Stock Buybacks and Family Businesses

Stock buybacks were in the news last week as the newly-passed Inflation Reduction Act includes a provision levying a 1% excise tax on share repurchases by public companies. As we’ve noted in previous posts, we question Congress’s grasp of the basic economics of what a stock buyback is, but Congress is not our focus today.

Privately held family businesses are exempt from the tax, but it is important for directors to understand the real economics of stock buybacks (or, in the case of family businesses, shareholder redemptions).

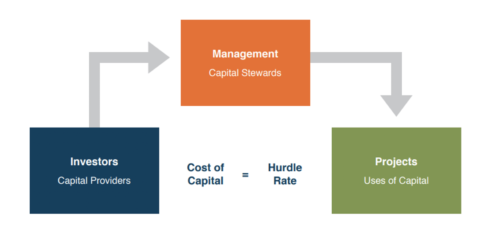

Family business directors are stewards of family capital. Family shareholders entrust their capital to the family business and the directors and managers of the business use that capital to generate a return.

Unlike money from a bank, the family business doesn’t owe interest to its family shareholders. However, that doesn’t mean that family capital is free. There is an opportunity cost associated with family capital. This means that if their capital was not invested in the family business, family shareholders would have the opportunity to invest it elsewhere to earn a return. We refer to that opportunity cost (i.e., what an investor could earn by making a different investment of comparable risk) as the cost of capital.

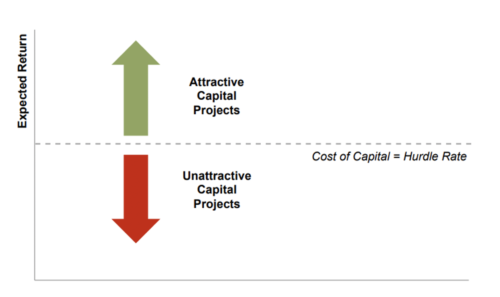

The cost of capital is a critical concept for family business directors as they evaluate how to invest family capital within the family business. The cost of capital is the breakeven point for whether an investment is financially prudent: if the expected return from an investment is less than the cost of capital, the shareholders would be better off investing that capital elsewhere. In other words, outside the family business.

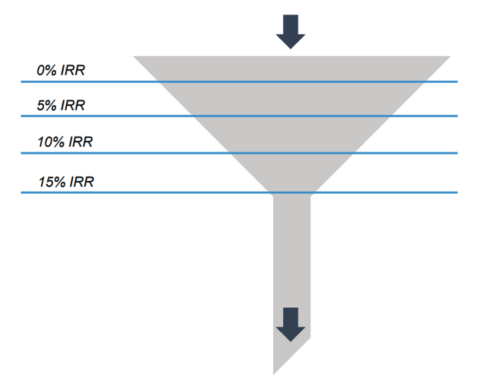

The supply of capital projects dwindles as the level of expected return increases. In other words, there are a lot more capital projects that are expected to earn a 5% return than a 15% return.

So one of the primary tasks of family business directors is monitoring the supply of attractive capital projects, those for which the expected return exceeds the cost of capital.

- For some companies, the supply of such projects far outstrips the amount of family capital available to invest. Directors of these companies are faced with a rationing decision: of all the financially acceptable investments that we could make, which ones will we make with our limited family resources? These are generally companies operating in new or growing industries.

- For others, the supply of capital projects with expected returns in excess of the cost of capital is small. Directors of these companies are faced with different decisions. Do we (1) return capital to family shareholders so they can invest to earn the cost of capital, or (2) do we hold on to the capital and try to find new avenues to invest to earn the cost of capital?

Too often, however, directors make a third, ill-advised choice – they hold onto the capital without a compelling plan for how they can use it to earn the cost of capital.

When directors elect to return capital, they can do so in two ways, by paying a dividend to all shareholders (pro rata to their ownership interests) or repurchasing the shares of select shareholders. From the perspective of the company, these paths are equivalent economically in that, under both strategies, family capital leaves the family business to be put to use elsewhere.

While paying pro rata dividends might seem most “fair,” some family shareholders may prefer to keep their capital invested in the family business, while others might be more eager to put their capital to other uses. Still, other shareholders might be seeking a way to be out of business with their family members. In any of these cases, a share repurchase can be the right tool to both prevent “lazy” capital from accumulating on the family business’ balance sheet and realign ownership interests to better conform to shareholder preferences and risk tolerances.

Your congressman may not understand what a share repurchase is, but you and your fellow directors should. If you suspect a share redemption might be in order for your family business, give one of our professionals a call to discuss your situation in confidence.

Family Business Director

Family Business Director