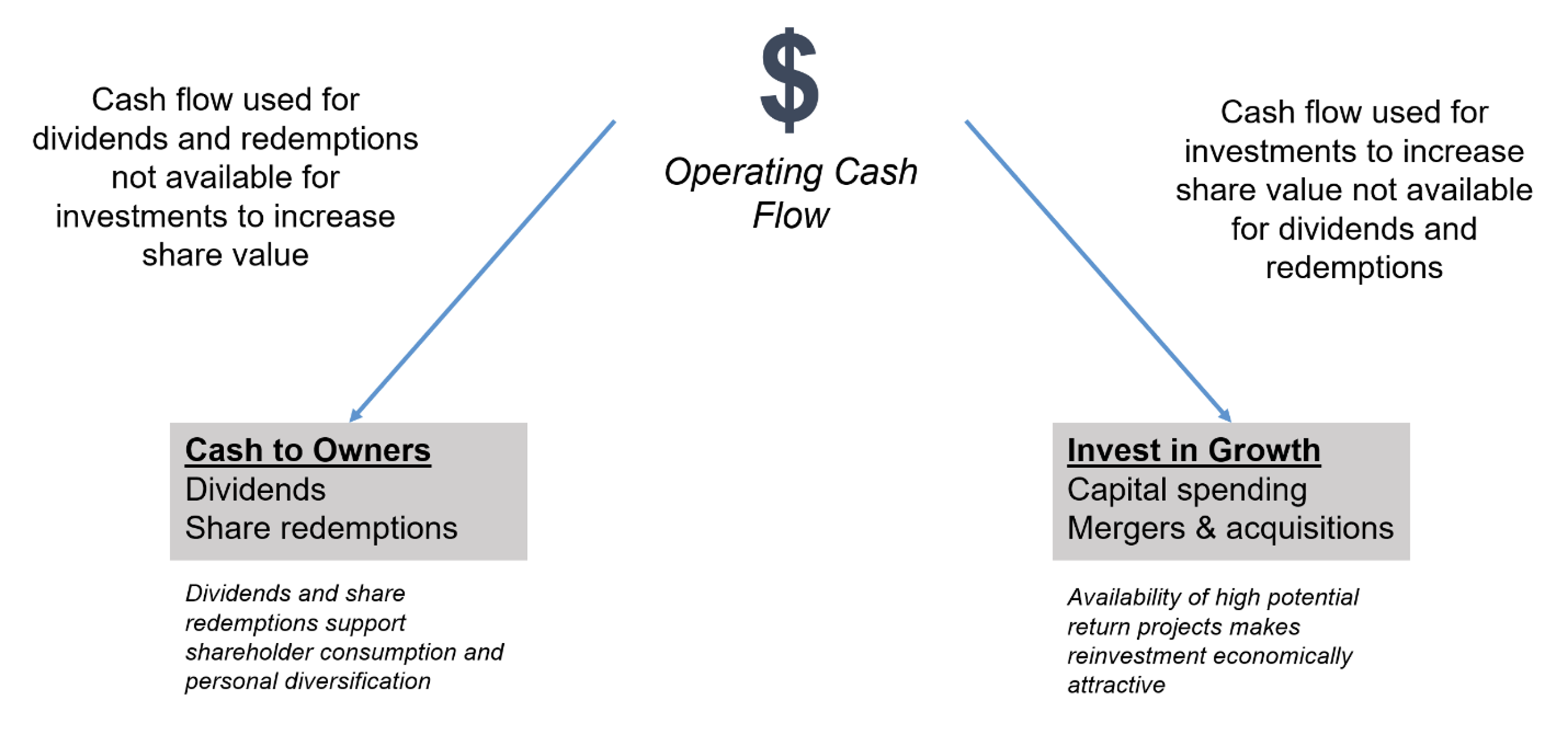

Dividend policy decisions are not made in a vacuum. When operating cash flows are used to pay dividends, those cash flows are not available to be reinvested to grow the business. Conversely, cash allocated for the future growth of the business is not available to provide for the liquidity needs of family shareholders. Family capital is a scarce resource that can either be put to work inside the business or distributed to provide liquidity to shareholders, but not both.

Successful family business directors must balance the company’s needs with those of the family when making capital allocation decisions. Analyzing investment choices and understanding your family shareholder objectives is not easy, but going back to the meaning of your family business will help provide a backdrop for making these decisions. If the family business is a “Source of Lifestyle,” you might be less likely to invest in a high-risk, high-return project that could potentially compromise current dividends. On the other hand, if the business is viewed as an “Economic Growth Engine,” you may be willing to accept more risk, making investment decisions that maximize the expected return.

Conclusion

What kind of family business are we? Dividend policy & capital allocation decisions help define what kind of company your family business is. Matching your family shareholders’ growth objectives with their relative risk tolerance is a key challenge for family business directors and one that is tied directly to what your family business means to you. Successful family businesses need to evaluate how they invest for future growth and their distribution policies in light of their family’s risk tolerance, growth objectives, and business meaning. Give one of our professionals a call today to help identify what kind of family business you want to be.

Family Business Director

Family Business Director