Spring M&A Update for Family Businesses

Following up on our post from a couple of weeks ago regarding the acquisition of SRS Distribution by Home Depot, we provide a brief update on private M&A markets in this week’s post.

Although middle market transaction activity remained depressed in the fourth quarter of 2023 compared to 2022, M&A activity and multiples improved a bit compared to recent quarters. Possible Fed rate cuts, a resilient economy despite 525bps of Fed rate hikes, and ample dry powder held by PE firms to deploy may be the catalysts for a stronger rebound in 2024.

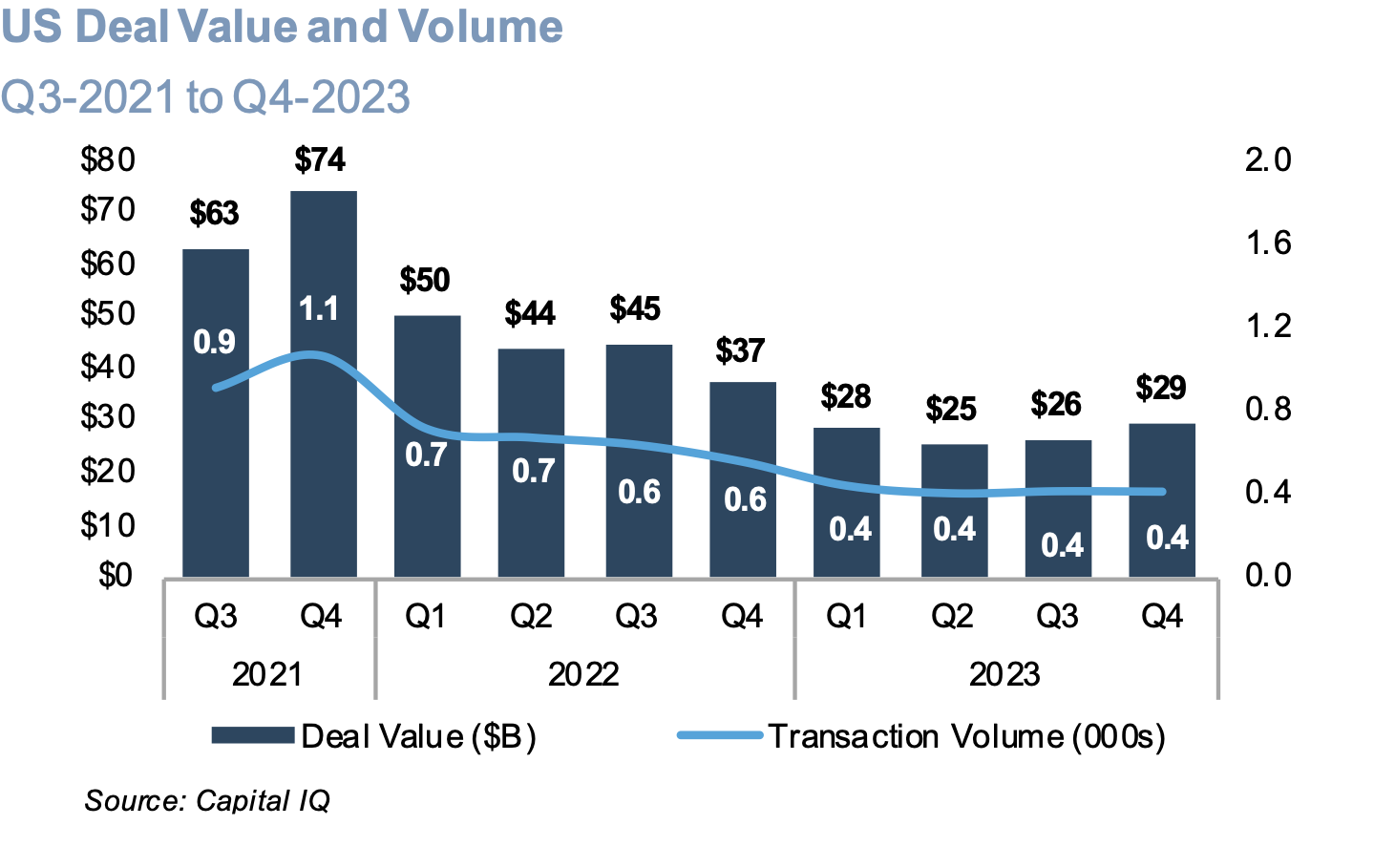

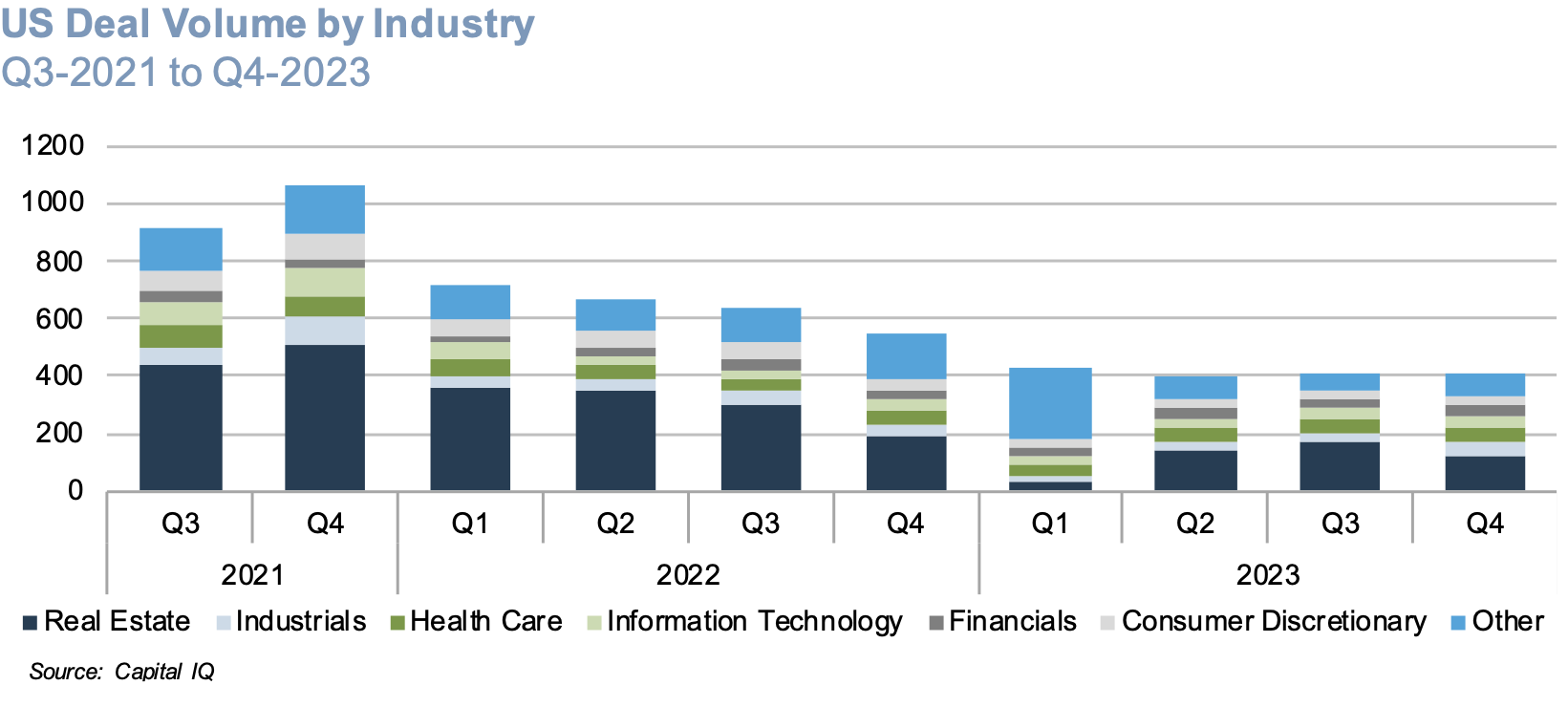

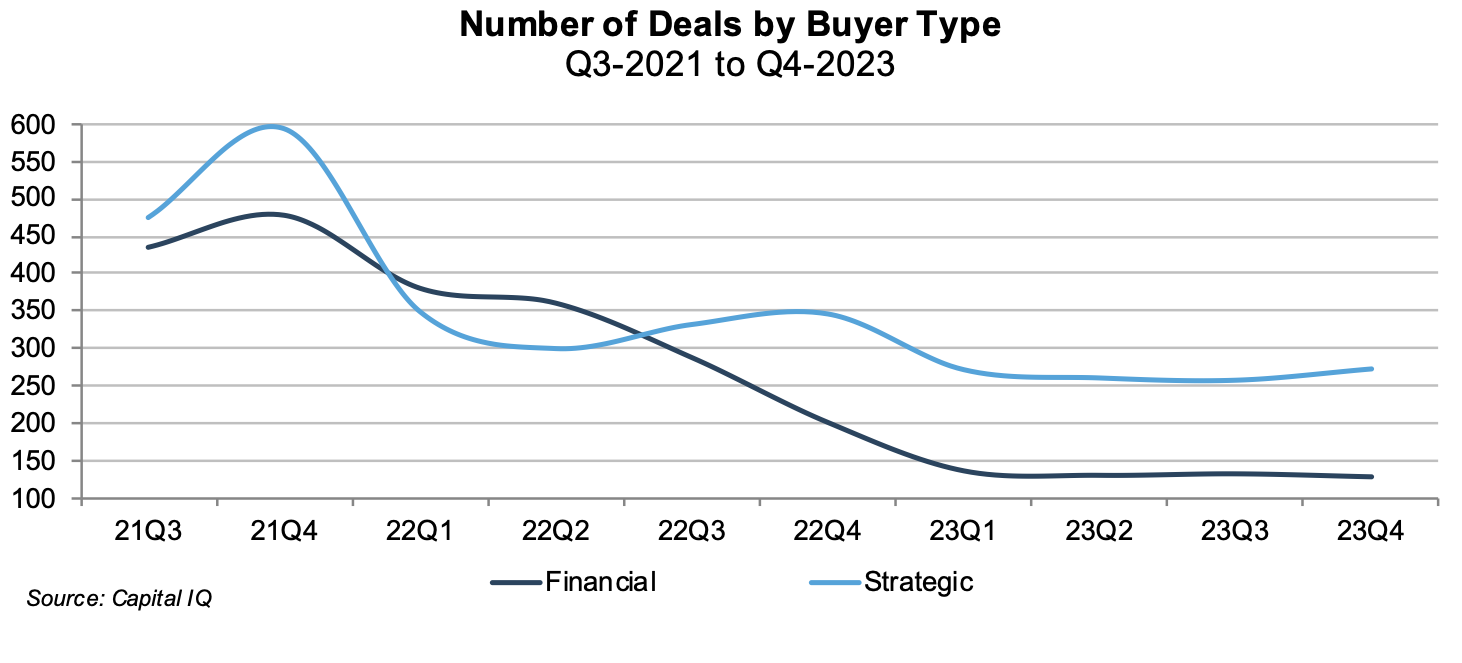

As shown in the chart below, overall U.S. deal activity, as compiled by Capital IQ in the fourth quarter, was little changed from the depressed levels observed in the first three quarters of 2023. Pitchbook reports that U.S. PE middle-market activity, defined as deals with an enterprise value of less than $1 billion, bounced back for the second time in the last eight quarters in the fourth quarter of 2023, suggesting that the depressed levels realized in the second and third quarters of 2023 could represent the trough in the current middle market M&A cycle.

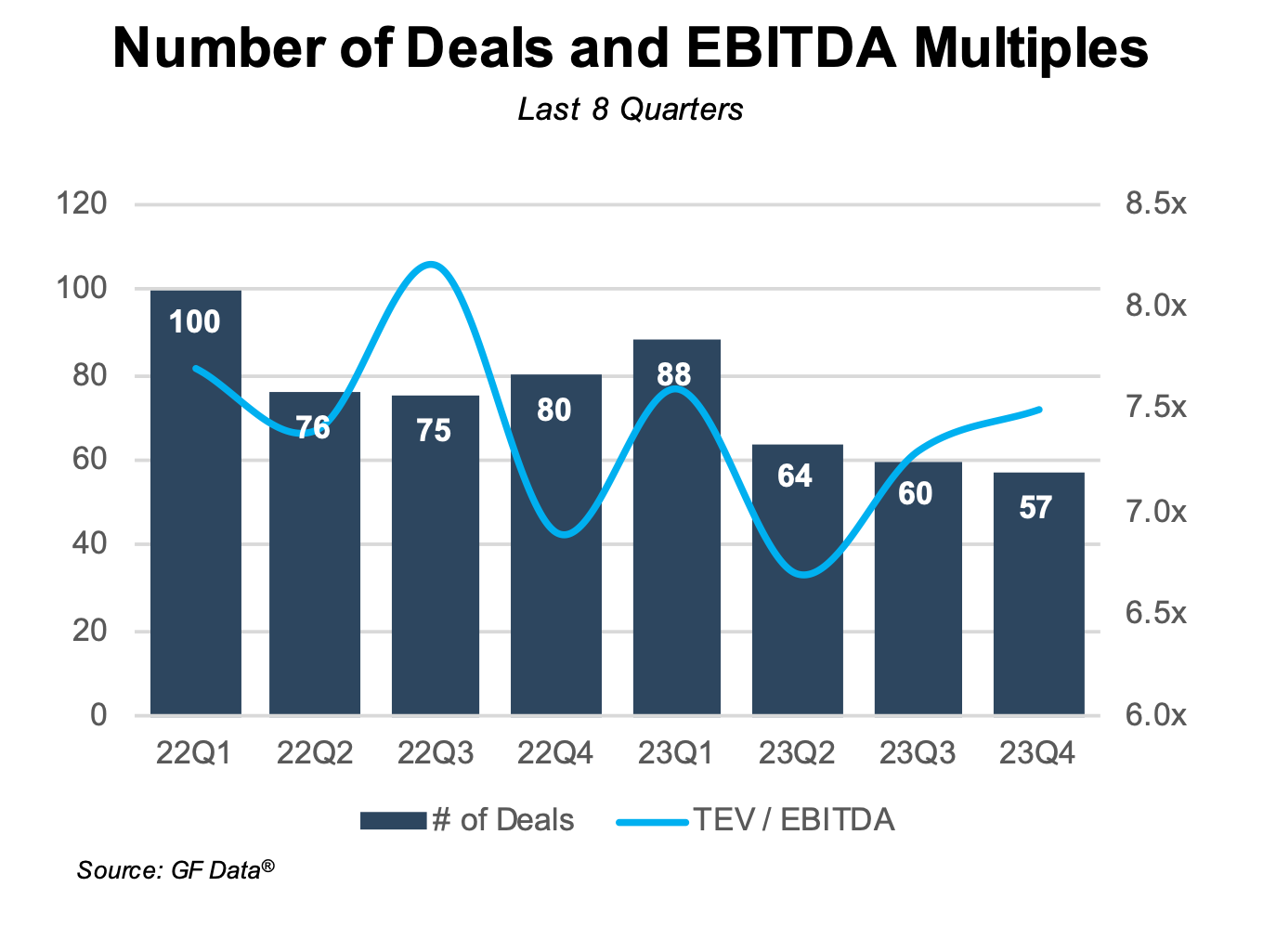

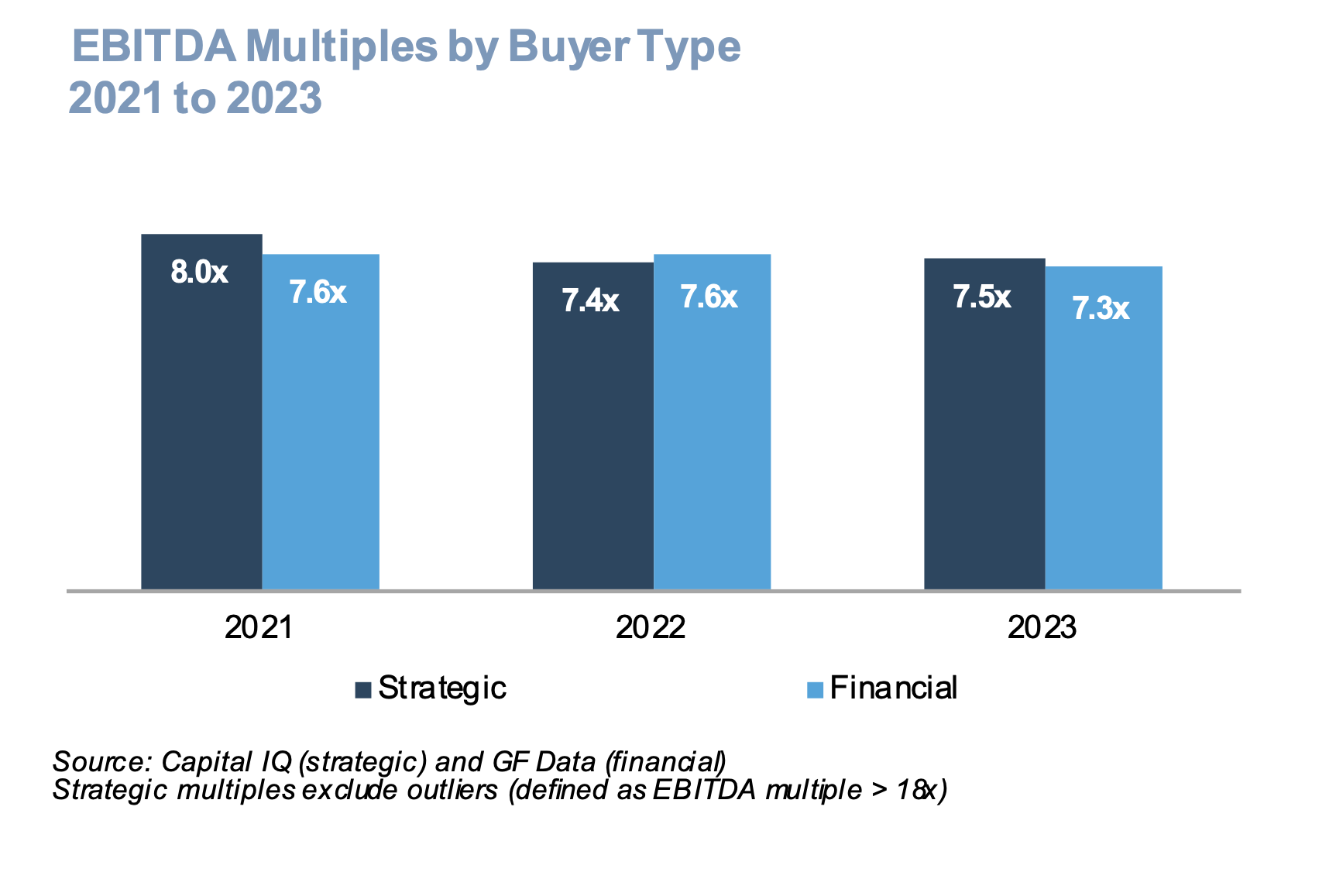

Lower middle market activity (defined as enterprise values of $10 million to $500 million), as compiled by GF Data® from ~300 PE firms for ~20 years, provides several notable observations about PE-backed transactions:

- Similar to the overall U.S. transaction level, lower middle market activity is depressed relative to 2022 and especially 2021, when financing costs were exceptionally low.

- The average EBITDA multiple for all sub-groups improved to 7.5x in the fourth quarter compared to 7.3x in the prior quarter and 6.9x in the fourth quarter of

- The average EBITDA multiple for trailing 12 months on a rolling quarterly basis increased to 7.3x compared to 7.1x in the prior quarter but is still lower than the 7.6x multiple in the prior year.

- The average EBITDA multiple for the trailing 12 months by sub-group ranged from 6.6x for deals with an enterprise value of $10-$25 million to 10.1x for deals in the $100-$250 million range.

- The year-to-date average multiple by industry ranged from 6.5x for manufacturing to 10.2x for technology.

- Buyer transaction costs that are excluded from the multiples cited above add about 0.3x to all-in costs.

Deal volume for both strategic and financial deals presents a similar picture. The chart below highlights overall deal value and volume, including strategic deals. The fourth quarter of 2023 represents a slight uptick in deal value and consistent volume across each quarter in 2023. Deal value is down approximately 22% year-over-year and down 61% from fourth quarter 2021 metrics.

We believe there are several reasons to be optimistic about middle market M&A activity in the coming year. Even with uncertainty surrounding the inflation rate, unknown interest rate hikes/cuts, and the U.S. economy as a whole in 2024, private equity firms have abundant, time-limited investment capital to put to work, and strategic buyers are still looking for growth opportunities as their businesses remain in a strong financial condition. The M&A market continues to be receptive to superior, quality companies, and while the market is no longer a seller’s market, there is still ample opportunity to sell well-positioned businesses.

As mentioned, there is a plethora of committed capital ready for deployment, allowing investors and acquirers to become increasingly more motivated to put their money to work. There have been no interest rate hikes since July 2023, which, when combined prospectively with a potential reduction in SOFR if the Fed follows through with rate cuts, portends lower borrowing costs. Increased consumer confidence, along with pent-up demand across many sectors, is likely to fuel heightened M&A activity. Lastly, technological advancement needs within the market could be driving factors in M&A growth activity through 2024 and beyond.

Mercer Capital has a deep bench of seasoned transaction professionals with experience in all different types of market environments, including this one. If you are a business owner contemplating a transaction on the buy side or on the sell side, feel free to reach out to discuss your needs in confidence.

Family Business Director

Family Business Director